lzf/iStock via Getty Images

This Article was researched and written by January Mbuvi.

Investment Thesis

Adecoagro (NYSE:AGRO) is a South American agro-industrial conglomerate that operates dairy farms and produces sugar, ethanol, cereals, and power. Since 2020, the company’s stock price has shown significant volatility. The sharp decline in its share price to $3.56 in April 2020 was, in my opinion, a precautionary measure taken by management to prepare for the potential consequences of COVID-19 and severe meteorological circumstances on output.

From $3.56 in April 2020, the share price has doubled to its current per-share price of $8.67, marking an upward trajectory since early 2021. The company has outpaced the market with a margin of approximately 33% YTD.

I accord good performance to the company’s diversified model and strategic management. The two aspects support my bull case argument both in the short and long run. I rate the company a strong buy because I find it undervalued with a very stable growth both in revenues and profitability.

The Business Model

AGRO has a diverse business model defined by low production costs, which appears to be a potent competitive edge over rivals. Its diversity is both geographical and product-wise.

Geographical Diversity

Although it has roots in South America, AGRO’s reach has expanded well beyond the continent. Large portions of its business are conducted in Europe, and it owns about 220,000 acres of property in places other than South America. The distribution of the assets is as follows;

- 18 farms in Argentina

- 8 farms in Brazil

- 1 farm in Uruguay

The company’s geographical diversification provides a large market for its products and protects it from seasonal price fluctuations. For example, when domestic ethanol prices fell in June, they exported a portion of their anhydrous ethanol to Europe and earned a 15% average premium. This geographical presence, I believe, aids the corporation in keeping its revenue and profit margins stable by taking advantage of the most lucrative markets for its products.

The EU is the world’s largest import market for agricultural commodities and food, making diversifying to the EU a prudent choice. Thus, it will be crucial to the company’s success.

Offerings/product Diversity

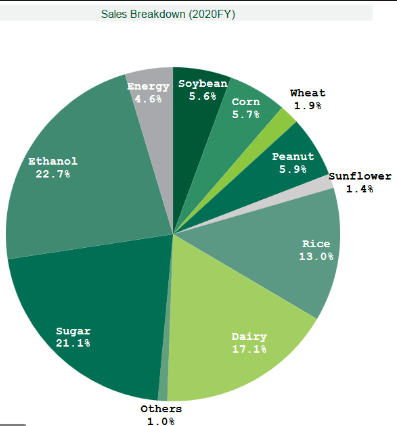

Besides geographical diversification, AGRO has a diverse product offering. The following are some of the offerings;

- Cereals (rice, oilseeds, wheat, corn, soybeans, peanuts, cotton, sunflower, etc.),

- Dairy products (raw milk, UHT, cheese, and powder milk),

- Sugarcane (sugar and ethanol),

- Electricity

The various products offer the company varied revenue streams, which protects the company from counting losses in case one of the products fails. The table below details the company’s sales in the 2020 fiscal year, broken down by product.

imgres

In light of the foregoing, I can confidently assert that the company is reducing the likelihood of bad performance in the event of any particular product or service line failure, as would be the case if the company relied on a single, large revenue stream.

Why is diversification important?

Seasonality and extreme price fluctuations are hallmarks of the agricultural industry. Actors in the industry continue to find the two factors problematic because of their significant impact on their bottom line. Here’s my opinion on how the variety of AGRO can help solve these problems in real time.

- Price volatility: Selling high is the best strategy to profit in the volatile market. Since AGRO has a large market from its different geographical presence, it can produce in low-cost places and sell in high-price areas. Also, due to its broad revenue stream, it can keep low-priced products until the market’s best prices without sabotaging the entire company. This is possible because they have an almost balanced product mix which allows such flexibility and also storage facilities that makes holding possible.

- Seasonality: Relying on one crop or area means the company is in limbo when the product is out of season. AGRO produces many products in diverse climates year-round and sells off-season products in off-season markets for the highest prices, therefore evading the seasonality challenge.

