CreativeNature_nl/iStock via Getty Images

REIT Rankings: Single-Family Rentals

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on December 5th.

Hoya Capital

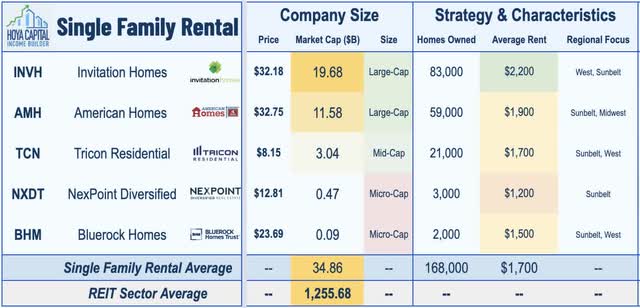

Single-Family Rental REITs have uncharacteristically lagged – dipping by more than 30% this year – swept up by stiff headwinds across the housing industry from the historic surge in mortgage rates. While residential rent growth has moderated significantly over the past quarter from the record double-digit levels seen earlier this year, the recent gloomy narrative on SFR REITs appears unwarranted. In the Hoya Capital Single-Family Rental Index, we track the three major SFR REITs: Invitation Homes (INVH), American Homes (AMH), and Tricon Residential (TCN) along with newly-listed Bluerock Homes (BHM) – a recent Blackstone spin-off. We also track NexPoint Diversified (NXDT) – which converted to a REIT from a closed-end fund this year – and owns minority interests in Vinebrook and NexPoint Home Trust.

