i-Stockr

Higher inflation leads to higher interest rates (which have a negative impact on infrastructure equities due to their high duration) and to higher revenues for infrastructure stocks.

The effect of higher rates comes first and we have seen this already: infrastructure stocks have a lacklustre performance (that also led to a cheaper valuation).

The effect of higher revenues will start to kick in: it’s time to step in because valuation is low now and growth will be high.

We expect inflation will be higher for longer while the FED rate hikes will slow down the economy. Infrastructure will profit from this high inflation low growth scenario: buy the Global X Funds Global X U.S. Infrastructure Development ETF (BATS:PAVE).

Infrastructure: high growth with low volatility

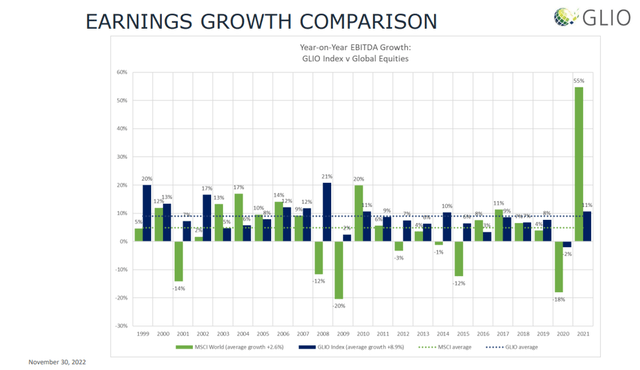

Figures by the Global Listed Infrastructure Organisation (GLIO) show that listed infrastructure equities in the past 20 years had a higher earnings growth than “normal” equities. This growth was at the same time more stable and less volatile.

Figure 1: Earnings growth (GLIO)

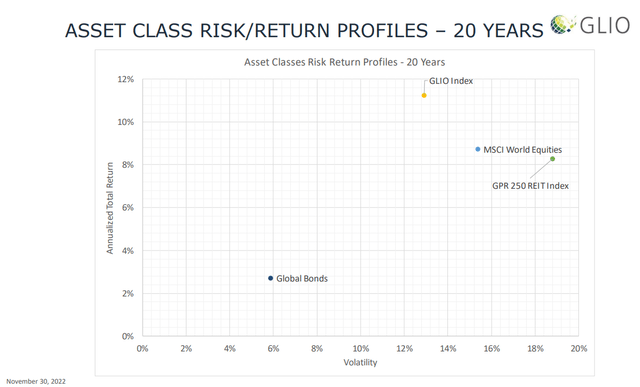

This higher and more stable growth was reflected in the share price performance: higher returns and lower volatility compared to equities in general.

Figure 2: Risk vs return (GLIO)

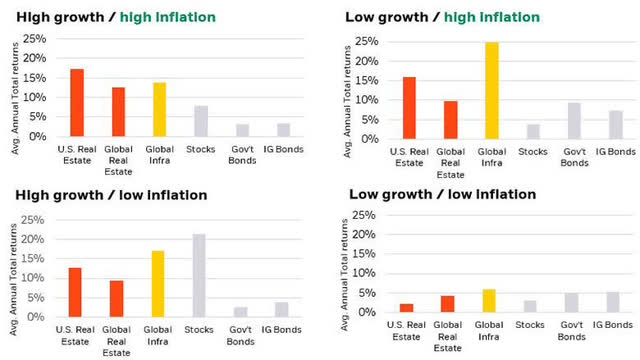

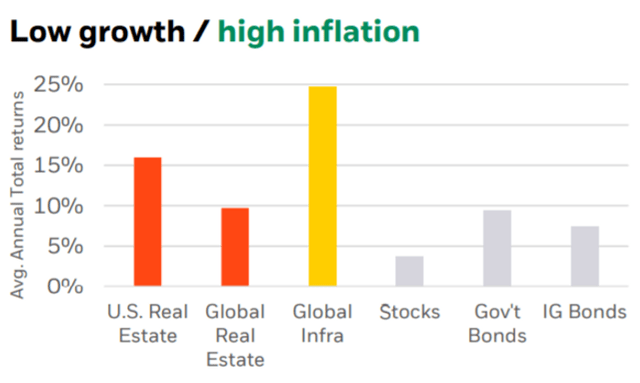

Research by BlackRock shows that infrastructure stocks perform well in different growth & inflation scenarios.

