Klaus Vedfelt

Sixth Street Specialty Lending Inc. (NYSE:TSLX) has a good opportunity for yield seekers to buy its fat 9.2% dividend yield while it is still trading at a small premium to book value.

In the third quarter, the BDC easily covered its dividend pay-out with net investment income, and the portfolio is both well-managed and well-performing.

The dividend income appears to be sustainable, and the BDC’s First Lien focus continues to protect against a potential recession in 2023.

New Portfolio Investments in Q3-22

In the third quarter, Sixth Street’s portfolio was dominated by First Liens, which was unsurprising. For years, the business development company has focused on First Lien investments, and this is unlikely to change in the future.

The BDC’s portfolio was valued at $2.81 billion at the end of the September quarter, a $270 million increase QoQ.

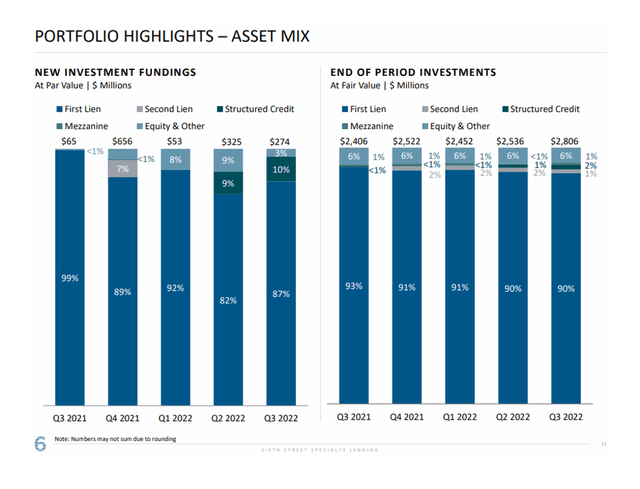

In terms of new investments, 87% of new investments in the third quarter were made in First Liens, which have a very low loss ratio, 10% in structured credit products, and 3% in the ‘equity & other’ category.

First Liens have consistently accounted for 90% or more of the business development company’s investment assets, as shown in the portfolio breakdown below.

Asset Mix (Sixth Street Specialty Lending)

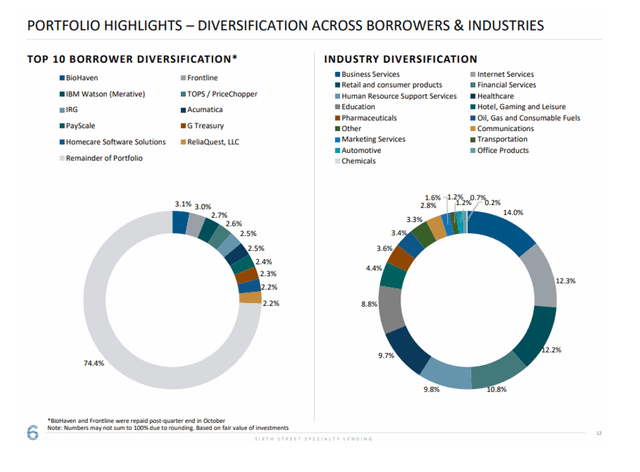

Sixth Street primarily invests in middle market loans for companies with EBITDAs ranging from $10 million to $250 million. The majority of the BDC’s target companies are in industries that are immune to the economy’s unpredictable cyclical swings and have cash flow-protected business models. Examples include companies that provide business and internet services, as well as financial and healthcare services.

In the third quarter, the business development company’s borrower portfolio remained diverse, with the top ten largest investments accounting for only 25.6% of total investments.

