Klaus Vedfelt/DigitalVision via Getty Images

The Investment Thesis

I believe that innovative healthcare practices that focus on individual liberty, ease of access, and high-quality treatment will easily fill in the demand for care in our aging populations. This contrasts with legacy assisted living facilities that are facing stiff competition that has resulted in poor performance over a growing period of time. In particular, one company, Brookdale Senior Living (NYSE:BKD), has consistently underperformed the broader market due to the fact that they focus on assisted living facilities. As the quality of home care increases, Brookdale has seen a decline in financial performance over the years. As a result, I continue to have a bearish opinion of the industry. In return, I will continue to invest in leading innovative health care infrastructure company Signify Health (NYSE:SGFY). However, I will address some other companies one can use to hedge both of these bets.

What is Home Healthcare?

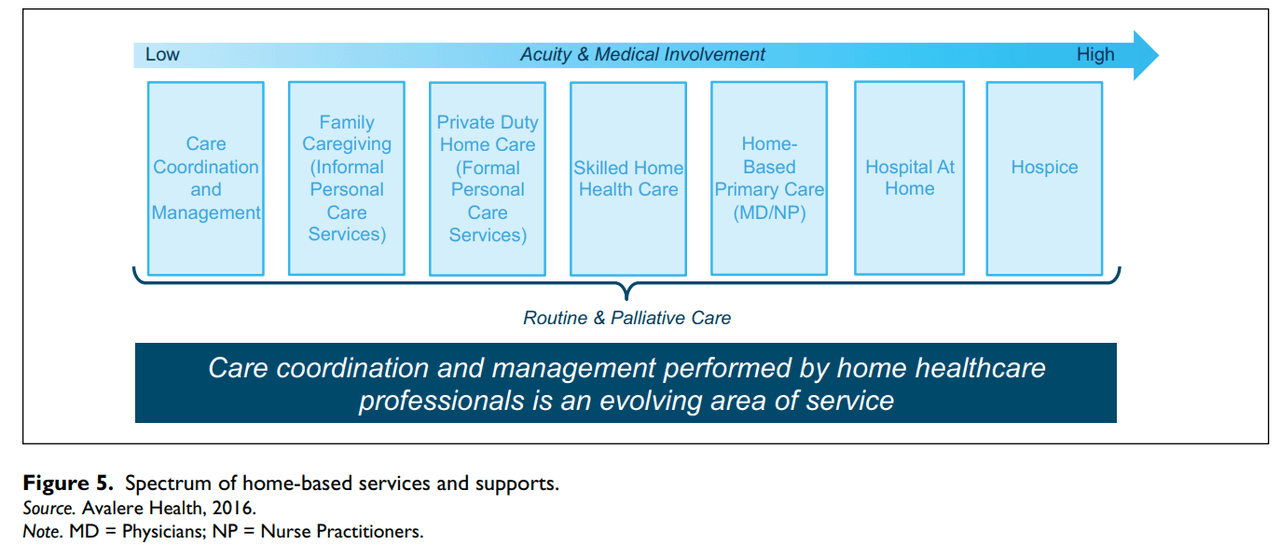

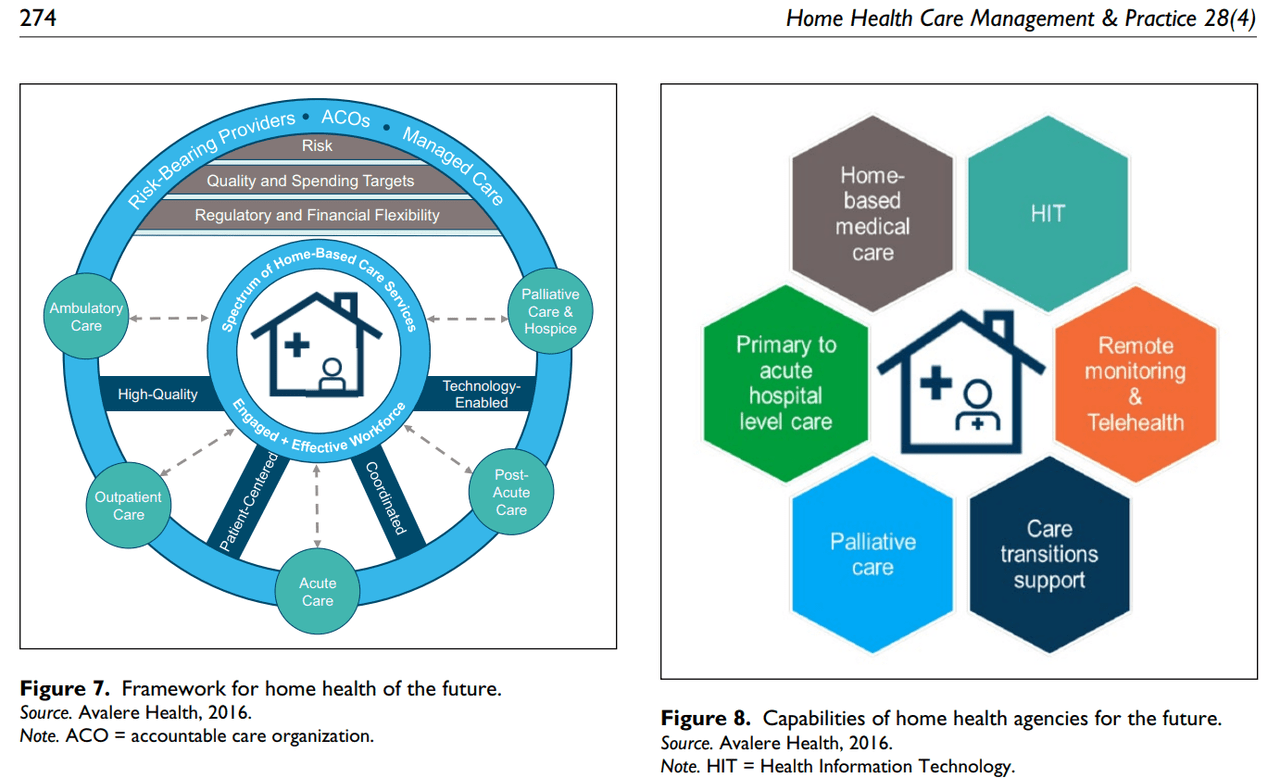

Home health services are quite diverse in application, ranging from informal family care to 24/7 palliative or “hospital at home” care. The wide scope of varying levels of involvement naturally leads to varying costs and quality. However, all areas work in tandem for two main goals: improved quality of life over facility care and increased ability to prevent expensive in-patient events. Naturally, the lower involvement services, including preventative care, are quite important in the formation of a successful industry, as serious acute diseases typically require patients to check into a hospital. At the moment, home healthcare is the leader in long-term care services by usage, and I expect the segment to continue stealing market share from assisted living, nursing homes, and adult day centers.

