coffeekai

Thesis

We are recommending a “SELL” rating on Six Flags Entertainment Corp (NYSE:SIX). The company’s recent Q2 performance should be alarming to investors. We believe that there are no immediate catalysts for Six Flags stock price to improve, and we would like to see dividend and share buyback programs to come back before we feel comfortable with recommending the stock.

Company Overview

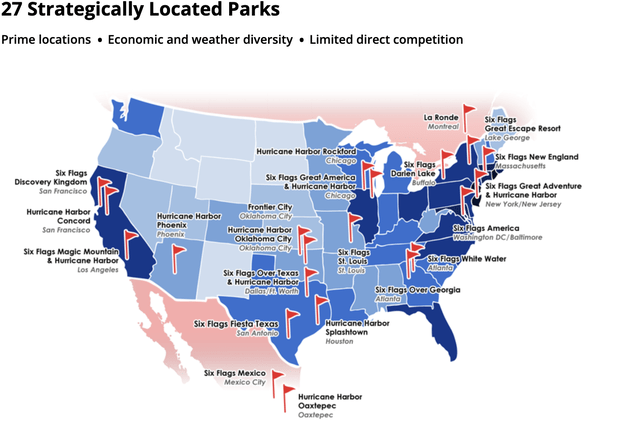

Six Flags Entertainment Corp is the world’s largest regional theme park company with 27 parks across the United States, Mexico and Canada. The company has theme parks near major cities in the United States, such as San Francisco, New York, Washington D.C., and Boston.