Hoya Capital

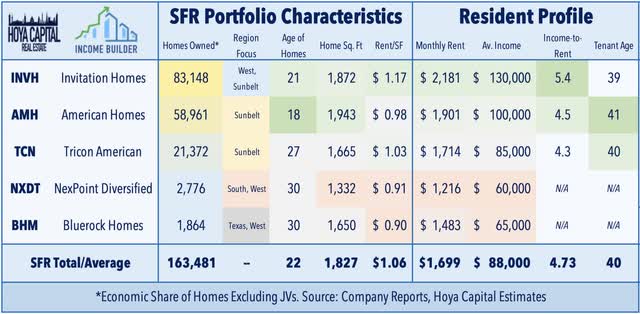

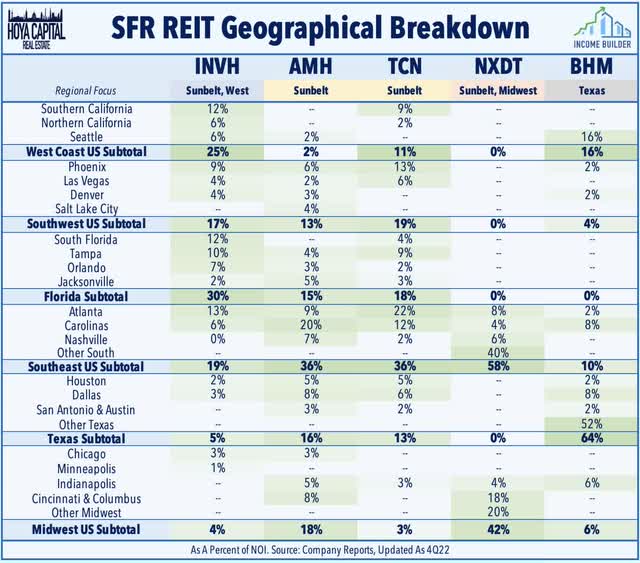

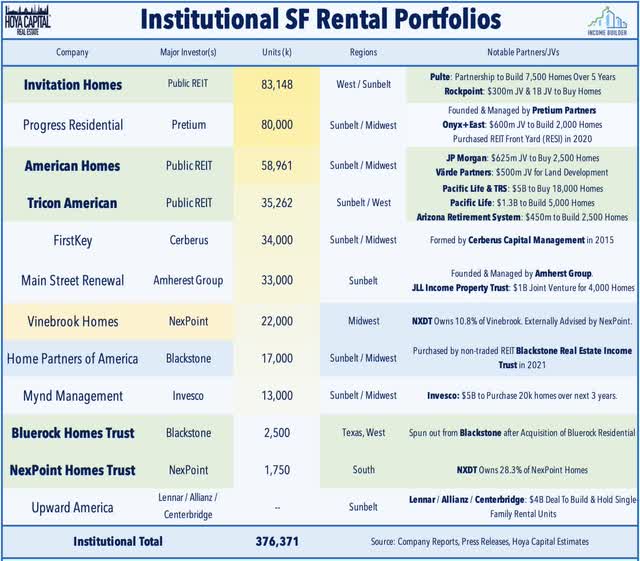

Single-Family Rental REITs concentrate heavily on the Sunbelt markets that have experienced the strongest economic growth during the post-GFC and post-pandemic recoveries. Invitation Homes is the single-largest owner of SFRs in the country with roughly 83k units with a significant presence on the West Coast and in Florida. American Homes owns nearly 60k units and focuses primarily on the Sunbelt and Midwest regions. Tricon Residential – which is dual listed in the U.S. and Canada operates more than 33k homes including its joint ventures with economic ownership in roughly 21k homes concentrated primarily in the U.S. Sunbelt markets. SFR REITs comprise roughly a third of NexPoint Diversified’s portfolio, through a 10.8% stake in Vinebrook’s 22,000k and a 28.3% in NexPoint Homes Trust’s 2k homes. Newly-listed Bluerock Homes Trust – spun out after Blackstone’s acquisition of Bluerock Residential – owns roughly 2k homes in the U.S. South.

Hoya Capital

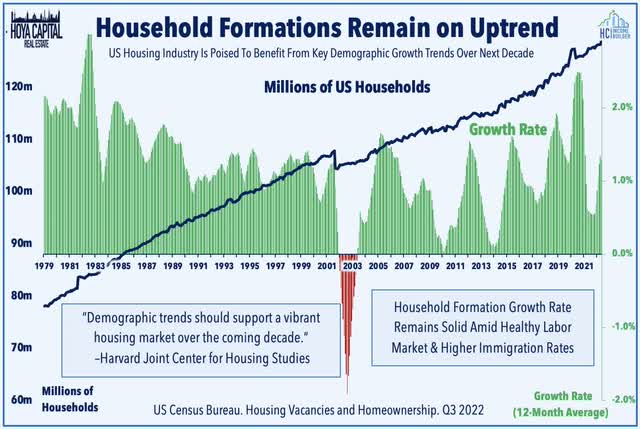

The average single-family monthly rent is $1,100 per month, but REIT portfolios skew towards the higher end of the quality spectrum with an average rent of around $1,800 per month in homes that are typically around 2,000 square feet. These three SFR REITs own a combined 165,000 SFR units in relatively high-value suburban markets and, importantly, their tenant credit profile is far better than the national averages for renter households with average annual income ranging from 85k-130k – well above the average renter household at 36k – and an average income-to-rent ratio of around 5x. The average SFR head-of-household is 38-42 years old, an age cohort that will see the strongest growth of any 5-year segment over the next decade.

Hoya Capital

Other major institutional investors involved in the SFR sector include private equity firms Pretium Partners which owns/operates more than 80,000 homes through its Progress Residential platform, Cerberus Capital, which owns more than 34,000 homes through FirstKey Homes, Amherst Group, which owns/operates more than 34,000 homes through Main Street Renewal, and the aforementioned NexPoint Advisors, which manages nearly 25,000 homes through Vinebrook Homes and NexPoint Homes Trust. NexPoint also manages apartment REIT NexPoint Residential (NXRT) and mortgage REIT NexPoint Real Estate Finance (NREF). Several traditional Wall Street “heavyweights” are active in the space as well including Blackstone (BX), which owns 17,000 homes through Home Partners of America, which recently made headlines for slowing its home purchases in several markets.

