Imgorthand

Introduction

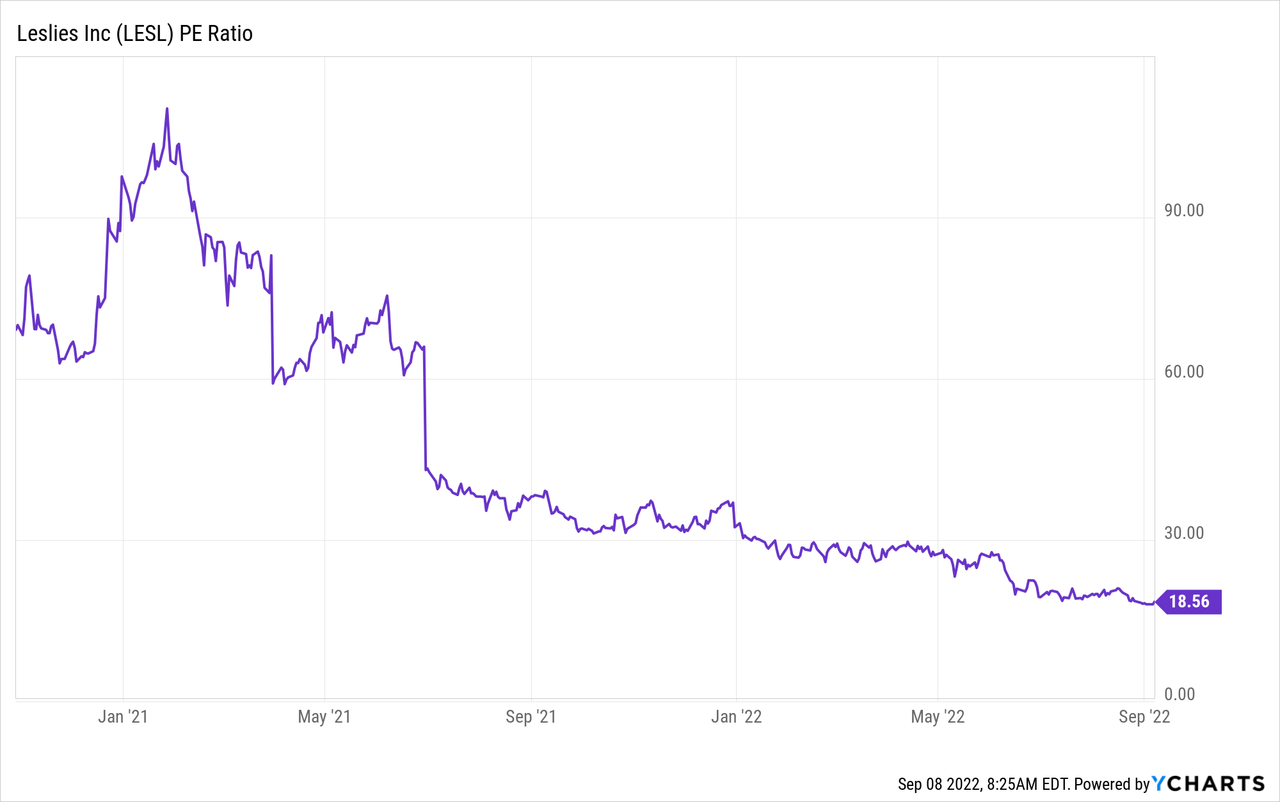

Leslie’s (NASDAQ:LESL) shares have had a rough start since their IPO in 2020. Often the advice is ‘don’t buy IPO’, and Leslie’s is no exception. Leslie’s is doing quite well. Both revenue and profits are growing steadily. And even during the past economic recessions, Leslie’s continued to grow. Leslie’s provides pool and spa maintenance products that are in constant demand for pool and spa owners. The reason that the stock price has declined since the IPO is probably the high valuation. Now that the price has declined, it’s interesting to take a closer look at Leslie’s.

