Just_Super/iStock via Getty Images

Macro-economic Overview

Lithium is big. The battery mineral is a critical component underpinning mass-scale EV vehicle production, presently at the heart of investment projects in Argentina, Chile, Australia, and Canada.

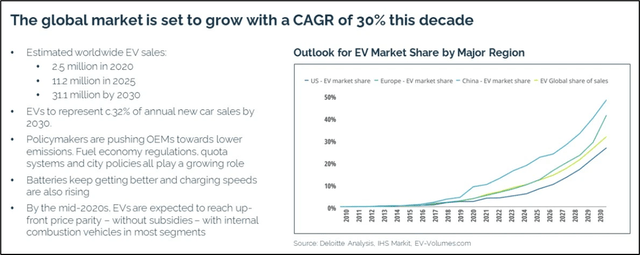

The sustainability agenda pushed widely by various political groups has promoted the electrification of transport, boosting the commodities industry and global mining. Gone are dirty old offshore oil rigs, making way for lithium brine pans, and capital-intensive hard rock surface mining activities.

Almost surreal, it is as if we have moved one problem to create another perchance only evidenced some years down the line. Only time will tell.

The Biden administration has demonized big oil, chastising US super-majors for generalized spikes in global energy prices, only to see those very firms tighten purse strings, abandon capital projects, and return cash to shareholders.

Therefore, oil prices have been supported, fueling an inflationary boom not seen for the past 40 years. Oppositely, the current US administration has praised the nascent EV industry. It has provided tax breaks, incentives, and copious amounts of public jawboning, spinning the benefits of green energy.

Exponential EV sales growth is expected to support lithium prices well into the second half of the decade.

That should be positive for projects like Snow Lake Resources (NASDAQ:LITM). Its Canadian lithium dream remains a way off but most of the puzzle pieces are present for big upside.

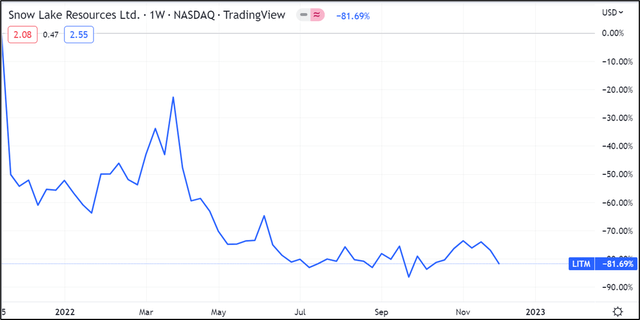

That is why investors may be scratching their heads; the firm’s capital destruction has been jarring with a -81.69% equity price implosion since inception.

I am bearish on Snow Lake Lithium as the project is premised on a range of assumptions that may not materialize. With more robust lithium projects being developed in other parts of the world, investors should look elsewhere.

Company Introduction

Snow Lake Resources is a lithium-focused natural resources company. The company engages in exploration and development of battery minerals in Canada, holding an interest in the Thompson Brothers Lithium property and a 100% interest in the Snow Lake lithium project. The company is Canadian based with headquarters in Winnipeg, Canada.

Snow Lake Resources has shed -81.69% of its value since inception, with a market cap of only $42M.

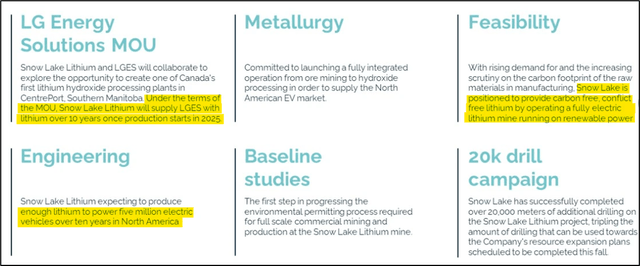

The company touts big project ambition but little in the way of revenues with the mining micro-cap presently capitalized to the tune of $42M. It has spent meaningful efforts promoting itself as a decarbonized pureplay on lithium rock mining without providing much indication on how it attends to achieve this.

It has memorandums of understanding for lithium supply with LG Energy Solution. However, these are non-binding and may not eventuate in the future. The company has positioned the Snow Lake project as a carbon free, conflict free lithium project powered by renewables and green energy.

That got me thinking, are there actually any lithium projects in conflict zones or is this an attempt by the firm to virtue signal project benefits? I could not think of any. Chile, Argentina, Australia, Canada?

The investment pitch uses ambiguous and intangible descriptions of company and project attributes.

