Viktorcvetkovic/E+ via Getty Images

It’s been about 2½ months since I wrote my “short puts are better” article on Boyd Gaming Corporation (NYSE:BYD), and in that time the shares are up about 5.25% against a gain of 1.6% for the S&P 500. The company has released full year results since, so I thought I’d check on the business again to see if it’s time to actually buy some shares. I’ll go through the financials, paying particular attention to the company’s buybacks, because I’m in the mood to write about buybacks. I’ll also look at the stock as a thing distinct from the underlying business. Finally, I recommended selling a put on this stock in my previous article, and I’m very keen to write about that.

I can picture many of my regulars when they come to this, the inevitable “thesis statement” paragraph. I imagine a collective “ugh, not this again” reaction, and I think that’s understandable on some level. In defence of the thesis statement paragraph, I would say it offers you an opportunity to “get in and get it over with”, without the need to read an entire 2,000+ word article. That’s gotta be worth something. Anyway, I argued previously that the shares were too expensive, and I’m still of that view. I am of that view in spite of the fact that the dividend has been reinstated. Not to blow my own horn, but I predicted the company was in the position to do just that in my last article. That was a lie. I totally brought up the dividend as an excuse to “blow my own horn.” Anyway, just because I don’t think there’s value in the stock at the moment, I do think there’s a way to make some great risk adjusted returns with short put options. I’ve done well on the puts I recommended in my previous article, and I suggest a similar trade today. In particular, the January puts with a strike of $42 are very near the price the company paid for its buybacks in 2021. I consider this to be a “win-win” trade because you either collect the premium or you collect the premium and are then “forced” to buy this stock at a near 30% discount to the current price. That’s about it. Thesis paragraph over.

Financial Snapshot

I’ll start the financial analysis by looking specifically at the buyback history here. The following facts are relevant:

- In 2021 the company spent $80,782,000 on stock buybacks.

- On February 22, 2021, there were 111,862,004 shares outstanding.

- On February 18, 2022, there were 110,006,004 shares outstanding.

- Thus, the company took 1,856,000 shares off the table.

Using the skills imparted to me by the good people at Holy Spirit School several decades ago, I calculate that the company has retired these shares at an average price of $43.52 per share. Some people consider this activity “good” or “bad” depending on whether the average buyback price is higher or lower than the current market price. I think this is too simplistic an approach, and seems to fly in the face of this whole enterprise. The foundational premise of being a stock picker is that you don’t necessarily consider the current market price to be some representation of “truth.” For my part, I judge the quality of the buyback based on the valuation at which the company retired the shares.

Looking beyond the buyback activity, it becomes pretty apparent that 2021 was a great year for the company. In particular, revenue was up by about 55% compared to 2020, and net income swung from a $134.7 million loss to profits of $463.8 million. Also, the capital structure improved dramatically, with debt down about 22% from 2020. Although sales in 2021 were barely greater than they were in 2019 (up by 1.3%), net income is something like $306 million higher than it was in 2019. I think the comparison to 2019 is most interesting, so I’ll spend some time on it.

In my view, the evidence is pretty strong that the company became much more efficient over the course of the past two years. While revenue barely rose from 2019 to 2021, profit exploded higher. The reason for this relates almost entirely to the company’s ability to control expenses. For instance, the gaming expenses, food and beverage, and room expenses in 2021 were down by about 10.5%, 53.5%, and 48% respectively. Although I’ll need to see some more evidence of this, I’m open to the possibility that this is a materially different business than it was in 2019.

Finally, in my previous missive on this name, I suggested that the company had the ability to reinstate the dividend, and lo and behold, they’ve done exactly that, and at a much higher rate than they previously offered shareholders. All of this leads me to conclude that I’d be very happy to buy the stock at the right price.

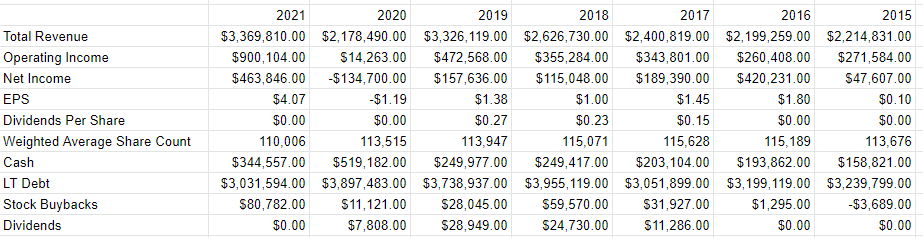

Boyd Gaming Financials (Boyd Gaming investor relations)

The Stock

My regulars know that it’s about this time in the article when I turn into a real “bummer” by pointing out that great financial stories like Boyd Gaming can be terrible investments at the wrong price. Whenever I write about, or talk about stocks I point out that the world’s greatest company can be a terrible investment at a near infinite price. If I were a bit more self aware, I would understand that my tendency to accost friends and family with this truism partially explains the current state of my social life. That aside, there’s a disconnect between companies and stocks because the former is a business that attempts to sell entertainment services, for instance, and the latter is a reflection of the mood of the crowd. In particular, the stock’s capricious price movements reflect the crowd’s opinions about the long term future of the business more than anything quantifiable today. This is why I treat them as separate entities.