Hoya Capital

Single-Family Rental Fundamentals

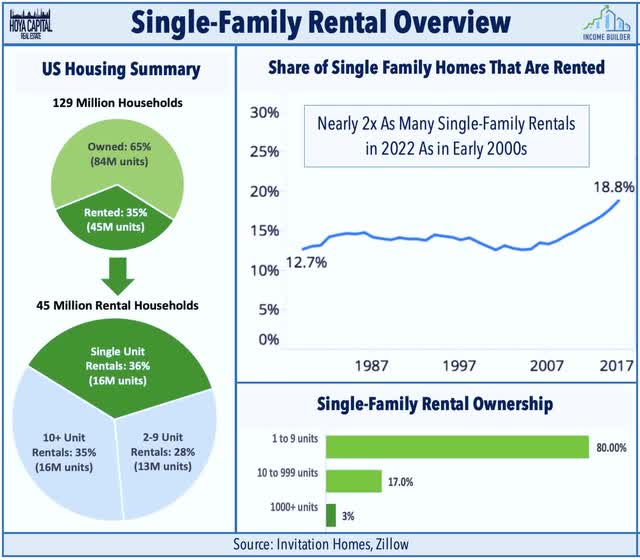

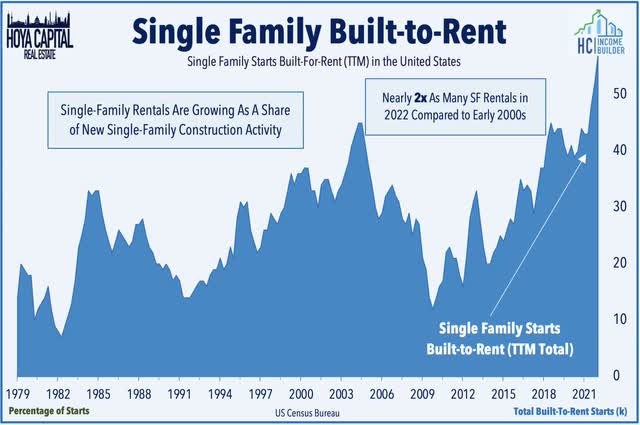

One of the notable success stories of the Modern REIT Era, SFR REITs were born from the last economic crisis when a cascade of foreclosures enabled a new class of institutional rental operators to emerge by buying distressed properties en masse. Even with forecasts for national home price declines of 5-10% over the next year, widespread distress in the U.S. housing market is highly unlikely given the underlying supply constraints resulting from a decade of underbuilding, and ironically, due to the more substantial presence of well-capitalized institutional investors. The share of single-family homes that are rented has nearly doubled since the early 2000s and now comprises nearly a quarter of the single-family market, but the vast majority of the SFR market is still managed by “mom and pop” investors that own between 1-9 units.

Hoya Capital

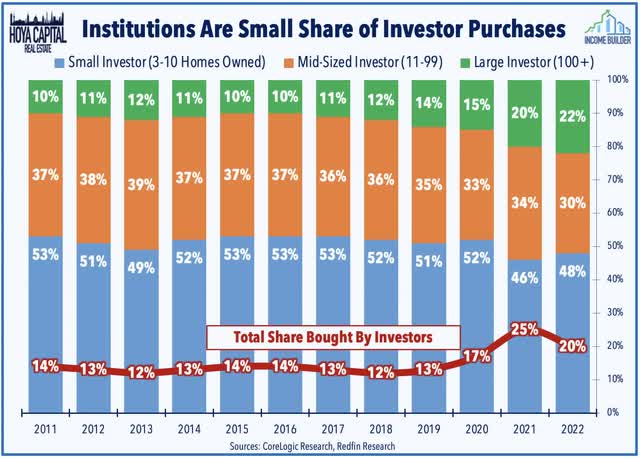

Cooling home price appreciation and tightening credit conditions is indeed bad news for many new “start-up” entrants into the SFR scene that are learning the hard way that the SFR game is a capital-intensive business that requires significant scale to operate profitably. Consistent with our view that the “institutionalization” of the SFR sector remains in the early-innings, we believe that many “mom and pop” investors that finance SFR investment properties with traditional mortgages with effective “Debt Ratios” well above 70% and account for more than 50% of the SFR market will cede market share to larger institutions that have access to cheaper and deeper sources of long-term capital. With debt ratios in the low-20% range, AMH and INVH are well-positioned to be aggressors as more highly-levered players seek an exit.

Hoya Capital

Four-decade-high levels of inflation have eroded built-up stimulus savings, but the economic slowdown will have to get awfully ugly to see widespread tenant credit issues. SFR REITs enter this uncertain economic period on solid footing, benefiting from historically favorable Buy vs. Rent economics resulting from the historic surge in mortgage rates through the first half of 2022. Our newly-developed Own vs Rent Index highlights that while the monthly cost of owning and renting was nearly identical at the start of the year, owning a home now costs $700 more per month than renting the same home. This differential is almost $300 higher than at any time since the turn of the century, and households now hold a historically high preference for renting over buying.

