hapabapa

Lucid Group (NASDAQ:LCID) remains my #1 holding in my portfolio despite all of the negativity surrounding the company lately.

I truly believe Lucid is like Tesla 2.0 (TSLA) and has the chance to greatly outperform the S&P 500 over the next 8 years.

And Lucid has what it takes in my honest opinion. Not only did the Lucid Air win MotorTrend car of the year in 2022 but the World’s richest man Elon Musk attacked Lucid’s production numbers in one of his tweets.

In my opinion, deep down inside, Tesla is terrified of Lucid’s superior EV technology and long-range capabilities.

Right now, Lucid only has 1 EV sedan for sale, but I believe the entire market will flip its sentiment once Lucid unveils its Project Gravity SUV next year.

Trucks & SUVs remain the top-selling vehicles in America, and I don’t expect Lucid to get the respect they deserve until the company enters the lucrative SUV market.

Q2 Earnings Update

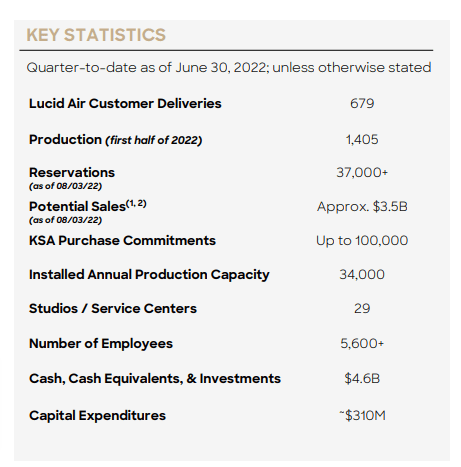

Let’s discuss some key Lucid Motors stats to provide more clarity on how things are going lately.

Lucid Motors Q2 Key Stats (Lucid Motors)

Q2 2022 earnings were a bit of a disappointment, but that’s expected due to supply chain issues and inflation. The company is on track to deliver between 6,000 to 7,000 this year.

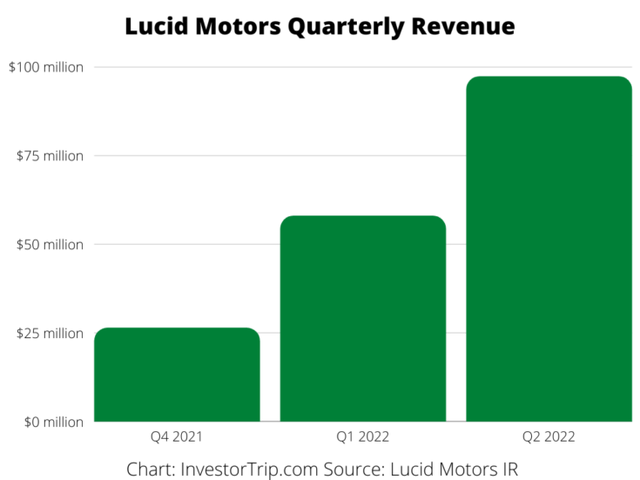

Lucid ended Q2 with over 37,000 reservations for the Lucid Air and generated $97.3 million in quarterly revenue.

Lucid Group Quarterly Revenue (Investor Trip)

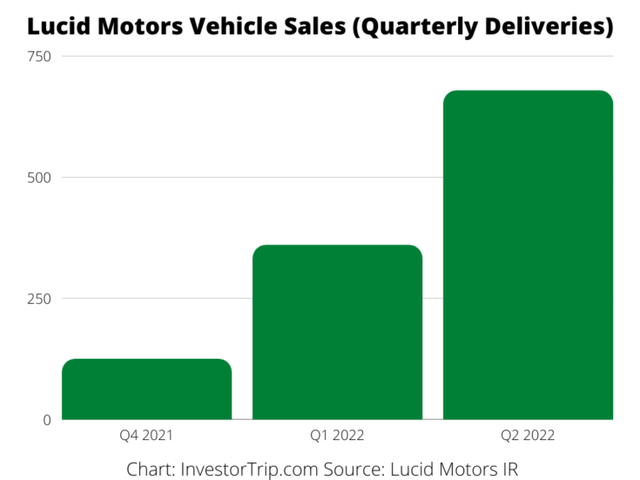

The company delivered 679 Lucid Airs in Q2. As of Q2 2022, Lucid Motors has produced 1,405 and delivered 1,164 Lucid Airs this year.

Net losses were -$222 million (-33 cents per share) but that’s expected during these early stages of production.

So far, quarterly revenue and deliveries are moving in the right direction.

Details on Shelf Registration

Lucid filed an $8 billion shelf registration to sell stock over the next 3 years and that news sent LCID shares down below the initial SPAC buy-in price of $15.

Should Lucid investors be worried? Absolutely not, and here’s why.

First off, companies like Tesla filed shelf registrations several times before TSLA stock soared in 2020. It’s completely normal to offer more shares in exchange for much needed capital to scale production.

Lucid enter Q2 with $4.2 billion in cash with quarterly capital expenditures of ~$300 million per quarter. This was the right time for management to raise capital.

Lucid has plenty of cash to fund production for the next few years while the market catches up to the benefits of electric vehicles.

Focus on Production & Deliveries Not Dilution

Let’s be honest: Lucid shares were extremely overvalued at one point when LCID stock trade over $50. Even now, LCID trades at a Price to Sales ratio of 139. That’s an extremely high premium to be paid for LCID stock.

So it’s normal that management announced an offering to strengthen its balance sheet. I wouldn’t be too worried now because we are in the early stages.

What’s important is that Lucid keeps increasing deliveries and revenue. We need more Lucid Airs in the wild so prospective buyers can witness first-hand the quality of Lucid Motors vehicles.

Lucid Motors Quarterly Deliveries (Investor Trip)

Only then will they consider transitioning to an EV and hopefully a Lucid Air if they can afford it.

Remember: if a business does well, then the stock usually follows.

Risk Factors

LCID comes with several risks that could affect the share price in the future such as:

- Additional supply chain issues that make it more difficult for Lucid to source crucial EV parts. This could slow down production to a slow crawl.

- More dilution if Lucid underestimates its capital needs and taps the equity markets for more money, which would increase dilution.

- The Saudi Public Investment Fund decides to dump its 1 billion share stake in LCID and run for the exits. The PIF owns 61% of all LCID shares and go send the stock crashing overnight if they sell.

- Luxury OEMs such as Mercedes, Lexus, Ferrari, and Lamborghini launch a better EV than the Lucid Air and steal luxury electric car market share.

- Lucid Air production doesn’t increase much and investors run for the exit.

There are a ton of risk factors but I love the upside here. Any company that builds a better EV than Tesla is a massive buy in my opinion.

Conclusion

There is no need to panic now. US markets are trending lower on higher interest rate fears and Lucid has plenty of cash on its balance sheet to stay in business.

All the haters can quit with the phony bankruptcy fears. I believe owning LCID stock under $15 is a wonderful entry price, and I’m only buying more at these levels.

Be the first to comment