cagkansayin

Earnings of Simmons First National Corporation (NASDAQ:SFNC) will most probably dip this year due to higher provisioning for expected loan losses ahead of anticipated economic headwinds. On the other hand, acquired loans and significant margin expansion will support the bottom line. Overall, I’m expecting Simmons First National Corporation to report earnings of $2.02 per share for 2022, down 18% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Simmons First National Corporation.

Loan Portfolio Relying on the Recent Acquisition

Simmons First National Corporation completed the acquisition of Spirit of Texas Bancshares on April 8, 2022, as mentioned in a press release. The acquisition increased Simmons’ loan portfolio by approximately 19% and its deposit book by around 14%.

Apart from the acquisition, loan growth will remain low this year as the outlook for organic loan growth isn’t too bright. The management’s strength does not lie in the organic growth area as the company has historically relied on acquisitions for growth. Simmons has, in fact, completed 13 M&A transactions in the last ten years, according to its website. The management mentioned in the conference call that it doesn’t expect discussions on M&A to continue for a while; therefore, there will likely be no acquired growth for the next year or so.

High interest rates will likely be the biggest headwind for organic loan growth. The Federal Reserve projects interest rates to peak in late 2022 or 2023. Therefore, it is very likely that commercial borrowers will postpone their borrowing plans for capital expenditure until next year when rates are declining.

On the plus side, the management mentioned in the first quarter’s earnings presentation that as of March-end, commercial loan pipelines were strong and had increased for six straight quarters. This means that organic loan growth can be expected to remain at a decent level through at least the second quarter of 2022.

Considering these factors, I’m expecting the loan book to increase by 20.6% by the end of 2022 from the end of 2021. Meanwhile, deposits will likely grow more or less in line with loans for the last three quarters of 2022, excluding the impact of the acquisition. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | |||||

| Net Loans | 11,667 | 14,357 | 12,663 | 11,807 | 14,242 |

| Growth of Net Loans | 8.6% | 23.1% | (11.8)% | (6.8)% | 20.6% |

| Other Earning Assets | 3,136 | 4,537 | 7,200 | 10,123 | 10,296 |

| Deposits | 12,399 | 19,850 | 16,987 | 19,367 | 22,329 |

| Borrowings and Sub-Debt | 1,795 | 1,836 | 2,024 | 1,908 | 2,325 |

| Common equity | 2,246 | 2,988 | 2,976 | 3,249 | 3,667 |

| Book Value Per Share ($) | 24.2 | 30.2 | 27.0 | 29.5 | 27.9 |

| Tangible BVPS ($) | 14.1 | 18.3 | 16.2 | 18.1 | 18.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Securities Portfolio and Deposit Book to Restrain the Margin’s Expansion

Simmons’ net interest income is only slightly to moderately sensitive to rate changes because of two main factors.

- A large securities portfolio. Simmons has a large balance of investment securities, most of which carry fixed rates. According to details given in the presentation, around 17% of securities were based on variable rates while the rest carried fixed rates. Therefore, the securities portfolio will hold back average earning-asset yields as interest rates rise. Additionally, the fixed portfolio’s market value will decline in a rising rate environment, which will reduce the book value of equity, thereby hurting the valuation.

- Highly rate-sensitive deposit book. Interest-bearing transaction accounts and savings deposits made up a hefty 62% of total deposits at the end of March 2022. Therefore, an overwhelming majority of the deposit book will reprice after every rate hike. Fortunately, presently there is excess liquidity in the banking industry, which gives banks above-normal power to price deposits.

Meanwhile, the loan portfolio is moderately sensitive because variable rate loans made up 44%, while fixed rate loans made up 56% of total loans at the end of March 2022, as mentioned in the presentation.

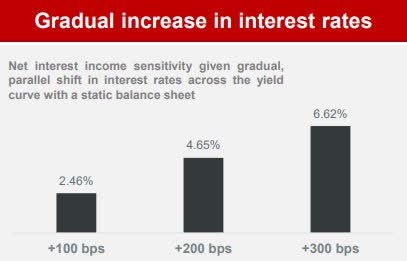

The results of the management’s interest-rate sensitivity analysis given in the presentation show that a 200-basis points hike in interest rates can boost the net interest income by 4.65% over twelve months.

1Q2022 Earnings Presentation

Considering these factors, I’m expecting the average margin in 2022 to be 14 basis points higher than the average margin for 2021.