In a nutshell, the company is almost immune to adverse price fluctuations and seasonality problem courtesy of its diversification. Investors should be enticed to join the company because, in my view, the company is well-positioned to always benefit from the highest prices. This argument is in line with its commercial strategy, which I will discuss later in this article. In other words, AGRO is an all-year high revenue earner in the agricultural sector, a scarce opportunity!

Strategic Management

Strategic management sets goals, creates plans, and allocates resources. It helps companies surpass their rivals when structured and implemented effectively. Managers must thoroughly understand their corporate environment to develop appropriate goals and implement effective policies. Based on my research, I am confident that AGRO’s leadership has a firm grasp of its industry and has strategically positioned the company to thrive and outpace the competition.

To cover this section effectively, I will divide it into the following sections:

- Commercial strategy

- Optimizing resources

- Share repurchases

- Reputation

Commercial Strategy

The commercial strategy is the company’s well-considered response to the market risk posed by the industry’s pricing fluctuations. The company frames the strategy to enable them to sell most of its production when prices are at their peak. The plan is to help them achieve high-profit margins even when production costs are high.

The strategy is supported by AGRO’s large market and broad geographical footprint as discussed in the preceding section. They offered European markets ethanol products when European prices were high, but American prices were low.

During the quarter, adjusted EBITDA went up by 42% year-over-year, despite an increasing costs. And this was tanks to our commercial strategy, which enabled us to sell most of our production at the peak of prices.

Optimizing Resources

I mentioned that management aims to cut costs and run a cost-effective diversified business model and in supporting this argument I like the management’s resource optimization realized through several dimensions.

The company’s asset flexibility allowed it to redirect 80% of its TRS to ethanol while the product was trading at a premium. Maximizing ethanol production allowed them to make more catalog grades and vinasse.

Vinasse is a byproduct that goes into making biofertilizers that AGRO uses on its farms. The biogas it generates relies heavily on this material. Businesses can reduce production costs by creating some of the input materials used in their manufacturing processes. In other words, manufacturing waste is a cheap ingredient in something else. The biogas production helps the company significantly; in their Q2 2022 transcript call, the company reported that 90% of total energy conception is self-generated renewable energy, which saves them the cost of power by an equivalent magnitude.

The company also buys underdeveloped land cheaply and puts it under its sustainable production model (520,000 hectares currently), fixing large amounts of carbon in the soil to enhance the farm’s condition. When the land appreciates, they use it for agricultural production or sell it at a premium.

Share Repurchase

Another strategic move is the share buyback program. The program is an ongoing exercise whereby for the first seven months of this year, they have managed to buy 2.7million shares for a total of about $ 20 million. The figure represents 2% of its market cap of $988.6million. Besides showing the management’s commitment to shareholders, the program, in my view, is a strategic move to deleverage the company. Although the company’s debt isn’t maturing soon, management is trying to deleverage the company and improve its leverage ratio.

Since its an ongoing exercise, I find it essential to evaluate whether it’s sustainable, and here are my findings:

For the 2.7 million shares already bought, the company spent about $20 million. I am evaluating how possible it is to double the figure to 5.4 million, implying the company needs another $20 million to fund the repurchase. In the worst-case scenario, I am assuming the company won’t generate more cash flows and work with their cash at hand balance of $188.35.

In the last three quarters, the company had an average of $50 million in total operating expenses and an average of $28.2 in total net interest expenses. Everything held constant and projecting these figures for the next two quarters; I arrived at a total of $156.4 million in the two quarters. Adding the $20 million required to fund 2.7 million shares buyback gives a sum of $176.4 million, which is $11.95 million less than the current cash balance of $188.35 million. Working with the worst-case scenario, the company can double its recent share buyback in the next two quarters without depleting its current cash; in my view, the company will continue to deleverage through this strategy because it’s very sustainable.

Reputation

In business, a good reputation equals more clients, better workers, and higher profits. I think AGRO’s solid practices will help them develop a good reputation and improve their publics. They include education, environmentalism, and women’s empowerment.

Education improvement

During their Q2 2022 transcript call, the company reported that they contributed to improving the education level of their regions.