Diversification Across Borrowers & Industries (Sixth Street Specialty Lending)

Interest Rate Exposure

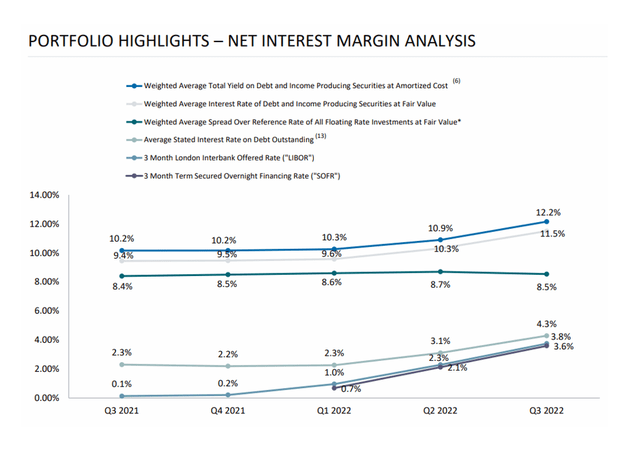

The management of Sixth Street has prepared the BDC and its debt investments for rising interest rates. The BDC has invested 98.9% of its debt investment portfolio in floating rate loans, implying that rising interest rates will result in higher net interest income and better dividend coverage in the future.

Interest rates have risen in the last two quarters as the central bank raised interest rates to combat inflation. Rising interest rates are an opportunity for Sixth Street to earn more money rather than a risk because the company has hedged its portfolio and makes loans to borrowers primarily on a floating rate basis.

Sixth Street’s total debt yield increased in 2022 as interest rates rose, rising from 10.3% in 1Q-22 to 12.2% in 3Q-22.

Net Interest Margin Analysis (Sixth Street Specialty Lending)

Sixth Street Covers Its Dividend Pay-Out

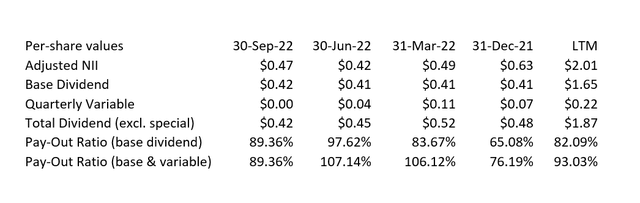

Sixth Street’s dividend was once again covered by net investment income in the third quarter. The BDC earned $0.47 in adjusted net investment income per share, which was enough to cover Six Street’s $0.42 per share dividend distribution.

The quarterly pay-out ratio was 89.4% in September, compared to a twelve-month pay-out ratio of 82.1% (covering only the base dividend) and 93.0% (covering the base dividend and the quarterly variable distributions).

Dividend & Pay-Out Ratio (Author Created Table Using Company Disclosures)

Low Premium To Net Asset Value

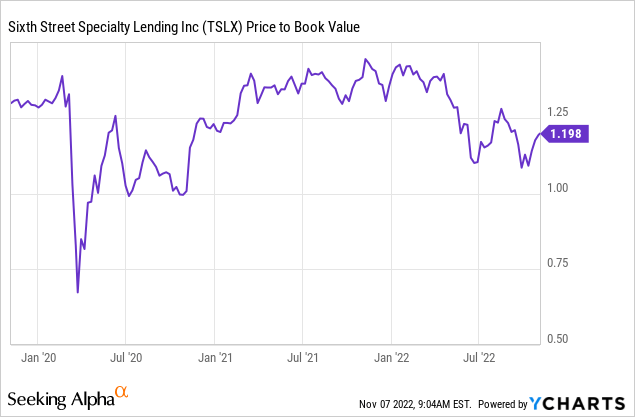

Sixth Street’s net asset value was $16.36 at the end of the September quarter, representing a 0.6% QoQ increase and a 12% premium to net asset value.

This is not a very high premium for Sixth Street’s stock historically, and the stock has traded at much higher premiums in the past (see chart below).

Why Sixth Street Could See A Lower/Higher Valuation

Sixth Street has a First Lien-focused debt investment portfolio that is performing exceptionally well.

However, changing debt market operating conditions, as well as a slowing demand for new investment capital, may result in lower net investment income and pressure on the BDC’s net asset value.

A recession could be a problem for business development companies in general, because loan defaults and borrowers’ financial distress could lead to decreases in portfolio income and net asset value.

My Conclusion

Passive income investors can still purchase Sixth Street’s high quality 9.2% dividend yield.

In the third quarter, the business development company covered its dividend with net investment income.

Sixth Street’s First Lien emphasis and floating rate exposure continue to be the company’s two most compelling selling points.

The premium to book value is also relatively low, which is why I believe TSLX is a Strong Buy for income investors looking for high and consistent dividend income.

Be the first to comment