Maks_Lab/iStock via Getty Images

Summary

First Trust Enhanced Short Maturity ETF (NASDAQ:FTSM) is a reasonable competitor in the short-term bond space, but it doesn’t jump out at us as a must-have ETF. It is showing signs of outperforming US T-Bills, and often does, thanks to a slug of corporate exposure. However, that outperformance might make it more of a complement to a Treasury ETF, rather than a substitute. For those looking beyond Treasury-only ETFs at the short end of the yield curve, this is an OK choice. We rate it a Hold, since we need a better yield premium to get excited about an ETF like this one.

Strategy

FTSM invests in US Treasury and corporate bonds, as well as Commercial Paper, with a very short-term maturity focus. It is an actively-managed fund, not an index ETF. It is run by First Trust, one of the upper-tier ETF providers.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: Short-Term

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Very Low

Holding Analysis

This fund traffics heavily in the Commercial Paper market, alongside a mixed bag of bonds. Investopedia.com has a good, succinct definition for Commercial Paper, so we won’t re-invent the wheel there. Here’s what they say: “Commercial paper is an unsecured, short-term debt instrument issued by corporations. It’s typically used to the finance short-term liabilities such as payroll, accounts payable, and inventories.” Commercial Paper issues make up about 45% of FTSM’s assets. This ETF has a weighted-average maturity of just under 6 months, making it comparable to US T-Bills in that respect. However, FTSM carries higher credit risk than T-Bills, albeit over very short-term maturity periods.

Strengths

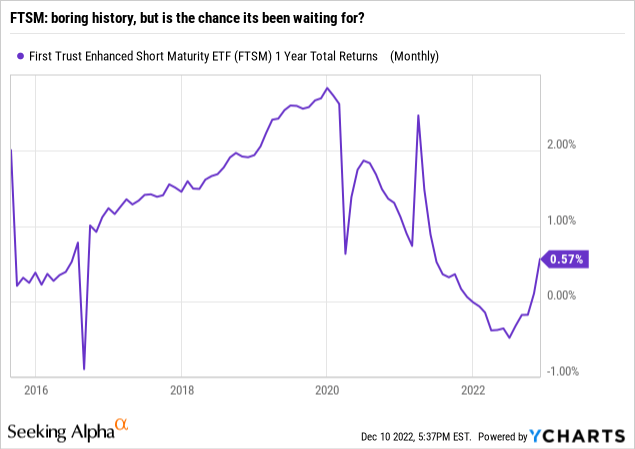

This is one of a class of ETFs that essentially exist to try to add some modest yield advantage over US T-Bills. FTSM has been in existence since mid-2014, and rates have been so low for so long, only recently has it even been able to sniff a market climate where it might be able to stand out.

Weaknesses

The main weakness here is the nature of the ETF’s asset class. For years, rates were so low that funds like this one could barely earn a return above their low expense ratios. In addition, this ETF has a more varied set of holdings than just owning T-Bills. It does own some US Government debt, though that accounts for under 10% of holdings.

Opportunities

If FTSM and its peers are going to shine, that moment is about to happen. After the Fed jacked up short-term rates, there is a mad scramble to invest in those much higher yields, given the ongoing concerns about the stock and bond markets. This ETF could be well-positioned to take advantage of that. It has nearly always earned a positive annual return. However, its best full year was 2019, when it returned 2.8%. 2023 might offer the opportunity to smash that personal record.

Threats

That forward-looking success is a possibility, but provided the markets don’t freak out and bring a credit crisis, reversal of rates, or both. The latter could again render this ETF inferior to money markets and CDs, and not worth the small price of admission (expense ratio is 0.25%).

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

This $7 Billion ETF from an ETF market leader, that trades around $90mm a day in volume, is solid enough to consider.

ETF Investment Opinion

The ETF has had inflows of nearly $3 Billion this year, because investors sense a long-awaited opportunity to invest in short-term, interest-bearing securities to take shelter from manic stock and bond markets. That situation, this fund’s limited-maturity makeup and solid backing make it one to consider. However, with US T-Bills providing similar returns, we don’t see the need to add complexity and marginal risk by venturing into the murky corporate bond market, even in the short-term maturity form that FTSM operates. It does enough to merit a Hold rating from us, but not a Buy at the current time. Call us wimps, but we’ll lean toward US Treasuries for now.

Be the first to comment