Landers, et al. Landers, et al.

An Aging, But Healthy, Population

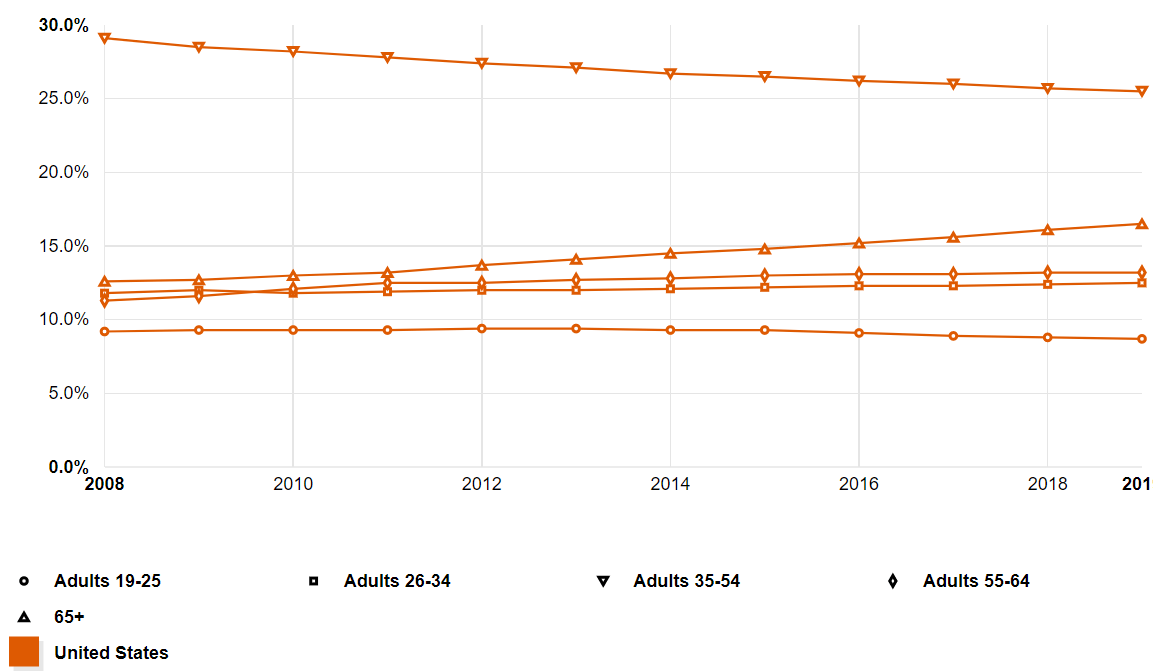

One may wonder why I am choosing to bet against assisted living facilities as populations age around the world, thanks in part to better healthcare and lifestyles. In fact, the number of seniors as a proportion of our population is currently increasing at a rapid rate as the world’s post-war Baby Boomer generation matures. This pattern can be seen in the chart below.

It is widely acknowledged that the United States has an aging population in what some have termed the “Silver Tsunami.” Those born in 1946-1964, known as the Baby Boomers, are aging into the 65 and over demographic.

KFF

This makes it a natural conclusion that assisted living facilities should grow in-line with the generational increase in seniors. However, I find that there are many headwinds that the industry faces at the moment, and this is reflected by poor financial performance. This contrasts with companies with exposure to the growing home health services industry. Although, there is still work to be done to improve home health, and this is why I decided on investing in a healthcare infrastructure services company, Signify Health. As I will discuss later in this article, there are many other ways to take advantage of the home health industry.

The demographics of an aging society will sustain the trend toward home-based care. Home health care practices grounded in careful research will sustain the patients and the clinicians who serve them.

