Olga Tsareva

Subscribers to the Microcap Review received early access to this article on August 27th, 2022. Anyone looking for additional microcap value and event driven opportunities should take a look at the offering and author Safety in Value’s work.

The price last closed at $9.10 before we shared this idea with the Microcap Review community. Since then it has jumped 15% to current levels of $10.50 with value still likely.

—

Silver Spike Investment Corp (NASDAQ:SSIC) is a recently IPOd business development company (BDC) currently trading below cash value and at a 23% discount to net asset value of $13.64. If the company were liquidated today and their two loans written off completely they’d have $60.073m cash to distribute to shareholders or $9.69. Despite how low the stock is trading, Q1 earnings revealed two new loans, profitability, and growing book value and a comparison to REIT peers that also do cannabis lending suggest a reversion of P/B to 1x or 29% return.

As a BDC it’s likely that as SSIC establishes their book that they will also initiate a dividend. I estimate that in a two year time frame with P/B reversion and one year of dividends that annualized returns would be 20%. Given the high amount of cash on hand relative to stock price and clean balance sheet I think there’s strong support for this to not trade much farther below current prices.

Silver Spike Investment Corp Company History and Business Overview

Silver Spike Investment Corp announced their IPO in February 2022 offering 6.071m shares for $14.00 per share. They are a closed end management company which is operating as a business development company with a focus on debt in the nascent cannabis space. In filings they’ve stated, “We intend to achieve our investment objective by investing primarily in secured debt, unsecured debt, equity warrants and direct equity investments in privately held businesses.”

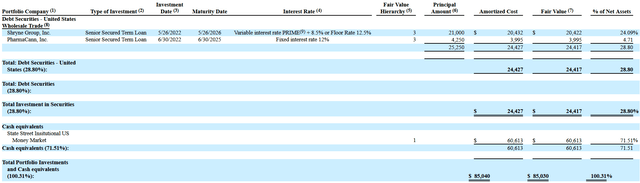

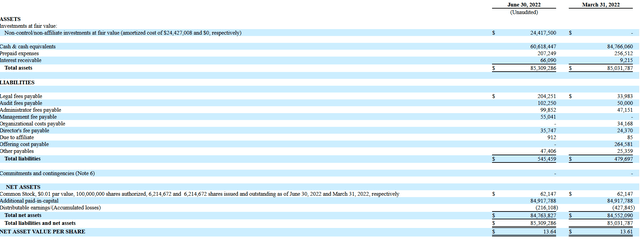

Through the IPO the company raised gross proceeds of around $87m which the company since February has been looking to invest. First quarter results have been announced and we can see some of the capital being deployed with $24.418m invested in loans and $60.618m left in cash. Total liabilities for the company are $0.545m which translates to net asset value per share of $13.64 as of June 30th, 2022. At current prices around $10.50 the company is trading at a 23% discount to NAV despite 71% of it being in cash.

We can see that two loans comprise the $24.418m invested so far. They offer a window into the kind of book the company may look to build.

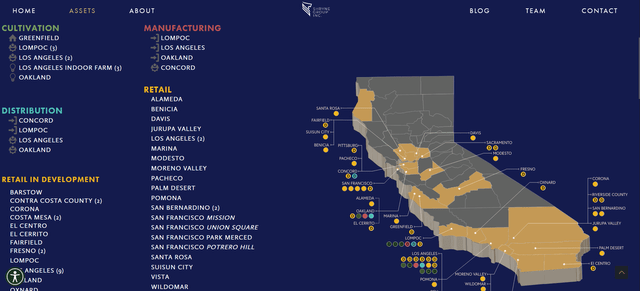

The first loan is to Shryne Group which had been previously announced as SSIC co-led the total $170m loan. Details for SSIC were not defined though so we can observe now that they participated by lending $21m or 12% of the total. It’s a floating rate loan with a 12.5% floor so the yield on it should be quite attractive moving forward. Shryne is a fully integrated cannabis operation in California owning brands STIIIZY and Honeyleaf among others. Their assets include cultivation, manufacturing, distribution, and retail properties throughout California.

The second loan is to PharmaCann. It’s a fixed rate three year loan for $4.250m at 12%. PharmaCann is another vertically integrated cannabis operation and claims to be one of the largest in the country on their website. They own two branded dispensary lines, Verilife and LivWell, operating in a combined seven states where they can sell their own products as well as others.

