RichLegg/E+ via Getty Images

Cost, range, and charging are frequently cited as reasons why households still pass up buying an EV for an internal combustion engine vehicle. Range anxiety is still somewhat pertinent in the minds of those used to filling up their gas tanks to full in a couple of minutes and then driving their car for hundreds of miles. And while US charging infrastructure continues to be built out and improved on the back of a surge of capital expenditure by EV charging companies like ChargePoint (CHPT), EVgo (EVGO) and Blink Charging (BLNK), it still takes a few hours to get to near-full charge from zero unless you’re using a DC fast charging station.

This really should not be a barrier as the average American drives only around 39 miles a day, a number more than covered by even the cheapest used EV models with batteries at the later stages of their charge and discharge cycle. However, consumers rightly want peace of mind. The prospect of waiting hours to charge a vehicle that they have paid more for has proved too daunting and a reason why EVs still accounted for just 4% of new cars sold in the United States in 2021.

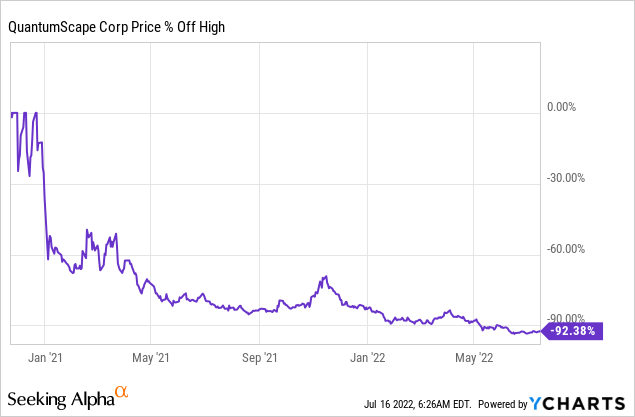

Founded in 2010 and based in California, QuantumScape (NYSE:QS) is developing solid-state batteries for the next generation of EVs. The company has had a colourful stock market history and went public via a blank check company in November 2020 at a $3.3 billion valuation. This would quickly rise to $54 billion in the weeks following with shares trading at $131 per common share.

With its stock now down by 92% from its all-time highs, two questions spring up. Is the future QuantumScape promised seemingly slipping away? And does the new share price present an opportunity for a long position?

The Future QuantumScape Promises

QuantumScape wants to replace conventional lithium-ion batteries with its non-combustible anode-free lithium-metal technology that has up to 80% greater energy density for enhanced range and has the ability to charge from 10% to 80% in just 15 minutes. The company is targeting 2023 to begin its pre-pilot production line and 2025 for its Start of Production.

At the core of its bull case is the partnership with Volkswagen, the largest automaker in the world by revenue who has financially backed QuantumScape since 2012. The German car behemoth expects to start rolling lithium-metal battery EVs off its production line from 2025. Volkswagen has also set out an ambitious roadmap for almost 70 new electric models by 2028 with 22 million EVs delivered. These are large numbers that are likely to be larger against the ongoing phase-out of fossil fuel vehicles. Indeed, the EU just recently announced a framework to phase out the sale of new internal combustion engine vehicles by 2035.

QuantumScape also now has three other automaker partners who will be testing its solid-state batteries. Whilst there are no real financials as the company is still may years away from commercialization, QuantumScape holds cash and equivalents of $1.35 billion as of its last reported quarter. This was against quarterly operational cash burn of $47.4 million and capital expenditure of $39.3 million. So assuming cash burn remains constant, there is more than enough cash reserves to fund itself until 2025. However, the company has stated it will need to raise more cash to build out its future factories. This will be a difficult task against the current stock market conditions, hence, shareholders will be hoping for a material improvement in sentiment in the near future to allow the company to raise the capital it needs to truly bring its products to market.

Solid-State Batteries And The New World

EVs form a fundamental tenet of the global drive towards net-zero. This has seen nations around the world rally through a patchwork of pledges and agreements to reduce reliance on fossil fuels and cut greenhouse gas emissions to as close to zero as possible. The ambition is clear; restrict the rise in mean global temperature to well below 3.6 °F above pre-industrial levels.

Solid-state batteries are very much in the early stages of their development and it isn’t just QuantumScape trying to commercialize them. Solid Power (SLDP), Panasonic (OTCPK:PCRFY), and Samsung (OTCPK:SSNLF) will all be competitors. The company has had its detractors in the past with a number of these bears questioning the technological claims of solid-state batteries and whether the company is truly only 3 years out from commercialization. Indeed, researchers have been working on solid-state batteries for decades to no avail.

QuantumScape thinks it has solved the dendrites buildup problem that has scuttled previous attempts at developing solid-state batteries. And even against this uncertain backdrop, the direction of the world is clear. EVs will increasingly grow their market share, a structural shift that will only speed up if and even solid-state batteries take over. This will be a game changer in terms of driving EV adoption even as government grants for EVs peel away. So whilst QuantumScape is some years away from commercialisation, a date its detractors say will remain a forever fairytale, the company has such a vast future of opportunity ahead of it.

Solid-state batteries will fundamentally change our world forever by solving most of the issues with current EV technology and rapidly accelerate the adoption of EVs across developed economies. This will have immense ramifications for the economy, environment, geopolitics, and ultimately the global drive toward net-zero. QuantumScape is one to watch for future technological progress and could be a buy now for only the most risk-taking investors.

Be the first to comment