deepblue4you/iStock via Getty Images

This article provides a Q2 update to June’s article, “RVL Pharmaceuticals: Chapter 1 Gives A Mixed Picture” (“Chapter 1”). RVL Pharmaceuticals (NASDAQ:RVLP) is a small/micro cap stock with big ambitions. It is working to parlay its FDA approved UPNEEQ into an entry to the aesthetics market.

The June article reviewed RVLP’s plans for making headway in this new market. I questioned whether the company could meet its guided revenue targets. As I will discuss, it is indeed struggling to meet its goals.

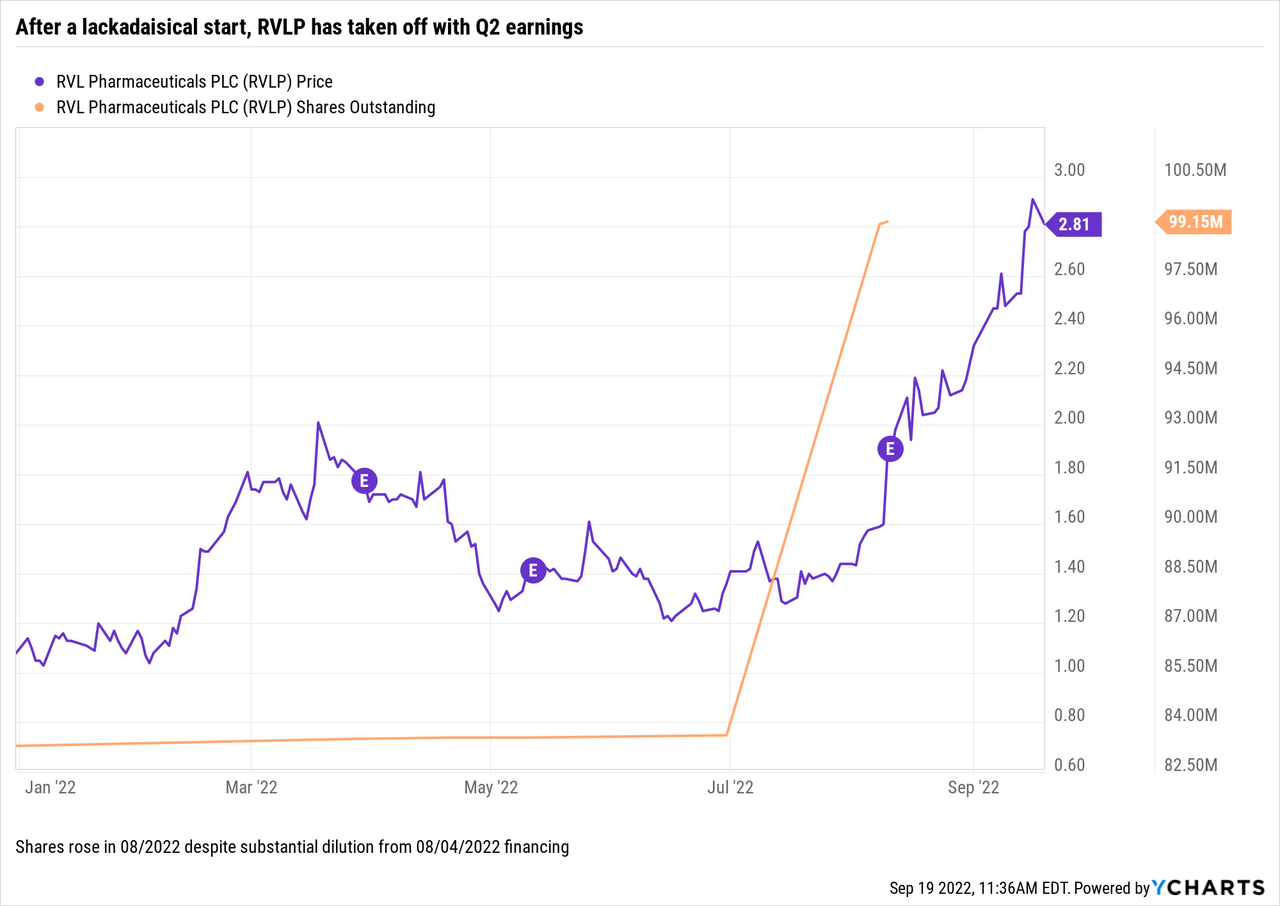

For Q2, 2022, RVLP shares have outperformed during an awful market environment.