Hoya Capital

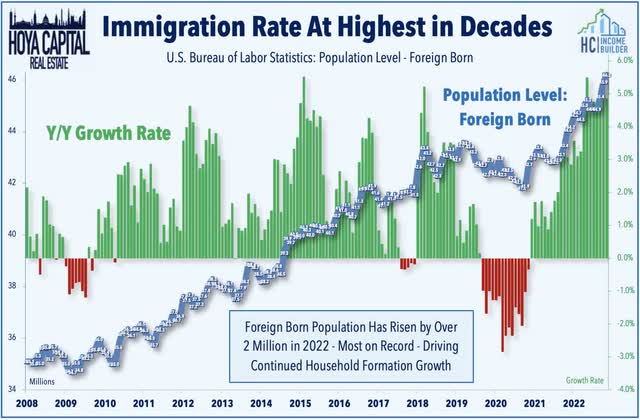

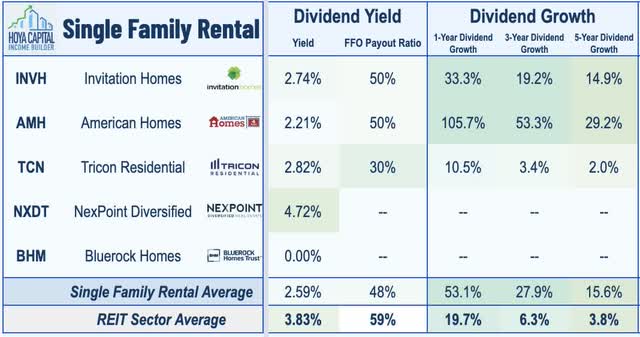

We remain more upbeat than consensus on the overall household formation outlook – which has actually accelerated in the back half of 2022 despite the stiff headwinds from higher rates and slowing economic growth. The boost this year has come from a pair of unlikely sources that many economists had largely “written off” in recent years – inbound immigration and accelerating birth rates. Census data shows immigration rates into the United States have accelerated to the highest rate in decades this year with the foreign-born population level increasing by over 2 million through eleven months of 2022 while the U.S. CDC reported that birth rates rose for the first time in seven years in 2021 – challenging two core tenants of housing skeptics’ prognoses.

Hoya Capital

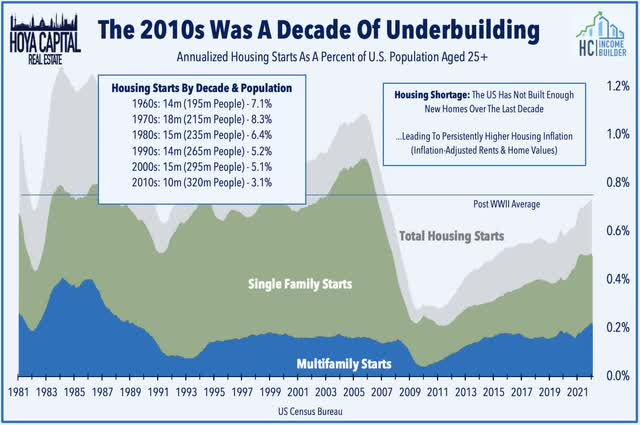

Fueled by the maturing millennial generation – the largest age cohort in American history – the 2020s were already poised to be a strong decade for household formation growth which comes at a time of historically low housing supply – and the effects of this significant supply/demand mismatch were on full display during the pandemic. New home construction – particularly in the single-family category – has been depressed over the last decade, a result of the substantial and far-reaching fallout from the financial crisis on the residential construction industry. In the 2010s, the U.S. built homes at a rate that was 50% below the post-1960 average adjusting for population growth.

Hoya Capital

Single-Family Rental REIT Fundamentals

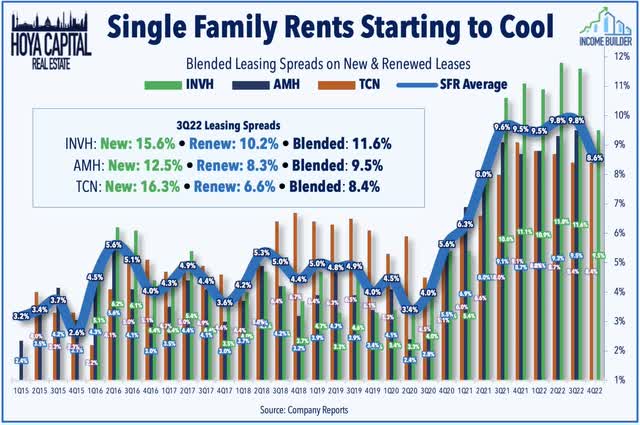

As discussed in our REIT Earnings Recap, single-family rent growth trends remained quite impressive despite the broader cooldown seen across national rental markets, with new lease rates higher by nearly 15% in the third-quarter, on average, while renewal rates rose by 8.5% resulting in average blended spreads of 8.6%. We expect the “stickiness” of single-family rent growth to be a theme over the next year because, unlike multifamily markets which are poised to face supply headwinds from a recent surge in new development, homebuilders have responded to the surge in rates by pulling back from an already historically supply-constrained single-family market.

