sarayut/iStock via Getty Images

Investment Thesis

Shopify Inc. (NYSE:NYSE:SHOP) has unfortunately continued to tumble, once it is evident that the inflation rate remained elevated at 8.3% in August against pre-pandemic levels and the Fed’s mandate of 2%. Since the September CPI is about to be released within the next few days, many analysts are waiting with bated breath, as it may provide the stock market with the potential catalyst for recovery. The Fed’s projected terminal rate of 4.6% by 2023 also possibly indicates a 75 basis point hike in November, with January 2023 moderating with a 50 basis point hike. Thereby, speculatively indicating near bottom levels with baked-in pessimism.

Nonetheless, the S&P 500 Index had also catastrophically fallen by -25.25% YTD, breaking previous June lows indicating maximum fear, uncertainty, and doubt levels previously unseen before in the stock market. In addition, SHOP broke its previous $30 support levels with a -80.24% free-fall YTD, with Amazon (AMZN) not spared either at a -33.69% plunge at the time of writing. Tragic indeed.

As much as we would like to aggressively pound the table, extolling the greatness of SHOP’s platform, we must highlight the fact that it is still at a growth-at-all-cost stage. Thereby, explaining its lack of sustained profitability thus far. It also appears that the company is losing some critical e-commerce market share in the US, from 33% in August to 29% in October 2022. On the other hand, SHOP still manages to boast 22% of the e-commerce market share globally, compared to 23% previously.

Moving forward, it remains to be seen if SHOP is able to maintain its tenuous grip on the global e-commerce market, especially since AMZN is embarking on the first ever two Prime shopping events in the year. Thereby, recognizing the latter’s need for a significant revenue boost in FQ4’22 as the world dives into more uncertainties ahead. As a result, the stock is only suitable for those with higher risk tolerance and long-term trajectory, significantly impacted by Mr. Market’s worsening pessimism. Take care, everyone.

SHOP’s Margins Remain Tight With Profitability Pushed Back Another Year

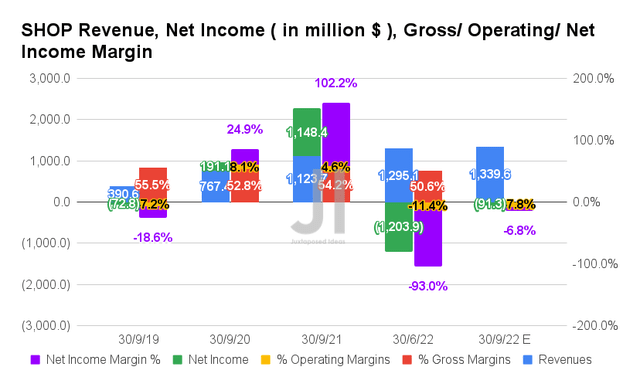

For the upcoming FQ3’22 earnings call, SHOP is expected to report revenues of $1.33B and operating margins of -7.8%, representing decent QoQ growth of 3.43% and 3.6 percentage points, respectively, partly attributed to its streamlined workforce in July. Otherwise, an excellent YoY increase of 19.21% though a decline of 12.4 percentage points, respectively, with the latter partly attributed to FX headwinds and high inflation.

In contrast, consensus estimates expect to see improved profitability, with SHOP reporting net incomes of -$91.3M and net income margins of -6.8% for the next quarter. It will indicate a notable increase of 51.14% and 7.63 percentage points QoQ, respectively, after adjusting for its losses on equity and other investments of -$1.01B in FQ2’22. Otherwise, an impressive YoY growth of 52.54% and -10.32 percentage points, respectively, after the adjustment for $1.34B in investment gains in FQ3’21.

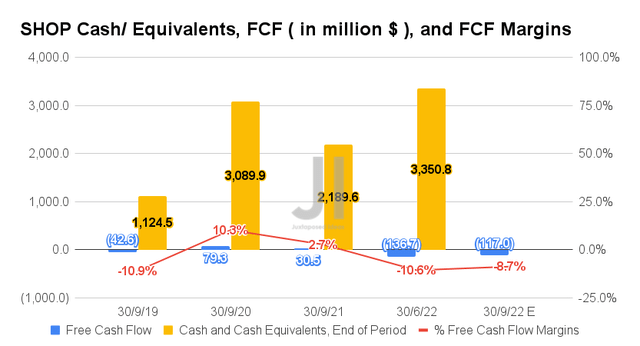

Nonetheless, given SHOP’s elevated investments of $65.83M in capital expenditure and $2.8B in operational expenses over the last twelve months (LTM), it is evident that the company is still growing its capabilities aggressively. Therefore, the company is not expected to report positive Free Cash Flow (FCF) generation yet, with an FCF of -$117M and an FCF margin of -8.7% in FQ3’22. However, these will represent notable QoQ improvement by 14.41% and 1.9 percentage points, respectively.

