HarvyMatters/iStock via Getty Images

Introduction

Today I will be discussing the pros and cons to utilizing methanol as an alternative fuel source, and highlight Methanex Corp (NASDAQ:MEOH) as a potential investment in the industry. I will provide a data-heavy list of the pros and cons for you to appreciate the rabbit hole of research in this often overshadowed use-case. Interestingly enough, there is a growing demand for methanol fuel use, especially in China, and multiple endpoints already in operation, such as marine vessels, that allows for some concrete foundational support.

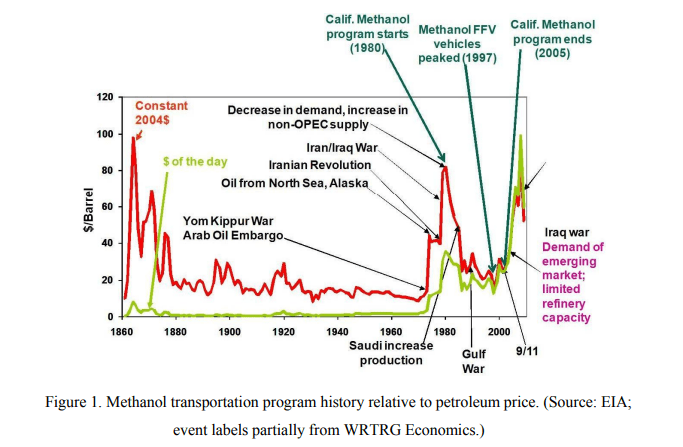

Methanol has been promoted as an alternative transportation fuel from time to time over the past forty years. In spite of significant efforts to realize the vision of methanol as a practical transportation fuel in the US, such as the California methanol fueling corridor of the 1990s, it did not succeed on a large scale… It has not become a substantial fuel in the US because of its introduction in a period of rapidly falling petroleum price which eliminates the economic incentive, and of the absence of a strong methanol advocacy. — US Department of Energy Report.

Pros to Methanol as Energy Source

-

Less carbon monoxide, nitrogen oxides, and particulate matter pollution compared to gasoline and ethanol fuels (IEA report).

-

Multiple ways to generate in a renewable manner are already developed, leading to potential carbon neutrality.

-

Ample production around the world, and especially China and US.

-

Endpoints of Marine Vessels and Fleet Vehicles that run on 100% methanol already completed and successful.

-

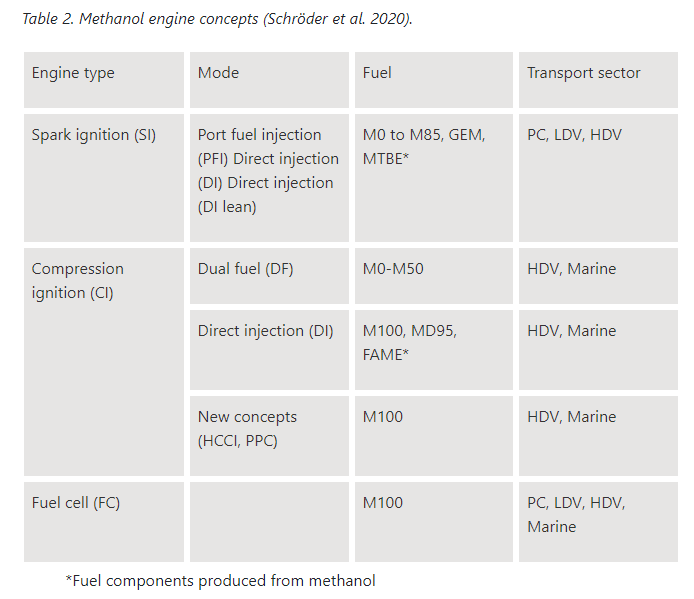

Wide range of potential alternative energy fuel mixes and uses, from vehicle fuel to utility scale power generation.

-

Faster at biodegrading and slightly less toxic in the event of a spill than gasoline, in-line with ethanol.

-

Competitive pricing now compared to historical attempts to market (DoE).

-

Wider range of feedstock for the production of methanol than ethanol.

IEA-AMF

Cons to Methanol as Energy Source

-

Requires further development of methanol fuel delivery systems if used for significant volumes of vehicles.

-

Still releases CO2, but “even when produced from natural gas, methanol has a slight greenhouse gas emission benefit over gasoline” (IEA report).

-

Burns invisibly in daylight (visible at night or in low-light conditions), leading to increased operational risk (although harder to ignite and cooler burning temp).

