ImagePixel

Over the last two and a half years, investors have had to deal with many challenges including the Covid-19 pandemic, mobility restrictions, political regime changes, Russia’s invasion of Ukraine, tensions with China, surging inflation, and rising interest rates. Although navigating these challenges seems daunting, investing is about building wealth in the long run while managing these risks. As investors, therefore, running away from these challenges is not an option. Today, many investors have to deal with a strengthening dollar as well, which is particularly true for tech investors. In this article, I will discuss why the dollar is strengthening, what it means to investors, and how investors can navigate this tricky environment.

Why Is The Dollar Rising?

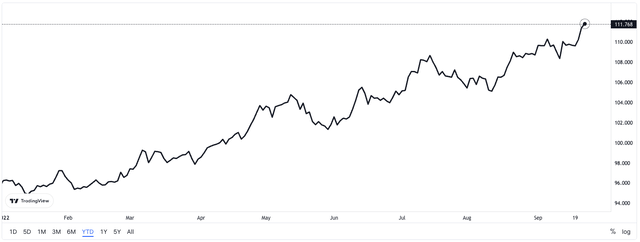

The U.S. Dollar Index, which measures the value of the dollar against a basket of major currencies, has increased by about 15% this year, reaching its highest level in 20 years as investors continue to prefer dollar-denominated investments in this period of market turbulence.

Exhibit 1: U.S. Dollar Index (DXY)

TradingView

Source: TradingView

The primary reason for the rising dollar is straightforward: higher demand equals higher value. As a source of relative economic strength and stability, the United States has attracted investors from every corner of the world whenever the global economy showed weakness historically, and things are no different this time around as well. Since foreign investors must typically use dollars to invest in U.S. stocks and bonds, the demand for the greenback remains strong today. U.S. Treasury yields are rising as investors anticipate aggressive action from the Fed in its efforts to curb inflation. The Fed is raising interest rates at a record pace to cool inflation, which reached a 40-year high in June. The monetary policy differences between the United States and other developed economies – the Fed is hiking rates at a faster pace – have made the dollar a high-yielding currency in a global context today, leading to strong demand for dollar-denominated investments.

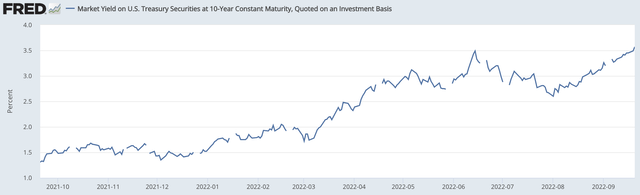

Exhibit 2: The market yield on U.S. Treasury securities at 10-year constant maturity

Federal Reserve

Source: Federal Reserve

The Fed has been raising interest rates for the past seven months, and yesterday, the Fed delivered another 75-basis point hike as expected. The Fed’s median forecast suggests the Fed funds rate will cross the 4% mark by the end of this year and peak in 2023 at 4.5% to 5%. This shows that the Fed will continue to restrict the money supply and raise interest rates, creating a strong platform for the dollar to outperform its major peers because of these outsized rate hikes.

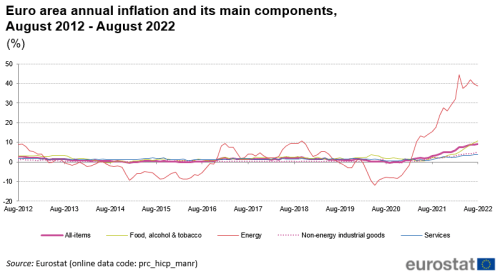

The dollar has also benefited from recession fears in Europe as a result of Russia’s invasion of Ukraine. Economic sanctions imposed on Russia, including a ban on most Russian natural gas sales to Eurozone countries, have increased the cost of fuel and driven overall inflation to 9.1% over the last year. The pound has dropped to its lowest level against the dollar since 1985, and the yen recently dropped to its lowest level since 1998 as well.

Exhibit 3: Euro area annual inflation and its main components

Eurostat

Source: Eurostat

With growth prospects outside the United States looking bleak and the Fed remaining laser-focused on pulling back inflation, the dollar is likely to remain strong against other major currencies in the foreseeable future. Investors, therefore, should get an understanding of how a strong dollar might impact tech stocks to make well-informed investment decisions that could lead to alpha returns.

How Does A Strong Dollar Impact Tech Companies?

A stronger national currency has its advantages and disadvantages. On the one hand, it makes imports cheaper, benefitting American consumers buying goods and services from other countries thanks to the strong dollar bolstering their purchasing power in other currencies. However, a strong dollar makes it more difficult for businesses to profit from foreign sales.

A strong dollar hurts corporate profits because it drives up the cost of American goods overseas, reducing international sales for American companies. This takes place in two ways. First, a stronger dollar devalues profits earned by American companies internationally when converted back into dollars. At the same time, their products and services become more expensive in local currency terms in global markets, which could have an impact on the demand.

Many tech companies have already issued warnings that the current quarter’s sales and profits may appear weaker than the second-quarter numbers. A stronger dollar makes it more expensive for international travelers to come to the United States as well, which could hurt industries that depend on tourism. According to Morgan Stanley, a strong dollar could result in an 8% drop in earnings per share for S&P 500 companies. Furthermore, a slowing recovery in Europe and recent lockdowns in China as a result of zero-Covid-19 policies are causing sluggish demand globally, posing a challenge for U.S. companies with significant overseas operations. Recent data also indicate a slowdown in business activity as inflation eats into consumer purchasing power.