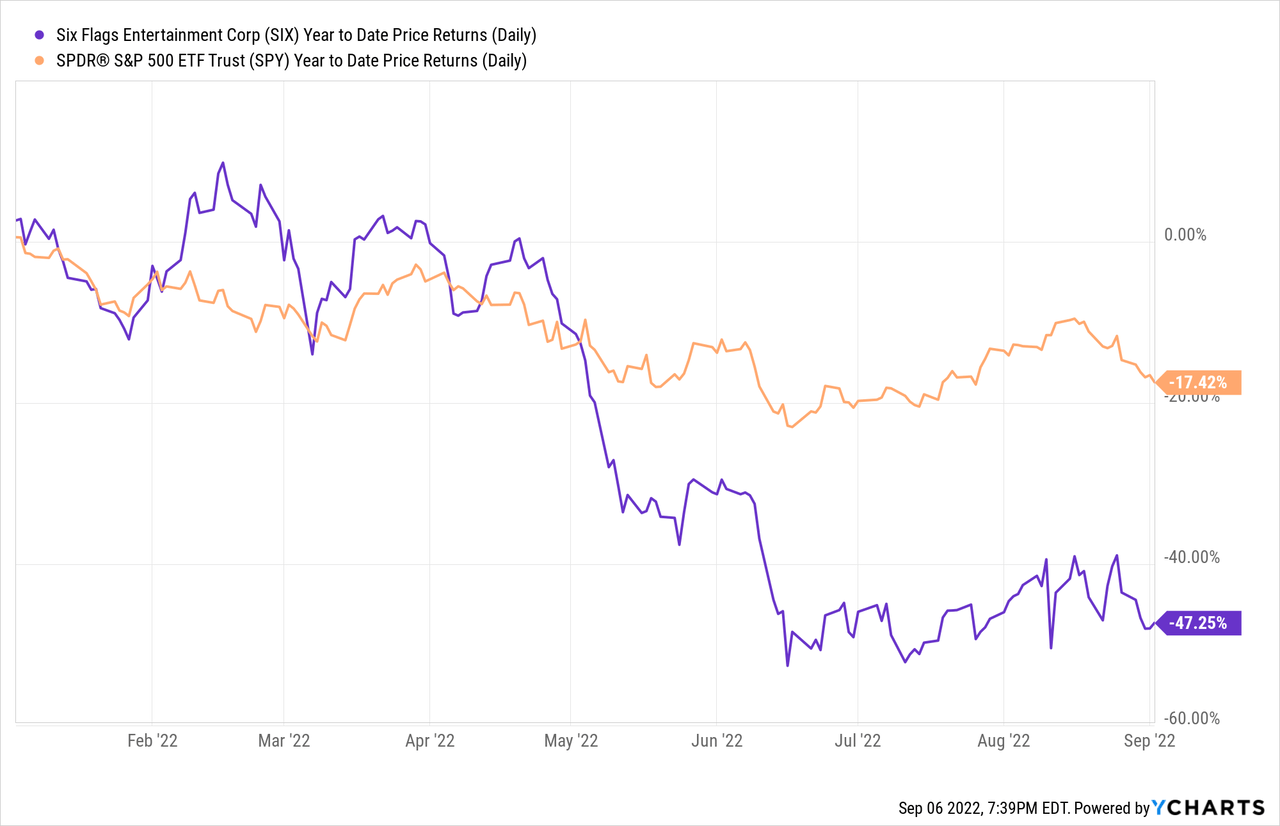

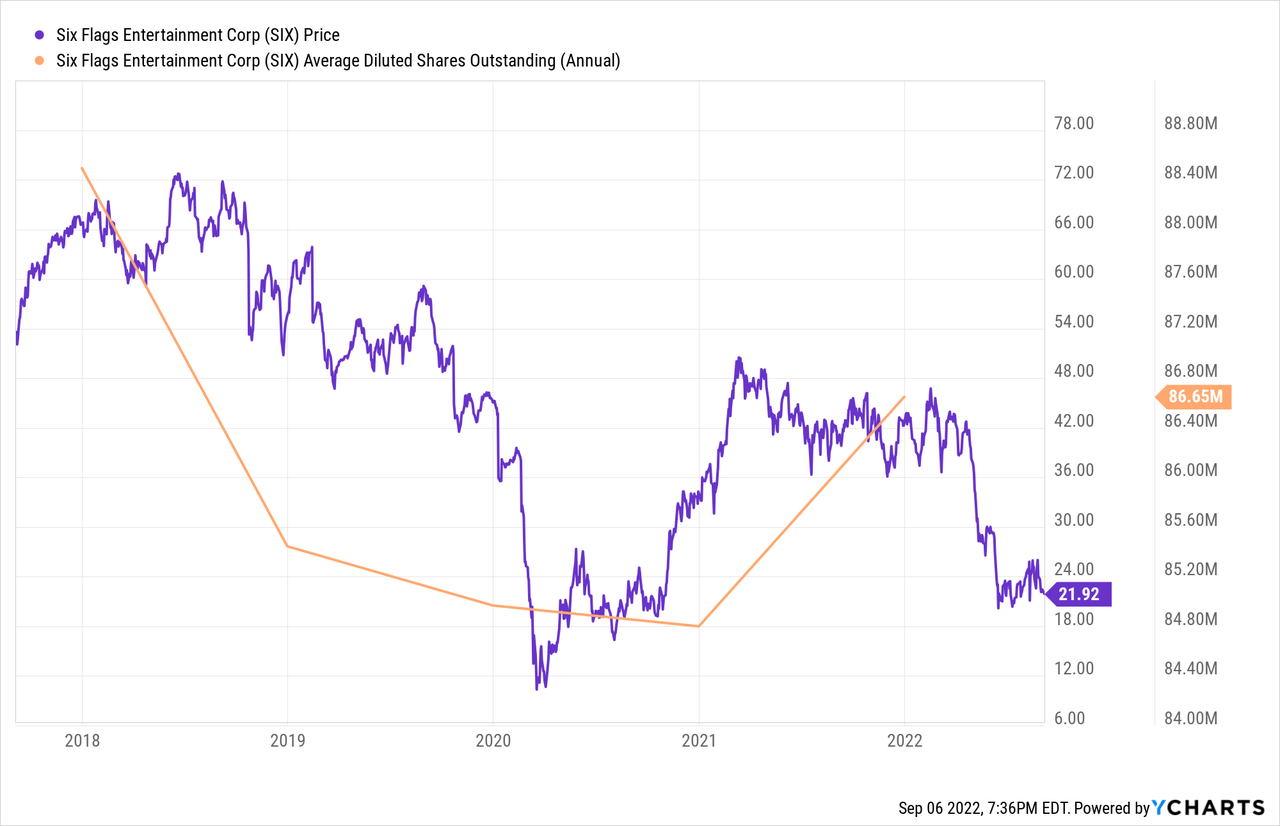

The company’s stock price performance has been abysmal year-to-date, as Six Flags had a price return of -47.25% since the beginning of the year. This is far worse than S&P 500’s price return of -17.42% in the same time frame. The company’s current market capitalization is $1.82 billion.