Figure 3: Growth/inflation scenarios (Blackrock)

Also the future looks bright for infrastructure investments. Estimates by McKinsey expect the need for roughly $130 trillion of global investments into projects to decarbonize the economy and renew critical infrastructure between 2022 and 2027 alone. In the US, the Infrastructure Investment and Jobs Act (IIJA) directs $1.2 trillion to U.S. infrastructure. The Inflation Reduction Act will give another boost to infrastructure investments.

Infrastructure: inflation hedge?

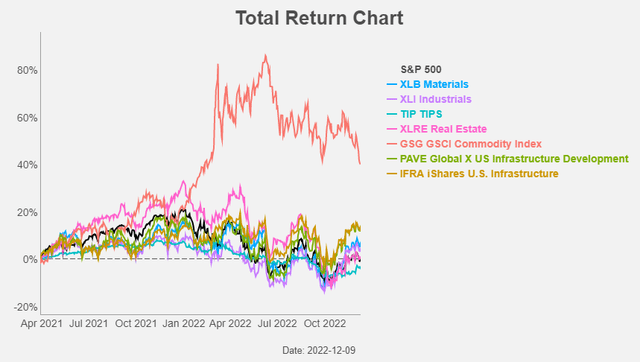

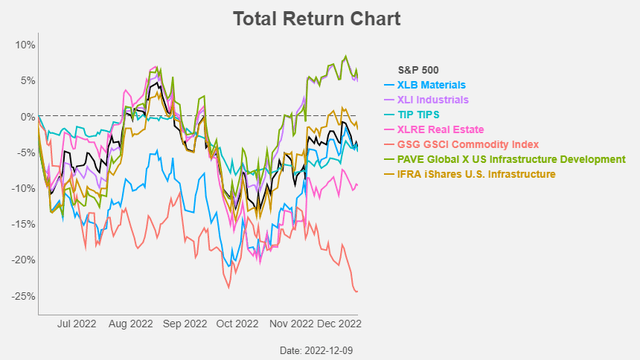

Infrastructure is often seen as a good inflation hedge just like commodities, real estate, and TIPS (and to a lesser extent equities).

Inflation started to rise in the second quarter of 2021 and in that period, commodities played their role as an inflation hedge, but the same cannot be said for equities, real estate, TIPS and … infrastructure.

Figure 4: Total return chart (Yahoo! Finance, Author)

The rising inflation forced the FED to hike interest rates and this will start to slow down the economy. The oil price started to decline in June due to this rising recession fears.

In this period commodities underperformed and infrastructure was among the best performers.

Figure 5: Total return chart (Yahoo! Finance, Author)

Higher inflation impacts infrastructure in two ways: higher interest rates and higher revenues and cash flows.

This ability to increase revenues as inflation rises is the main reason to label infrastructure an inflation hedge. Of course interest rates can rise quickly in the face of higher inflation while revenues are only able to do so with a lag.

Most infrastructure assets are characterized by long-term contracts that very often include explicit inflation adjustments. This allows for a rather swift adjustment of the revenues (and cash flows) to rising inflation. Other infrastructure assets, mostly in the utility space, are regulated and have to agree on prices with their regulator. A review of these arrangements with the regulator typically takes place once every five years. How quickly prices can be adjusted to inflation depends how close one is to such a review.

Eaton (ETN), one of the top 10 holdings in PAVE, is a good example. In both its divisions – Electrical and Industrial – ETN was able to manage price effectively more than fully offsetting the impact of inflation. This resulted in all-time record high margins of 21.2%, up 130 basis points over the prior year.

Infrastructure derives large part of their value from a stream of cash flows that extend far into the future; they are long duration assets. And long duration assets are much more sensitive to rising rates. So the negative effect of the rising rates is visible in the lacklustre performance of infrastructure the past year and a half, while the positive effect of higher revenues and cash flows will only start to kick in now. This higher growth kicks in now that the overall economy is slowing down. At the same time we expect inflation will be higher for longer.

