Chinnapong

Rationale

Silvergate (NYSE:SI) is a regulatory play on the Bitcoin ecosystem, with a profile to take advantage of higher interest rates. The company takes advantage of the Bitcoin adoption trend by getting zero-cost funding from institutions using the SEN network. The company applies those funds to high-quality assets (mostly variable-rate). Silvergate has also introduced a lending product called SEN Leverage. It is a Bitcoin collateralized lending product that allows its clients to use their Bitcoin as collateral for funding.

The rationale here is very simple. The bank is an FDIC-insured institution operating in the crypto ecosystem, and there aren’t many at this stage of the crypto scene. Most startups in the field are not even trying to get regulated, and the ones trying have been going through regulatory hell. Therefore, Silvergate is in an advantageous position to take advantage of the growth in crypto. While at the same time, it is in a good position to take advantage of the rising rates landscape.

Silvergate’s Business model

Silvergate is a traditional bank that became involved in Bitcoin because it needed funding alternatives. Back in 2013, the CEO Alan Lane started researching Bitcoin. After concluding that institutions in the Bitcoin ecosystem had huge problems that traditional Wallstreet banks weren’t interested in solving, the company saw an opportunity. The company developed the Silvergate Exchange Network (“SEN”). That network allows clients to move payments in real-time. Additionally, as mentioned before, the company developed SEN lending, a funding solution for Bitcoin holders.

Other than that, Silvergate is a traditional bank. However, I believe that their success around Bitcoin will push them more and more into the crypto ecosystem.

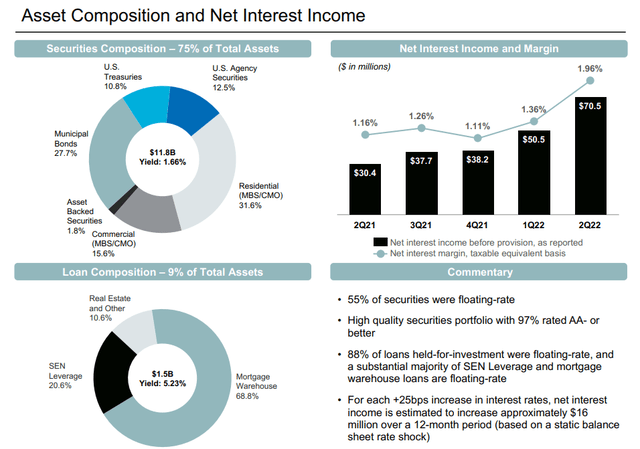

However, at present (2Q22), the bank is very traditional in its business. It gets funding from clients while it invests in high-grade mortgage securities (97% AA- or higher). More than 50% of the securities are floating rate, which means the company is also well-positioned to take advantage of a rising rate scenario.

Silvergate

The innovative footprint in Silvergate’s business model is the SEN network that has allowed them to scale and get more funding to invest, while the SEN Leverage is broadening their options to offer loans.

Their old-school approach to banking is excellent for a regulated company entering the crypto ecosystem. That will likely lead them to avoid the most outrageous business experiments and to go with the most down-to-earth ideas. Because crypto rehypothecation is one of the main sources of trouble for centralized companies operating in the field, and Silvergate seems very conservative in its approach, they will likely avoid significant problems.

The company is applying a bread-and-butter approach to its business. On the one hand, it provides valuable help to customers that need to move payments in exchange for cheap funding. On the other hand, they leverage their network to offer over-collateralized loans. On the way, they collect interest margin and substantial fees while holding the optionality for further growth (further expand SEN and to stablecoins).

Silvergate’s Growth Prospects

The company is expanding the SEN network to other currencies like the Euro. Giving their clients the ability to move Euros 24/7 is a valuable addition to their services offerings.

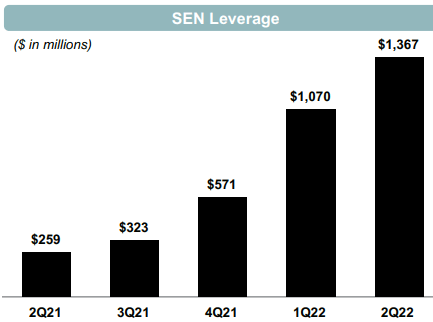

Now, the SEN leverage is also driving its yield-generating applications. The growth has been incredible, around 600% YoY, while generating zero losses and no forced liquidations. It is worth noting that in the SEN Leverage direct lending program, Silvergate acts as the custodian, holding the client’s Bitcoin, and then the bank loans the money through the SEN network directly to the client’s account. The company also provides SEN Leverage indirect lending that might use third parties for custody or digital currency services. In any case, the company can liquidate, if necessary, the collateral. Furthermore, the collateral coverage is set in case of liquidation to yield an amount above the client’s loan.