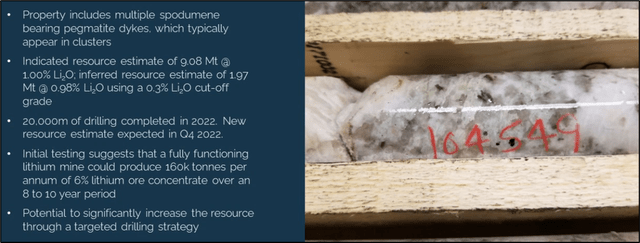

Snow Lake Lithium Project

I am wary when companies showcase ambiguous metrics to sell project attributes. Powering 5 million electric vehicles over 10 years seems much more enticing that selling a hard-rock lithium mine producing 160kt of 6% lithium concentrate over an 8 to 10-year period.

Put that into perspective against some of the projects currently underway in Australia. Liontown Resources’ (OTCPK:LINRF) Kathleen Valley project is geared for 500kt/ year of 6% spodumene production coming online in 2024.

It’s a 156Mt hard rock underground mine (unlike the Snow Lake project) with a project price tag of $545M. Compare this to Snow Lake’s 11Mt of indicated and inferred lithium resources and you need to be asking yourself why to invest in the first place?

The Snow Lake Project is only in its early stages making asset valuation difficult and risk ever present.

On one side, you have the Snow Lake project marketed by micro-cap Snow Lake Resources – the $42M lithium junior has a vastly unexplored asset but currently posts a project producing 160kt/ year of 6% lithium concentrate equivalent over 8-10 years. Note this project is yet to commence construction nor has it been financed. It is noteworthy to highlight that nowhere in the investor materials do we find any detailed project economics related to the Snow Lake deposit.

On the other side, you have Liontown Resources’ Kathleen Valley project – the A $3.2B lithium miner has started construction on its asset which posts production numbers of 500kt/ year of 6% lithium concentrate equivalent over the next 20 years. This project has commenced construction and has been financed.

No matter which way you look at it, it’s hard to make the pitch for Snow Lake Resources.

Financials

Snow Lake Resources currently does not have the financial firepower to fund a hard rock lithium project, even of Snow Lake’s caliber, without recourse to additional funding. The company has never posted any revenues, which is normal given its stage in the business cycle.

Losses have accumulated, with the lithium venture posting -10.6M in net income FY2022. Nothing dramatic per se, but it does provide some insights into the financial strain to get a medium-sized lithium project off the ground. The company does have $26M in cash ready to deploy should a final investment decision be made.

Stock based compensation – presently at $9M triggers alarm bells. Thus far, the company’s projects are in their embryonic stages with cash generation several years down the line. Rewarding executives this early into the project cycle may not be a prudent alignment of shareholder/ insider interests.

The good news is that the company holds little in the way of debt. Notwithstanding, getting the Snow Lake lithium project up and running will require a capital raise, either in the shape of debt or additional stock issuance. Some cash has been deployed with $6.7M being spent (FY2022) in capital expenditure.

Issuance of common stock has been the main way the company has accessed additional funds. Given the current tight monetary environment, it is likely that stock issuances remain a primary source of finance.

In any case, the company’s financial situation does not appear geared to take on development of a project likely to cost North of $200M.

Risk

There is risk aplenty with Snow Lake Resources. The company is developing a project still in its very infancy facing a tight credit market where alternative projects are competing for cash. Risk premiums on equity have increased as investor sentiment for equities has dampened.

While issuance of new equity to finance the project is possible, this provides increasingly marginal returns as new issuances pressure the stock price and shareholders are diluted. Little is known on the project economics as the company has yet to provide any meaningful details and no tangible offtake deals exist.

The MOU signed with LG Energy is non-binding, providing little comfort in terms of future revenue generation. When information is relatively scarce, investors should be wary.

Even the investor section of the Snow Lake Resources website provides little tangible information.

Upside Risks & Eventualities

While there are currently not a great deal of eventualities that would change my outlook, some upside risks do exist. These include a progressive easing of tight monetary policy making access to credit markets more easy for project funding. Cheaper project finance is likely to provide some notable upside to the equity price as the project goes into full swing.

Finally, takeovers are always a risk for short equity holders. While presently, there seems little appeal for the firm to be a takeover target, the likelihood of consolidation in the lithium space is likely to increase. Accordingly, the risk of a buy-out of the company at a premium would be wholly detrimental to the short thesis.

Key Takeaways

With multiple lithium mining projects competing for investor dollars, prudence and conservative assumption-building around projects are critical. Australia, Argentina, Chile, and Canada are all developing long-term lithium plays aimed at capitalizing on a battery minerals boom. That is why projects like Snow Lake should be regarded with a hint of skepticism.

A $42M Canadian mining junior that is going to bring us the world’s first non-conflict area, green energy lithium hard rock operation? To get a project of this magnitude over the finish line, the capital expenditure will be onerous.

Capital is scarce and continued capital raises through equity issuance will continue to damage the firm’s long run capitalization. Yet not many other opportunities exist, credit markets are tight with an increasing number of projects competing for money.

With little in terms of rock-solid project financials, there is little to get excited about this project, particularly when more tangible, advanced projects exist elsewhere.

Be the first to comment