RVLP reported Q2 earnings on 08/11/2022. Its shares have been on a tear for the whole month of August continuing into September. Shares closed 07/2022

at $1.44. Despite a slight recent downdraft as I write on 09/19/2022, shares are trading at $2.89. RVLP has doubled over the last ~six weeks. Seeking Alpha’s RVLP news feed offers nothing to account for this dramatic move.

However in my review of RVLP’s Q2, 2022 10-Q, I ran across a possible explanation. Under a subheading “equity financing” (p. 20) it stated:

…on August 4, 2022, the Company entered into a series of share subscription agreements (collectively, the “Share Subscription Agreements”) with Athyrium Opportunities IV Co-Invest 2 LP (“Athyrium”), Avista Healthcare Partners, L.P. (“Avista”), Brian Markison, Chief Executive Officer, and James Schaub, Executive Vice President and Chief Operating Officer, (together, the “Equity Purchasers”) pursuant to which the Company sold and issued to the Equity Purchasers, in a private placement (the “Private Placement”), an aggregate of 15,451,612 ordinary shares of the Company, nominal value $0.01 per share (the “Ordinary Shares”), at a purchase price of $1.55 per Ordinary Share, the closing market trading price on August 4, 2022.

As reflected by the price chart above, $1.55 was a nice anchor price for these shares which had been trading in a range from a low of ~$1.00 to a high of ~$2.00 since the start of the year. The fact that investors, including the CEO and COO were willing to make such large purchases at $1.55 seems to have emboldened the market.

The market for RVLP shares since 08/04/2022 has launched upwards in terms of both volume and price. The share purchases were not only helpful in terms of volume, they were also most apt in terms of pricing. RVLP’s Q2 earnings were only so-so as reflected by Seeking Alpha’s earnings headline below:

GAAP EPS of -$0.14 beats by $0.07, revenue of $8.45M misses by $0.07M

A revenue miss during a key early quarter when RVLP was trying to establish its credibility in aesthetics could have been received poorly. Significant share purchases from the CEO and COO help to defray any such narrative.

UPNEEQ’s Q2, 2022 net sales were $8.4 million, well short of its guided for Q4, 2022 net sales.

In 01/2022 RVLP issued its guidance pegging net sales for UPNEEQ during Q4, 2022 to fall in the range between $20-$25 million. At the time it issued this guidance RVLP was selling UPNEEQ exclusively as a medical treatment being offered through medical channels. Its intent at the time was to open up sales to take place in the aesthetics market. It hoped by doing so to significantly expand its market.

Success in this new approach is critical to RVLP. That is the reason I have been so focused on its quarterly earnings. During Q1, 2022, it generated net UPNEEQ sales of $5.9 million. In doing so it achieved a 90% increase over its Q4, 2021 UPNEEQ sales. Now for its latest Q2, 2022 report it has net UPNEEQ sales of $8.4 million, a quarterly increase of 42%.

Revenues of $8.4 million for Q2 are well short of the low end of its guided range of $20-25 million for Q4. With decelerating growth rate from 90% to 42% it is hard to see it reaching its guided goal.

Q3 promises to present even greater challenges to the UPNEEQ growth narrative.

RVLP’s Q2, 2022 earnings call (the “Call“), reporting earnings as of 06/30/2022, did not take place until 08/11/2022. By that time RVLP had pretty good visibility into Q3 UPNEEQ sales trajectory. An analyst question as to the phasing of UPNEEQ sales during the 3rd and 4th quarters and as to whether RVLP wanted to update its Q4 guidance for UPNEEQ was a real eye-opener.

