AndreyPopov

Introduction

Costco (NASDAQ:COST) and Target (NYSE:TGT) are oftentimes compared one to the other to the extent that the respective earnings reports and news that are linked to one of the two do have an impact on the stock of the other.

However, this year I spent some time researching the two retailers and I have come to the conclusion that it is usually incorrect to consider them together when trying to understand the value of each of the two businesses. On the other hand, they are part of the North-American economy and, as such, they are affected by some macro events that are linked to the broader trends, rather than to specific aspects of how the two companies are managed.

In particular, I think that this year Costco has proved more than once that its business model enables it to weather in a more efficient way tough economic challenges. In addition, Costco’s management didn’t make some mistakes that Target’s made, generating millions of savings.

In this article, I would like to talk about inventory management and how this is linked to the issue of shoplifting that seems to be spreading more and more, as has been recently reported by Walmart (WMT).

Previous Coverage On Costco

Back in May, Costco had a rough week when it dropped by 12% following concerning reports from Walmart and Target that had huge EPS drops YoY due to rising costs. Since Costco is not a very volatile stock, I felt it was important to dig deeper into this situation to understand whether or not Costco was being punished for something that was real or not. In particular, I started stressing one point that I have, since then, repeated over and over: it is not correct to assess Costco’s performance by looking at margins. In fact, the company tries to have them as low as possible, unlike many other retailers.

At that time, I wrote this article “What To Consider About Costco’s Earnings Report“, which I think is an evergreen article that can be quite useful for any quarterly report Costco releases. My main point was that Costco considers itself more like a buyer on behalf of its members rather than a seller of goods to its customers. This makes the company focused on passing onto its members as big of chunk of its savings as possible.

Another point I made was to underline how Target’s management admittedly didn’t plan well the inventory in several categories, leading the retailer to carrying too much of it in the areas where the slowdown in sales was bigger than expected. Since most of these goods belonged to kitchen appliances, furniture and outdoor living, Target was also required to find a high storage capacity which is indeed costly. It is not the same to have to store, for example, tables and chairs compared to storing soaps or tissues.

Costco didn’t have the same problem for one simple reason: it stores, on average, only 4,000 goods at a time so it controls its inventory much better.

From overstocking to shoplifting

Target was thus forced to clear its inventory through promotions which caused margins to compress further. Target had to fill its stores with merchandise of big size that was no longer wanted and had to be marked down. This caused the stores to be rather messy because of overstocking. Target announced that it would simply clear its inventory, taking the hit once and for all by accepting a few quarters with low margins. However, no one, at that time, had thought about a further problem: messy stores encourage shoplifting, especially at a place like Target, where many items are small and easy to hide.

It has been all over the news how thefts are more and more common all around the States. Shoplifting is becoming such an issue that it had to be dealt with during interviews of different CEOs and during the last earnings calls.

Michael Fiddelke, Target’s executive VP and CFO, had to talk about it during the last earnings call

A second factor that’s impacting our gross margin is inventory shortage, or shrink, which is a growing problem facing all retailers. At Target year-to-date, incremental shortage has already reduced our gross margin by more than $400 million versus last year, and we expect it will reduce our gross margin by more than $600 million for the full year.

As Brian mentioned, this is an industry-wide problem that is often driven by criminal networks, and we are collaborating with multiple stakeholders to find industry-wide solutions. For example, because stolen goods are often sold online, Target strongly supports the passage of legislation to increase accountability and prevent criminals from selling stolen goods through online marketplaces.

Now, of course, shoplifting is a crime and a retailer can’t solve it by itself, without the help of the law. However, there are some things a retailer can do to prevent it.

Why Costco is more insulated from theft

I would like to list a few aspects that make me think that there are some true reasons why Target is hit by this issue more than Costco.

- First of all, in a tight labor market, we all know that Costco treats its employees extremely well and, as a consequence, it has a very low turnover rate, much better than its peers. On the other hand, Target has a harder time finding all the workers it needs. A shortage of workers leaves some areas of its stores unsupervised.

- Secondly, we can’t overlook the fact that Costco’s shoppers are all members, whereas Target doesn’t have a membership for its customer base. Costco’s guests are known by the company and being a member is akin to joining a club (or even entering a church, for some members). This makes guests somewhat committed to accepting a proper behavior and building a trustworthy relationship with what they have become a member of. If a member is caught shoplifting, the membership will be canceled for life.

- Costco sells items in large packages, which are less likely to be hidden and stolen, whereas a Target store is full of small items that can be easily taken by thieves.

