travelism/E+ via Getty Images

Similarweb Ltd. (NYSE:SMWB), a digital intelligence firm, is being forced to go on the defense in light of a weak global economy that is causing businesses to tighten up on spending, which has slowed down the new business the company is getting.

In response to the slowing market the company decided to cut 10 percent of its workforce while cutting back on spending. Consequently, that could be a positive heading into 2023, as the company has changed its focus from accelerating growth at the expense of the bottom line, to having the goal of being cash flow positive next year.

Once the global economy starts to recover, it could put SMWB in a much better position of growing revenue while moving to sustainable profitability.

This is a good thing in my view because I believe the company was too optimistic concerning its short-term growth prospects, which resulted in making decisions that were detrimental to its bottom line, which struggled to improve over time.

I think the company being forced to address this under the current economic and market conditions will make it healthier in the years ahead. Being forced to focus on defensive measures under tough conditions will I believe, force fiscal discipline on management which will I think, stay in place once it starts targeting new-customer growth.

In this article we’ll look at some of its recent numbers and how it’s transitioning into defensive mode in order to stem losses while continuing to focus on existing customers in anticipation of a potentially long recessionary period, which in my view is already well under way.

Some of the numbers

Revenue in the third quarter was $50 million, up 41 percent year-over-year.

Guidance for revenue in the fourth quarter is for it to be in a range of $50.5 million to $50.9 million. Revenue for the full year is projected to come in at $192.4 million to $192.8 million

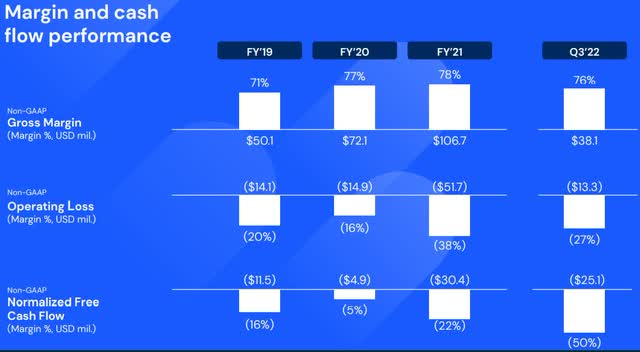

GAAP operating loss in the reporting period was $20.6 million, while non-GAAP operating loss was $13.3 million, lower than the $20.9 million loss the company had anticipated for the third quarter.

Non-GAAP operating loss in the fourth quarter is guided to be in a range of $14.5 million to $15 million, with full-year losses expected to be from $67.4 million to $67.9 million.

Non-GAAP gross margin is projected to be from 75 percent to 76 percent in the fourth quarter of 2022, and about 75 percent for full-year 2022.

I think a slowing economy is good for SMWB

One of the strengths of SMWB has been its ability to grow revenue on a consistent level. At the same time, one of its weaknesses has been it has continued to do so while producing significant losses.

With that in mind, the weak economic and market conditions is forcing it to look at the business from a different point of view than growing revenue at any cost. It’s also forcing it to face the fact the economy is causing businesses to change their spending priorities, which is resulting in it getting more difficult for SMWB to win new business.

I’ve seen this with other companies in other sectors as well. What’s happening in general is lower-level decision-makers are having to kick many decisions up the hierarchy in the tightening spending market, which makes it longer to receive an answer one way or another, and in a growing number of situations, the answer is increasingly no and/or wait.

For that reason, revenue growth is probably going to slow down, remain level, or contract some over the next year or so. I don’t see anything changing that in the first half of 2023, but it could improve in the second half depending upon the length and depth of the recession.

I believe all of this is good news for SMWB because it’s forcing management to look closer at its bottom line and how to improve it, while also focusing more on its existing customer base and serving it even better, while it waits for the economy to improve and spending budgets to loosen up.

Longer term this should make SMWB a better company as it focuses on the top and bottom lines at the same time.

My last thought on this is I think management was far too optimistic earlier in 2022, which resulted in them waiting too long before cutting its workforce and adapting more of a defensive strategy to align with changing economic and market conditions. It’s unlikely that it’ll happen again in the quarters and years ahead, which means long-term shareholders should benefit from the learning experience.

Conclusion

SMWB is going to remain under pressure for at least a couple of more quarters, and possibly longer. It recently hit a 52-week low of $4.37 per share, dropping from its 52-week high of $18.635 in December 2021.

It has since bounced off its low to trade in the mid-$5s, but it’s really impossible to know at this time whether or not it has further to drop or if the stock has found its bottom. I would like to see it test its lows again before concluding the worst is already priced in.

Whether it has or not though, the company will probably continue to face significant headwinds for at least two quarters and winning new business will be harder than it has been in the past until the economy shows sustainable signs of improving. Until then, corporate spending is going to remain tight, and the best thing SMWB can do is focus on its existing customers and find ways to further streamline the business in anticipation of the economy improving.

Management is identifying and saying the right things, now it has to prove it has the will and ability to execute upon them. Investors should lower their expectations for at least the next couple of quarters, and those looking to add to or take a new position in the company are in a good position to lower their cost basis or get a good entry point.

That doesn’t mean the worst is over, but that with its existing customer base and their propensity to stay with SMWB, it seems to represent a floor that investors can have confidence in, even if there is more temporary downside for the stock.

At its current price range, it should produce good returns for investors with a long-term horizon. On the other hand, if the company fails to deliver on its positive free cash flow and continues to struggle with costs, it could be a long period of disappointment for shareholders believing things are going to turn around.

Be the first to comment