-

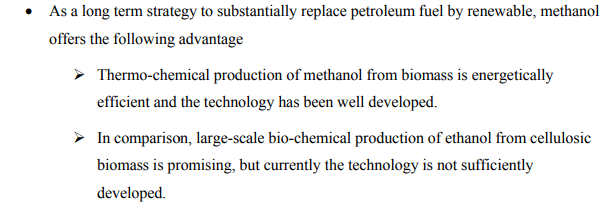

Historically, more expensive to produce via thermo-chemical routes if additional methanol production is required.

-

Remains predominantly produced by fossil fuels.

-

Ethanol is promising and cheaper for the same benefits (but efficient production is lacking behind methanol).

US DoE Report US DoE Report

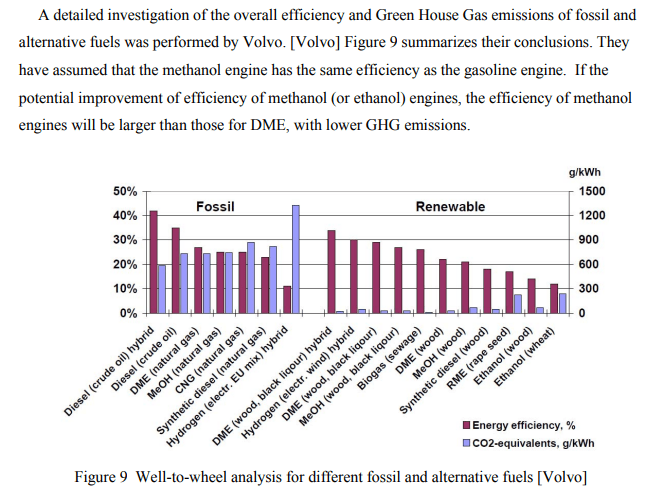

GHG Emissions

Due to the fact that methanol releases CO2 upon combustion, there is little in terms of net-zero fervor in terms of development. However, there is data that indicates reduced emissions are possible, especially if renewable methanol is taken into consideration in the future. I believe there will be a niche that remains, especially in Marine and Fleet applications, but perhaps not consumer. This will require you to consider this limited potential when investing in methanol technologies.

US DoE Report

Methanex Summary

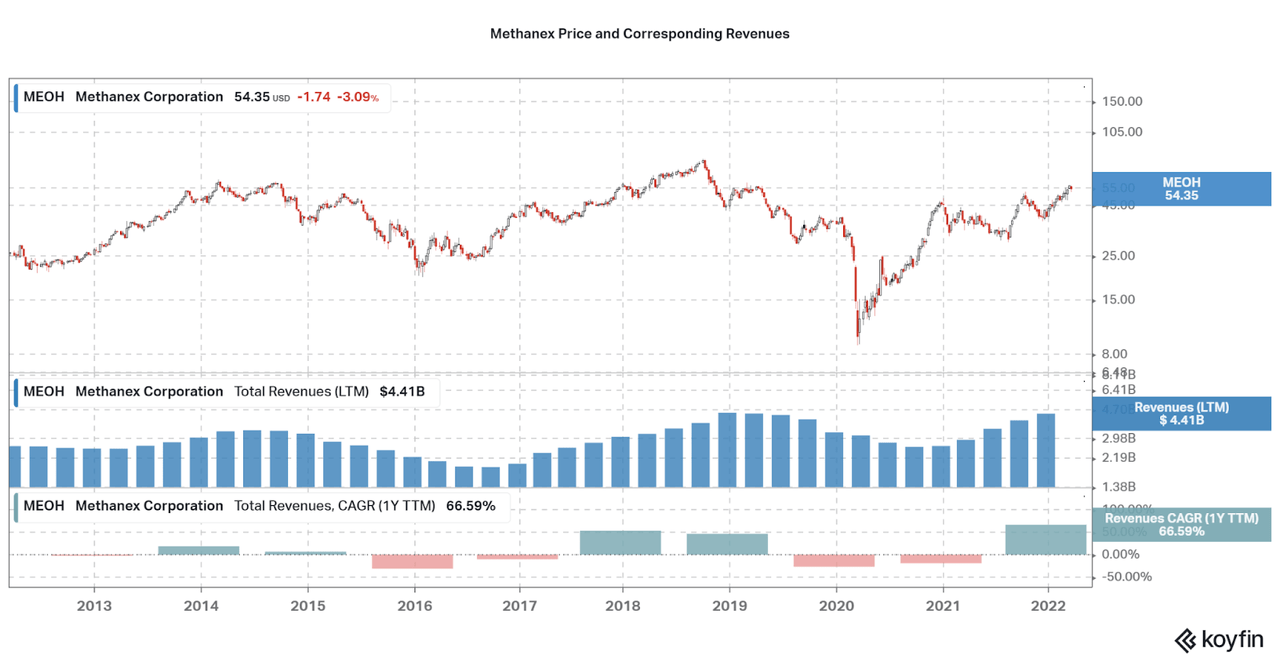

Methanex is one of the few pure-play investable companies involved in the production and distribution of methanol. While offering an overall upward trend in revenues, these are highly cyclical over a short period, typically just a year or two bull cycle. The chart below highlights this fact. However, the company has plenty of merits as a suitable choice for methanol exposure, such as worldwide infrastructure, multiple strategic partnerships with fuel users, and capabilities for biomethanol production that may be favored over Chinese coal-based methanol.