Higher than Normal Provisioning to Drag Earnings

Simmons First National reported a large provision reversal during the first quarter of 2022. Nonperforming loans made up 0.53% of total loans, while allowances made up 1.49% of total loans at the end of March 2022, as mentioned in the presentation. Although the allowance coverage seemed comfortable at the end of March, in my opinion, the coverage will be a bit tight ahead of the upcoming economic headwinds.

Heightened interest rates will likely push some borrowers into default who were already stretched because of the elevated inflation. Moreover, banks will want to build up their reserves now in case a recession comes to pass later this year or early next year.

Overall, I’m expecting the provisioning to be well above normal for the last nine months of 2022. However, due to the first quarter’s performance, provisioning for the full year will likely be only slightly above normal. I’m expecting Simmons First National to report a net provision expense of 0.25% of total loans in 2022. In comparison, the net provision expense averaged 0.24% of total loans in the last five years.

Expecting Earnings to Decrease by 18%

The anticipated hike in provisioning for loan losses will likely be the chief contributor to an earnings decline this year. Moreover, merger-related expenses will most probably push up the non-interest expenses for this year. Furthermore, the acquisition of Spirit of Texas Bancshares will dilute the per-share earnings. As mentioned in a previous press release, Simmons estimated that it will have to issue 18.3 million new shares for the shareholders of Spirit of Texas Bancshares.

On the other hand, the jump in the loan portfolio and significant margin expansion will likely support the bottom line. Overall, I’m expecting Simmons First National to report earnings of $2.02 per share for 2022, down 18% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||||

| Income Statement | |||||||||

| Net interest income | 553 | 602 | 640 | 592 | 697 | ||||

| Provision for loan losses | 38 | 43 | 75 | (33) | 35 | ||||

| Non-interest income | 144 | 198 | 240 | 192 | 208 | ||||

| Non-interest expense | 392 | 454 | 485 | 484 | 546 | ||||

| Net income – Common Sh. | 216 | 238 | 255 | 271 | 265 | ||||

| EPS – Diluted ($) | 2.32 | 2.41 | 2.31 | 2.46 | 2.02 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Simmons First National Corporation will announce its second-quarter results on July 21, 2022, according to a press release. I’m expecting the company to report earnings of $0.44 per share for the quarter.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

High Upside Calls for a Buy Rating

Simmons First National is offering a dividend yield of 3.6% at the current quarterly dividend rate of $0.19 per share. The earnings and dividend estimates suggest a payout ratio of 38% for 2022, which is higher than the four-year average of 28% but easily sustainable. Therefore, the earnings outlook presents no threat to the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Simmons First National. The stock has traded at an average P/TB ratio of 1.55 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 14.1 | 18.3 | 16.2 | 18.1 | ||

| Average Market Price ($) | 29.4 | 24.9 | 18.9 | 29.2 | ||

| Historical P/TB | 2.08x | 1.36x | 1.16x | 1.61x | 1.55x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.4 gives a target price of $28.6 for the end of 2022. This price target implies a 37.0% upside from the July 15 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.35x | 1.45x | 1.55x | 1.65x | 1.75x |

| TBVPS – Dec 2022 ($) | 18.4 | 18.4 | 18.4 | 18.4 | 18.4 |

| Target Price ($) | 24.9 | 26.8 | 28.6 | 30.5 | 32.3 |

| Market Price ($) | 20.9 | 20.9 | 20.9 | 20.9 | 20.9 |

| Upside/(Downside) | 19.4% | 28.2% | 37.0% | 45.8% | 54.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.8x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.32 | 2.41 | 2.31 | 2.46 | ||

| Average Market Price ($) | 29.4 | 24.9 | 18.9 | 29.2 | ||

| Historical P/E | 12.6x | 10.3x | 8.2x | 11.9x | 10.8x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.02 gives a target price of $21.7 for the end of 2022. This price target implies a 3.8% upside from the July 15 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.8x | 9.8x | 10.8x | 11.8x | 12.8x |

| EPS 2022 ($) | 2.02 | 2.02 | 2.02 | 2.02 | 2.02 |

| Target Price ($) | 17.6 | 19.7 | 21.7 | 23.7 | 25.7 |

| Market Price ($) | 20.9 | 20.9 | 20.9 | 20.9 | 20.9 |

| Upside/(Downside) | (15.5)% | (5.9)% | 3.8% | 13.4% | 23.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $25.1, which implies a 20.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 24.0%. Hence, I’m maintaining a buy rating on Simmons First National Corporation.

Be the first to comment