claffra/iStock via Getty Images

Sibanye Stillwater Limited (NYSE:SBSW) is having a tough 2022 so far. The long strikes in the South African gold operations, the flooding in the area of the USA platinum group metals (“PGM”) operations, and court battle over the terminated US$1B deal for Brazilian assets have caused disruptions and additional expenses to the company. These have weighed on the stock. The PGMs are also suffering from higher volatility, due to increased uncertainty about the global economy.

However, looking at the bigger picture, SBSWs strategy to diversify away from South Africa and focus on green metals should pay off in the future. The current market weakness in some metals like copper and the unfavorable market conditions for raising capital could be an opportunity for Sibanye to leverage its strong balance sheet and expand its project portfolio even further.

PGM market outlook

The PGM market have been rocked by serious volatility from the beginning of the year. While fears about global recession are putting pressure to the downside, the upside is supported by production problems in South Africa and the uncertainty surrounding supply from Russia. Platinum’s price has fallen year-to-date (“YTD”) around 7.5% to a bit below US$900/oz, while palladium has gained more than 15%, to around US$2,200/oz, from the beginning of the year. Currently, the platinum market is at a surplus, while the one for palladium is at a deficit, which to an extent could explain the price dynamics so far. However, the longer-term future outlook for the two metals projects that the supply/demand balance will turn upside down and the roles will be reversed.

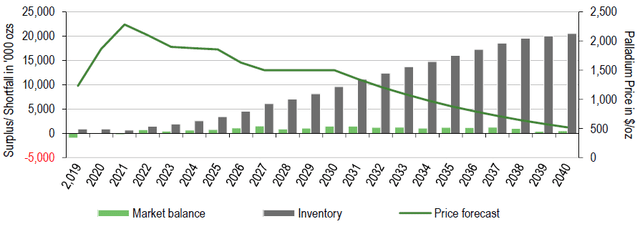

Palladium price, market balance and inventory forecasts (Edison Investment Research)

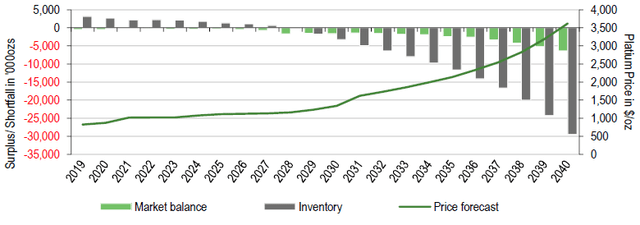

The main driver of the reduced demand for palladium is expected to be the wide scale adoption of all-electric vehicles, which would lead to lower demand for platinum as well. However, the latter has much more diversified applications and even is expected to play an important role in decarbonization. For example, the growth in green hydrogen technologies could increase demand by about 1.7Moz around the middle of the next decade, according to research from Bloomberg Intelligence.

Platinum price, market balance and inventory forecasts (Edison Investment Research)

Rare earth metals, such as iridium and ruthenium, which SBSW also mines, are expected to benefit, too. In light of the latter, it’s worth mentioning that recently the company teamed up with Heraeus Precious Metals for the development and commercialization of novel electrocatalysts, based on those rare-earths, to be used for the production of green hydrogen.

Geopolitical considerations

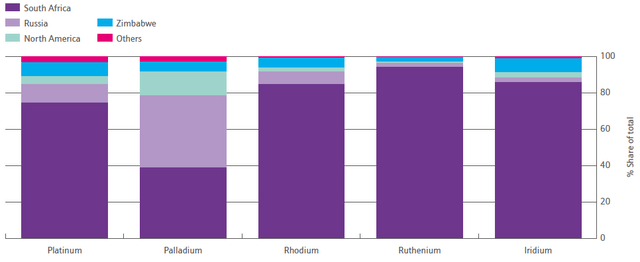

One country – South Africa – dominates the PGM production in a way that can hardly be found in any other good or service. About 75% of Platinum originates from South Africa, while in rare earths like rhodium, iridium, and ruthenium the market share is even bigger. Only in palladium, Russia rivals and even slightly surpasses the African country with market share of about 40%. The third notable source of PGMs is Zimbabwe, but its market share is a lot smaller than that of SA.

