barbaragibbbons/iStock Unreleased via Getty Images

Investment Thesis

- I rate Anheuser-Busch InBev SA/NV (BUD) (OTCPK:BUDFF) as a buy: the company has a strong economic moat, a broad and diversified product portfolio with strong brands, and is highly profitable.

- I also rate Heineken N.V. (OTCQX:HEINY) as a buy: the current valuation of the company in combination with its financial strength and profitability make it an appealing investment.

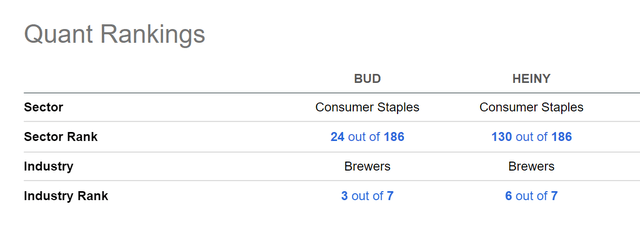

- Taking into account the Seeking Alpha Quant Ranking, AB InBev is ahead of its competitor Heineken. While AB InBev is ranked 24th within its sector, Heineken is 130th (out of 186). Within the industry, AB InBev is ranked 3rd and Heineken 6th (out of 7).

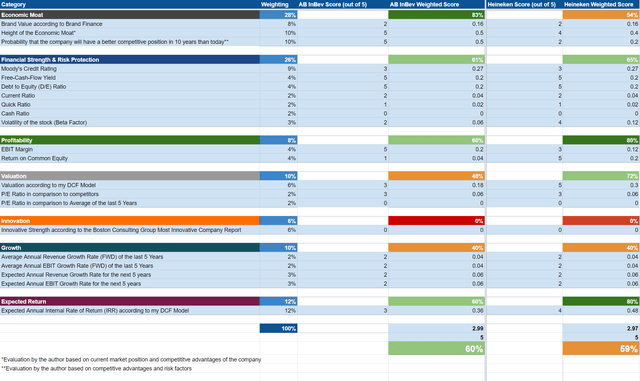

- According to the HQC Scorecard, AB InBev scores 60 out of 100 points, which is an attractive overall rating in terms of risk and reward. The company produces very strong results in the category of Economic Moat (83 out of 100 points) and shows an attractive rating in the categories of Financial Strength (61 out of 100), Profitability (60 out of 100 points) and Expected Return (60 out of 100 points).

- Heineken scores 59 out of 100 points according to the same Scorecard. This is a moderately attractive scoring in terms of risk and reward. Heineken achieves very attractive ratings in the categories of Profitability (80 out of 100) and Expected Return (80 out of 100) and attractive ratings for Valuation (72 out of 100) and Financial Strength (65 out of 100).

- In terms of Growth, both companies show a moderately attractive rating according to the HQC Scorecard.

AB InBev and Heineken’s Competitive Positions

AB InBev has a broad and diverse product portfolio of more than 500 beer brands, including: Budweiser, Corona, Stella Artois, Beck’s, Hoegaarden, Leffe and Michelob Ultra.

Several factors contribute to AB InBev’s strong competitive advantages over its opponents: the company’s broad product portfolio with strong brands helps to reduce the risk of its operations and also provides strong pricing power, which is very important in these times of high inflation. Through synergies of its global business units, the company reduces its operating costs, which allows it to operate with lower costs than most of its competitors.

Additionally, AB InBev has a premium strategy for many of its products that allows the company to charge higher prices while having lower costs as compared to some of its competitors.

AB InBev’s lower operating costs, its premium price strategy, as well as having a global and well diversified product portfolio all contribute to building strong competitive advantages over its competitors.

In its product portfolio, Heineken has over 300 different brands in more than 190 countries. Similar to its competitor AB InBev, Heineken has also managed to establish a strong and well recognized brand image around the world.

When comparing the EBIT margin of both companies, we see another indicator which demonstrates the stronger competitive position of AB InBev in comparison to Heineken. While AB InBev operates with an EBIT margin of 25.8%, Heineken operates with one of 14.63%.

AB InBev’s stronger competitive position, reinforces my belief that the company is the more attractive investment when investing with a long time-horizon.

The Valuation of AB InBev and Heineken

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of AB InBev and Heineken. The method calculates a fair value of $54.96 for AB InBev and $115.32 for Heineken. At the current stock prices, this results in an upside of 1% for AB InBev and 22% for Heineken.

I assume a Revenue Growth Rate and EBIT Growth Rate of 4% for AB InBev and Heineken over the next 5 years. The GDP Growth Rate of the United States is about 3% per year on average. Therefore, I assume a Perpetual Growth Rate of 3% for both AB InBev and Heineken.