Both PharmaCann and Shryne Group are well positioned as vertically integrated operations to benefit most in a recessionary environment as their scale enables them to reduce cost. The loan base across the two companies offers national exposure yet are non-competing. With the upcoming possibility of SAFE banking provision creating huge catalysts for well-positioned cannabis players going into next year, senior loans in these two companies seem well secured at this point.

As a cannabis focused company with two loans at this point there is a lack of diversification in their book. For those that are bearish on cannabis overall then SSIC is likely a pass for you. If one believes that there are profitable companies to be found within the cannabis sector that will continue to be so in the coming years than offering loans to these companies may be a good way to have some exposure. SSIC will be continuing to build out their book and likely will have further loans to announce next quarter, though again focused in the cannabis sector.

Investment income will fully start to come through in their next quarterly earnings though net interest income for this quarter was $0.810m with interest income at $0.390m. We can estimate based on the floor for Shryne Group that the company will receive $0.784m in interest income per quarter on these loans.

| Loans ($m) | Principal Amount ($m) |

Base Rate ($m) |

Annual Interest ($m) |

Quarterly Interest ($m) |

Quarterly Interest Per Share |

| Shryne Group | $21.00 | 12.50% | $2.63 | $0.656 | $0.11 |

| PharmaCann | $4.25 | 12% | $0.51 | $0.128 | $0.02 |

| TOTAL | $0.784 | $0.13 |

Operating expenses for this quarter came in at $0.6m and likely included one off items related costs in establishing the loans. What I take this to mean is given implied costs and interest income on just these two loans the company is already profitable with optionality in terms of how profitable given the $60m they can still invest. Meanwhile the stock price of SSIC is trading at a P/B of 0.77x. With the company already generating profit and further loan book to build out I expect a reversion to at least a P/B of 1x over the next year or a 29% return.

This is a conservative estimate though as it ascribes no value to their growing book value. From March to June NAV increased from $13.61 to $13.64 and with the base of these two loans generating profitability this value should grow from here. Expenses will remain low as the company is externally managed by an affiliate Silver Spike Capital. What this means is that the investment team isn’t paid out SSIC expenses and there is no staff. Rather their main expense comes in the form of a base management fee of 1.75% of gross assets (excluding cash) and an incentive fee based on performance with an annualized hurdle of 7%. We can expect moving forward the company to target returns in excess of this 7% and the two loans around 12% suggest that’s achievable. Management fee expenses in Q1 were $0.055m.

Silver Spike Capital interests are strongly aligned with SSIC stockholder’s interests as they are 72% owners. They believe that their “investment platform has positioned the firm to be the leading, institutional quality provider of equity and debt capital to the burgeoning plant based and alternative health & wellness industry”. Previously to SSIC the company successfully launched another SPAC at $250m, SSPK, which brought Weedmaps (MAPS) public. SSC maintains 7.3% ownership in Weedmaps according to their latest proxy. The value of the relationships that SSC has in the space is clear given SSIC already maintains a pipeline of $1.25b in potential investments.

Business Development Corporations: Mispriced Compared to Averages

Business development corporations are similar to closed end funds in that they invest in other companies and have shares that trade publicly. They are often characterized by high dividend yields between 5-14% or more and give investors access to investments they likely would not otherwise. In the case of SSIC, investors are offered exposure to private cannabis companies.

We can look at data from Closed-End Fund Advisors to see some averages for BDCs to get a sense of the landscape. They break out averages for debt focused and equity focused BDCs. Average discount to premium for debt focused BDCs is just -3.05% compared to SSIC’s -23% discount. Part of this discount may be due to the lack of dividend currently as most BDCs offer one. I suspect that in the coming year as the book is fully built out and cash invested that a dividend will be established which will likely help to remove the discount while also offering additional return potential. The average debt BDC yield is 8.99% according to the data.

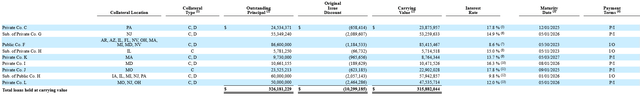

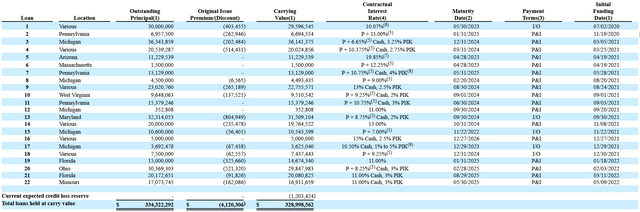

Comparison to Similar REITs

While SSIC has no BDC peers, there are two REITs which are similar: AFC Gamma (AFCG) and Chicago Atlantic Real Estate Finance (REFI). AFC Gamma is an institutional lender to the cannabis industry focused on senior secured loans. A look at their book shows that an average rate of 13.99% which suggests that a rate above 10% for future loans for SSIC is supported. AFCG trades for a P/B of 1.06x and offers a 12.04% dividend yield.