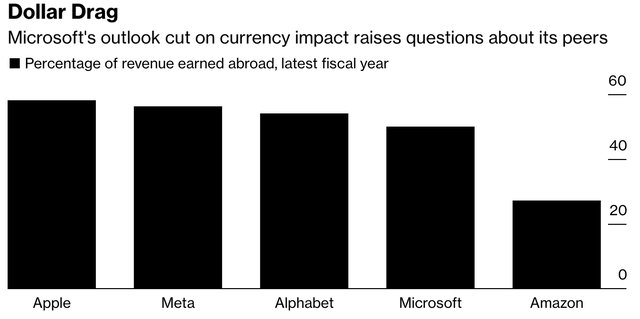

As evidenced by Microsoft Corporation’s (MSFT) recent financial results, technology companies are particularly vulnerable to currency fluctuations because the majority of their sales come from foreign markets. In the fiscal quarter ending June 30, Microsoft reported the slowest revenue growth since 2020. According to the company, the biggest challenge in the fiscal fourth quarter was worsening foreign-exchange rates, which reduced revenue by a staggering $595 million and earnings by 4 cents per share. The company informed investors that it now expects exchange-rate challenges to impact sales by around $460 million in the fiscal fourth quarter.

Many U.S. companies that sell their products overseas are facing this problem. For example, Oracle Corporation (ORCL), one of the leading software companies in the world, recently reported a lower-than-expected profit and provided lower-than-anticipated guidance due to currency risks. The U.S. revenue index also reveals that certain big tech companies, including Apple Inc. (AAPL), Google parent Alphabet Inc. (GOOG), Nvidia Corp. (NVDA), Tesla Inc. (TSLA), Amazon.com Inc. (AMZN), and Meta Platforms Inc. (META), the holding company for Facebook, are exposed to these currency risks.

Exhibit 4: Percentage of revenue earned internationally in the latest fiscal year

Bloomberg

Source: Bloomberg

According to Goldman Sachs, two industries—information technology and materials—generate 59% and 50% of their sales outside of the United States, respectively. S&P 500 companies made 29% of their $14 trillion in revenue in 2021 abroad as well. These numbers suggest the tech industry is up for a big challenge in the coming quarters amid the prospects for a strengthening dollar.

Investors may need to rethink their strategy

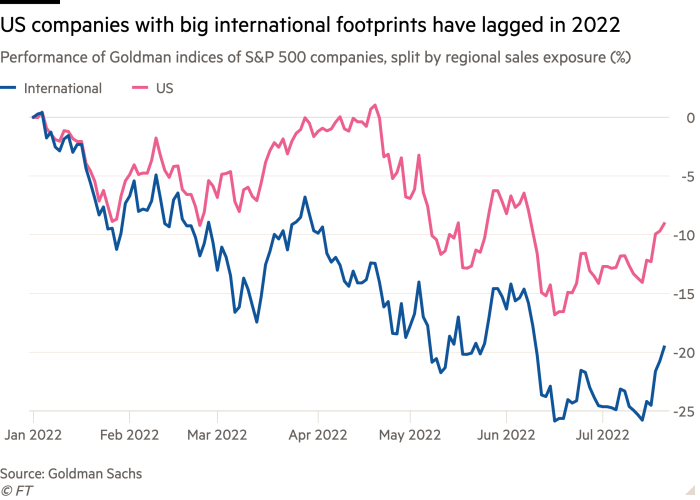

The impact of currency fluctuations on earnings will vary by company and industry, depending on their revenue mix. Investors might benefit by shifting their focus to companies with primarily domestic operations. According to Goldman Sachs’ mid-year investment outlook report, shares of companies that earn the majority of their revenue in the United States have outperformed companies that earn the bulk of their revenue internationally by about 9% in the first seven months of this year.

Exhibit 5: Performance of Goldman indices of S&P 500 companies, split by regional sales exposure

Financial Times

Source: Financial Times

As the dollar weakens the international performance of U.S. companies, it will have a direct and possibly greater impact on investor portfolios with significant international exposure. To prepare for a strong dollar, it may be prudent to shift allocation toward small and mid-cap stocks while reducing exposure to multinational corporations that are expected to take the biggest hit from the strong dollar. Investors may also want to consider increasing their holdings in sectors that are less likely to generate revenue outside of domestic markets such as utilities which typically generate the majority of their revenue in the United States. Furthermore, major U.S. retailers such as Home Depot Inc. (HD) and Walmart Inc. (WMT) can be included on the list of companies that could weather a strong dollar better than their tech counterparts.

Despite all this, investors must remember that these are short-term headwinds and that investment decisions should be taken with their long-term investment objectives in mind. Although it may seem necessary to make changes to the portfolio to protect it from this uncertain macroeconomic environment, looking for short-term gains may not be beneficial to investors in the long run. As an investor with an extensive investment time horizon, I am not rushing to make any changes to my portfolio as I believe in the long-term prospects of the companies that I have invested in.

Bottom Line

The Federal Reserve’s decision to tighten monetary policy has caused volatility in the U.S. stock and bond markets, sending the U.S. dollar soaring against rival currencies. High inflation and tighter monetary policies are having an adverse effect on businesses and consumer demand, which may result in weak corporate earnings in the coming quarters. Investors who are looking to protect their portfolios from the impact of the strengthening dollar could take action today to reduce their exposure to the tech sector, especially to companies that depend on international revenue.

Be the first to comment