Silvergate

Silvergate has already revealed that it intends to run a stablecoin network. It even bought Diem assets from Meta (META). The company sees in stablecoins the potential to become global payment rails. Because the bank is an insured depository institution, it might become one of the first regulatory-compliant institutions to offer stablecoin services and products. That will likely drive the next leg in growth for the company.

Financial Highlights

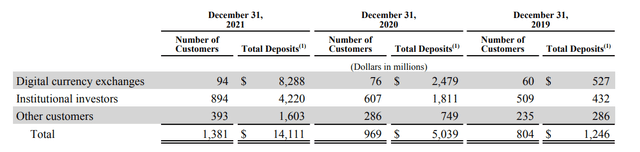

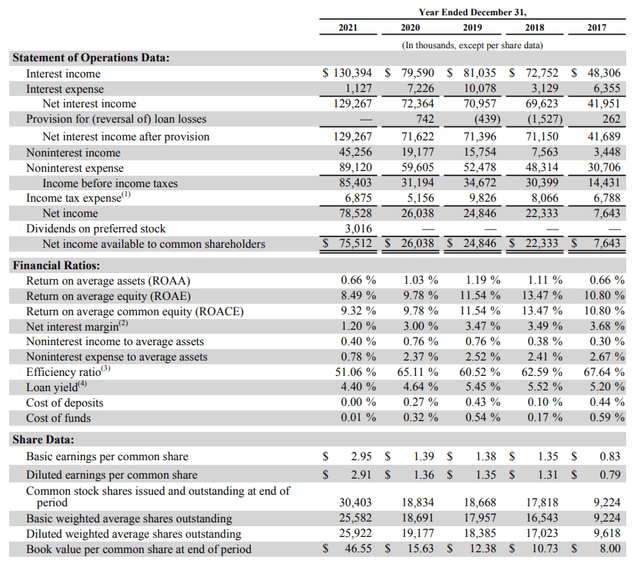

The strategy started back in 2013 has yielded some impressive results. The SEN network allowed the company to increase its noninterest-bearing deposits and became its main funding source.

Silvergate

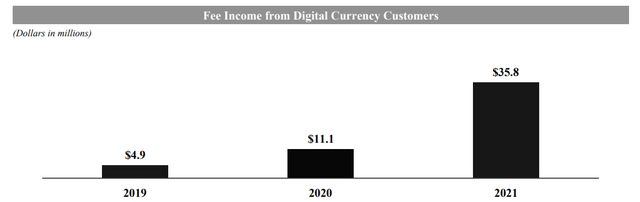

The table above is just deposits related to the digital initiative (total deposits are $14.2 billion). The SEN has also proved valuable in generating a source of noninterest revenues, specifically, fees from services and products associated with the SEN network.

Silvergate

The impact on the income statement is nothing short of amazing. Interest income has climbed rapidly, while interest expenses have decreased in the same period. If there is a holy grail in banking, that must be as close as you can get. Obviously, the bottom line has also improved significantly, as have the earnings per share. From 2017 to 2021, the EPS grew from 0.79 to 2.91. In short, most metrics have performed incredibly.

Silvergate

Risks

As I have mentioned, the company has a substantial part of its investments in floating rate instruments. Assuming a static balance sheet, a 25bps rise in interest rates will increase net income by 16 million over twelve months, according to the company. However, this can also go the other way.

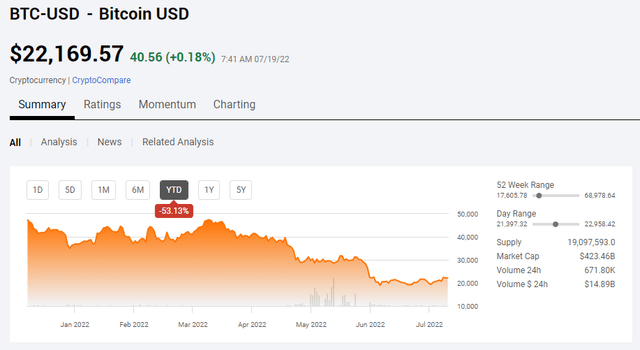

On the other hand, crypto prices tend to list as a significant risk for Silvergate. The company’s stock price tends to follow the Bitcoin price. In my opinion, the available data discards the notion that a decrease in Bitcoin’s price is bad for business. The way Silvergate’s business model is structured has allowed for revenue and net income growth even after huge drawdowns in crypto prices.