–Patient Safety and Quality in Home Health Care

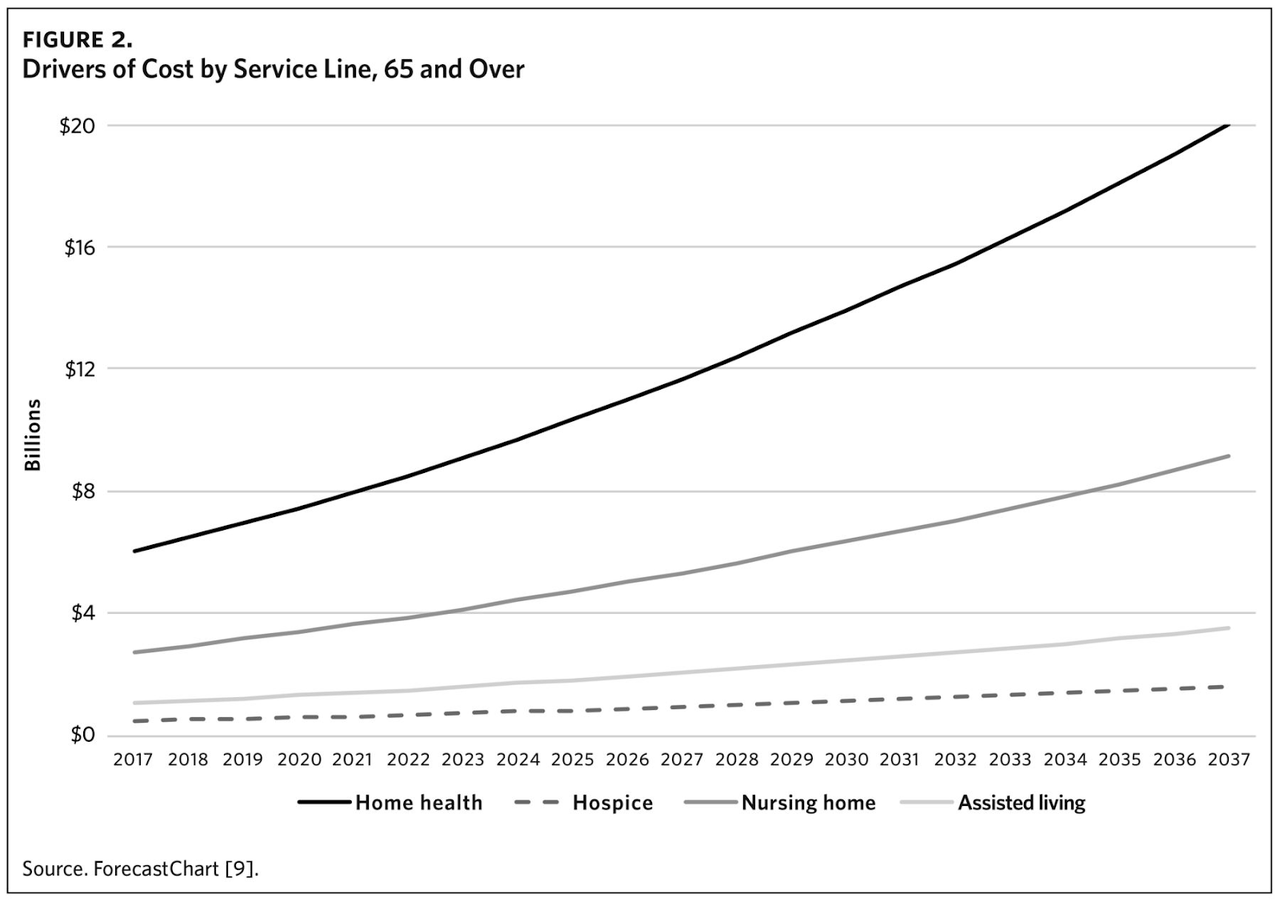

Spending

There is one major problem with home healthcare, at least as service quality has improved. This is the fact that home healthcare is expensive. In fact, for those 65 and over, home health services are currently, and expected to remain, the main driver of healthcare costs. As of 2017, home health is a market that is at least 5x as large as assisted living facilities. This is not only because of the number of recipients or users of the services, but in the fact that generalized costs are higher for the equivalent services. Having a central location to care for multiple patients in an assisted living facility has the benefit of economies of scale, but remains weak in terms of quality of life.

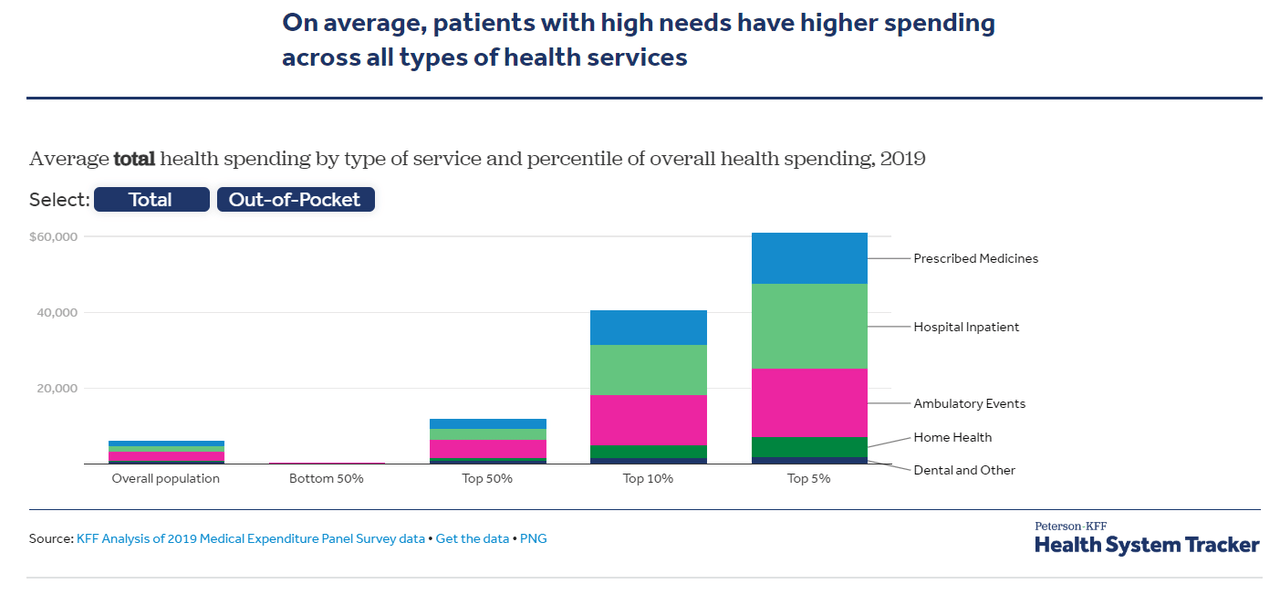

Zolotor and Tippet

It is also important to realize that home health still remains a small portion of the entire healthcare ecosystem. Other areas of spending such as prescribed medicines and dental are unlikely to be affected by home healthcare, but we could see shifts in the ratio of hospital and ambulatory forms of acute care. Home health services are eating into both of these segments, especially when considering in-home and telehealth services combined. This provides the ability for the segment to grow at a far higher rate than other areas of the market. This financial advantage is one of the major reasons why I believe a company such as Signify Health will outperform in the long run. I am not the only one who believes this as well.

