sanjeri

Investment Thesis

Shopify Inc.’s (NYSE:SHOP) is definitely still at the stage of growth-at-all-costs, since the company chose to delay its profitability in pursuit of aggressive market penetration and growing market share. In the US alone, SHOP accounted for the largest market share with 33% penetration, while doing excellently in the global arena at 23%, coming second place only to WooCommerce at 26%, as of August 2022.

Long-term investors should be happy with SHOP’s growth strategy, given the massive returns further down the road. We are already starting to see decent returns thus far, with excellent GMV of $46.9B and MMR of $107.2M in FQ2’22, representing YoY growth of 11% and 13%, respectively, despite the reopening cadence. SHOP is also deepening its critical partnerships with excellent advertising and social media Tech Giants, such as Alphabet (GOOG) (GOOGL) and Meta (META), while also successfully monetizing these platforms globally.

Therefore, we are not concerned at all about SHOP’s profitability or current stock prices in the bear market. Things can only go up from the bottom.

SHOP Showed Us That Pain Is Necessary For Growth

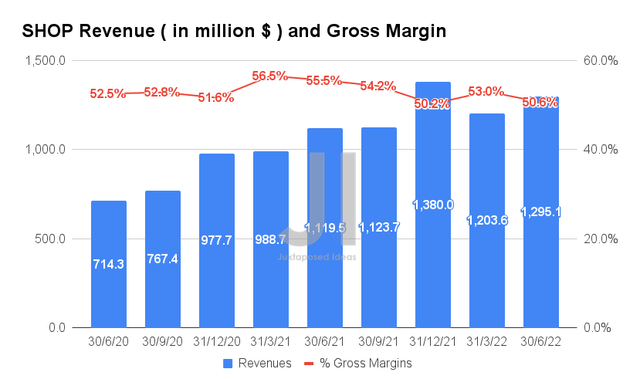

In FQ2’22, SHOP reported revenues of $1.29B, representing a remarkable increase of 7.6% QoQ and 11.6% YoY. However, it is apparent that the company has been struggling with declining gross margins thus far, with 50.6% reported in FQ2’22. It represented a decline of 2.4 percentage points QoQ and 4.9 percentage points YoY, highlighting the rising inflationary issues affecting most businesses globally.

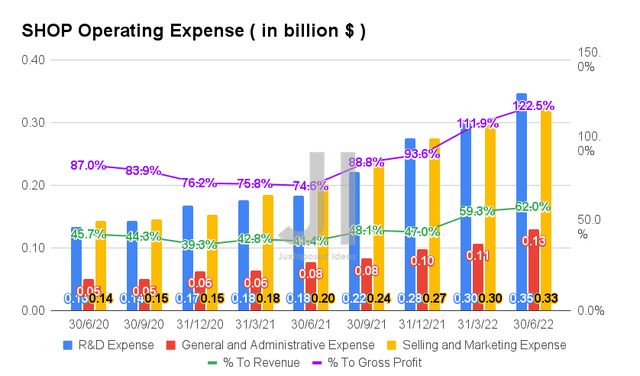

It is very apparent from the way that SHOP has been aggressively expanding its operating expenses and capital expenditure thus far that the management is growing its long-term capabilities at the cost of short-term profitability. By FQ2’22, the company reported $0.81B of operating expenses, representing a tremendous increase of 76% YoY and 261.2% from FQ2’20 levels.

In response, the ratio to SHOP’s growing sales has also burgeoned seemingly out of control, accounting for 62% of its revenues and 122.5% of its gross profits by FQ2’22. This is a massive increase from FQ2’21 levels of 41.4% and 74.6%, respectively.

Therefore, combined with the rising costs, there is no wonder that SHOP has reported negative operating and net incomes for the past three quarters. By FQ2’22, the company reported GAAP net income of -$1.2B and net income margin of -93%. Otherwise, an adj. net income of -$186.8M and an adj. net income margin of -14.4%, representing a YoY decline of -64.8% and 23.4 percentage points, respectively, after adjusting for the losses/ gains in its investments.

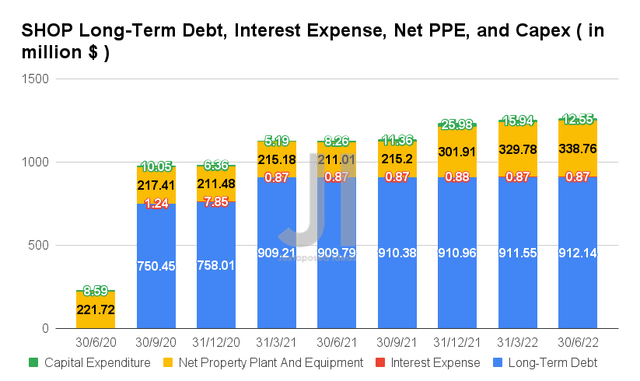

In the meantime, SHOP also reported growing long-term debts of $912.14M and interest expenses of $0.87M in FQ2’22, while expanding its net PPE assets to $338.76M at the same time. The latter represented a noteworthy increase of 60.5% YoY. The company also pressed on with capital expenditures of $12.55M in FQ2’22, indicating an increase of 51.9% YoY.