Hoya Capital

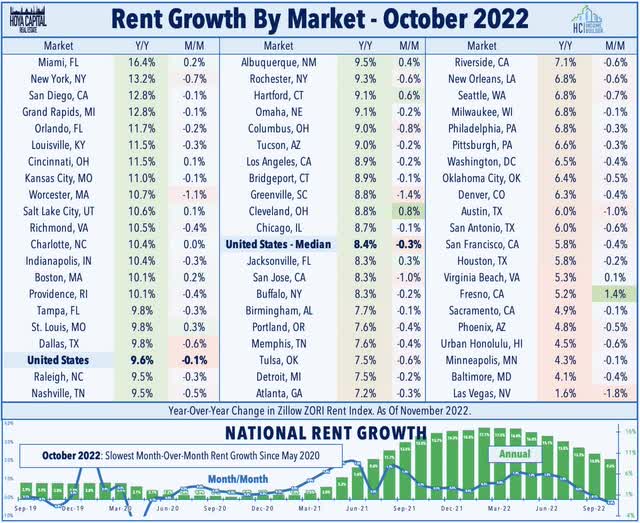

These reports were consistent with private market data showing moderating rent growth – but with notably more “stickiness” in the SFR sector compared to the multifamily sector. CoreLogic reported last month that year-over-year single-family rent growth cooled to 10.2% in September, down from a high of 13.9% in April 2022. By comparison, Apartment List has observed a more pronounced slowdown in multifamily markets in their latest report with the year-over-year rent growth figure slowing to 4.7% from a peak of 18%. Recent data from Zillow (Z) – which includes both SFRs and apartments – shows that rental rates cooled to an 8.4% year-over-year rate in October, down from the peak of 17.1% earlier this year.

Hoya Capital

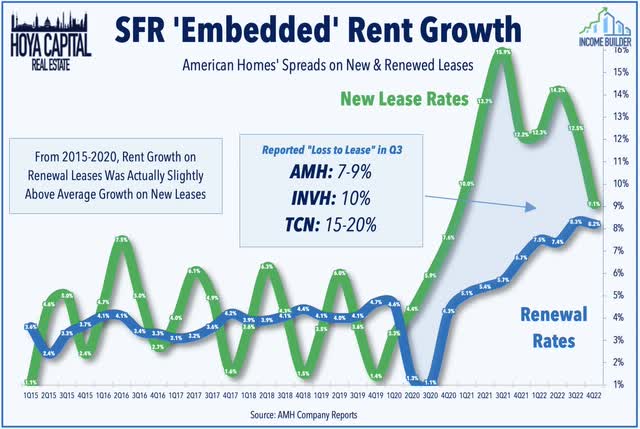

The “embedded” rent growth potential for SFR REITs should not be discounted, either, given the still-wide spread between rent growth on new and renewal leases – which we believe has built-up a longer runway for sustained rent growth that will be unlocked over the coming quarters. Invitation Homes estimated that its current leases are 10% below market rate while American Homes commented that its comparable “loss to lease” spread is in the “high-single-digits.” Tricon estimated its embedded spread is “in that 20% range. Single-Family Rental REITs have been under pressure since reporting uncharacteristically soft third-quarter results, however, with INVH and AMH each lowering their full-year FFO and NOI outlook on higher-than-expected property tax expenses and higher bad debt expense from renters who have fallen behind on their rent.

Hoya Capital

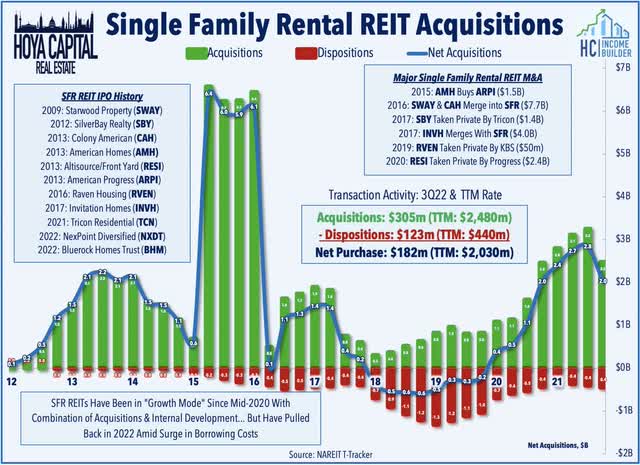

SFR REITs also scaled back their recently aggressive pace of external growth this past quarter, but importantly, are currently one of the few remaining “net buyers” in the SFR space given the stiff rate headwinds. Combined, these REITs have added more than $2B in net acquisitions over the past year, down from the $2.8B pace last quarter. Tricon now expects to acquire approximately 7,300 homes for the full year – down from its prior guidance of 8,000. Invitation Homes also revised its assumptions for annual 2022 net acquisitions to $850M, down from $1.3B. American Homes revised down its assumptions to $1.65B in total investments, down from $1.8B last quarter.