Worrisome Q2 Financial Performance

Six Flags has had a poor financial quarter in Q2 2022, reporting a revenue of $435.4 million, which presents a 5.3% decline YoY. Compared to the revenue consensus of $518.5 million, the reported revenue was a miss of -16.02%. Furthermore, the EPS came in at $0.68, which was well below the analyst consensus estimates of $1.01. Given that Q2 is an important quarter for the company’s fiscal year due to the warmer months in the Spring/Summer, the disappointing performance was a great shock to investors who hoped that theme parks would benefit from the end of the pandemic. In addition, what is more troubling is that attendance has dropped compared to pre-pandemic years:

We estimate that the optimal attendance level that allow us to deliver an exceptional guest experience while maximizing our profit represents a 20% to 25% decline relative to 2019. Our year-to-date attendance through July is down approximately 35% versus 2019.

– Selim A. Bassoul

Given that other theme park operators like Disney and Comcast (operator of Universal Studios) are reporting record park attendance and financial performance, the relative underperformance by Six Flags should raise major concerns for investors and show management’s inability to take advantage of high consumer demand for entertainment.

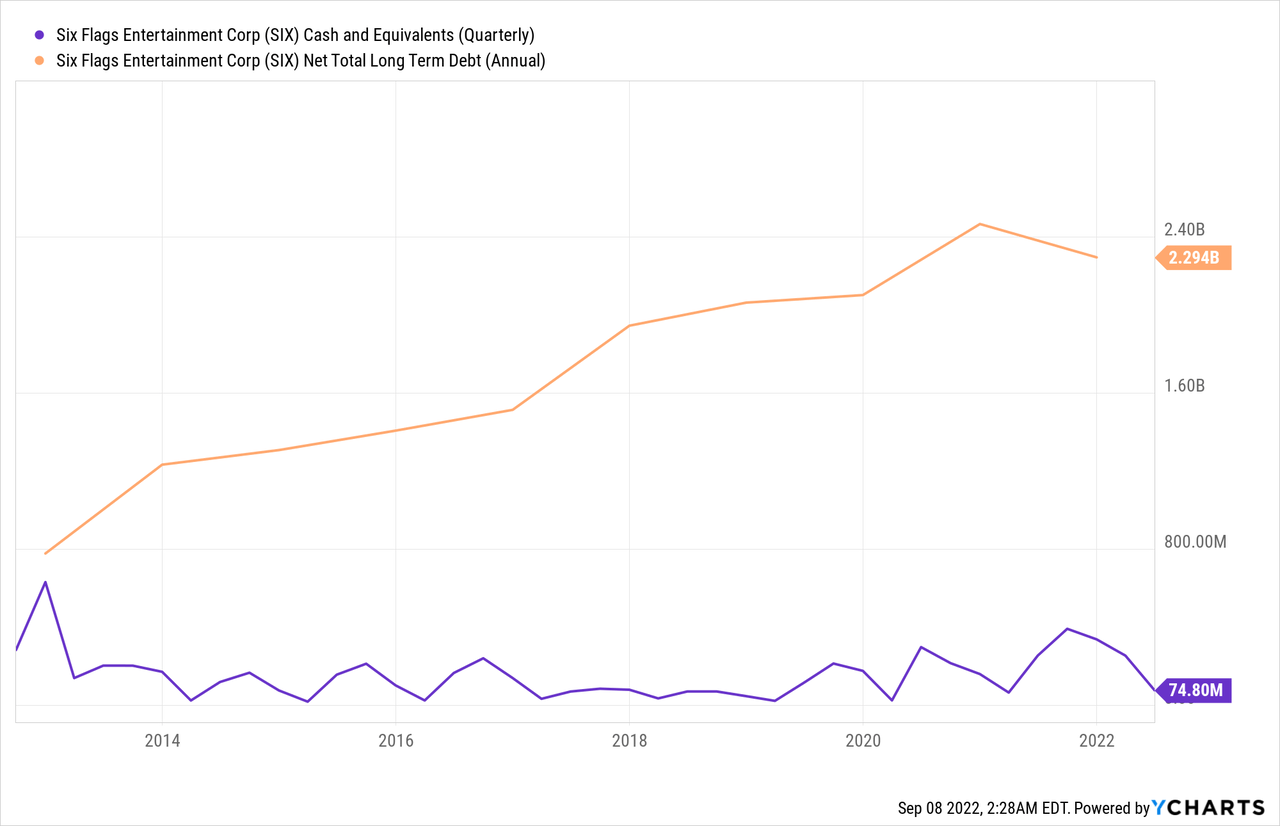

Furthermore, the company’s balance sheet is weakening with no signs of a turnaround. Over the past ten years the company’s net total long term debt has increased significant from ~$800 million to now ~$2.3 billion. The current net total long term debt now exceeds the current market capitalization of the company. In the same time frame, the company’s cash on hand has been extremely low compared to the net debt, and we believe this trend is not sustainable in the long run.

No Immediate Catalysts

Furthermore, there is not much catalysts in the short term to turn around the business in a meaningful way. Consumer spending is showing signs of a slowdown, and this will be a major headwind for theme park operators such as Six Flags which has a high exposure to consumer discretionary spending. As the Federal Reserve continues to raise rates as it has signaled in Powell’s Jackson Hole speech, it is likely that macroeconomic conditions will deteriorate and weigh on consumer sentiment and spend. Furthermore, after this quarter, Q4 and Q1 are seasonally poor quarters due to low attendance resulting from colder weather. As a result, after Q3 results are reported, it is unlikely that the stock will find any company performance-related catalysts, and headline risk along with general macroeconomic conditions will negatively impact the stock price.

Poor Shareholder Returns