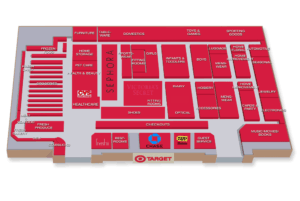

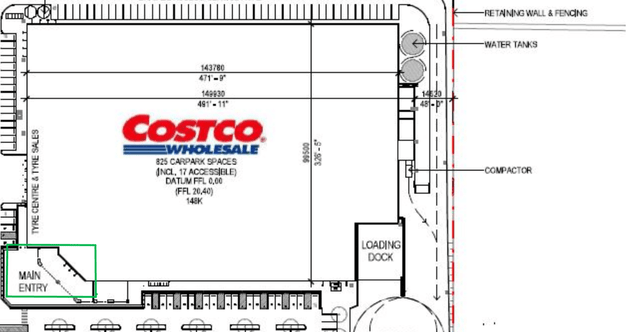

- Costco and Target have two different store layouts as we can see below.

Costco stores usually have only one main entry and this provides the retailer with a better control over incoming guests and exiting ones. The entry is monitored by staff standing there to check receipts on the way out, looking at the total number of items and at high value items such as jewelry and electronics. Costco uses its store layout to prevent theft. The stores are big and there is a lot of room between shelves so that no thief can easily grab an item without being noticed.

On the other hand, Target stores are usually built with two entrances which offer some advantages to thieves. Furthermore, the aisles are not that big and the stores are packed with lots of items, making it easier for shoplifters to conceal themselves while stealing.

popcollectorsalliance.com

- At Costco, goods such as postage stamps are purchased in this way: the customer takes a cardboard and trades it for the item when he is paying. For high value, small size items, like stamps, gift cards, computers, etc., they have you grab a pretty large cardboard cutout that is taken to the register which is then scanned and then they call for a pick-up. Which they trade the card for the item which is either brought back to you, or you go and get at a window.

- At Costco, most of the time it is the staff that empties the carts and repacks them. In this way, every cart is scanned. This is not ideal for shoplifting.

Valuation is not only about numbers

When we value a stock, we go to the company’s financials and usually run a discounted cash flow model or some other kind of calculation in order to assess the fair value of the business. This must be done. However, financials don’t always represent the whole picture. In the case of Costco this is even more true and I have tried to show more than once how it would be a big mistake to give a valuation of the company basing it on margins. With Costco, there are a few aspects that don’t immediately translate into numbers but that do have an impact on the final numbers the company releases in its reports.

Here we are dealing with one of these situations. Target disclosed that it will take a hit of about $600 million on its gross margin. This is about $30 million per store. Since the company should have a gross profit of about $31 billion, we are before an issue that takes away 2% of the gross profit.

Nowhere on Costco’s income statement can we find a line that shows the benefit its store layout creates. However, if we consider that Costco has 584 stores in the U.S. and that, if it was hit by theft like Target, the sum would be around $180 million of gross profit. We can double this thinking that Costco stores are about double the size of Target’s, so we can estimate that Costco is saving about $360 million of gross profit. This is equal to about 1.2% of gross profit. Considering Costco’s low margins (gross profit margin at 12%), we are talking about something that is quite important as it creates about a tenth of the total gross profit of the company.

This shows how important some details are in how similar businesses execute their operations.

One last thought. Costco’s shareholders have proven more than once to be a bit reluctant in selling the shares they own. This is another aspect that is not always considered but that gives the stock more stability and less volatility. We saw this during the last earnings report, which slightly missed estimates. The same happened for comparable sales growth of 6.6% that came up just short of the 6.87% consensus and a 6.5% jump in US comparable sales ex-gas also came in just below the 6.58% expectation. However, the stock fell less than 1% on news that, in other cases, would have created more shaky hands.

As for me, I wasn’t particularly concerned by the report, given the fact that the November sales are for the four weeks through the 27th and this leaves out 3 shopping days that were actually holiday days. This makes me think that December will probably reach better numbers. In any case, I have shown in my other articles how Costco, though not immune to a recession, usually recovers in less than 12 months. This is another reason why I am in for the long-term.

Conclusion

Though both Target and Costco are great retailers, I currently own only Costco. I am not bearish on Target, but this year I have been disappointed by its management and until I see some signs of recovering, I am not willing to become a shareholder. On the other side, I am convinced that Costco has a business model and a management team I can rely on for the long-term.

If you want to read my full coverage on Costco, you may want to look at these articles, where I tried to show one point at a time the reasons why I am investing in this retailer.

- The influence of Costco on Amazon Prime

- Costco’s Earnings Call First Valuable Business Lesson: A Top-Line Company

- Costco’s Earnings Call Second Valuable Business Lesson: The Membership Program

- While Wells Fargo Downgrades Costco, I Prepare To Pull The Trigger

Be the first to comment