I have used AB InBev’s current discount rate [WACC] of 9% and Heineken’s current discount rate [WACC] of 6.75%. Furthermore, I calculate with an EV/EBITDA Multiple of 10.7x for AB InBev and an EV/EBITDA Multiple of 13.9x for Heineken. Both are the companies’ latest twelve months EV/EBITDA.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

AB InBev |

Heineken |

|

|

Company Ticker |

BUD |

HEINY |

|

Revenue Growth Rate for the next 5 years |

4% |

4% |

|

EBIT Growth Rate for the next 5 years |

4% |

4% |

|

Tax Rate |

29% |

30% |

|

Discount Rate [WACC] |

9.00% |

6.75% |

|

Perpetual Growth Rate |

3% |

3% |

|

EV/EBITDA Multiple |

10.7x |

13.9x |

|

Current Price/Share |

$54.40 |

$94.56 |

|

Shares Outstanding |

2,012 |

577 |

|

Debt |

$88,830 |

$19,204 |

|

Cash |

$12,097 |

$3,697 |

|

Capex |

$5,640 |

$1,507 |

Source: The Author

Based on the above assumptions, I calculated the following results (in $ millions except per share items):

Market Value vs. Intrinsic Value

|

AB InBev |

Heineken |

|

|

Market Value |

$54.40 |

$94.56 |

|

Upside |

1% |

22.0% |

|

Intrinsic Value |

$54.96 |

$115.32 |

Source: The Author

Relative Valuation Models

AB InBev’s and Heineken’s P/E [FWD] Ratio

AB InBev’s P/E Ratio is currently 19.06, which is 4.16% below the sector median (19.89). This provides us with an indicator that the company is currently slightly undervalued.

Heineken’s P/E Ratio is currently 19.89, equal to the sector median of 19.89. This demonstrates that the company is currently fairly valued.

Dividend Projections for AB InBev

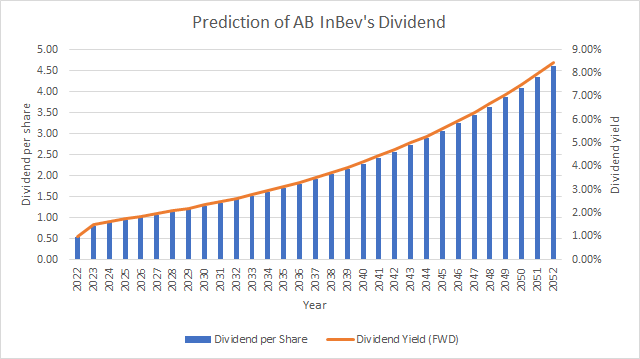

For 2023, consensus EPS estimates are 3.43 for AB InBev. At the same time, analysts estimate the dividend to be $0.81 in 2023 and $0.90 in 2024. This would result in a dividend payout ratio of only 23.62% in 2023, leaving plenty of scope for future dividend enhancements.

For the calculation below, I will assume an average dividend hike of 6% per year beginning in 2024 (while assuming a dividend of $0.81 in 2023 and $0.90 in 2024, in line with estimates). Due to the company’s leading market position, its growth prospects and low dividend payout ratio, I assume that AB InBev could be able to raise its dividend by about 6% per year on average.

I believe that AB InBev will be able to increase its dividend more so than Heineken on average due to its stronger competitive position (proven by its higher EBIT margin) and lower dividend payout ratio. Another indicator showing that AB InBev should be able to raise its dividend by 6% per year on average is the company’s 5 Year Average EPS Diluted Growth Rate [FWD] of 6.63%.

Projection of AB InBev’s Dividend and Dividend Yield When Assuming a Dividend Growth Rate of 6% per Year on Average beginning in 2024

Source: The Author

In the table below, you can find AB InBev’s accumulated dividend when assuming a dividend growth rate of 6% per year beginning in 2024. Here you can see that in 2042, you would receive 58.25% of your initial investment in the form of dividends (for simplification, no withholding tax has been taken into account) and 124.16% after 30 years.

Projection of AB InBev’s Accumulated Dividend When Assuming a Dividend Growth Rate of 6% per Year on Average beginning in 2024