Chicago Atlantic Real Estate Finance is focused on senior loans in the cannabis industry as well. They trade for a P/B of 1x and offer a 11.72% dividend yield currently. The average interest rate implied at the floor here is 12.53%.

Given these details I think it’s likely that SSIC will be able to continue to fill out their book at rates of at least 10%. They are also benefiting from the inflationary environment so current rates are a bit higher than when some of these loans above were written.

Silver Spike Investment Corporation Valuation

At current prices of $10.50 and 6.2m shares outstanding market capitalization is $65.1m. Net investment income in Q1 was $0.03 with that value likely to climb as they invest their cash on hand. Total net assets came in at $84.674m in Q1 with 71% represented by cash on hand.

With the company already profitable with just two loans and a lot of potential to grow interest income moving forward I think it’s reasonable for the company to trade for at least a P/B of 1x which I believe suggests a 29% margin of safety. The margin of safety is derived from the reality that book value is likely to grow moving forward so our estimate is likely low and 71% of the book is cash with the potential to generate interest income above 10%. Comparison to more mature peers AFCG and REFI both trading at around a P/B of 1x seems to support the idea that this is reasonable. And this is with AFCG and REFI just coming off their 52 week lows.

There’s additional return potential embedded in that as a BDC it’s likely they will declare a dividend as income starts to normalize. We can use the average debt focused BDC yield of 8.99% as a proxy. If we estimate a P/B reversion to 1x in two years with one year of dividends annualized return would be 19.45%.

Why Does This Opportunity Exist?

As a microcap, SSIC flies under the radar of most institutional investors and with an average trading volume of 27.9k shares only $258,000 is transacting each day. When SSIC IPOd they did so with Silver Spike Capital making 72% of the initial investment meaning there was not a lot of new interest brought to the name and with virtually no news since February and broadscale market fears, I suspect that SSIC has simply been left behind by the market. Add to this pressure on all cannabis names due to uncertainty regarding pending legislation.

From my calculations 86% of shares are held by SSC, funds, and institutions leaving only 14% likely trading hands. Retail investors have not seemed interested just yet as there has been nothing written here on Seeking Alpha where it has just 34 followers. The only coverage I’ve seen on this is from the Value Investors Club where it was written up in May which is where I learned of the name. Management has not held a call nor do they seem inclined to at this point.

I think the most plausible upcoming catalyst will be if the company starts a dividend. We might see some price movement in the name with earnings results given they should likely reveal a growing book and earnings though given the lack of attention it may trade sideways for a while before the market fully realizes the value here.

What Are The Risks?

One major risk is that they will be unable to deploy their cash into favorable lending situations. I suspect there is some fear that with possible SAFE Banking legislation enabling larger financial players in the space that smaller ones, like SSIC, will not be able to compete. At this point this is just speculation and given the climate in Washington these days it’s hard to know what will actually happen legislatively. Regardless of what Washington does there are cannabis companies out there that need funding now which we can clearly observe given the $1.25b pipeline of opportunities SSIC is reviewing. Even with SAFE Banking legislation there likely will be some time before larger players fully enter the space given the previous legal risks which will enable first movers like SSIC to take advantage of the benefits of legislation sooner.

Another risk is that they will need to write down these loans. Cannabis is a risky industry given the legislative climate overall. We can look at credit cost reserve ratios for AFCG and REFI to gauge this risk a bit.

|

AFCG |

REFI |

|

|

Loan Value |

315.882 |

330.202 |

|

Credit Loss Reserve |

11.12 |

0 |

|

% |

3.52% |

0% |

It seems that broadly the risk of losses has not caused either of these companies to set aside sizable loss reserves. I’ve analyzed the two companies SSIC has loans with above and I have reason to believe that they have physical assets which help to secure the value of the loans made so far. Reviewing their loans moving forward will help to mitigate risk of writedown as investors can gauge for themselves the level of risk inherent in the loan.

Management’s underwriting skills remain to be tested. We will only be able to see with time if cash is being deployed in value accretive ways.

As noted, volume is low in this name so there is potential illiquidity risk.

Be the first to comment