Research by Blackrock shows that infrastructure stocks outperform in such a low growth & high inflation scenario.

Figure 6: Low growth / high inflation scenario (Blackrock)

PAVE

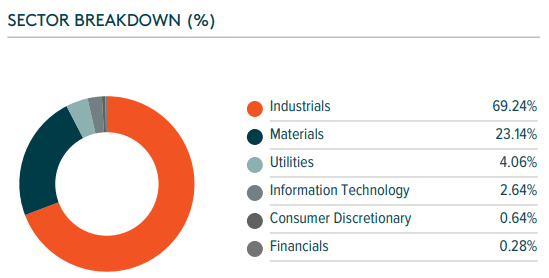

The two major US infrastructure ETFs are the iShares U.S. Infrastructure ETF (IFRA) and Global X U.S. Infrastructure Development ETF (PAVE). While IFRA has a lower expense ratio (0.30%) than PAVE (0.47%), we prefer the latter due to the better sector allocation. Almost half of IFRA’s assets are in the utility sector and for regulated assets like utilities the ability to increase revenues takes much longer.

The main sector in PAVE is Industrials, followed by Materials.

Figure 7: Sector allocation (Global X)

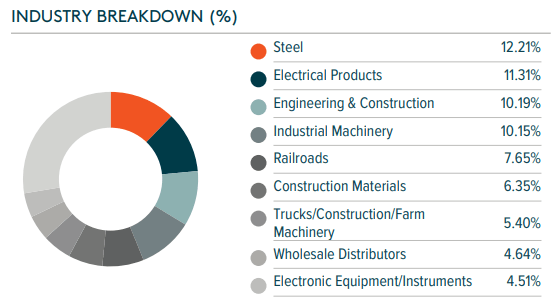

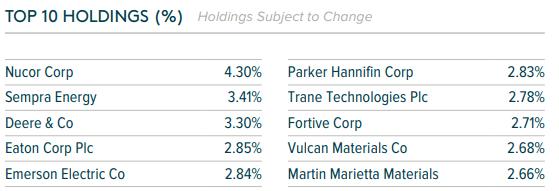

PAVE invests in companies that provide exposure to “domestic infrastructure development, including companies involved in construction and engineering, production of infrastructure raw materials, composites and products, industrial transportation and producers/distributors of heavy construction equipment.”

Figure 8: Industry allocation (Global X)

Figure 9: Top 10 Holdings (Global X)

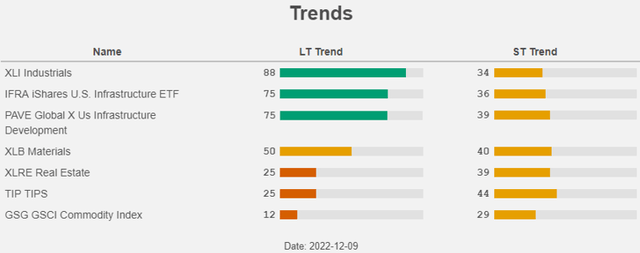

When we take a look at trends, we can see two things. Traditional inflation hedges like commodities, TIPS and real estate are in a downtrend. Infrastructure stocks are in an uptrend. The same can be said of Industrials, the biggest sector in PAVE.

Figure 10: Trends (Yahoo! Finance, Author)

Valuation

The effect of higher rates on infrastructure had two consequences: a lacklustre past performance and a cheaper valuation.

PAVE has a P/E of only 13 (versus 20 for the S&P 500) and a P/B of 2.60 (versus 3.8 for the S&P 500). The dividend yield is only 0.8% but you do not buy PAVE for the yield but for the high expected growth and total return.

Conclusion

Infrastructure stocks have a history of strong but stable cash flows and earnings and this has resulted in strong returns in the past two decades. Infrastructure stocks are long duration stocks and the rising rates caused by the higher inflation had a negative impact on the share prices. This led on the other hand to the current cheap valuation ratios.

Infrastructure stocks can with some delay pass through the higher costs and increase revenues and cash flows. That moment has come. Infrastructure stocks are in a bright spot: the valuation is low, the expected growth is high and infrastructure stocks are in an uptrend.

This is a nice moment to buy Global X US Infrastructure Development ETF.

Be the first to comment