South_agency

BIT Mining Limited (NYSE:BTCM) is a corporate entity that has a rollercoaster ride-like history. From its IPO in 2013 to now, the company has gone through several business model pivots. Some of those areas of focus have included lottery ticket sales, sports information services, spot commodity trading, and online gaming. The timeline of these shifts are detailed well in this February 2022 coverage of the company by Bamboo Works. After unwinding the gaming business, the corporate entity has once again shifted; now to a collection of crypto-focused business models where it aims for a diversified footprint across self-mining, mining pools, datacenter services, and miner manufacturing.

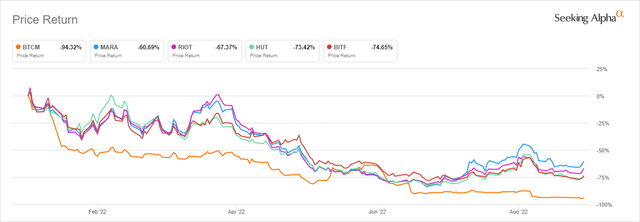

The share price action year to date really speaks for itself. If uncertainty spawns investor fatigue, BTCM offers that in spades. While all of the publicly traded crypto miners are struggling as mining margins get squeezed, most of them are down somewhere between 60-75% year to date. BTCM is down about 95%. I’m a firm believer that when a potential investment is down more than 90%, it’s either a very attractive entry opportunity or it’s going out of business. Unfortunately, BIT Mining Limited looks like the latter.

Potential Delisting, Dilution, and a Shareholder Letter

As an NYSE-listed stock, the dramatic fall in share price over the last few months has put BTCM shares at risk of delisting. The company disclosed on August 5th that it had received a noncompliance notice from the New York Stock Exchange on July 29th. The noncompliance stemming from the company’s ADS shares closing under $1.00 for 30 consecutive trading days. In the same disclosure, BIT Mining Limited stated the NYSE had been notified of the company’s intention to cure the deficiency and regain listing compliance.

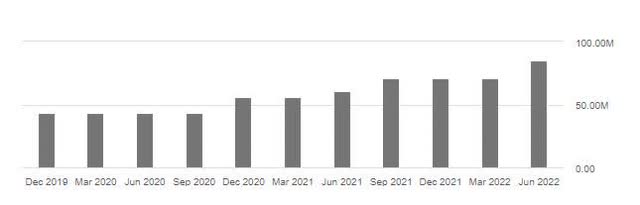

Roughly two weeks later, the company shared news of a $9.3 million direct offering that will see roughly 15.6 million new shares outstanding before the possibility of more dilution through warrants. This comes less than two months after a $16 million direct offering that added 16 million new ADS shares outstanding with more via warrants. Unfortunately for shareholders, dilution has been the name of the game over the last couple years with just 43 million shares at the end of September 2020 and roughly 100 million projected for the end of the current quarter.

Shares Outstanding (Seeking Alpha)

To the company’s credit, Chairman Bo Yu recently released a shareholder letter in late August recounting some of the hardships the company has faced and detailed why the leadership team remains optimistic:

Having overcome many obstacles, what was once a gradually growing confidence in our company’s ability to redefine itself has turned into excitement about the next challenge to come, as every crisis we’ve faced has been turned into another opportunity to evolve. We want to remind our investors that the fluctuations in our share price will not affect our regular business operations, nor will it cause us to lose sight of our long-term growth strategy.

While I think some shareholders may be put at ease by these words, the fact of the matter is BIT Mining Limited is facing rather serious headwinds and the fate of the company looks troubling. The letter made no mention of the company’s plan to regain NYSE listing compliance and the company seems to be spending resources on building machines for altcoins like Dogecoin (DOGE-USD) and Ethereum Classic (ETC-USD); each of which have had questionable network usage fundamentals historically.