Hoya Capital

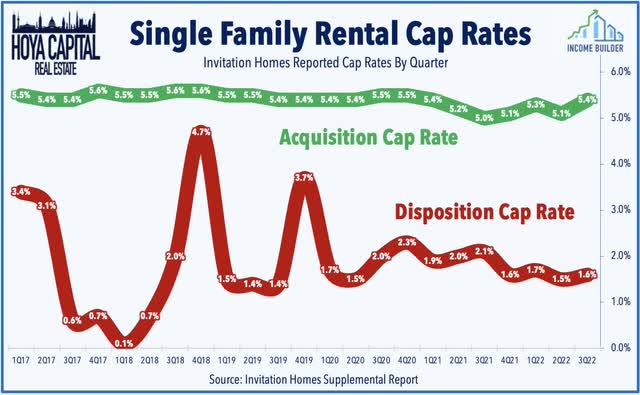

Despite the recent successes, critics continue to question the long-term sustainability of the institutional stabilized ownership model pioneered by SFR REITs, particularly if home price appreciation consistently outpaces rent growth. This can create a problematic situation for SFR REITs: Future acquisitions can become less accretive as REITs are forced to pay higher prices for the same cash flow. Meanwhile, property taxes and other expense items are generally tied to rising home values. Aided by the PropTech efficiencies, however, INVH continues to see accretive acquisition opportunities with acquisitions with cap rates in the mid-5% range while it has historically sold properties with incredibly low cap rates between 1% and 3%.

Hoya Capital

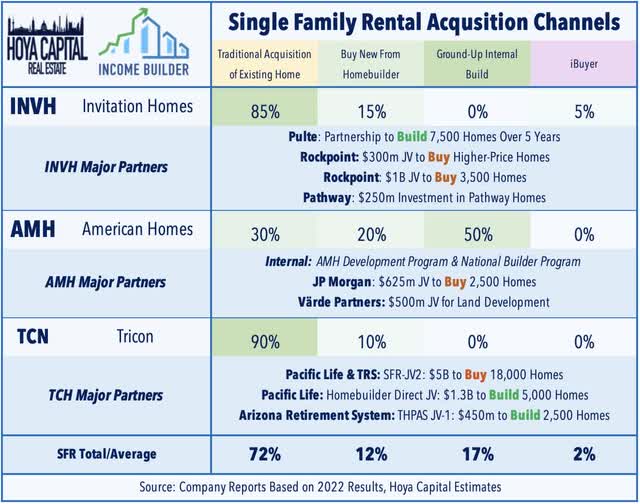

Rapid home price appreciation and stiff competition in the “traditional” acquisition channel have forced SFR REITs to get creative with external growth plans. These three REITs combined to add more than 10,000 homes to their portfolios in 2021 led by Tricon, which added roughly 6,500 homes while American Homes added 4,600 to its portfolio in 2021 while Invitation Homes added 4,000 homes utilizing a mix of traditional channels, ground-up internal development, and partnerships with homebuilders.

Hoya Capital

“If you can’t buy it, build it” has been the recent mantra as SFR REITs have effectively become strategic homebuilders through internal development and partnerships with existing builders. INVH announced a partnership with PulteGroup (PHM) in July to buy 7,500 new built-to-rent homes while Lennar (LEN) partnered with Allianz to build $4B worth of SFR homes and Toll Brothers (TOL) partnered with Equity Residential (EQR) to build $2B rental units. American Homes – which has quickly become one of the largest homebuilders in the country – built over 2,000 homes in 2021 through its internal pipeline which now accounts for half of AMH’s acquisitions with the remaining 50% split between its National Builders Program (buying new homes from homebuilders) and traditional acquisitions.