PGMs supply by region (Johnson Matthey’s PGM market report – May 2022)

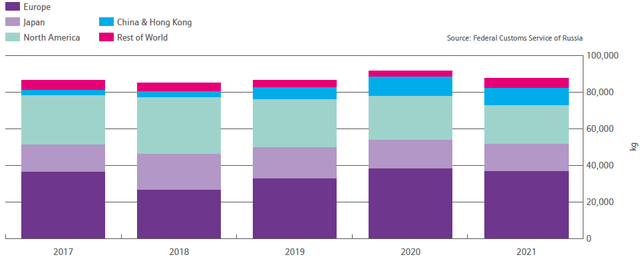

Taking this into consideration, the ongoing Russian invasion of Ukraine could have major impact on the PGMs market, especially when it comes to the supply of palladium. So far, sanctions by Western countries, imposed on Russia don’t include PGMs. However, as the situation in Ukraine escalates further, new packages of sanctions are being introduced. Recently, the London Metal Exchange began exploring the potential for a ban on Russian metals. Although this will not be critical for Russian-sourced PGMs, as selling directly to customers bypasses the LME, an outright ban on a government level will have severe impact on the market, given that the vast majority of Russian-sourced palladium is sold in Europe, North America and Japan.

Russian palladium exports by destination region (Johnson Matthey’s PGM market report – May 2022)

Besides, the sanctions threaten the access of Russian mining companies to technologies used in the production process. The main Russian PGMs players – such as Norilsk Nickel (OTC:NILSY) – have taken measures to mitigate this threat by organizing an import substitution forum in order to secure its production components domestically. Still, if the sanctions are prolonged and expanded, PGMs supply could be impacted to an extent.

Company overview

Sibanye Stillwater is a leading producer of PGMs with a legacy gold business. Recently, the company has repositioned its strategy to focus on “green” metals and made some notable acquisitions in that regard in 2021. As of the end of Q2’22, the number of shares stood at 2,830,018,926, down 3.9% YoY, due to share buybacks in H2’21. The largest shareholders are the Public Investment Corporation – a wholly owned entity of the South African government with 15.09%, followed by the investment company Allan Grey Pty (6.89%) and BlackRock with 4.99%. The company has a listing of ADRs (1 ADR = 4 ordinary shares) on the NYSE under the ticker SBSW.

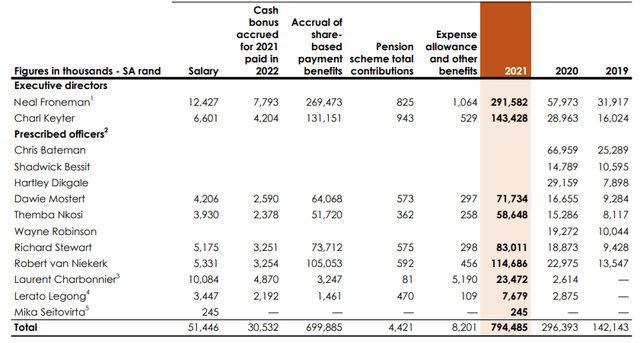

Sibanye Stillwater is led by an experienced management team, led by Neal Froneman as the CEO. Something that I like about the company is the way that the management’s compensation package is structured – the vast majority of it is linked to the share price performance.

Management’s compensation package (Sibanye-Stillwater)

Challenging 2022 so far

After a record-breaking 2021, SBSW’s problems in 2022 began from January, when the US1$B deal for the acquisition of the Santa Rita nickel mine and Serrote copper mine, both in Brazil, was terminated by the company, citing geotechnical event as the reason. The seller – Appian – as a result has filed a US$1.2B claim against SBSW in the English High Court. However, the PGM producer is confident that it can win the dispute.

Meanwhile, in March, a nearly 3-month strike began in the gold operations of the company, which was resolved in June with 3-year wage deal. As a result of the strike, the already high-cost gold operations of SBSW generated negative adjusted free cash flow of US$0.5B for H1’22. To make matters worse, the area surrounding the Stillwater mine in the USA suffered a major flooding. Operations at the mine were subsequently halted for 4-6 weeks. The impact on production for 2022 is expected to be around 60k 2Eoz.

In the meantime, power outages in South Africa continue. It’s worth noting that, while this is a risk to SBSW’s operations, due to the unique structure of the PGMs market the effects of the blackouts are not entirely negative. Since SA is the dominant producer with market share in excess of 75% in Platinum, nearly 40% in Palladium and more than 80% in the PGM rare earths, any supply production disruptions will have major effect on total world supply, hence weight in on the price of the metals. Same could be said about the difficult relationship with labor unions. SBSW’s peers Impala Platinum (OTCQX:IMPUY) and Anglo American Platinum (OTCPK:ANGPY), too, have to deal with tough union relations.

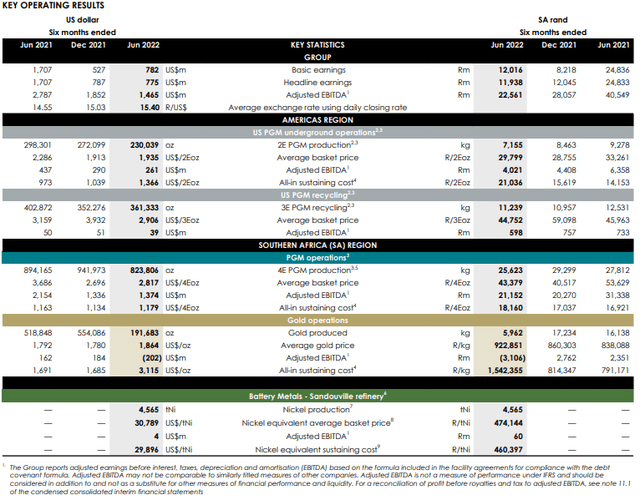

Sibanye-Stillwater’s results (6-K Form)

When it comes to H1’22 results, the cost inflation and the above mentioned problems have led to elevated AISC of all divisions. According to the updated guidance, cost pressure will persist in H2’22 with AISC between US$1,380 and US$1,425 for the US PGM operations and US$1,233 and US$1,280 for the SA PGM operations.

Adjusted free cash flow has fallen to US$241M for H1’22, compared to nearly US$1.2B in H1’21 and over US$1.3B in H2’21. The big dent in the number for Jan-Jun’22 was mainly due to the negative developments in the gold operations, which chopped-off nearly US$0.5B from adjusted free cash flow. Despite that, the company has paid out US$230M in dividends for the quarter, sticking to its dividend policy.

Expansion plans

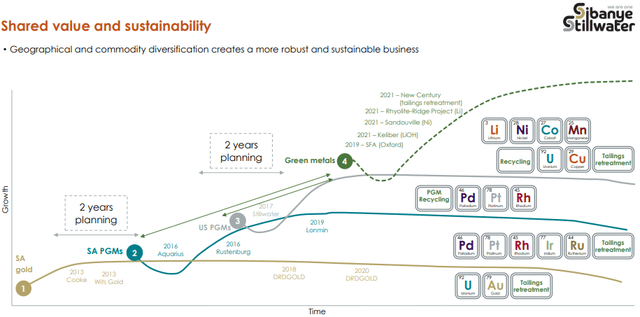

Sibanye Stillwater was at first mainly a gold producer. However, as some of the gold assets were approaching depletion and AISC were rising, the need for strategy focus was rightfully identified. As a result, the company has managed successfully to turn itself from a gold producer to one of the major PGMs producers, while maintaining its gold business. In the meantime, some geographical diversification was achieved through the acquisition of Stillwater Mining company in the USA, reducing the political risk coming from South Africa.

Sibanye-Stillwater’s expansion to date (Sibanye-Stillwater)

However, in recent years with the rapid growth of all-electric vehicles and the worldwide push towards electrification, the company foresaw the need for another major shift – this time towards green metals. In light of that, a series of acquisitions were made in 2021. As a result, SBSW now has exposure to lithium through two advanced stage projects.

The first one is the Rhyolite Ridge project in Nevada, USA. For US$490M, SBSW has acquired 50% interest in the project, which has estimated NPV on 100% basis of US$1,265M calculated using lithium carbonate equivalent price of just US$13k/tonne, while the current market price is north of US$70k/tonne.

The second one is the Keliber project, located in Finland, which has estimated NPV of EUR1,228M on 100% basis using LiOH price of US$24,936/tonne. Sibanye-Stillwater has recently increased its ownership in the project to 84.96%. It’s worth noting that SBSW has chosen two safe jurisdictions – USA and Finland for its exposure to lithium, unlike many other companies, who bought properties in South America. I consider this a move towards de-risking, since the political risk exposure of SBSW is already quite high, due to the core businesses in South Africa.

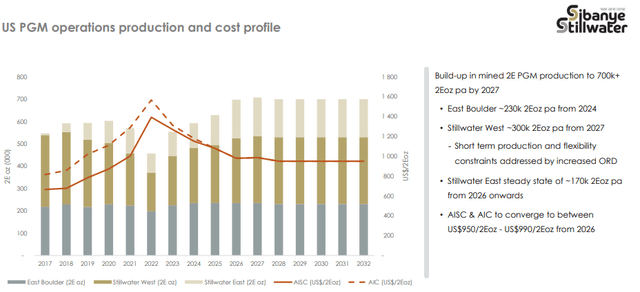

Regarding the de-risking strategy it also includes the main business – PGMs. SBSW is planning expansion and optimization of its US PGMs division, which is expected to bring annual production to 700k E2oz by 2027 and achieve leaner cost profile with AISC bellow US$1000/2Eoz.

SBSW’s US PGMs division production and cost profile (Sibanye-Stillwater)

This is very important in order to strengthen the stability of the cash flows, since any potential worsening of the business conditions in South Africa, leading to lower production will significantly impact global PGMs prices and SBSW will be able to benefit from it through the production from the US division. The estimated NPV of the U.S. division is US$3.2B, using 6.2% discount rate and basket price of US$1,250/2Eoz. For reference, the current basket price (given 77% Palladium and 23% Platinum) is around US$1,850/2Eoz, which would indicate estimated NPV close to US$10B.

Looking at SBSW’s balance sheet, it looks that there are funds for further expansion. The company has a cash and equivalents of around US$1,673M and IB debt of around US$1,275M with the majority of it being US$675M of 4.0% notes due in 2026 and US$525M of 4.5% notes due in 2029. There is also additional available liquidity through a RCF of up to US$600M.

Such strong balance sheet will allow the company to exploit short-term market turmoil, when valuations are falling and potentially acquire new assets at attractive price. For example, recently SBSW expressed interest in the Mopani Copper Mines in Zambia. There are also lucrative copper opportunities in much safer jurisdictions like the USA. I believe that Taseko Mines (TGB) is one of them, as I wrote here. Another attractive takeover opportunity, this time in the lithium space, I see in Cypress Development Corp. (OTCQX:CYDVF) as explained here.

Share price and valuation

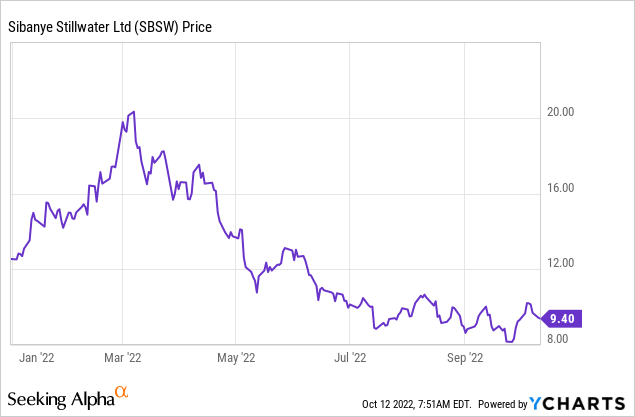

Looking at the share price performance in 2022, it is down roughly 25% YtD and more than 50% lower compared to the highs in the beginning of March.

The reasons for the decline in addition to the operational difficulties that the company faced this year could also include the overall risk-off environment in the market, an increased perception of the South African risk and skepticism around PGMs future in a world where all-electric vehicles are growing rapidly.

Looking at the current valuation with current price of US$9.40/ADR, the market cap stands at around US$6.65B and the enterprise value at US$6.25B, taking into account the net cash position. Indeed, the South African gold business looks more of a drag at current gold prices, given the high AISC. I view it more as a call option on gold’s price, but in an event of persistently lower Au price, it may have to be closed down.

On the other hand, the South Africa PGMs division is the cash cow of the company US$724M of adjusted free cash flow in H1’22 alone. Looking at the assets outside South Africa the US PGMs division has an estimated NPV of US$3.2B, which would be closer to US$10B if current basket price is used – significantly more than the current enterprise value. On top of that, there is the lithium exposure, which has very impressive indicated economics as well. For these reasons I believe that currently Sibanye Stillwater is undervalued and could offer significant upside.

So how this upside could be unlocked? Besides PGMs prices dynamics, there’s no immediate catalyst in sight other than a potential court decision in favor of SBSW in the US$1.2B court case against Appian will probably drive the share price higher. An acquisition of attractive assets at reasonable valuation could also lift the share price. In the meantime, long-term investors will likely continue to enjoy the semi-annual dividend that the company is paying. At current prices, the gross annual dividend yield is around 8.9%. Although the rest of 2022 won’t be easy, given that some of the operational difficulties will weigh in on the production, the dividend looks sustainable given the cash generating potential of the PGMs business at current metals’ prices.

Risks

Lower PGMs prices – this is an obvious risk for SBSW, given that the PGMs business is the cash cow of the company. The most probable cause of such an event could be a worldwide recession, leading to lower auto-catalysts demand. The strong financial position of SBSW should help in the short term in such an event, but if lower prices of those metals are persistent this could become a major problem. However, given that the PGMs market is basically an oligopoly, one may wonder, weather there could be an OPEC style production cuts in case of lower demand/prices of PGMs.

Interest rates risk – Given that SBSW has fixed rate notes, due in 2026 and 2029 and the strong financial position that it currently has, the impact of higher interest rates should be limited. However, on a larger scale higher interest rates will lead to lower equity valuations though the discount rate.

Political risk – the significant exposure to South Africa is a problem, given that economic freedom in the county has been deteriorating. However, given the sheer dominance on South Africa on the PGMs metals, further deterioration that lower production and raises costs should weigh in of PGMs prices to the upside. In addition the other two notable producers – Zimbabwe and Russia are not very safe politically as well. Besides, SBSW has recognized this risk and plans to strengthen its U.S. PGMs division and is expanding in the green metals space though much safer jurisdictions.

Lower gold prices – The legacy gold business will continue to be a burden and struggle at current gold prices, which are already around last year’s AISC. If such or even lower Au prices persist, maybe the company has to make a strategic decision whether to discontinue this part of the business.

Labor union relations risk – Labor union relations have been a weak spot of SBSW for long. The 3-month long strike at the gold operations had a negative effect on the results and currently there are wage negotiations about the SA PGMs division. Recently the company reported that agreement has been reached with two out of three unions. It’s important to avoid a possible strike in the PGMs operations, especially given their cash flow generating potential at current basket prices.

Conclusion

Since its inception, Sibanye Stillwater has come a long way, transitioning from a high cost gold producer to a leading PGMs miner. Management has identified the tectonic changes that are taking place in the world regarding electrification and the introduction of all-electric vehicles and is responding accordingly with shifting the focus towards expansion in the green metals space. The significant uncertainty and political risk in South Africa also appears to be identified and is being addressed through strengthening the U.S. PGMs division. At the same time, the valuation looks attractive, as only the assets outside South Africa have the potential to be worth significantly more than the current enterprise value.

Be the first to comment