Michael Vi/iStock Editorial via Getty Images

MEMS timing leader SiTime (NASDAQ:SITM) has vastly under-performed the broader PHLX Semiconductor Index, falling over 67% over the past year compared to the index’s 28.7% decline as sequential revenue growth has stagnated. A slowdown in demand in SiTime’s end markets has seen customers building up inventory, dragging down the outlook for FQ4 and FQ1 2023. An expected recovery in sales in the back half of 2023 after a sharp slowdown heading into FQ1 positions shares for an attractive options-oriented opportunity to beat the market in 2023.

Navigating Challenging Headwinds

SiTime is not alone in the semiconductor industry as it navigates a pretty rapid market shift, battling a downturn in broadband industrial and mobile, IoT, and consumer end markets in FQ3 and projecting a multi-quarter slump in communications and enterprise.

Management expects the down cycle to substantially dent revenues, projecting about ~$60 million in sales for FQ4 (about 15% to 20% lower sequentially) and between $45 million to $48 million for FQ1 (about 20% to 25% lower than FQ4). That projected FQ1 revenue figure represents a major reset in the company’s growth story, reflecting how this rapid end market shift is severely cutting into revenues. At a $46.5 million midpoint for FQ1, revenues would be down approximately 34% y/y, and up just ~11% on a two-year basis. At SiTime’s current 7.1x forward EV/sales — based on projections for $242 to $248 million in revenues in FY23 — the stock is by no means cheap here for two quarters of declining growth ahead.

SiTime also is exposed to a decent level of customer concentration risk — the company noted that its largest customer, positioned in the mobile, IoT, and consumer end market, accounted for $18.2 million, or 25%, of revenues for FQ3. Excluding the customer, revenues in that segment had declined 62% sequentially to $6.0 million, a substantial q/q drop that illuminates the weakness in that end market.

SiTime mentioned that average selling prices [ASPs] for its sensors have grown for eight consecutive quarters, a solid indicator of its leading positioning in timing and oscillator markets and pricing power. While consistent ASP growth supports long-term revenue expansion, the current revenue picture suggest a decline in sensor volumes. With revenues falling 8% sequentially from FQ2 to FQ3, an increase in ASP means that fewer sensors were sold, and over the next few quarters, sensor volumes will decrease at a higher rate than revenues. Thus, a resumption of strong sequential growth likely is not in the picture until late FQ2, early FQ3 2023 when sensor volumes can recover.

Areas Of Growth – Automotive, New Products

While revenue growth has fizzled in the near term, SiTime’s long-term opportunity remains massive, with the company noting that automotive is “definitely a growth segment” with more product launches due in 2023.

SiTime is aiming to close out 2022 with the launch of 6 products during the year, focusing on the automotive and communications end markets. During 2023, SiTime is planning to launch at least 10 new products — 5 oscillators and 5 clocks — across the same end markets.

In September and October, SiTime launched precision timing solutions for ADAS, ECUs, and infotainment — differential oscillators and ultra-low-power oscillators. SiTime says the former “are 10x more resilient and ensure reliable operation of ADAS across extreme road conditions and temperatures,” while the latter extend battery life up to 20% with the highest accuracy across the 32kHz band. Both oscillators are set for volume production in Q2 2023.

The autonomous driving industry, from semi-autonomous ADAS to fully-autonomous robotaxis and trucks, presents a long-term, multi-billion dollar opportunity up for grabs.