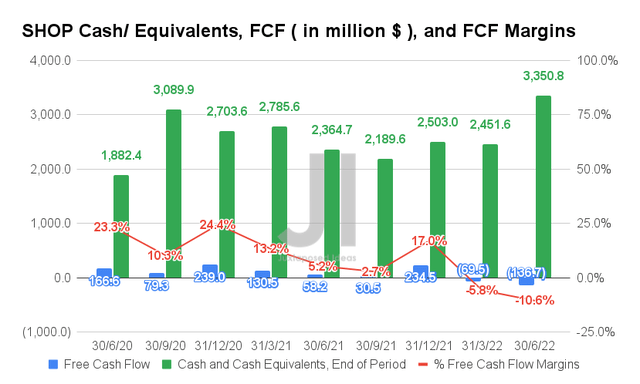

Therefore, given its aggressive growth mode, especially in the Fulfillment Network, we can understand why SHOP continues to report negative Free Cash Flow (FCF) generation in FQ2’22, with an FCF of -$136.7M and an FCF margin of -10.6% then. The same can be said for Amazon (AMZN), which has been reporting so for the past two quarters. Nonetheless, SHOP remains well poised for expansion, given its cash and equivalents of $3.35B on its balance sheet in FQ2’22. That should cushion the management long enough before needing to raise more capital in the short term.

Mr. Market Remained Bearish About SHOP’s Potential

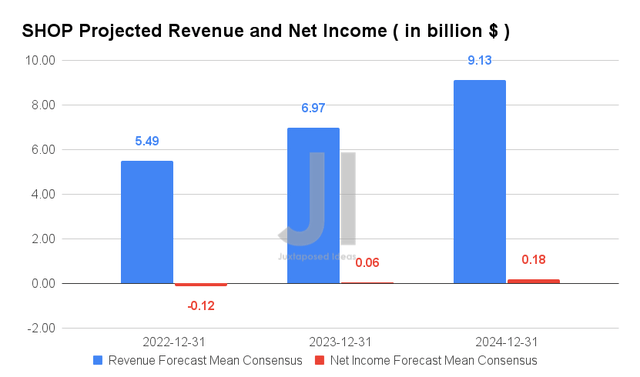

Over the next three years, SHOP is expected to report revenue growth at a CAGR of 25.58%, while potentially reporting a net income break-even in FY2023. The number is an apparent deceleration from pre-pandemic levels of 59.48% or pandemic levels of 70.94%. In addition, the revised revenues represent an apparent downgrade of -15% from the previous consensus estimates in April 2022. The revised profitability from FY2022 to FY2024 further indicates the rather bearish long-term outlook from Mr. Market.

For FY2022, consensus estimates that SHOP will report revenues of $5.49B and net incomes of -$0.12B, representing YoY growth of 19% though a decline of 95.8%, respectively. However, as discussed above, most of it was attributed to the losses in its investments at -$2.57B in H1’22 and the gains in the same investment of $2.85B in FY2021. Therefore, after certain adjustments, we can therefore assume that the decline in its projected profitability in FY2022, is due to SHOP’s aggressive investments and lack of profitability in the newly established Fulfillment Network.

At the moment, these investments may seem foolish, given the rising inflations, the Fed’s hike in interest rates, and potential economic downturn. However, we remain bullish about SHOP’s expanding capabilities, since the company would be able to swiftly capture critical market share upon the eventual economic recovery, triggering a red-hot demand for e-commerce then. In the meantime, sit tight, hold on, and patiently wait for the long-term recovery as SHOP grows at all costs. Profits will come eventually once it hits an inflection point.

We encourage you to read our previous article on SHOP, which would help you better understand its position and market opportunities.

- Shopify: The Bubble Burst – Still A Solid Buy But After Market Stabilizes

- Shopify: Time For Long-Term Growth After The Roller Coaster Ride

So, Is SHOP Stock A Buy, Sell, or Hold?

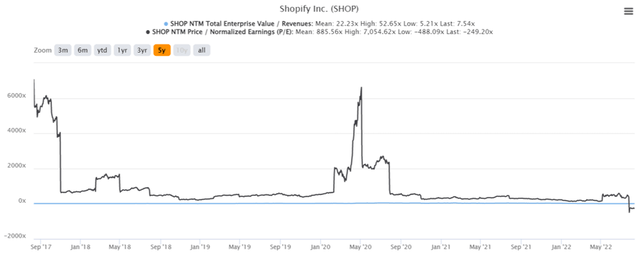

SHOP 5Y EV/Revenue and P/E Valuations

SHOP is currently trading at an EV/NTM Revenue of 7.54x and NTM P/E of -249.20x, lower than its 5Y mean of 19.79x and 250.66x, respectively. The stock is also trading at $40.42, down 77% from its 52-week high of $176.29, though at a premium of 36% from its 52-week low of $29.72. It is evident that the stock has recovered part of its mojo, post FQ2’22 earnings call.

SHOP 5Y Stock Price

However, post-COVID-19 stock party and hangover, it is also apparent that analysts are more careful now, given SHOP’s price target of $46.28 and the minimal 14.5% upside. That is a far cry from the previous rock star heights of $166.83 (post-stock-split) in November 2021. Though it is unlikely to see those levels again anytime soon, long-term investors who had gotten in at lows have nothing to worry about, since we expect the stock to easily triple by FY2025, if not more.

As SHOP is still riding on a high post-earnings call, investors may want to wait for a meaningful retracement to the low $30s before adding more, given the historical support level for the past three months. Otherwise, the bulls may continue to nibble at every dip.

In the meantime, we rate SHOP as a Hold for now.

Be the first to comment