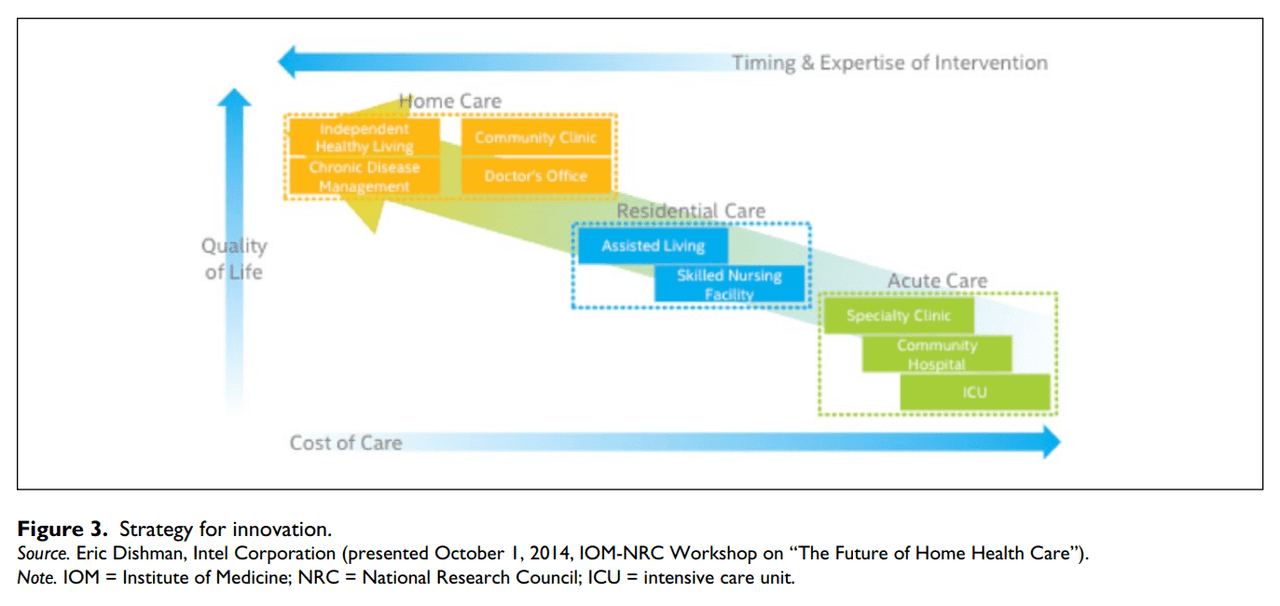

Peterson-KFF

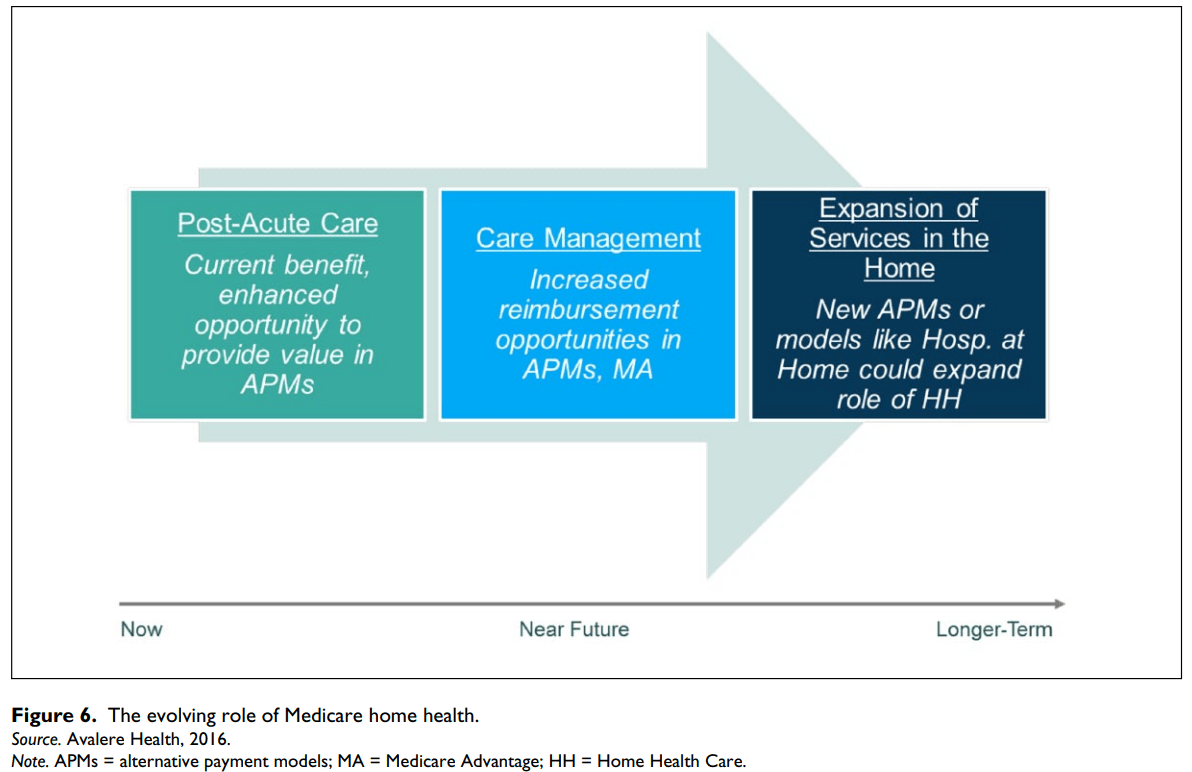

To combat high costs, Medicare and other federal agencies are investing heavily in supporting the home health segment. Having this kind of support is a positive signal for the industry and has multiple benefits. First, since cost of care increases as the care becomes more complex with acute situations (regardless of being in home or not), strategies for innovation are being focused towards utilizing home care as a cost prevention technique. This also includes improvements to the private practice industry, including the rise in telehealth services. However, I will continue to note that we remain in the early stages of the secular swing, and that full Medicare expansions to home health services are expected in the years ahead.

The future of health care delivery hinges on the ability of payers and providers to leverage the spectrum of home-based care, with Medicare skilled home health as a formidable linchpin in that spectrum…

Consistent with this report, the home health industry must commit to pursuing a process to transform home health and home-based care to benefit patients and the U.S. health care system. Through collaboration with multiple stakeholders, including patients, caregivers, policy makers, payers, and providers and professionals across the spectrum of care, pursuit of this transformation process has the potential to improve the way health care is delivered in America (Landers, et al.).

Landers, et al. Landers, et al.

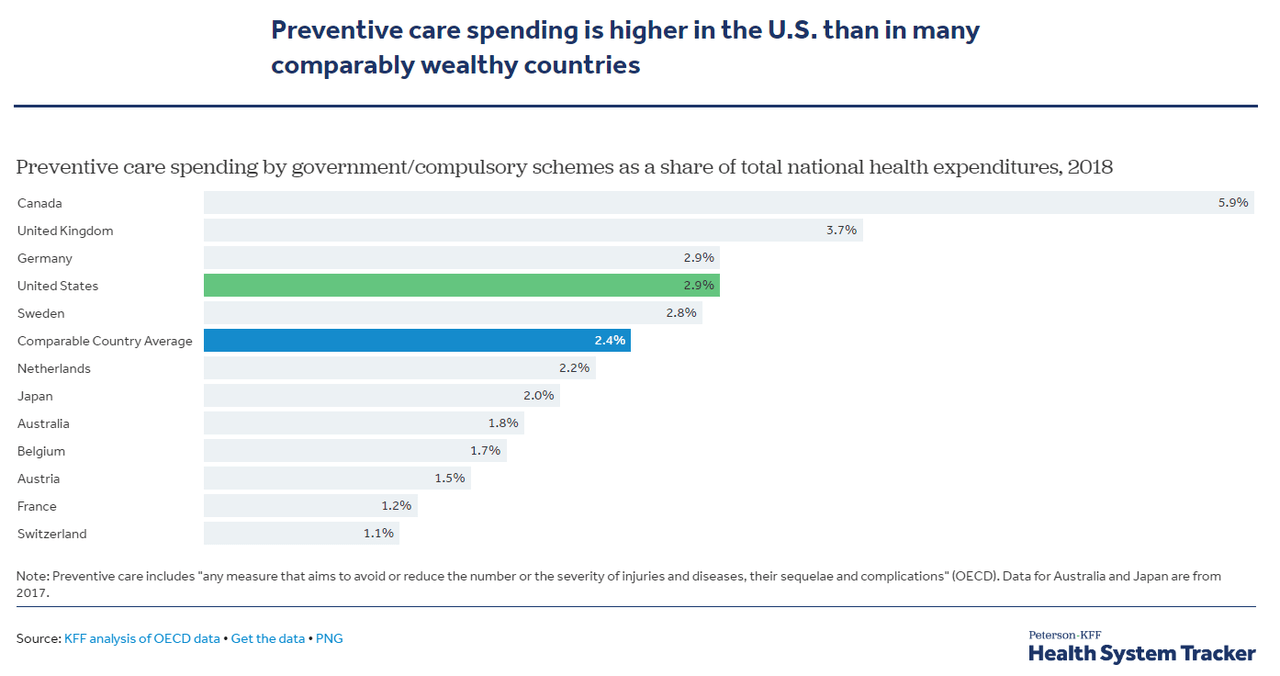

Lastly, I will circle back to one important area of support for the secular shift in the healthcare industry: preventative care. While I have discussed these points already, they are important to the thesis.