At Sweet Minute Capital, we like to assess company’s history and current commitment to shareholder value by looking at dividend and share buyback programs. Unfortunately, Six Flags has neither a dividend or a share buyback program currently. As recent as the recent earnings call, management has made no note of any reinstatement of a dividend policy, and given the declining financial fundamentals, we find it unlikely that the company will bring back its dividend program anytime soon. The same logic applies to any hope of Six Flags reinstating its share buyback program, and without a buyback program, we believe that the company’s stock price is more prone to major downside risk. Lastly, investors have seen a bit of an increase in shares outstanding in the past year, diluting shareholder value. In all, we believe there are many other consumer discretionary stocks out there that presents better shareholder value for investors.

DCF Valuation

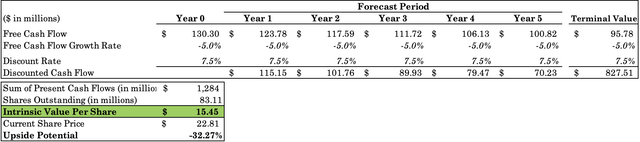

We valued Six Flags by using a Discounted Cash Flow Model (DCF). Using a TTM Free Cash Flow of $130.3 million, we estimated future cash flow decline of 5% YoY over the next five years. We believe that the cash flow decline is likely as a result of increased cost pressures, slowdown in discretionary spend, and our disbelief in management’s ability to turnaround the company’s financial prospects. Using a 0% terminal growth rate and a discount rate (WACC) of 7.5%, we see our model’s intrinsic value per share for Six Flags come out to be $15.45, which represents a -32.27% downside from current levels.

Sweet Minute Capital Valuation Model

Risks to Thesis

A better than expected economic environment would pose a potential risk to our thesis. As mentioned prior, Six Flags is heavily exposed to the health of U.S. consumers. If the economy were to do better than anticipated and U.S. consumption remains strong, it is possible that the company will perform better than we expect. However, given the high inflation and the Federal Reserve’s commitment to raise rates and keep rates high for foreseeable future, we find it unlikely that we will see strong discretionary consumption in the U.S. given the fact that budgets will be constrained by high prices and high costs of borrowing.

Conclusion

Overall, Six Flags should be a stock to be avoided, especially given the economic uncertainties today. The deteriorating revenue and earnings YoY are major points of concern, and we believe that Six Flags is exposed to further deterioration in macroeconomic conditions and consumer spend. In addition, due to the absence of dividend and share buyback programs, we believe that there is just too much downside risk for investors to continue owning these shares.

Be the first to comment