Top Crypto Networks Remain Strong, Miner Solvency Less so

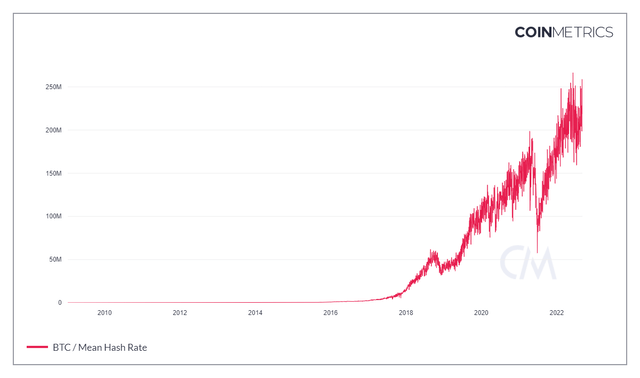

As far as cryptocurrency adoption goes, I think the top coins are here to stay. Even as Bitcoin (BTC-USD) and other cryptocurrencies have sold off dramatically in price over the last 10 months, the Bitcoin network has never been more secure from a hash rate perspective. Hashrate is continuously making new all-time highs despite price declines:

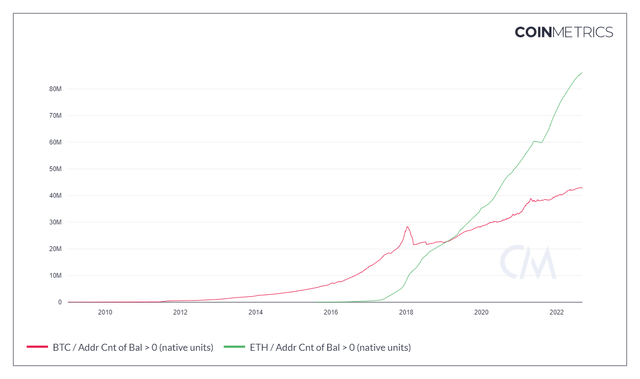

And non-zero address adoption is hovering near all-time highs for Bitcoin and has exploded for Ethereum (ETH-USD):

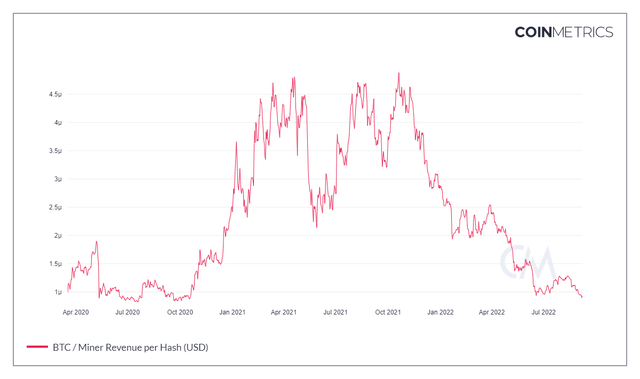

The network effect that we’re seeing in crypto adoption is still valid, in my opinion. But the mining space is an incredibly competitive one and miner profitability is continuing to get squeezed by the doubled edged sword of higher costs and lower prices. Miner revenue is now at two year lows:

Likely because of the added layers of third party risk, so far, we’re seeing some of the crowd-mining organizations showing less resilience than self-miners. The recent struggles from Compass Mining have been well documented; alleged payment defaults, executive resignations, and site closures.

Self-Mining Revenue

The biggest issue I see though for BIT Mining Limited’s self-mining business going forward is how reliant it is on Ethereum mining. In the unaudited financial results for end of June 2022, the company cited $11.2 million in recognized revenue from ETH mining and just $3.6 million in recognized revenue from BTC mining.

| Recognized Rev from Mining | ETH | BTC | ETH % of Total |

|---|---|---|---|

| Q1-22 | $16.0 million | $6.9 million | 69.9% |

| Q2-22 | $11.2 million | $3.6 million | 75.7% |

Source: BIT Mining Limited

This means that BIT Mining actually became more reliant on Ethereum mining for its mining production in Q2 than it was in Q1. This is problematic because after the Ethereum merge in mid-September, the block reward goes away when transactions are validated by Proof-of-Stake rather than Proof-of-Work. I’ve covered this and why ETC isn’t the safe haven for displaced ETH miners in detail here.

Summary

The company cites four different crypto-related business models under the corporate umbrella and I see clear issues for two of them. BTCM’s self-mining revenue is going to take a massive haircut when Ethereum moves from PoW to PoS. The company’s mining manufacturing arm seems to be spending resources on altcoins that may not survive crypto winter. And to be clear, the data center and mining pool businesses aren’t exactly safe either because they add an element of third party risk that self-mining doesn’t necessarily have. While I’d never recommend shorting a stock after a 95% selloff, I can’t say that I’d long this one either. If I were a shareholder, I’d probably cut my losses.

Be the first to comment