|

Year |

Dividend per Share |

Dividend Yield [FWD] |

Accumulated Dividend |

|

2022 |

0.53 |

0.97% |

0.97% |

|

2032 |

1.43 |

2.63% |

21.45% |

|

2042 |

2.57 |

4.72% |

58.25% |

|

2052 |

4.60 |

8.45% |

124.16% |

Source: The Author

Dividend Projections for Heineken

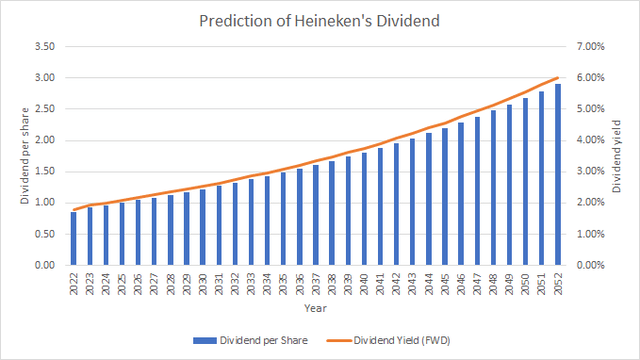

For 2023, consensus EPS estimates are 2.69 for Heineken. At the same time, analysts estimate the dividend to be $0.93 in 2023. This would result in a dividend payout ratio of 34.57% for the same year, leaving enough scope for future dividend enhancements. For the calculation below I will assume an average dividend hike of 4% per year beginning in 2023 (while assuming a dividend of $0.93 in 2023 such as analyst estimates).

Projection of Heineken’s Dividend and Dividend Yield When Assuming a Dividend Growth Rate of 4% per Year on Average beginning in 2023

Below you can find the results of Heineken’s accumulated dividend when assuming a dividend growth rate of 4% per year on average beginning in 2023. In 2042, you would receive 59.28% of your initial investment in the form of dividends (for simplification, again, no withholding tax has been included in the calculation).

In 30 years, your dividend yield for Heineken would be 6.02% (assuming a dividend growth rate of 4%), and the accumulated dividend would be 110.07%. The dividend yield for AB InBev would be 8.45% (assuming a dividend growth rate of 6%), and after 30 years the accumulated dividend would be 124.16% (as shown in the previous section).

Projection of Heineken’s Accumulated Dividend When Assuming a Dividend Growth Rate of 4% per Year on Average beginning in 2023

|

Year |

Dividend per Share |

Dividend Yield [FWD] |

Accumulated Dividend |

|

2022 |

0.86 |

1.79% |

1.79% |

|

2032 |

1.32 |

2.75% |

24.97% |

|

2042 |

1.96 |

4.07% |

59.28% |

|

2052 |

2.90 |

6.02% |

110.07% |

Source: The Author

The results of the dividend projections for both companies add to my belief that AB InBev is the more attractive proposition when investing with a very long time-horizon.

Financial Overview: AB InBev vs. Heineken

|

AB InBev |

Heineken |

|

|

Ticker |

BUD |

HEINY |

|

Sector |

Consumer Staples |

Consumer Staples |

|

Industry |

Brewers |

Brewers |

|

Market Cap |

109.38B |

54.30B |

|

Revenue |

55.25B |

24.97B |

|

Revenue Growth 5 Year [CAGR] |

2.41% |

1.08% |

|

EBITDA |

17.93B |

5.35B |

|

EBIT Margin |

25.80% |

14.63% |

|

ROE |

7.75% |

20.74% |

|

P/E GAAP [FWD] |

19.18 |

19.32 |

|

Dividend Yield [FWD] |

0.97% |

2.15% |

|

Dividend Growth 3 Yr [CAGR] |

-36.19% |

-9.68% |

|

Dividend Growth 5 Yr [CAGR] |

-32.96% |

-1.93% |

|

Consecutive Years of Dividend Growth |

0 Years |

1 Year |

|

Dividend Frequency |

Annual |

Semiannual |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

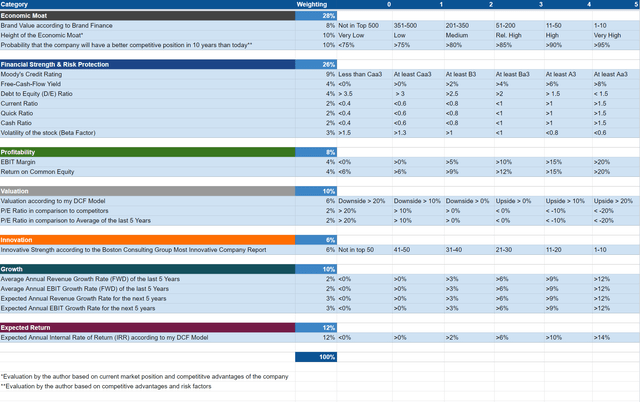

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

AB InBev and Heineken According to the HQC Scorecard

According to the HQC Scorecard, the overall score of AB InBev is 60 out of 100 points. The scoring of the HQC Scorecard demonstrates that AB InBev can currently be classified as an attractive investment in terms of risk and reward.

Heineken’s overall score is 59 out of 100, resulting in a moderately attractive rating for Heineken in terms of risk and reward.

AB InBev is rated as very attractive in the category of Economic Moat and rated as attractive in the categories of Financial Strength, Profitability and Expected Return. For Valuation and Growth, the company achieves a moderately attractive rating.