Koyfin

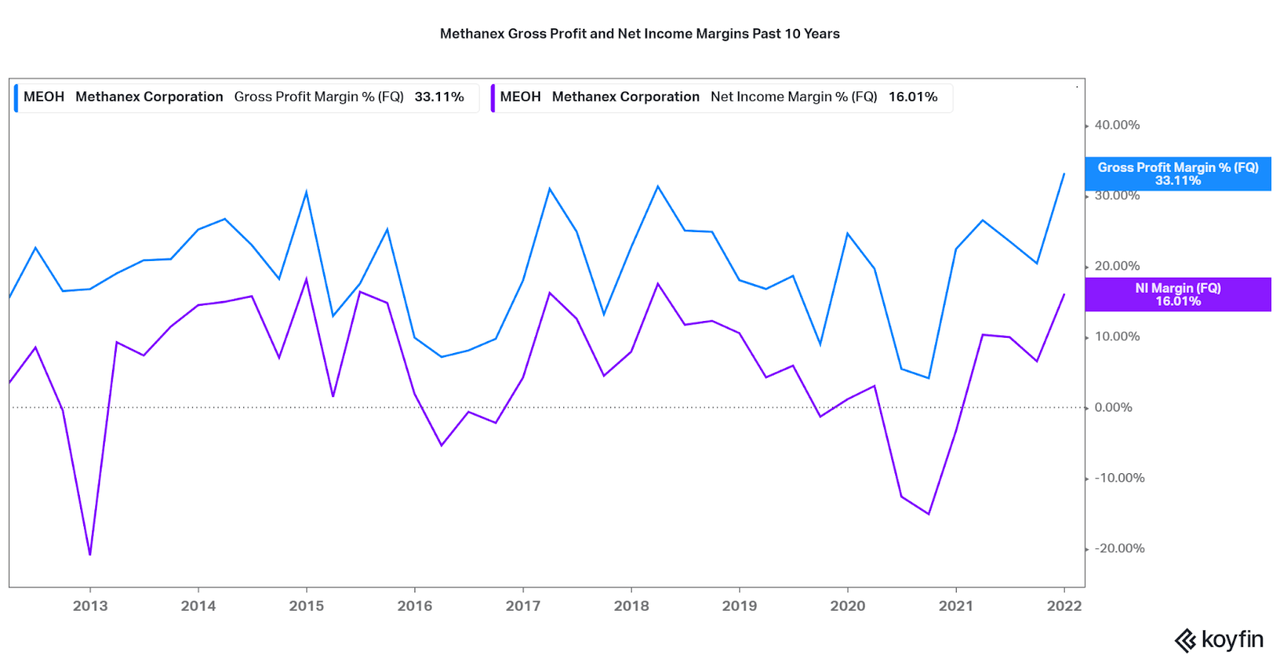

The company is currently in an upward trend, and this is a major risk to consider if you are purchasing shares at this time. This is also an issue with profitability variability, as both gross profit and net income margins fall significantly during poor revenue cycles. The only way for stable and eternal positive EPS long term will be increased usage of methanol, maintained high gas prices, and a shift in favorability towards the company’s renewable methanol products.

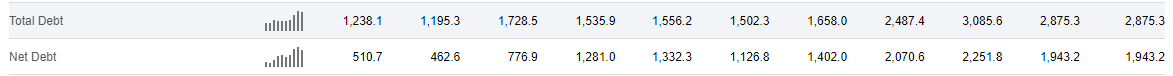

Koyfin Annual Debt Levels of Methanex (Seeking Alpha)