I was hoping that this might generate a serious discussion of how RVLP hoped to reach its guided target. Not so. Rather in terms of guidance, CEO Markison advised that RVLP was sticking to its previous range albeit he made it clear that it was the lower end of the range which seemed doable. In this regard he explained:

…we’re remaining on, on at the lower end of our initial range and I think it has to do a bit with phasing. We know that July was a heavy vacation month. Other folks have said at the macros in the industry certainly support it and our expanded team originally was scheduled to be out July 05. We took the time to train them during the month of July and they really didn’t hit the street until the end of the month, the very last week.

So, I think we’re still on the low end of the range of what we gave as guidance almost a year ago before we launched into aesthetics. Feel really good about it, but I would think that our third quarter will be tempered a bit by what we seeing in July, certainly supported by the industry.

This is a bit of a downer for RVLP bulls. It had intended to get its expanded sales team working during July. Instead it pulled them back for additional training. Expanded training could be a good thing; time will tell. A need for expanded training is nonetheless concerning.

RVLP has prepared for potential ongoing losses with a recent hefty cash raise.

The liquidity section, at pg. 10-11 of RVLP’s Q2, 2022 10-Q, provides cautionary advice that investors need to take to heart. For example it states:

…there is a substantial doubt as to the Company’s ability to operate as a going concern. The Company’s ability to continue as a going concern will require it to obtain additional funding, generate positive cash flow from operations and/or enter into strategic alliances or sell assets.

At the close of Q2, 2022, RVLP had cash and cash equivalents of $27.4 million. In addition it had a substantial debt load it described as:

…total long-term debt with aggregate principal maturities of $55.0 million, with such maturities commencing in March 2024 and extending through October 2026 … . In addition, the Company’s primary indebtedness contains various restrictive covenants including minimum liquidity and minimum quarterly product sales requirements….

Management substantially enhanced the situation with its 08/04/2022 financing. This added ~$44 million in liquidity, with its ~$24 million private placement and its ~$20 million borrowing. Interim CFO DePetris assessed RVLP’s liquidity after the financing as having:

…meaningfully advanced our cash runway for UPNEEQ …[with] many variables in play, but depending on the commercial development, we believe it is possible to extend our cash runway through the entirety of 2023 with or possibly without borrowing under the third [tranche] notes. Accordingly, we believe our near-term liquidity is reasonably assured and thereby expect to continue to fully invest and act upon our commercial ambitions for UPNEEQ.

The third tranche notes he mentions refers to the commitment RVLP negotiated for an additional advance of $25 million.

RVLP has done an admirable job of attending to its short term liquidity needs. Longer term it viability will depend on the delta that develops between growing SG&A expenses ($20.2 million for Q2, 2022) and UPNEEQ sales.

During the call COO Schaub indicated that the situation is under control; he expressed growing conviction in RVLP’s:

…multi-channel business strategy we have created. Remember, the provider and subsequently their patients have the ability to access this product directly through our pharmacy within the provider office setting or virtually in states where direct dispensing is prohibited.

These channels all serve as meaningful growth levers for UPNEEQ as well as any future business development opportunities. Beyond the continued sales growth, during the quarter, our leading indicators demonstrated robust expansion and brand awareness and importantly adoption, while also delivering on our commitment to manage operating expense within the range of $7 million a month.

The $7 million a month operating expense level is important and leaves little room for error when expecting to reach lower end of guided revenues ($20 million a quarter).

Conclusion

During the Call, CEO Markison confirmed RVLP’s intent to focus on UPNEEQ rather than seeking to expand its product offerings. Accordingly, for the current discussion, one must assume RVLP is a single product company. Its opportunities and its risks are exclusively dependent on UPNEEQ.

In other words, RVLP is a single product microcap that has so far generated losses of $0.536 billion over its lifetime. It does not seem likely to turn this around any time soon. Its quarterly sales to date give little comfort that it can reach even the lower end of its Q4 guided revenues of $20-25 million.

This is definitely a situation that bears close attention. I submit that the shares have gotten ahead of themselves. I anticipate that those who like UPNEEQ’s prospects will find better entry points within the next few months.

Be the first to comment