-

First, the need to prevent high-cost acute services is the main way to reduce home care costs.

-

Then, improvements to personal health as acute events decrease allow the geriatric to remain home to a higher age.

-

Lastly, improvements to the quality and diversity of home care applications complete a positive feedback loop as available home treatments and better health allow more and more people to continue living at home.

These three factors allow home health services are supported by the ~3.0% government preventative care spending as a proportion of healthcare expenditures. While trending downward since the 2000s, the current rate remains higher than many other major nations in the world. I would look to see this proportion increasing over time as another bullish indicator for home health services.

Peterson-KFF

Catalyst: moving in with family

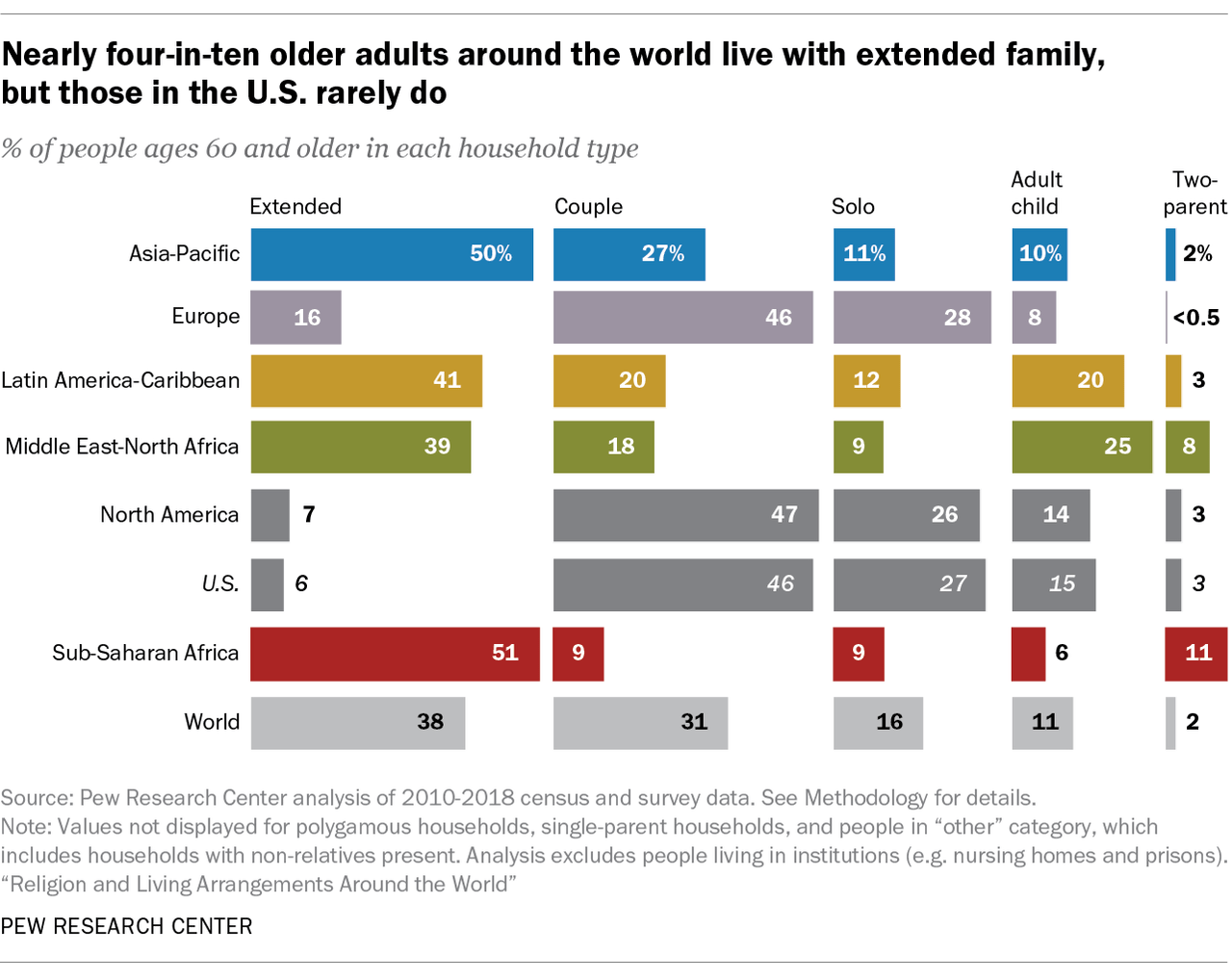

One last unproven catalyst is related to family dynamics. This revolves around the fact that most elderly live on their own, and must be shifted to assisted living facilities when unable to care for themselves. While the US famously leaves the elderly to fend for themselves, any change to this dynamic would be a welcome sign for the home health industry. When the elderly live at home with extended family, home health services will continue to be the norm. Interestingly, the rate of shared households seems to be driven by housing costs, and current pricing may be leading to more adults living with younger family members. In fact, an article by AARP in 2018 indicated there was already a shift occurring, although I have not found data for the post-pandemic era.

“Adults who live in someone else’s household typically live with a relative,” Pew stated in its report on its findings. “Today, 14 percent of adults living in someone else’s household are a parent of the household head, up from 7 percent in 1995.” By contrast, “some 47 percent of [such] adults are adult children living in their mom and/or dad’s home, down from 52 percent in 1995.”

–AARP

Pew Research Center

The Long: Signify Health

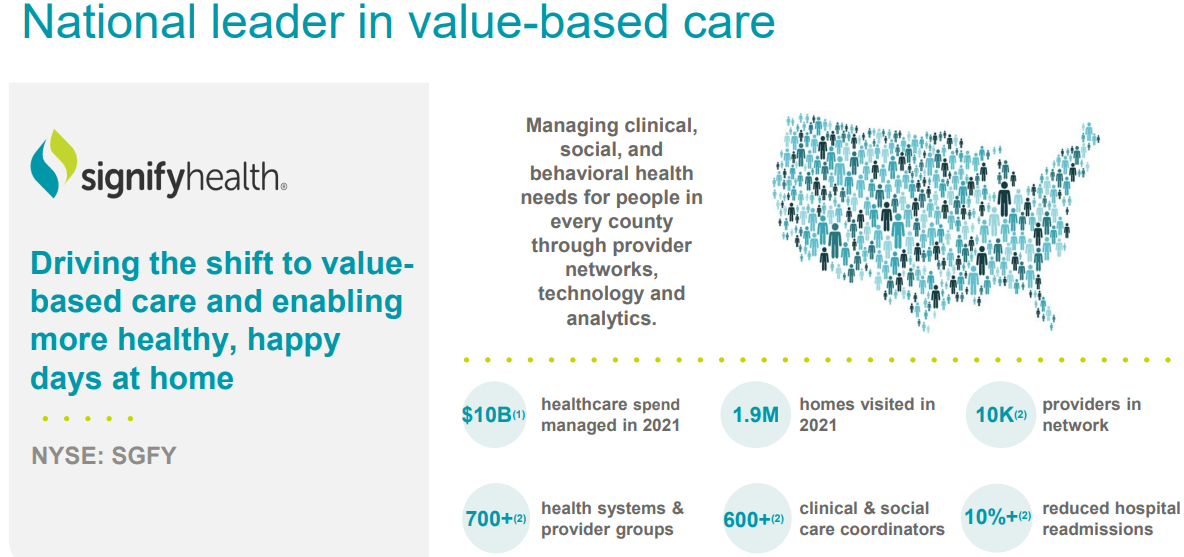

Signify Health is one of my heaviest weighted investments and I have covered the company before. I would recommend reading the two articles (here and here) to gain a better understanding of the company. The company is a complex play on the healthcare industry and is B2B rather than B2C. I summarized the company in this way:

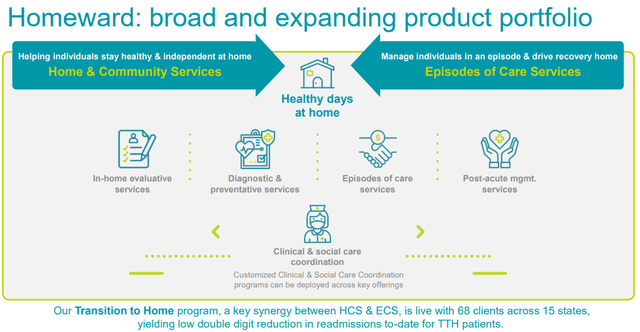

Signify provides a unique niche in the healthcare world. The first important factor to note is that Signify does not directly work with patients. Instead, clients are the general healthcare system infrastructure pieces, ranging from state-run or federal medical programs, to hospitals and clinics, and to healthcare providers like Anthem (ANTM) and Humana (HUM). Then, Signify works to provide optimized and innovative platform tools for value-based programs such as Medicare Advantage plans, managed Medicaid, ACOs, and commercial health plans.

Signify has two main components to their platform. First, the technology focused applications are able to provide data analytics across all areas of the market, particularly to drive efficient operations and reduce costs. Next, the company leverages a group of providers that focus on acute virtual and home care services. The integration of these two different capabilities allows for clients, healthcare providers, to increase the quality of their home care offerings. In essence, Signify Health allows legacy healthcare providers to improve the quality of their services into the modern era at a lower cost than if they try to do so on their own. Being agnostic to the particularities of the industry, Signify has the power of diversification to support the long-term success of the platform.

‘We are moving beyond the facility-centric view of the world and instead taking a look at the entire continuum of care…’

– CEO Kyle Armbrester

Signify Health

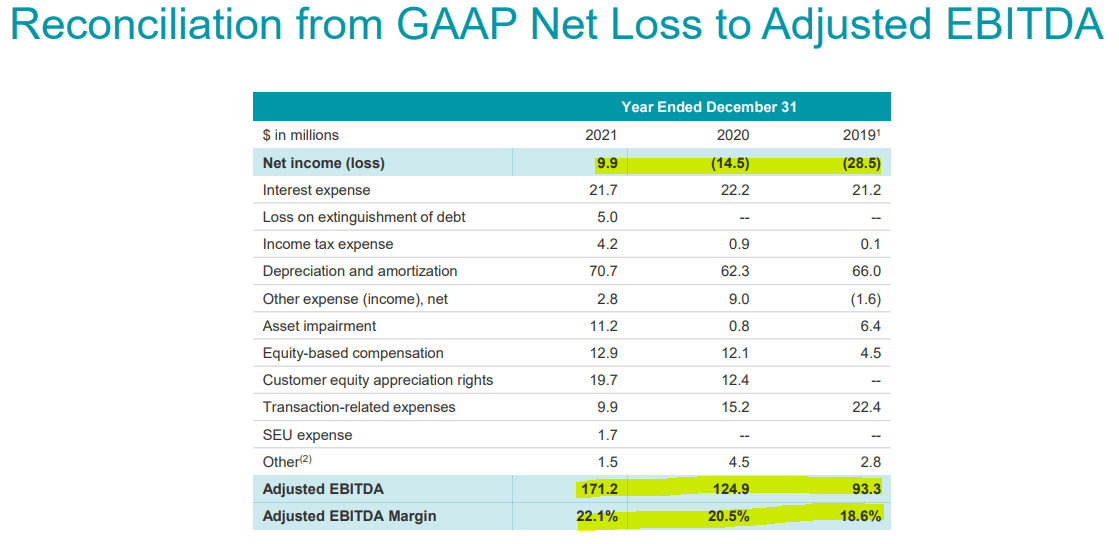

Note how 1.9 million homes were visited; hundreds of integrated payors, providers, & coordinators are involved; and hospital readmissions were reduced by 10%. This checks off many of the boxes that I am looking for. Efficiency through economies of scale, prevention of costly events, and a continual focus on home care are all bullish points for my thesis. With this, Signify’s revenues have been able to grow at a stable 24% annual rate since 2019, and earnings have been positive for a few quarters recently. I continue to support the company as the financials improve, rather than what is occurring with the alternative company I will discuss next.

Signify Health

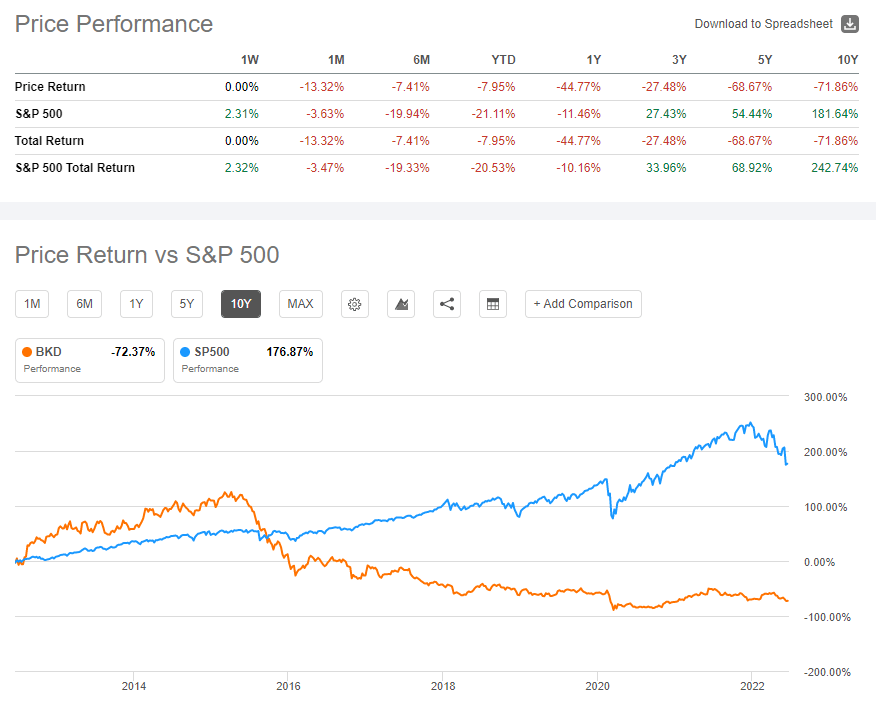

The Short: Brookdale Senior Living

Brookdale owns and operates a large collection of assisted living facilities across the US. As one of the largest collections of assisted living facilities in the country, performance has struggled over the past decade. This result bolsters my thesis that facility based care is the weak area of the market. Over the past 10 years, the share price has fallen 70%. In fact, outperformance has not been seen since 2015. This performance is the result of multiple factors, but as a result, the share price has been beaten down and is the main risk point of shorting the company.

Seeking Alpha

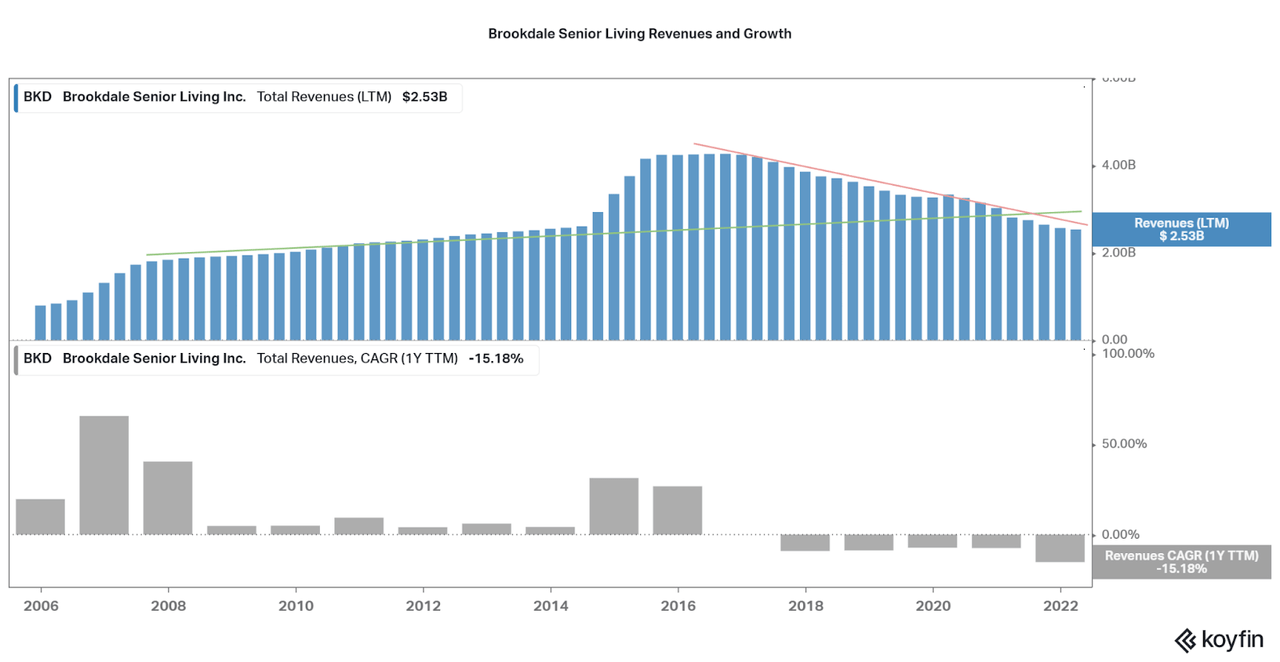

Revenues are one major weakpoint of the company. While a boost of momentum in 2015 broke the underlying trendline, revenues have exhibited a strong downward trend since 2016. One has to wonder if the current downward trend (shown in red) will be maintained, but the underlying trend line still offers extremely slow growth. As a result, even if BKD’s overall growth rate follows underlying growth, the company will underperform the broader market.