Hoya Capital

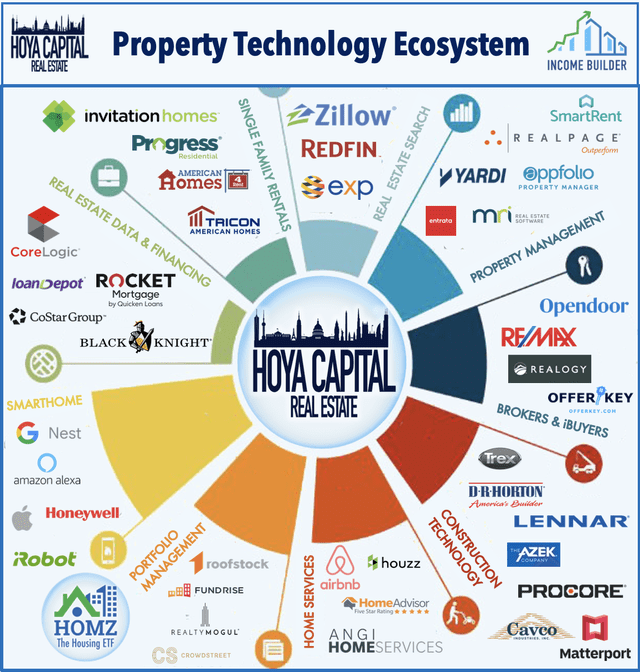

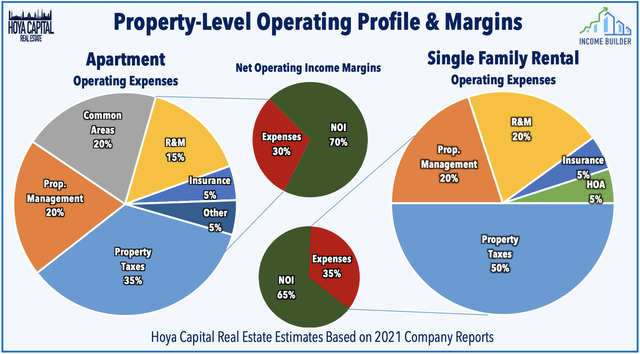

A major factor fueling the rise of large institutional operators is the significant efficiencies gained in recent years through emerging property technology offerings (“PropTech”) that have enabled SFR REITs to operate with Net Operating Income (“NOI”) margins that are on par with apartment REITs. These REITs have tapped into the emerging “iBuying” industry to source acquisitions through relationships and direct investments into companies like Opendoor Technologies (OPEN) and Offerpad (OPAD) and leverage data from CoreLogic, CoStar Group (CSGP), Black Knight (BKI), and Redfin (RDFN) to source accretive acquisition opportunities.

Hoya Capital

Deeper Dive: Broader SFR Industry Trends

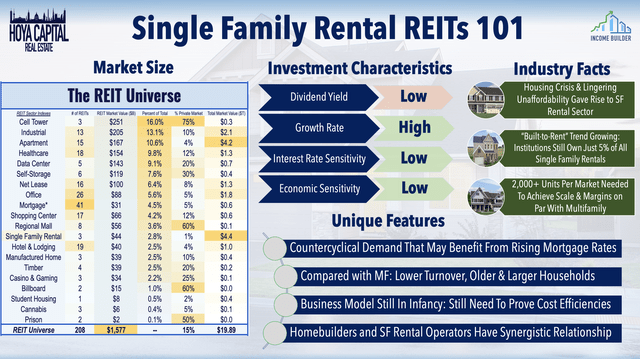

Taking a step back, single-family rental REITs comprise roughly 1-2% of the broader REIT Indexes and 5% of the Hoya Capital US Housing Index. Initially, in a phase we call SFR 1.0, the SFR REIT business model depended on the bulk acquisition of distressed properties, and REITs used foreclosures as a primary source of new home acquisition. In SFR 2.0, the business model evolved into a stabilized ownership model, focused on achieving efficiencies and growing via one-off acquisitions. In SFR 3.0, we see SFR REITs mirroring the model of the larger apartment REITs with internal development teams capable of supplementing the acquisition-fueled external growth channels.

Hoya Capital

Scale is a key competitive advantage for these large institutional SFR owners, and relative to apartment buildings where each property can have several hundred units, geographical fragmentation makes it more difficult to acquire a substantial number of units to achieve scale. Density within markets is especially critical for SFR REITs for achieving efficiencies in leasing, acquisition, and maintenance. We estimate that 500-1,000 units per market are needed to achieve minimum scale, but that 2,000 units or more are needed to reach a “critical mass” whereby the REIT can localize operations within that market and achieve cost efficiencies on par with apartment REITs.

Hoya Capital

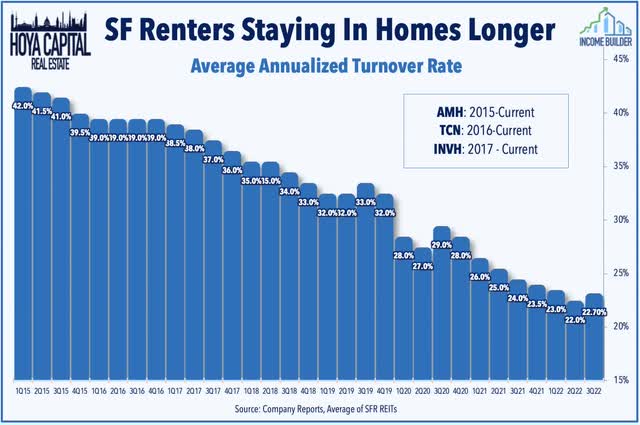

While Wall Street’s growing presence in the SFR space has garnered plenty of political and media attention (and “blame” for the rise in home values and rents over the last several years), large institutional investors represent a tiny fraction – roughly 1-2% – of the overall single-family market. Smaller “mom and pop” investors – those that own between 2-10 homes and finance purchases with traditional mortgages – are responsible for the bulk of investor home buying activity. While these trends attract a fair share of negative headlines, renters appear quite content with these larger landlords, underscored by ever-lower turnover rates and near-record-high occupancy rates achieved by these SFR REITs – both at levels that are stronger than the average single-family rental property.