Seeking Alpha

Silvergate

However, there are risks associated with crypto. If the industry shrinks permanently (e.g., regulation tightening), Silvergate would be in harm’s way due to its reliance on that funding. Additionally, even if the business model is not directly affected by Bitcoin’s quotation, it will impact adoption and, therefore, Silvergate’s growth.

The SEN Leverage loans are another potential source of risks. The first quarter earnings call included a mention of a MacroStrategy loan (MacroStrategy is a subsidiary of MicroStrategy). The company explained that this loan is part of the SEN Leverage segment. After the blowup in several crypto ventures (Luna, 3AC, Voyager), many fear that the SEN loans may carry much more risk than perceived. However, the publicly known details of the loan suggest that this has a low probability of affecting Silvergate. MacroStrategy put up $800 million worth of Bitcoin to support the $200 million loan. The loan concession happened when Bitcoin was trading at around $47 thousand. Since then, the collateral has more than halved. However, it is still close to double the loan amount.

Finally, all this growth has its drawback. It triggers the need to raise capital. In my opinion, this type of capital raise is benign. The money goes towards growing the business and not just to mask ill-fated past decisions. Size, however, increases the risk of settlement accidents.

Updated Investor Action

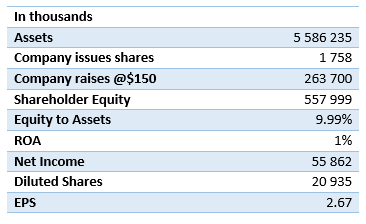

In a previous article, I argued that the company has the potential to generate around $2.7 per share if it raised capital to increase the SEN deposits and target a 1% ROA. The original table is below:

Author

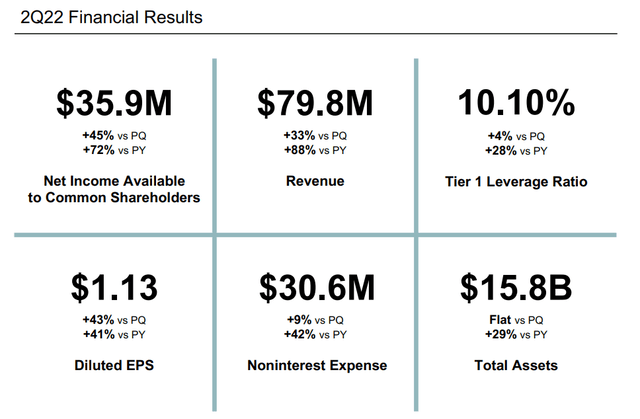

I built that more than one year ago. Now, the company has just released its 2Q22 results, and for the first half, it reported EPS of $1.92. The estimation of $2.67 in the table corresponds to a whole year. We will likely exceed that this year. I think the prospects are exciting.

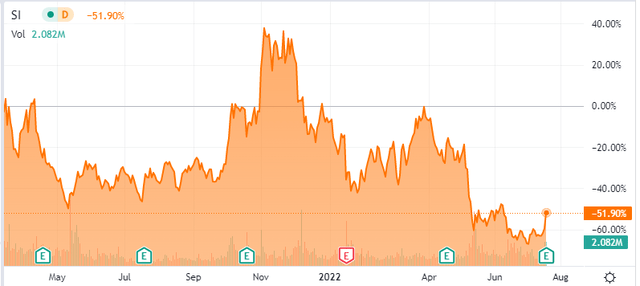

How has the share price fared then? Bad, very bad. Since I wrote that article, Silvergate dropped more than 50%.

Seeking Alpha

There are several reasons for that. One of them being the macro backdrop is terrible, with valuation compressions across the board.

More than ever, I believe this stock is a good investment opportunity, even for crypto skeptics. If you are one, bear with me for a second. Silvergate has a conservative management team, running an old-school bank entrenched in a high-growth industry. They apply the same orthodox tactics that gave so many old-school bankers the upper hand in the past. While at the same time, they extract value from one of the fastest-growing fintech sectors.

I won’t ask any skeptic to drop all their assets and go all-in on this, but I would argue that if there is one good asset for them to enter the crypto scene, that is Silvergate. Trading at 15 forward PE, the company seems to be a value stock with growth potential. One of those opportunities that seldom appears. You can also look at this in the following way. The company last raised capital in 2021 at $145. Now, it has deployed that capital successfully and is already reaping the rewards of that move. Nonetheless, the market now offers the opportunity to enter at roughly half the price. What’s not to like about this in a diversified portfolio?

Be the first to comment