If you thought you’d escape this lecture about how stocks and companies are different, you’re about to be disappointed, because I’m about to continue to drone on about it by using Boyd Gaming itself as an example. The company released annual results on February 28th. If you bought this stock the next day, you’re down about 13.8% since then. If you waited until March 8th, to pick a date completely at random, you’re up about 1.8% since then. Not enough changed at the firm over this short span of time to warrant a near 15%+ variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

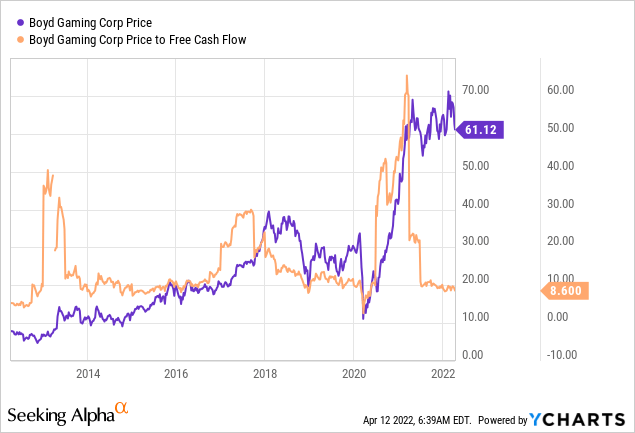

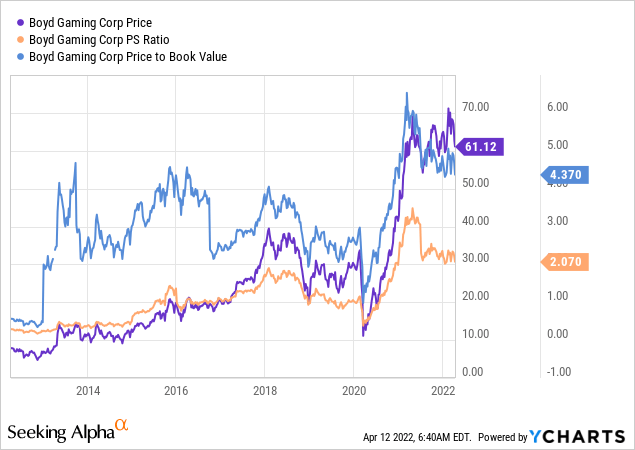

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In the previous article I noted that the shares had returned to a more typical 8.8x free cash flow, but I threw a bit of a hissy fit over the fact that both price to sales and price to book ratios were very near multi-year highs. It seems that not much has changed over the past short while, per the following:

Source: YCharts

The only thing that appears to have changed over the past couple of months is the fact that the company’s slightly more expensive on a price to book basis, per the following:

Source: YCharts

In spite of the reintroduction of the dividend, and the great year the company has just enjoyed, the valuation isn’t attractive in my view, and thus I can’t recommend buying shares.

Judging the Buyback

To refresh your collective memories, the company bought back shares at an average price of ~$43.52. Given the above, we know that this price lines up with a price to free cash flow of ~6.4 times. In addition, it lines up with a price to book of ~3.1, and a price to sales ratio of about 1.47. These ratios are on the high side relative to the past decade, but they’re not egregiously expensive in my view. For that reason, I think the buyback activity in 2021 was actually reasonably good for shareholders.

Options Update

In case you don’t have your “Doyle’s trade recommendations” almanac handy, I’ll remind you that in my previous article on this name, I recommended selling the September puts with a strike of $40. I sold these for $1.65 each, and, since time has rolled on, and the stock price has marched higher, they’re currently bid at $0.65. I consider this to be a reasonably good trade. I like to try to repeat success when I can, and for that reason I’m going to be selling some more puts this morning. I consider the buyback price of ~$43.50 to be reasonable, so I’ll choose a strike price as close to that number as possible. I consider this to be a “win-win” trade. If the shares remain above the strike price, I’ll pocket the premium. If the shares drop in price, I’ll be obliged to buy, but will do so at a relatively attractive price.

In terms of specifics, I like the January 2023 puts with a strike of $42. These last traded hands at $1.45 and are currently bid at $1, which I consider to be a reasonable level. If the shares remain above $42 over the next nine months, I’ll pocket the premium, which is acceptable. If the shares fall just under 30% in price over that time, I’ll be obliged to buy, but will do so at a price that lines up with a forward dividend yield of ~1.4%, which I consider to be reasonable.

It’s that time again. Welcome to the point in the article where I get to indulge in my semi-sadistic tendency to spoil people’s moods by pointing out that the phrase “win-win” is really just a bit of rhetoric. This trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So, dear reader, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the stock price of Boyd Gaming shoots to $100 per share between now and the third Friday of January 2023. Obviously my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls. Thankfully for me, my expectations have been lowered dramatically over the decades, so this isn’t really an emotional hardship for me.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me more than a few times over the years. While it always works out well because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. So, I can make a reasonable argument that Boyd would be a steal at a net price of $41, but if the shares drop to $30, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

If you understand these risks, and can tolerate them, I would recommend that you sell puts in lieu of buying shares. The return may be lower, but in my experience this game isn’t about trying to capture maximum returns. It’s about trying to capture maximum risk adjusted returns, and a deep out of the money put is a far less risky proposition than the stock in my view.

Conclusion

I think the shares are still too expensive, in spite of the fact that the dividend has been reinstated as I predicted previously. Although the company has had a great year in 2021, the share price reflects that, and thus I’m not hopeful about future stock appreciation. That said, I think there is some money to be made here. I think the short puts I describe above offer a great risk adjusted return. If the share price remains above the strike price, you pocket a decent premium. If the shares fall, you buy this wonderful business at a price that might be described as a “steal.” In any case you’d be buying at a price ~30% below the current market price. As I hopefully demonstrated in the “stock” section above, the people who buy shares more cheaply do better.

Be the first to comment