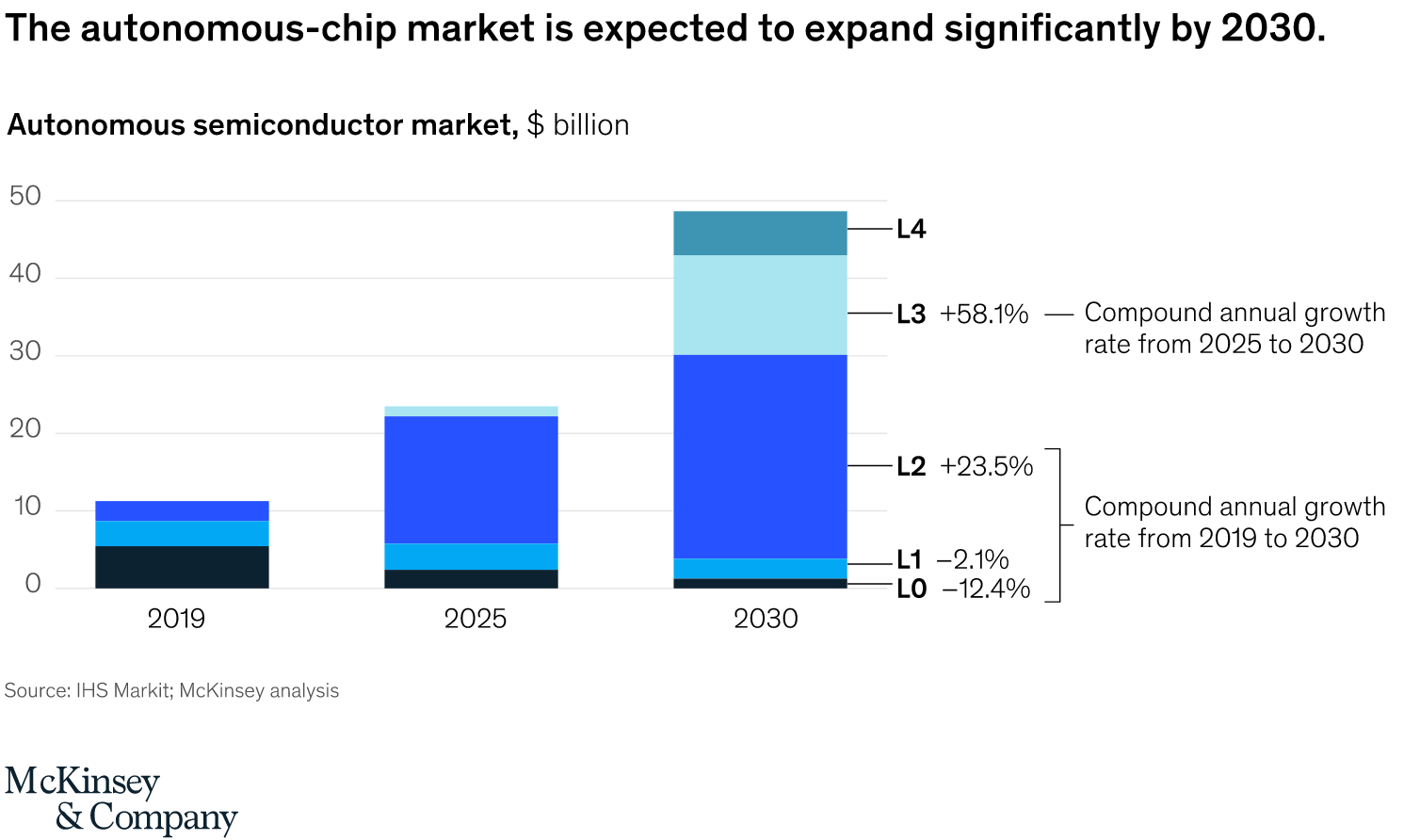

For autonomous chips, McKinsey projects the market to witness substantial growth, from ~$11 billion in 2019 to nearly $50 billion by 2030; although this opportunity is not quite as large for SiTime’s specialized solutions, there is substantial growth in the L2+ sphere ahead. This encompasses currently available semi-autonomous driver assistance systems such as Tesla’s (TSLA) Autopilot, GM’s (GM) Super Cruise, Ford’s (F) BlueCruise, Mercedes’ (OTCPK:MBGAF) Drive Pilot, and more, all the way to robotaxis.

McKinsey

The electrification and automation shift in vehicles will drive increasing content per vehicle — Gartner projects semiconductor content per vehicle will rise from $712 in 2022 to $931 in 2025, while Qualcomm (QCOM) sees content per vehicle potentially reaching $3,000 for premium vehicles by 2030.

Major OEMs are investing billions into ADAS development — Polestar (PSNY), NIO (NIO), XPeng (XPEV), Kia, Honda (HMC), Lucid (LCID), Toyota (TM) and Hyundai (OTCPK:HYMLF) are all adding L2/conditional L3 ADAS to vehicles over the next few years. This major increase in ADAS deployment will require equal or greater growth in precision timing solutions like SiTime’s, as these vehicles could require 60 or more of the sensors and oscillators.

SiTime is positioning the auto segment as a driver for revenues in 2023, and the segment will play a key role in elevating ASPs, as one of the three factors highlighted as an ASP driver during FQ3. Although headwinds are aplenty for SiTime’s major end markets, clearer skies in the second half of fiscal 2023 boosted by a strong auto segment position the company for resumption of high growth rates moving into 2024 and potential share price upside.