Short sellers expect Leslie’s to fail because 16% of shares float is short, which is quite high. With sales growth of 13% yoy and a history of years of growth during recessions, I don’t expect Leslie’s to fail. On the contrary, due to the high short interest, I expect the stock to skyrocket. Short sellers must buy Leslie’s shares to cover their short position. With a short float of 16%, a growing profitable business and a fair valuation, I see this as a good buying opportunity.

Company Overview

Leslie’s has been a supplier of pool and spa care supplies in the United States since 1963 and sells its products directly to consumers through 952 corporate locations and e-commerce websites. Leslie’s sells pool chemicals such as chlorine, sanitizers, water balancers, specialty chemicals and algae control. But also pool covers, pool equipment and pool maintenance products are part of the range. In addition, Leslie’s provides pool equipment and repair services.

The company has grown strongly and has acquired a market-leading share of approximately 15% of spending on residential aftermarket products. Their digital sales are estimated to be more than five times that of their largest digital competitor.

The company is divided into the following segments. From their 2021 annual report:

Residential Pool: The residential pool market consists of 8.6 million pools representing a total aftermarket sales opportunity of $6.9 billion. Many of our residential pool consumers visit our locations on a regular basis to conduct water testing, seek expert pool advice, and purchase products as well as utilize our integrated digital platforms.

Residential Spa: The residential spa market consists of nearly 5.5 million spas or hot tubs representing a $0.8 billion aftermarket sales opportunity for chemicals and equipment. Including the $1.2 billion market for new spas, residential spa represents a total addressable market of approximately $2.0 billion.

Professional Pool: The professional pool market consists of pool service professionals and professional pool operators. Pool service professionals specialize in maintenance and equipment repair for DIFM homeowners, businesses, and government entities. Professional pool operators manage 250,000 pools across hotels, motels, apartment complexes, and water parks. This market represents a total aftermarket sales opportunity of $2.4 billion.

Leslie’s Third Quarter Results Were Outstanding

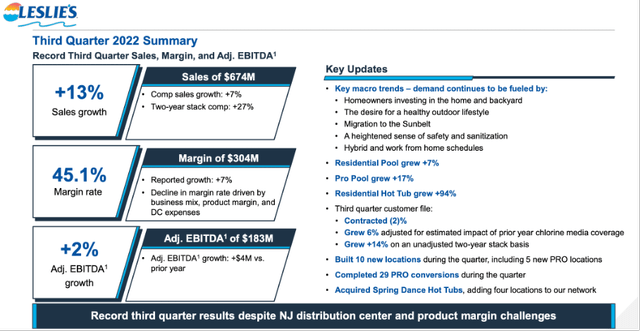

During the third quarter, Leslie’s continued to grow strongly, with revenue growing 13% year over year. EBITDA grew at a slightly slower pace, growing 2% year over year as a result of a change in business mix, product margin and DC costs.

Leslie’s earnings are seasonal, with the third quarter being their top quarter with the highest earnings. The lowest profits are made during the winter periods.

Third quarter 2022 summary (3Q22 Investor Presentation)

Leslie’s Expects Strong Growth

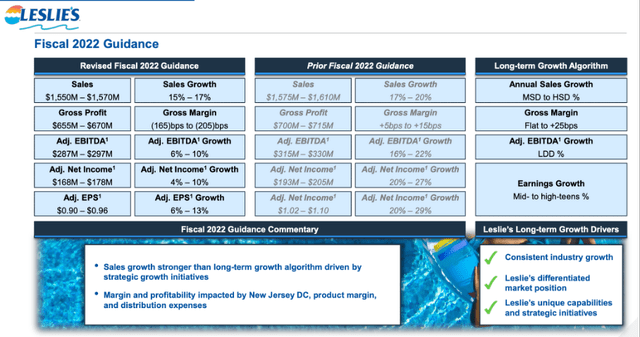

Leslie’s is steadily growing, but they have slightly lowered their outlook for fiscal year 2022. Still, they expect solid revenue growth of 15-17% yoy and adjusted EBITDA growth of 6-10% yoy. Their adjusted earnings per share are estimated at $0.90-$0.96, representing growth of 6-13%.

Fiscal 2022 guidance (3Q22 Investor Presentation)

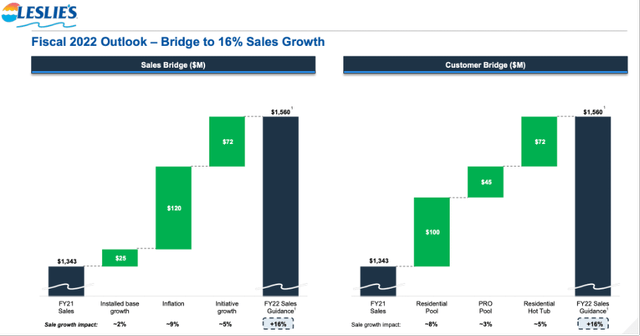

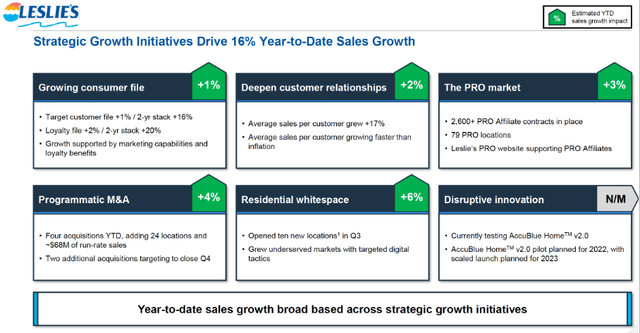

How did this growth forecast come about? In the screenshot below, mainly price inflation has led to an increase in sales. Excluding inflation, Leslie’s expects solid growth of 7%.

Bridge to 16% sales growth (3Q22 Investor Presentation)

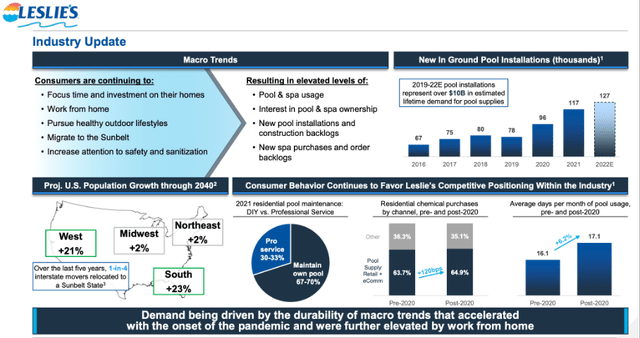

Leslie’s is benefiting from the coronavirus crisis as more consumers are spending time at home. Consumers also spent more time in their pool and spa, resulting in higher sales of maintenance products.

Industry update (3Q22 Investor Presentation)

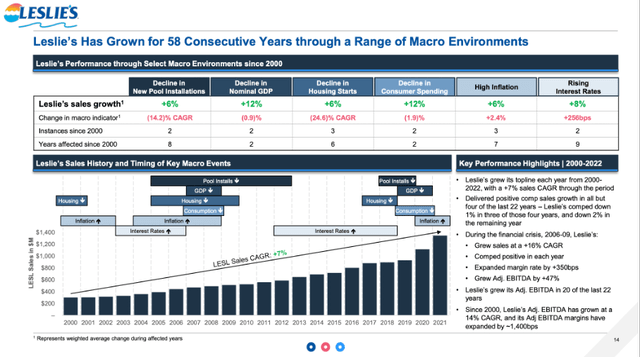

Leslie’s Is A Resilient Business

Leslie’s supplies consumables, such as pool chemicals and maintenance products, so they can expect a constant revenue stream. During the dotcom recession, the housing crisis and the corona crisis, the company grew its revenue strongly. Macroeconomic issues such as negative GDP growth, housing crisis, higher interest rates and even negative pool installation growth did not hinder Leslie’s growth.

Leslie’s is recession proof (3Q22 Investor Presentation)

Forward-Looking Thoughts

Leslie’s customer base is growing rapidly, providing it with a solid 15% market share. Their customers are also spending more, the average revenue per customer grew by 17%.

A recent initiative is called Leslie’s PRO, customers who need weekly maintenance on their pool or spa can take advantage of this. PRO customers also receive other benefits, such as:

- Wholesale pricing on the products pool pros use every day.

- A rebate program.

- Vendor discounts.

- Extended protection on Jacuzzi equipment and other select products.

- Free in-store water testing, free in-store labor, and free pool cleaner inspection.

Because of the close relationship with the customers, customers are more likely to shop with Leslie’s than with competitors.

Leslie’s has strategic growth initiatives to grow their business. Leslie’s opened 10 new locations in growing markets in the third quarter. Not only is Leslie’s growing organically, but they also have a strategic M&A program. In the current year, Leslie’s made 4 acquisitions, adding 24 new locations for a total of approximately $68 run-rate revenue.

In addition, Leslie’s offers a new concept: AccuBlue Home v2.0. This also includes a $50 per month membership to the AccuBlue Home program. The AccuBlue Home is a test device that tests the water for health.

Strategic growth initiatives (3Q22 Investor Presentation)

The loyal customer base, PRO service, organic and M&A growth, and Leslie’s AccuBlue Home v2.0 system will continue to drive sales going forward.

The pool industry is expected to show a CAGR of 2%, and Leslie’s is currently the market leader. Leslie’s expects to have a 15% market share, and their rather large market share makes it more difficult to grow. Their deep customer relationships keep customers sticky, so I expect Leslie’s to maintain market share and grow with the pool industry.

Risks

Analysts have a mixed view of Leslie’s future. Analyst Dana Telsey sees challenges as Leslie’s has experienced strong growth over the past 2 years due to a significant increase in demand related to the pandemic and US government stimulus measures. Price inflation on pool chemicals such as chlorine is also seen as a headwind to earnings. However, I don’t see this as a headwind. Leslie’s announced in its third quarter figures that it can calculate inflation properly without losing customers.

In general, the leisure industry in which Leslie’s operates is volatile in times of recession. High inflation, rising interest rates, negative GDP growth indicate difficult times ahead. Leslie’s has weathered the recessions of the past well, and so I expect Leslie’s will continue to do so. Especially since Leslie’s sells maintenance products, there will be a constant flow of sales here.

Valuation

Short sellers see a bleak future for Leslie’s, 16% of the outstanding float is short. These short sellers eventually have to buy back the stock, which pushes the price up.

When will the short sellers buy back their shares? Currently, US GDP growth is negative, inflation is high and interest rates are rising. If there is improvement visible, then the share price will be pushed up considerably. With the current falling oil price, I expect an improvement soon.

How is the stock valuation? To map the stock valuation, I take the PE ratio. The PE ratio is historically low as the stock price has declined since the IPO. With a PE of 18.6, the stock is undervalued relative to the current market. The projected earnings per share for 2022 is $0.92, making the forward PE ratio 15.7.

Earnings per share are expected to grow, and the stock is undervalued based on the PE ratio. If the company continues to show growth trends, short sellers will buy the stock, causing the stock price to rise sharply

Conclusion

Often the advice is ‘don’t buy an IPO’ because stock prices usually fall after the IPO. Leslie’s went public in 2020, and here too, the share price has declined. Short sellers are quite pessimistic about Leslie’s, with 16% of the float being short. Those short sellers will eventually have to buy stocks to close their positions, which will drive the stock price sharply.

During the third quarter, Leslie’s sales grew steadily, 13% year over year. Leslie’s customer base continues to grow, and their customers are spending 17% more. Leslie’s PRO offers customers weekly maintenance, including numerous benefits. Their customers are loyal, which is reflected in their constant growth. Leslie’s continued to grow during recession years, and pool and spa supplies are also needed during a recession. Leslie’s is a resilient business.

The loyal customer base, PRO service, organic and M&A growth, and AccuBlue Home v2.0 system will continue to drive sales going forward.

The company continues to grow strongly during recessions, the stock is valued cheaply, and the short sellers will have to close their short positions; all these make the stock a buy.

Be the first to comment