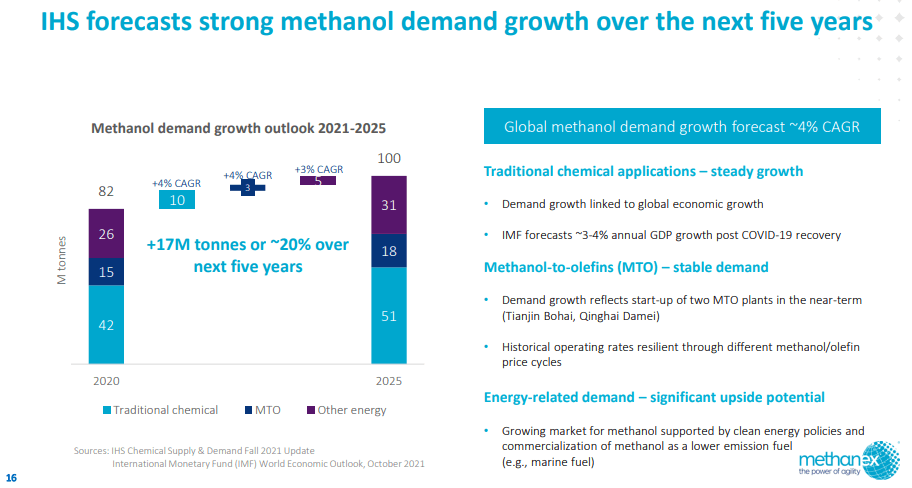

Another point to consider is that while the company has maintained significant FCF growth over the past decade and is relatively stable in regards to debt and liquidity, there remains a significant amount of debt on the table. Fellow contributor Daniel Thurecht covered the debt, liquidity, and capital aspects of the company in his recent article, which can be perused here. In summary, he found the company offers enough growth potential in both revenues and earnings to support significant shareholder returns in the next few years. I would tend to agree, but would be hesitant at this point to initiate a long position at current prices and due to volatility in the energy markets. I find the cyclicality of methanol will remain as methanol fuel use in the energy market has not seen equivalent growth when compared to prices. Next, I will dive into data on methanol demand data to allow you to determine your own conclusions on the prospects of Methanex at current prices.

Cloudy Outlook on Demand

While Methanex seems fairly positive for the opportunities in their markets, it is important to consider where the risk points exist. Methanex is on the way to completing their Geismar 3 facility which will produce 1.8 million tonnes of methanol, and I just hope the demand is sufficient to support this investment. Let’s take a look at the four major points to consider.

-

Methanol is seeing growth as a low emission fuel, especially as China is swiftly phasing out coal. Methanex is able to then leverage their renewable methanol. However, significant effects to methanol prices may arise due to the development of green production costs and limited supply.

-

Fleet vehicles seem to have some acceptance and growth potential in China, although this remains in limited scope with manufacturers even as methanol producers claim rising growth. Further, methanol ships are few and far between, only 13 dual-fueled methanol ocean-going vessels were in operation as of Nov 2021. Maersk has an order for 8 more vessels due to hit the water in 2024.

-

The rise of sustainable forestry practices via Timber REITs and Forest Operators allows for a renewable feedstock but unknown effect on wood prices may be a significant risk. Other forms of renewable generation such as via geothermal energy are still expensive and limited.

-

One way to produce renewable methanol is by reacting hydrogen gas with CO2. This now links the methanol industry with the green hydrogen industry (think Plug Power (PLUG) & Bloom Energy (BE)).

Transition to renewable methanol – derived from biomass or synthesised from green hydrogen and carbon dioxide (CO2 ) – could expand methanol’s use as a chemical feedstock and fuel while moving industrial and transport sectors toward net carbon neutral goals. The cost of renewable methanol production is currently high and production volumes are low. But with the right policies, renewable methanol could be cost-competitive by 2050 or earlier. IRENA

Methanex

Conclusion

If even methanol and renewable energy advocates do not expect cost-competitiveness until around 2050, then significant headwinds exist in the short-term for Methanex. Additionally, demand is cloudy due to requirements to develop wide scale applications. However, I do find Methanex offers significant exposure to the industry through their leading infrastructure and can take advantage of any positive events in the industry. I would recommend following news about consumers such as Geely (OTCPK:GELYF) and Maersk (OTCPK:AMKBY) and competitors such as Thyssenkrupp (OTCPK:TYEKF). As for me, I will wait for the next cyclical swing towards low methanol prices before considering investing, but I see the case for a short-term momentum trade.

One interesting aspect of net-zero/renewable/green/sustainable technologies is that they all build on each other. This article introduced how green methanol can be produced by green H2 which can be produced by renewables or biomass and in the end requires methanol compatible engines and infrastructure. Therefore, I find that this age of significant ESG investments to be a positive indication for dozens of innovators across the stock market, and this is why I will be continuing this series on Earth Focused Investments. I hope this article is sufficient in introducing methanol and its uses, and Methanex as a pure-play on the industry.

Stay tuned and thanks for reading.

Be the first to comment