A Market-Beating Opportunity

Although 2022 has proven to be a challenging year for shares, 2023 opens up an opportunity to capture a recovery in shares while limiting losses in case growth deceleration over the next two quarters is higher than expected.

The opportunity here would be long shares, combined with a long put and covered call. For example, a May ’23 $150 covered call and a May ’23 $95 long put would cost a net debit of ~$700, bringing the total cost of shares to ~$108.80. The break-even for that trade to be profitable would be above $108.80, or a +6.8% move higher over the next five months. Profits would be capped at $4,120, or +37.8%, until the May expiration should shares recover above the covered call’s strike of $150.

Losses with this trade would be limited to ~12.6%, or the $1,380 difference between the capital outlay and the put strike price. In essence, this trade prevents downside stemming from an expensive valuation while SiTime navigates through growth deceleration. Switching the put’s expiry to February or January ’23, for example, would both increase profit potential and further minimize losses by reducing the option debit, but increase downside risk following the put’s expiry.

Limiting downside risk looks to be vital here — SiTime’s expensive valuation heading into this two-quarter downturn increases the risk that shares underperform.

By FQ1 2023, TTM EBITDA is projected to be $8 to $12 million, declining from FQ2 and FQ3’s EBITDA of $21.8 million. This decline is driven by higher levels of operating expenses, declining gross margins to the low 60% range, and an increase in interest income. With SiTime’s TTM EV/EBITDA bottoming at ~17x in mid-October when TTM EBITDA peaked at $64.5 million, shares are increasingly exposed with declining EBITDA, trading at well over 100x with this projection.

However, the outlook remains broadly positive — shares have rebounded nearly 27% since FQ3’s earnings report, which highlighted the upcoming end market weakness and revenue declines, suggesting that the market may have found a short-term bottom in early October given the relatively muted post-earnings reaction.

For 2023, FQ2 through FQ4 are expected to show sequential growth after FQ1’s weakness; at the high end of projected FY23’s revenues of $248 million, q/q revenue growth would be averaging ~18% each quarter, from ~$56 million in FQ2 to ~$78 million by FQ4. Automotive is expected to be a major growth driver in the second half of the year with more ADAS-equipped models hitting the markets from Hyundai, Kia, Ford, GM, VW (OTCPK:VWAGY), BMW (OTCPK:BMWYY), and many other high-volume manufacturers; SiTime’s recent product launches will also be in serial production, boosting end-of-year revenue growth.

For 2H ’23, SiTime’s profitability is expected to resume growth, with GAAP earnings projected at ~$0.64 in an initial estimate; however, the continuation of sequential revenue growth in early 2024, driven by automotive and resumption of growth in multiple end markets following this slump, are expected to drive revenues towards $330 million and GAAP earnings towards $2.50 at a net margin of ~17%. With strong profitability and ~35% y/y revenue growth projected for FY24, 2H ’23 could see shares valued around 65x FY24 earnings (39x FY24 EV/EBITDA) to close the year around $168, or ~55% upside in a bull case scenario.

On the other hand, a worse-than-expected downturn in end markets earlier in 2023, coupled with worsening macroeconomic conditions could easily cut SiTime’s rich valuation by a third, or even half — towards a 26x PE or >100x EV/EBITDA ratio with EBITDA dipping below $8 million as R&D and total operating expenses outweigh gross profit recovery. Should SiTime’s financials erode or the macro picture worsen, the put in this trade will minimize downside, but not entirely eliminate losses.

Outlook

SiTime has significantly under-performed both the broader market and the PHLX Semiconductor Index as it nears an expected two-quarter slump in end-market demand and revenues. However, expectations for sequential growth beginning in FQ2 ’23 and continuing through the end of the year set the stage for a potential market beating opportunity with shares. EBITDA and EPS are expected to resume growth in the back half of the year as revenues are projected to rise above $65 million and near $80 million by FQ4. A paired covered call and long put trade for May offers protection to downside movements for FQ4 ’22 and FQ1 ’23 earnings reports should the end market demand be weaker than expected, while providing at least 37% upside potential through May and higher potential should both options expire out of the money. Overall, it’s undoubtedly a risky trade on an expensive stock as macro headwinds have not yet cleared within rates or inflation, but it offers the opportunity to enter a leading, profitable niche semiconductor player with massive long-term tailwinds in major end markets such as ADAS at a capped-loss trade.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment