JONGHO SHIN

Investment Thesis

Affirm Holdings, Inc. (NASDAQ:AFRM) has finally reached our price target in the $10s before the end of 2022, since our previous Sell article in July. However, with shaky forward execution through FY2023 and worsening macroeconomics through CY2023, things are unlikely to improve in the short term. Investors who choose to add at these levels must be comfortable with more volatility indeed, as the Fed has yet to commit to a pivot against the Bank of Canada’s earlier moderation. The peak recessionary fears through the difficult winter would also put further pressure on AFRM’s funding costs, and consequently, stock performance, due to the record-high oil/gas prices and rising inflationary pressures.

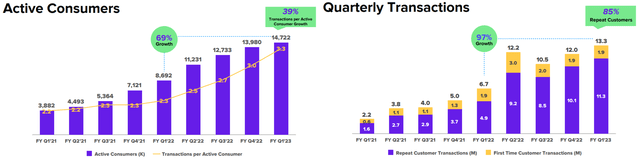

On the other hand, AFRM’s product offerings remain sticky among its existing base, comprising of 85% repeat consumers by FQ1’23, while continuing to add a robust sum of 1.9M first-timers. The number of transactions is also accelerating to 3.3 per active consumer then, compared to 2.3 in FQ1’22 and 2.2 in FQ1’21. Combined with the continued growth in active merchant engagement (despite the notable slowing growth QoQ), we expect the company to perform decently through the worsening macroeconomics for now.

AFRM Continues Struggling With Top & Bottom Line Growth

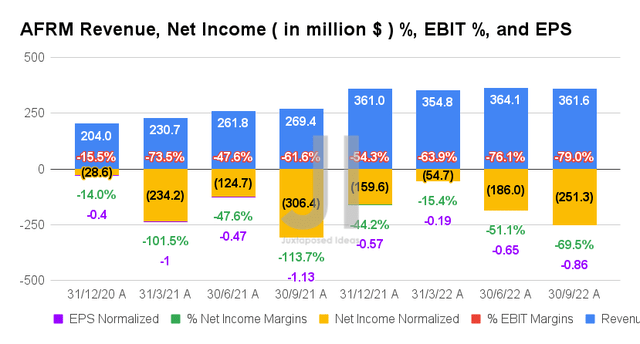

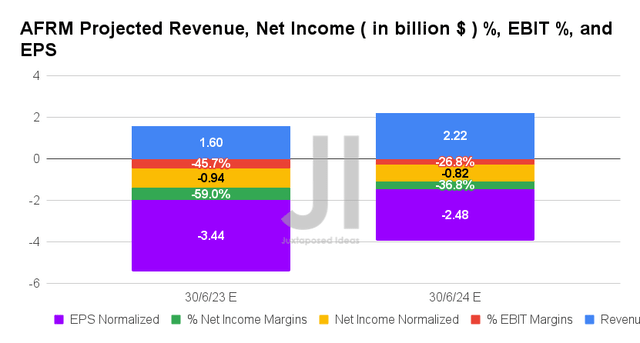

In its FQ1’23 earnings call, AFRM reported slowing revenue growth of $361.6M, indicating a decline of -0.68% QoQ though an increase of 34.22% YoY. Its profit margins remain compressed thus far, with EBIT margins of -79% and net income margins of -69.5%, indicating notable widening losses from FQ2’22 levels of -54.3% and -44.2%, respectively. Thereby, explaining its worsening EPS of -$0.86 for the quarter.

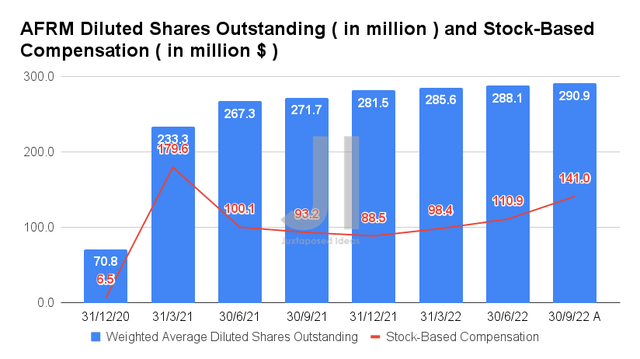

Much of AFRM’s lack of profitability is definitely attributed to its elevated operating and Stock-Based Compensation (SBC) expenses, which have been growing tremendously by 49.06% YoY to $649.09M and 51.28% YoY to $141M by FQ1’23, respectively. Combined with the deceleration in revenue growth of 34.23% against hyper-pandemic levels of 75.01%, it is easy to see why the company continues to report a lack of GAAP profitability.

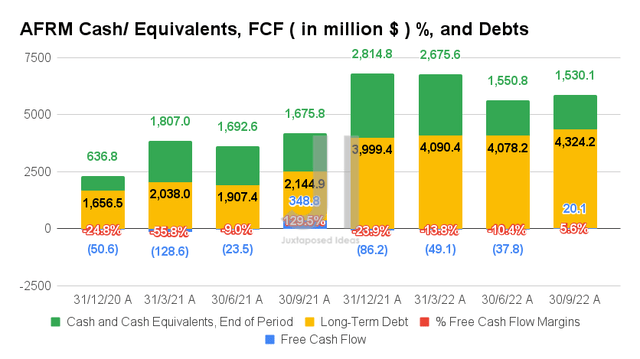

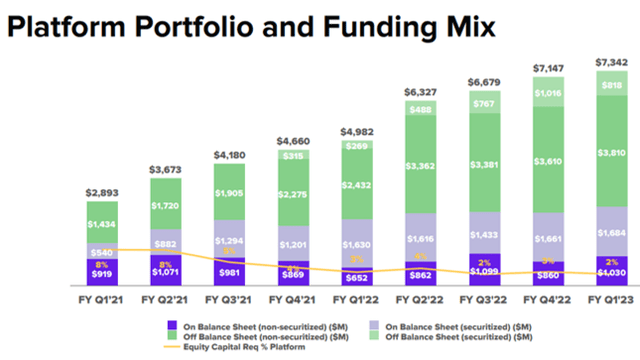

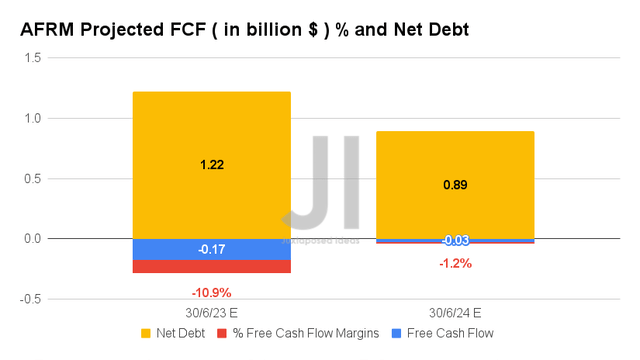

Thereby, explaining AFRM’s lack of sustained cash flow as well, despite the $20.1M of Free Cash Flow (FCF) and 5.6% of FCF margins reported in F1’23, since it is obviously an outlier month based on the chart above. Furthermore, the company continues to increase its reliance on debts to approximately $4.32B by the latest quarter, indicating a massive YoY growth of 201.86%, though $2.71B of the sum is attributed to funding debts. Meanwhile, AFRM’s liquidity seems well insulated from the impending recession, due to the $1.53B of cash and equivalents reported on the balance sheet thus far.

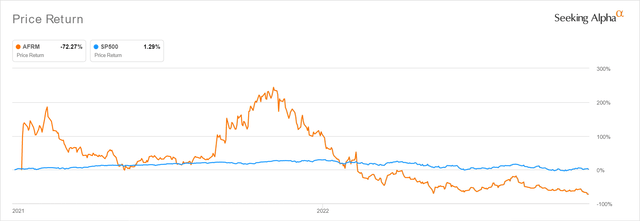

Over the next two years, AFRM is expected to report a further normalization in revenue growth at a CAGR of 28.3%, while continuing to be unprofitable by FY2024. The downgrades in its top and bottom line growth are alarming as well, by -14.23% and -22.71% since our previous analysis, indicating Mr. Market’s growing skepticism about its forward execution. Combined with its recently lowered FY2023 revenues by -3.17% and Gross Merchandise Value by -2.27%, it is no wonder that the stock has plummeted by -84.93% YTD against the wider S&P 500 Index decline of -18.86%.

In the meantime, some analysts are relatively optimistic about the increased availability of loan funding by the end of FY2023, as witnessed with the projected decline in AFRM’s net debts from $2.58B in FY2022 to $1.22B by FY2023 and $0.89B by FY2024. Naturally, this is probably attributed to 80.6% of analysts predicting a more moderate 50 basis points hike in the Fed’s December meeting from the upbeat October CPI results. In that optimistic event, the stock might be able to reverse some of the tragic losses it has sustained so far. The recovery, however, may not last through the worst of storms in 2023.

Meanwhile, we encourage you to read our previous article on AFRM, which would help you better understand its position and market opportunities.

- Affirm: Borrow-Now-Pay-Later With $1.4B Of Cash Burn

So, Is AFRM Stock A Buy, Sell, or Hold?

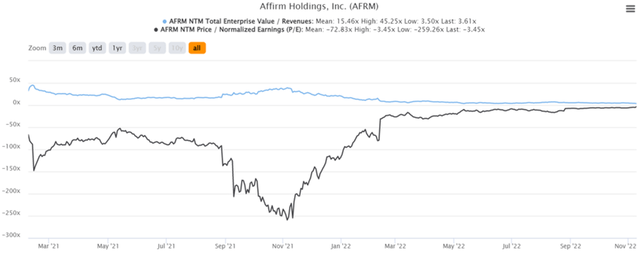

AFRM 2Y EV/Revenue and P/E Valuations

AFRM is currently trading at an EV/NTM Revenue of 3.61x and NTM P/E of -3.45x, lower than its 2Y mean of 15.46x and -72.83x, respectively. The stock is also trading at $12.10, down -93.15% from its 52 weeks high of $176.65, nearing its 52 weeks low of $11.94. Nonetheless, consensus estimates remain bullish about AFRM’s prospects, due to their price target of $27.00 and a 72.63% upside from current prices.

AFRM 2Y Stock Price

We have to admit that AFRM is trading somewhat attractively at these P/E valuations. Investors with long-term trajectories may potentially nibble at these levels, given the natural recovery from the upbeat October CPI results, assuming a higher risk tolerance and speculative portfolio allocation. The management has guided positive operating margins by the end of FY2023 as well, though the information should naturally be taken with a pinch of salt, as seen with the massive SBC reported thus far.

In the meantime, we remain unconvinced about its growth story even after the recession ends, given the intense competition in the BNPL segment by other legacy players such as Visa (V), Mastercard (MA), and PayPal (PYPL). Due to its lack of moat and minimal profitability ahead, AFRM is still not a Buy at the current blood-bath levels, despite predictions of a 50 basis point hike for the Feds’ December meeting.

Be the first to comment