aamorim/E+ via Getty Images

By Rob Isbitts

Summary

SPDR® Blmbg Inv Grd Flt Rt ETF (NYSEARCA:FLRN) looks simple and attractive at first glance. In this era of rising rates, why not own an ETF whose holdings are bonds with rates that rise with rising interest rates? Because it is not that simple. Corporate bonds are a different animal from US Treasuries. That adds a level of complexity and potentially rapid drawdown risk. Barring another “bond market credit event,” FLRN is a decent choice. We rate it Hold.

Strategy

FLRN aims to track the Bloomberg US Dollar Floating Rate Note < 5 Years Index. In other words, it focuses on bonds issued in US Dollars, though not necessary by US corporations. The bonds mature 5 years from now or less. The unique feature of FLRN, which makes it particularly intriguing these days, is that it only buys Floating Rate Notes. These are bonds that do not pay a fixed rate of interest like the majority of bonds do. Instead, they are each based on some formula that typically requires the issuer to raise the rate of interest paid when interest rates go up. Likewise, in a period of falling rates, the issuer has the right to pay out less in percentage terms. The rate on these bonds “floats” during their lifetime thus the term “Floating Rate.”

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: Floating Rate

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Very Low

Holding Analysis

FLRN owns a widely-diversified group of Floating Rate bonds, with 377 holdings as of a recent report. Furthermore, no holding takes up more than 1.2% of the fund, and only 2 holdings have over a 1.0% weighting. The ETF can go out as far as 5 years in maturity, but only 24% of current holdings mature in more than 3 years. The bulk of holdings (57%) mature between 1-3 years from now.

This fund has one good example of why we are in the business of analyzing ETFs. If you look at many data sources, FLRN appears to have no holdings under 90 days to maturity, which would imply that bonds are sold prior to their final maturity. However, this is not the case. Once a bond holding is within 90 days of maturing, it is no longer considered a “bond” by most services (even though it didn’t just suddenly change its nature!). Instead, it is considered a “cash equivalent” holding, and will be grouped with cash holdings.

Strengths

We point out that “called cash when it is really still a bond” situation because it can be confusing to investors. And, ETFs like FLRN can be good substitutes for buying a collection of short-term securities. After all, you it allows investors to own a diverse set of short-term floating rate bonds, without taking all the time needed to buy and sell them individually. In normal times, when interest rates are not jockeying up and down, and when corporate credit ratings are believable, FLRN is a solid way to get access to the floater market.

Weaknesses

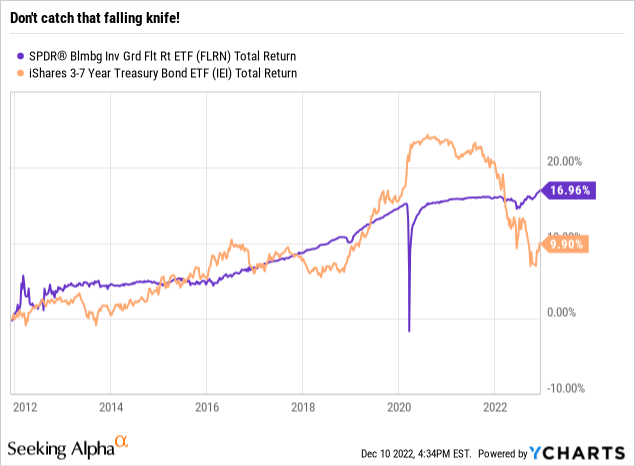

Short-term maturities, high-quality corporate bonds, a floating rate ETF in a rising rate environment: what could go wrong? Here’s what can go wrong, and it is pictured on the chart below. Every time the bond market “freaks out” about corporate credit safety, even temporarily, these bonds get marked down significantly. Call it a “flash crash” if you like, and that’s what 2020 was for corporate floaters. But 2008 was a bigger problem, and there’s a decent chance of another credit “event” in 2023 or 2024, given the fragile state of the corporate bond market. The chart shows that, as compared to Treasuries in the same general maturity range, FLRN collapsed in 2020, while Treasuries were their typical “flight to safety.” The net result for FLRN was a quick decline of nearly 18%. That’s a nightmare for short-term bond investors.

Opportunities

Using that same chart, the counter-argument in favor of FLRN now is what happened during 2022, when Treasuries sold off due to rising rates making their fixed interest rates a bad deal. Meanwhile, FLRN’s return drifted higher, as its holdings had a mass-rate-increase along with the bond market in general. And, it could be argued that while FLRN did not produce much in 2022 (it is about break-even year-to-date), it could be a big winner in 2023. That could be the case if rates stay up or continue to rise, and if the ongoing adjustment in the corporate bond market to the long-awaited reversal in Fed policy (tight, not loose) doesn’t create a credit market panic.

The tie-breaker for us, and why we have FLRN on our watchlist, is that only 12% of assets are currently invested in bonds rated BBB, and none are below that (junk status), other than a trace amount in Non-Rated bonds. So, with 88% of FLRN in A, AA, and AAA bonds, it provides a layer of confidence for us. That might dampen the yield versus other, more risky floating rate ETFs. But we are conservative investors at the core, so FLRN gets points with us for relative bond quality.

Threats

The biggest threat is that aforementioned credit event. That, or the possibility that rates don’t move much in the corporate world, or that they decline. Frankly, if rates dip a lot in early 2023 due to a surprise Fed rate cut (not our base case outlook), it probably means the economy is much worse than most think, and that could invite the very worst-case scenario we depicted above.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

FLRN is a solid fund, backed by a solid investment firm (iShares/Blackrock), and is large and liquid at the fund level. It passes our tests for “will we consider owning it.”

ETF Investment Opinion

The key to assessing FLRN is this: when owning it, you have to watch the developments in the corporate bond market. Credit “events” happen suddenly. And no corporate ETF will be immune if everything in the A and BBB-rated range starts to act like busted junk bonds. We saw it in 2008, which is probably why many floating rate ETFs debuted in 2011. That allowed the bitterness and disappointment of the Global Financial Crisis to fade from investors’ memories. So, as much as we like FLRN, we limit our enthusiasm to Hold, not a Buy rating.

Be the first to comment