Heineken is rated as very attractive in the categories of Profitability and Expected Return. The company is rated as attractive in the categories of Financial Strength and Valuation. For Economic Moat and Growth, Heineken is rated as moderately attractive.

The fact that AB InBev’s overall rating according to the Scorecard is currently higher, increases my confidence in choosing the company over Heineken.

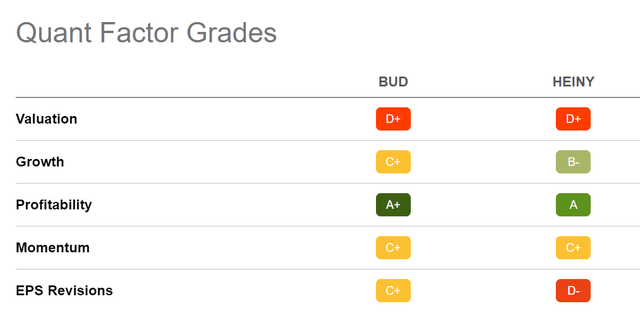

AB InBev and Heineken According to Seeking Alpha’s Quant Factor Grades

According to Seeking Alpha’s Factor Grades, both AB InBev and Heineken receive a D+ rating in terms of Valuation. For Growth, AB InBev gets a C+ while Heineken gets a B-. In terms of Profitability, AB InBev receives a grade of A+ and Heineken an A. Below you can find the Seeking Alpha Quant Factor Grades:

AB InBev and Heineken According to Seeking Alpha’s Quant Ranking

According to the Seeking Alpha Quant Ranking, AB InBev is better positioned than its rival Heineken. Within the sector, AB InBev is ranked 24th while Heineken is 130th. In terms of Industry Ranking, AB InBev is 3rd and Heineken 6th. The Seeking Alpha Quant Ranking is a further indicator that AB InBev is currently more attractive than Heineken. Below you can find the results of the Seeking Alpha Quant Ranking:

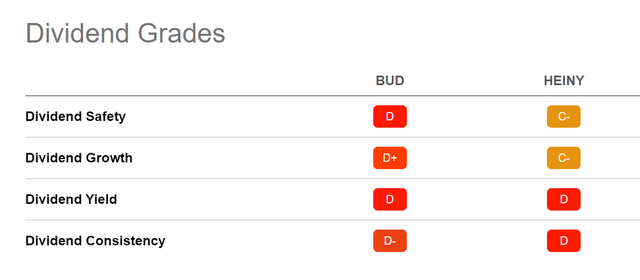

AB InBev and Heineken According to Seeking Alpha’s Dividend Grades

In terms of Dividend Safety, Dividend Growth and Dividend Consistency, Heineken is rated slightly better than AB InBev. In terms of Dividend Yield, both companies get the same D rating. Below you can find an overview of the Seeking Alpha Dividend Grades for AB InBev and Heineken:

Risks

I see similar risk factors when investing in AB InBev or Heineken. One of the main risks for both companies is that they rely on the reputation of their brands; if one of their brands was damaged, it could have a major impact on the companies’ results. The success of both companies also depends on the development of favorable brand images for new products. If they are unable to achieve this, it could result in decreasing profit margins.

Both AB InBev and Heineken are exposed to the risk of a global recession or a recession in the key markets in which they operate. A recession could result in declining sales of its products, lower revenues and reduced profit margins for both.

Additionally, changes in the prices of raw materials, commodities, energy and water could have adverse effects on business. As a result, the profit margins of both companies could decline.

Considering all of these risk factors, I would still lean towards an investment in AB InBev over Heineken. The reason being that compared to Heineken, AB InBev has a broader and more diversified product portfolio.

The Bottom Line

When taking into account the Seeking Alpha Quant Ranking, we get a first indicator that AB InBev is currently a more attractive investment than Heineken. Within the industry, AB InBev is ranked at position 3 while Heineken is at position 6 (out of 7). In the sector, AB InBev holds position 24 while Heineken is at 130 (out of 186).

The HQC Scorecard also shows that AB InBev is currently slightly more attractive than its competitor. While AB InBev is rated as attractive in terms of risk and reward, Heineken only reaches a moderately attractive score. The overall scoring of the HQC Scorecard provides another factor in validating my belief that AB InBev is currently slightly more attractive than Heineken.

I rate both companies as a buy, but if I had to choose one, then I would select AB InBev. Especially because of its stronger economic moat which, in my opinion, makes it an even more attractive long-term investment. The company’s higher EBIT margin in comparison to Heineken, is another indicator of AB InBev’s strong market position, and thus reinforces my belief in choosing AB InBev over Heineken.

Author’s Note:

Thank you very much for reading! If you have any questions regarding this analysis, feel free to leave a comment below!

Be the first to comment