Koyfin

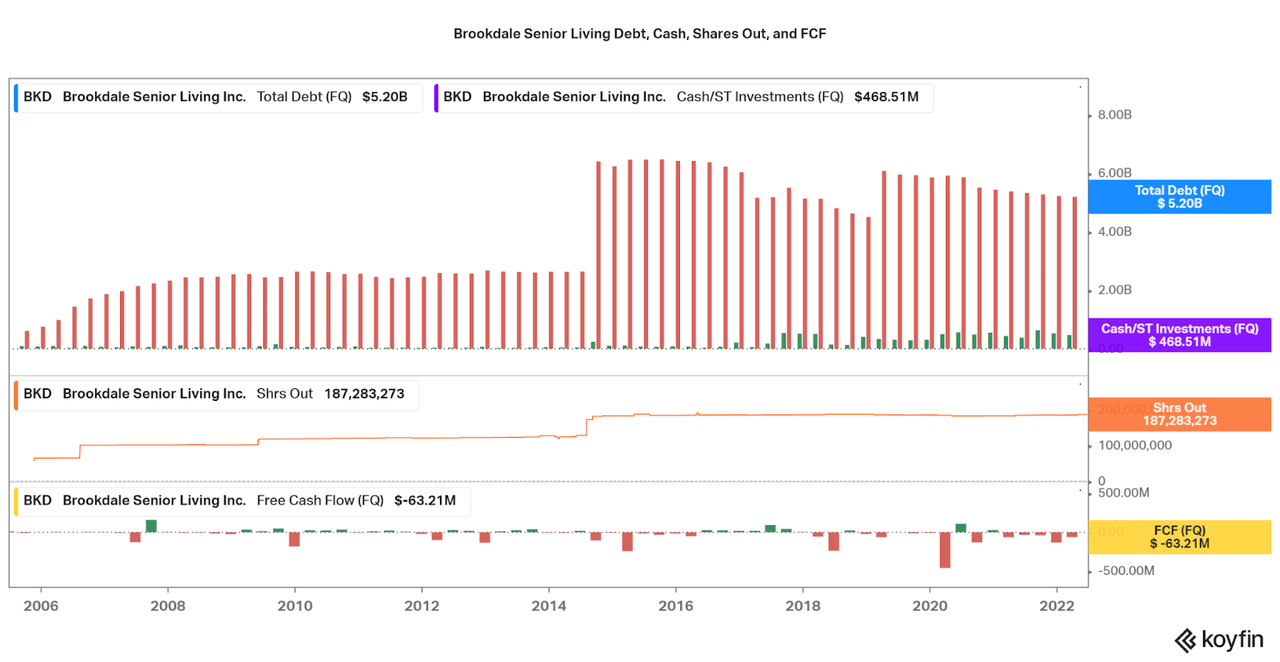

Along with a poor revenue growth profile, negative profitability has damaged the company’s balance sheet. It seems that a leveraged buyout in 2015 was not well managed as the revenues and total debt share a similar pattern. This leverage is very damaging to BKD’s performance as FCF remains negative as debt is paid off. As a result, this low-quality balance sheet will continue to suppress performance for the company and is a major reason to avoid.

Koyfin

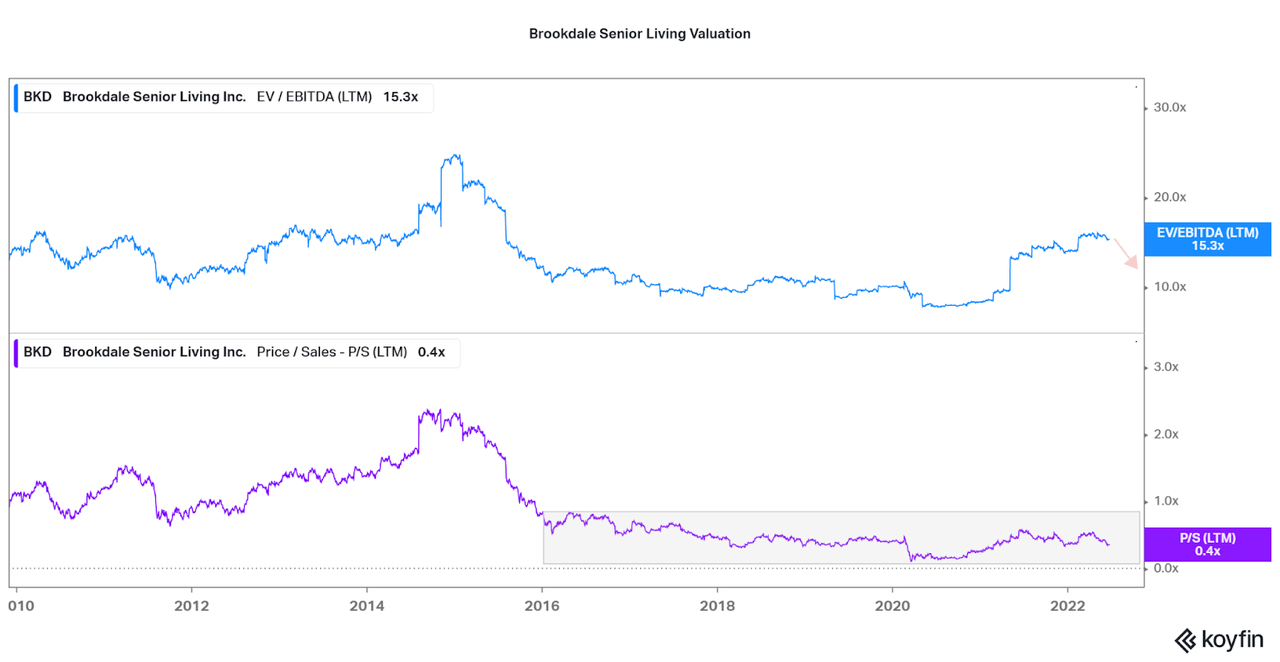

As a result of declining revenues, poor profitability, and a terrible balance sheet, BKD has a rightfully low valuation. However, this is the major risk point to the short thesis, as there is little room to move to the downside. Due to a rebound in occupants, revenues seem to have the chance to level out in 2022/2023 and this may allow the valuation to continue rising due to optimism. At the same time, it is extremely unlikely that performance will return to a level such was seen prior to the 2015-16 era. Therefore, I believe the EV/EBITDA has room to fall and the P/S will remain in the highlighted pattern.

Koyfin

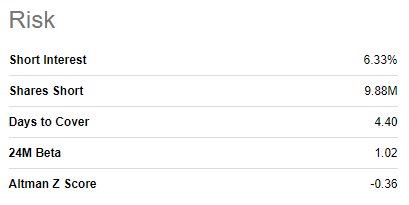

I rarely short stocks due to the fact that attitudes change quick and the market follows no predictable pattern. This short faces risk due to the low valuation and the opportunity for BKD to buck the downward spiral. However, when facing a secular decline in their respective industry, I will continue to believe performance will be poor. Further, if upward momentum fails to hold, the share prices may fall rapidly, there is no such thing as too low of a valuation. This is also highlighted by the extremely Altman Z score of -0.5, signalling a high probability of going bankrupt.

Seeking Alpha

Although due to the already weak market, I will personally be watching the market closely over the next few months to decide when to strike. If you so choose to short based on this data, consider using options to help offset the risk. Feel no rush, especially if you just want to go long Signify Health. Lastly, if you want better exposure to the facility-based health care market, I would recommend Ensign Group (ENSG) or Welltower (WELL), who are diversified enough to have a pattern of solid revenue and earnings growth, even as the market weakens. Even so, financial data shows that facility-based revenues will remain the slowest growth segment.

Conclusion

Current data is indicating a secular decline in facility-based health care services such as Assisted Living facilities. There is also far more data than I covered in this article, and I recommend reading the linked sources for a deeper look. While a secular decline, there is the opportunity for individual assets within the facility-based ecosystem to rebound slightly in a short cycles, however, I feel the short thesis is bound to last for decades. Therefore, do take time to look at the industry and be patient before making a move. At the moment, I will continue establishing my long position with Signify Health, and will be monitoring Brookdale’s valuation over the next few quarters.

Thanks for reading. Feel free to share your thoughts, possible hedges, and alternate strategies below.

Be the first to comment