We also contributed towards improving the educational levels of the regions where we operate. When we arrive to Angélica and Ivinhema to Mato Grosso do Sul their educational levels, well below the national average. Today I’m proud to say that both cities outperform Brazil’s score.

Environment Conservation

It is of particular concern to many nations that the use of fossil fuels has led to increased environmental pollution at a time when the world is working to combat climate change. I think AGRO is making a name for itself by promoting eco-friendly energy sources like biogas. This change will free them from the externality issue that plagues most businesses.

Empowering women

Due to prejudice based on gender and ingrained societal norms, women in rural areas are limited in their ability to participate in the economy. With this phenomenon being a challenge, AGRO has sought to bridge the gap by empowering women. In its Q2 2022 earnings call, the company said it was teaching women to operate tractors to help them find jobs in the region.

I think these three things will help AGRO create a good reputation and gain market share, resulting in significant revenues and profits.

Empirical Evidence

After arguing that company diversity and strategic management are crucial to performance, it would be helpful to prove the hypothetical argument empirically.

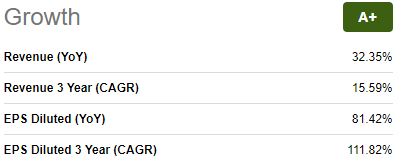

In revenues, the company has a revenue growth of 32.35% YoY. The company has reported $383.67million in Q2 compared to a revenue of $206.36million in Q1 2022. It also has a diluted EPS growth rate of 81.42% YoY.

Seeking Alpha

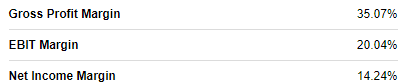

In terms of profitability, the company’s profit margins are relatively high, although they declined due to inflation resulting in increased production costs. I credit the high margins to the company’s commercial strategy. AGRO reported a gross profit margin of 35.07%, an EBIT margin of 20.04%, and a net income of 14.24%.

Seeking Alpha

These outcomes are good given COVID-19’s impact on the agricultural industry and high inflation. The company’s successful performance is primarily due to its excellent business model and long-term strategic management; thus, I expect it will continue doing well in the short and long term.

Valuation

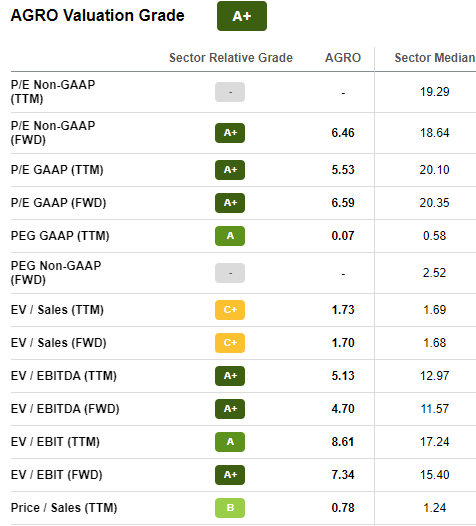

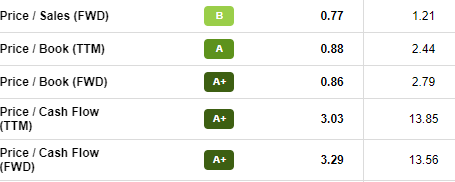

Despite successful operations, the company appears undervalued in comparison to its rivals. Pricing ratios are consistently lower than the market average, often by more than half.

Seeking Alpha Seeking Alpha

This firm trades at a discount because, with a few exceptions, all of its TTM and FWD valuation measures are below the industry median. Its stock repurchase program lends credence to this claim.

Conclusion

Agriculture markets are plagued by seasonality and volatility. These worries lead to losses or low returns. AGRO’s diversified business approach helps to reduce the impact of these threats. To maximize output while decreasing expenses, strategic management is essential. The administration also builds a good reputation to boost market share and revenues.

The model and the strategic management are long-term in scope, which spells a bright future for the company. This fact and the cheap valuation guide my strong buy rating. However, AGRO isn’t a flawless venture; investors should be aware of the increasing cost of inputs and inflation, which may threaten the company’s profit margin.

Be the first to comment