Hoya Capital

Single-Family Rental REIT Performance

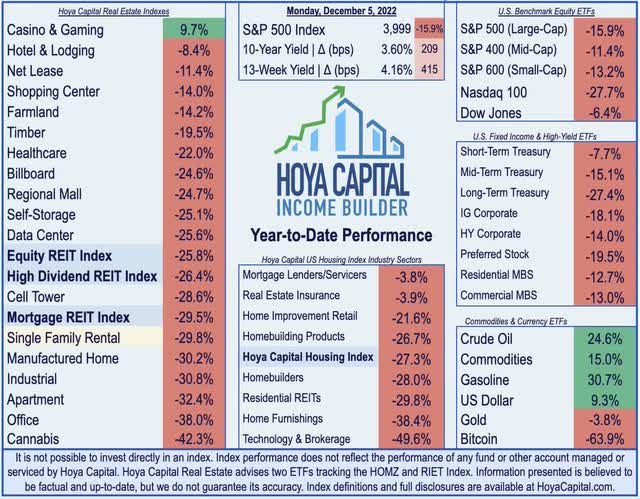

Swept up by stiff headwinds across the housing industry from the historic surge in mortgage rates, SFR REITs have uncharacteristically lagged this year. After delivering total returns of 52% in 2021, the Hoya Capital Single-Family Rental REIT Index is lower by nearly 30% in 2022, slightly underperforming the 25.8% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 15.9% decline from the S&P 500 ETF (SPY). One of the newer REIT sectors, single-family rental REITs have produced excellent total returns relative to other REIT sectors in their relatively short history.

Hoya Capital

Single-Family Rental REIT Dividend Yields

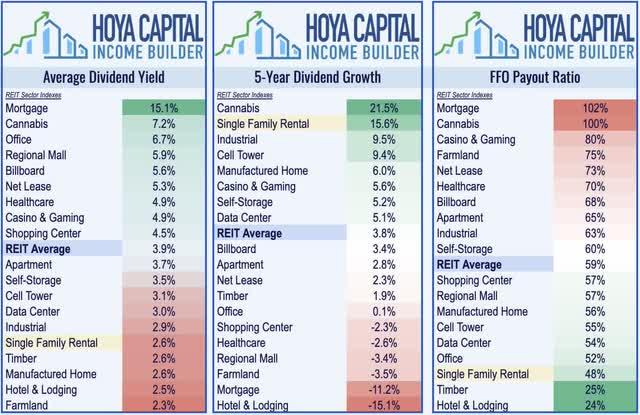

Single Family Rental REITs are quintessential “Growth REITs” with relatively low dividend yields but with a high potential for dividend growth. Based on dividend yield, SFR REITs rank near the bottom of the REIT universe, paying an average yield of 2.6% compared to the REIT sector average of 3.9%. SFR REITs pay out just half of their available cash flow, however, and dividend growth has averaged more than 15% per year over the last five years, powered by the combination of robust external growth and strong rent growth.

Hoya Capital

Dividend growth has been especially strong over the past three years during the “pandemic era” as all three REITs have significantly raised their dividends over the past several quarters. After raising its dividend by another 30% earlier this year, Invitation Homes now pays a dividend yield of 2.74%, similar to the dividend yield offered by Tricon of 2.78%. American Homes pays a dividend yield of 2.21% after hiking its payout by 80% earlier this year. NexPoint Diversified declared its first quarterly dividend in October after paying monthly distributions as a CEF, implying a forward dividend yield of 4.72%. Bluerock Homes has not yet indicated its dividend rate.

Hoya Capital

Takeaways: Save The Gloom And Doom

Residential rent growth has moderated precipitously over the past quarter from the record double-digit levels seen earlier this year, but the recent gloomy narrative on SFR REITs is unwarranted. While multifamily markets are poised to face supply headwinds from a recent surge in new development, builders have pulled back from an already historically supply-constrained single-family market. Cooling home price appreciation and tightening credit conditions is indeed bad news for many new “start-up” entrants into the SFR scene that are learning the hard way that the SFR game is a capital-intensive business that requires significant scale to operate profitably, but SFR REIT are well-positioned to be aggressors as more highly-levered seek an exit. Despite the sharp housing cooldown, household formations have actually accelerated this year, lifted by historic levels of inbound immigration and an uptick in birth rates – challenging two core tenants of housing skeptics’ prognoses.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment