Marco Bello

MicroStrategy (NASDAQ:MSTR) is my favorite Bitcoin (BTC-USD) proxy stock that doesn’t charge any annual fees unlike Grayscale Bitcoin Trust (OTC:GBTC).

I’ve been a longtime believer in Bitcoin and decided to double down on my MSTR stake in my IRA as a long term store of value.

There’s been a lot of negative news in the media lately surrounding MicroStrategy’s executive chairman Michael Saylor.

Being born and raised in DC, I felt like this story hit close to home since the District of Columbia is suing Saylor for tax evasion.

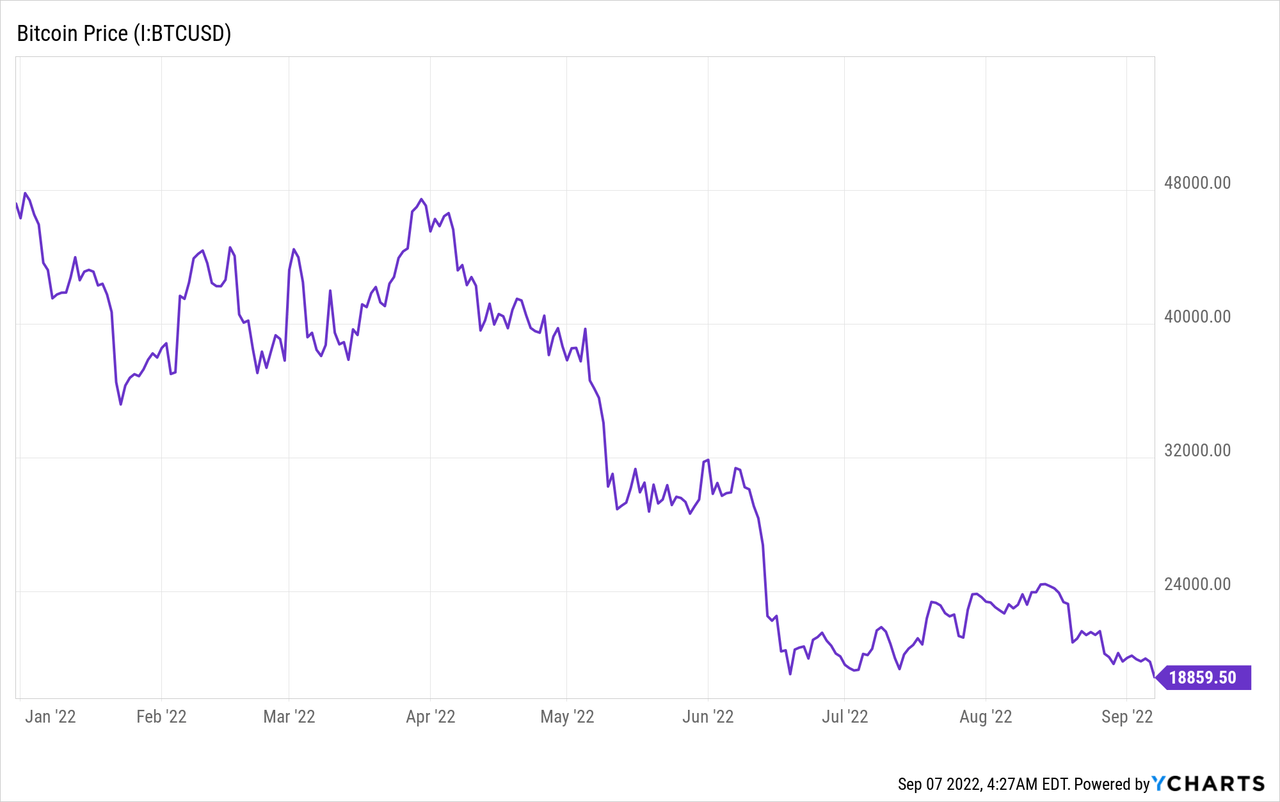

There’s also plenty of rumors circulating about a potential Bitcoin margin call if Bitcoin continues dropping in price. As of writing this article, BTC trades around $19,000 and broke down past $20,000 support.

If you’ve been following me for some time, you already know about the Bitcoin halving cycle and how it effects the crypto markets.

Bitcoin could easily trend much lower leading up to block #770,000 where I predict the price will bottom and start recovering leading up to the 2024 Bitcoin halving.

In this article, I want to touch on some of the things mentioned above and share exactly why I plan to HODL MSTR stock right now at these price levels.

MicroStrategy Business Update

MicroStrategy holds 129,699 BTC on its balance sheet and adopts a DCA Bitcoin strategy of buying Bitcoin on a consistent basis. The current value of MSTR’s Bitcoin holdings is ~$2.4 billion.

The company reported once again sluggish revenue and earnings numbers that reflect its slow growing enterprise software business. Q2 2022 revenue hit $122 million and net losses were $908 million (mostly due to a $918 million Bitcoin impairment charge).

Michael Saylor stepped down as MicroStrategy CEO at the end of Q2 2022 to focus exclusively on Bitcoin as the company’s new executive chairman. He quickly announced a new enterprise lightning wallet to spur corporate adoption of Bitcoin. This is a great sign and it looks like Saylor made a smart move by handing over the business to new CEO Phong Le.

Some of you may wonder why one should purchase MSTR stock over BTC in the first place.

You can buy Bitcoin yourself but there are additional risks to holding your own BTC.

First off, your crypto wallet may get hacked or someone scams you out of your coins. If you choose an offline hardware wallet then you may forget your private keys and lose access to your Bitcoin.

I think Bitcoin is a digital revolution that will be adopted by the younger generations moving forward. I don’t expect Baby Boomers to bother setting up a crypto wallet and risking their retirement in a completely new digital asset class.

But anyone can buy MSTR stock and gain exposure to Bitcoin without needing to purchase Bitcoin outright. I hope that explains the benefits of buying MSTR stock.

Ignore The Margin Call FUD

Next, let’s talk about the rumors surrounding MicroStrategy and a potential margin call. MicroStrategy has little to zero chance of defaulting on its SilverGate loan unless BTC crashes to around $3,000 per coin.

In the Q2 2022 earnings transcript, MicroStrategy CFO Andrew Kang explained how the SilverGate loan works and what would happen if Bitcoin price continues to fall.

The company pledged 30,000 BTC as collateral for the loan and still has 85,000 unpledged coins that are available for use.

The $205 million loan requires a LTV ratio of 50% ($410 million) or less so MicroStrategy can pledge more BTC if prices drop even further. As BTC falls in price, the value will decrease so the company could tap its 85,000 unpledged coin stash to maintain a solid LTV.

Michael Saylor tweeted that BTC must crash to $3,562 for the company to get margin called.

That’s a far cry from BTC’s current $19,000 price tag. It’s unlikely but I wouldn’t worry right now because we are a few months away from the bottom of the crypto market.

The DC Lawsuit Doesn’t Change Saylor’s Long-Term Bitcoin Views

The DC Attorney General accused Saylor of avoiding $25 million in DC taxes by residing in Washington, DC while pretending to live in Florida.

I’m not exactly sure where Saylor resides because he is known to move around frequently as a major supporter of Bitcoin. He does own property in multiple states and probably chose Miami due to Florida’s zero state income tax.

Either way, the lawsuit is noise and doesn’t affect MicroStrategy’s Bitcoin stash one bit.

Saylor is a Billionaire and owns a personal BTC stash of 17,732 worth ~$333 million at current market values. My guess is he will fight this lawsuit and get it under control.

MicroStrategy is not in any trouble so just ignore all the FUD you read on forums such as Reddit.

Risk Factors

Betting on Saylor and his company means taking on quite a bit of risk. Owning MSTR stock isn’t for the faint of heart because Bitcoin is still in its early adoption stages.

There are several risk factors including:

- Bitcoin gets replaced by a newer crypto coin and loses its market dominance.

- Saylor changes his mind and decides to sell MicroStrategy’s Bitcoin stash. I believe most investors would run for the exits because the company’s core enterprise software business doesn’t do much in terms of hypergrowth.

- The SEC approves a Bitcoin spot ETF such as GBTC and investors sell MSTR to buy a safer Bitcoin proxy.

- Short sellers continue betting against MSTR stock and send it lower. MSTR has a current short interest of 32% according to Fintel.

MSTR is probably the most risky stock I own but it also has the largest upside. There are only 9.3 million shares outstanding and the shorts are pushing MSTR shares down right now.

However, I believe we will see a major reversal around January 2023 when Bitcoin reaches block #770,000.

According to BTC.com, we are currently at block #753,280.

Conclusion

I’m long MSTR and will continue holding my shares at the moment. If MSTR dips below $200 then I will consider adding more near the $150 level.

This is a long term hold for me and I also believe in owning BTC too.

Until 2023, I’m going to ignore the noise and HODL.

Be the first to comment