In the meantime, SHOP’s growing cash and equivalents of $3.35B on its balance sheet from FQ2’22 should be more than sufficient to weather the economic downturn through H1’23. This is significantly aided by the fact that only $96.43M of its financial contractual obligations will be due within the year and $108.88M within the next three years.

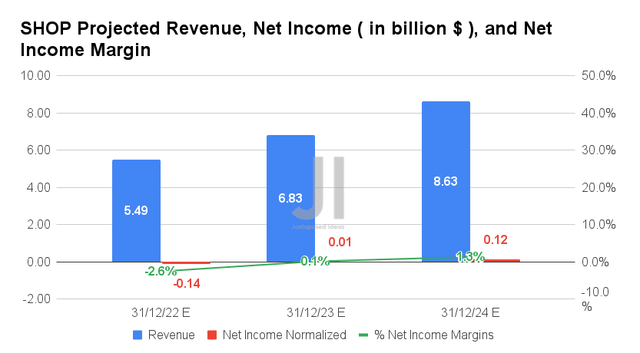

Over the next three years, SHOP is expected to report revenue growth at a CAGR of 23.25%, while reporting a net income break even by FY2023. It is evident that Mr. Market is more pessimistic than expected, given the massive downgrade by -20.09% since our analysis in April 2022 and -5.47% since August 2022.

Meanwhile, For FY2022, consensus estimates that SHOP will report revenues of $5.49B, net incomes of -$0.14B, and net income margins of -2.6%, representing YoY growth of 19.08% though a decline of -355.19% and -3.78 percentage points, respectively. Given the Fed’s aggressive battle against the rising inflation, we will likely see the recession hit us sooner than later, if we are not already in one. Therefore, further impacting consumer discretionary spending ahead, as more wallets are tightened through the economic downturn.

However, while there may be temporary headwinds on SHOP’s Gross Merchandise Volume, we expect to see the company sustain its Monthly Recurring Revenue and Merchant/Subscription Solutions, given its robust partnerships with global e-commerce players. We shall see, since these key collaborations will prove to be top and bottom lines accretive once the macroeconomics improves by H2’23. In the meantime, we encourage you to read our previous article on SHOP, which would help you better understand its position and market opportunities.

- Shopify: Turning Bullish In A Time Of Maximum Pain

- Shopify: The Bubble Burst – Still A Solid Buy But After Market Stabilizes

So, Is SHOP Stock A Buy, Sell, Or Hold?

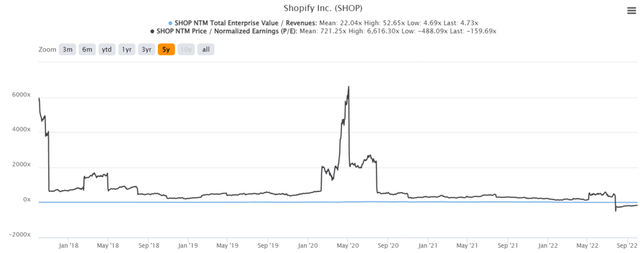

SHOP 5Y EV/Revenue and P/E Valuations

SHOP is currently trading at an EV/NTM Revenue of 4.73x and NTM P/E of -159.69x, lower than its 5Y EV/Revenue mean of 22.04x though worsened from its 5Y P/E mean of 721.25x. The stock is also trading at $26.94, down -84.71% from its 52 weeks high of $176.29, nearing its 52 weeks low of $26.38. Nonetheless, consensus estimates remain bullish about SHOP’s prospects, given their price target of $46.46 and a 72.46% upside from current prices.

SHOP 5Y Stock Price

Market pessimism is obviously at an all-time high, and you may think that investing in a stock that has plunged so much as a foolish endeavor. True that, if one is a conservative investor looking for a safe harbor during tumultuous times like this. In that case, please avoid SHOP like the plague.

However, we must highlight the fact that SHOP remains a legitimate contender to AMZN’s dominance in the global e-commerce market, given its direct partnership with global advertising giants such as Meta (META) and Alphabet (GOOG). While accounting for 50.5% of the global digital advertising spend, both companies also boasted immense ad revenues of $114.93B and $209.49B in FY2021, respectively, with the global advertising market expected to reach $792.7B by 2027, at a CAGR of 5.04%. Therefore, it is not hard to see SHOP riding that monster wave of growth once the macroeconomics improves and consumer demand returns.

These are temporary growing pains especially worsened by the economic downturn, with AMZN previously reporting a -54.93% stock plunge between August and November 2008, during the previous recession. Despite so, AMZN had proved that consumer discretionary spending remained robust, given the impressive YoY revenue growth of 27.9% and YoY net income growth of 39.84% in FY2009, compared to 29.2% and 35.5% in FY2008. Its stock had recovered by April 2009 and proceeded to record a tremendous 10Y Return of 783.1% thus far.

In the long run, SHOP will achieve its sustainable scale and profitability, while returning much value to its long-term investors who had entered at current lows. As for those who had been arguing for and against AMZN/ SHOP, why not own both? It is a no-brainer really, given the insatiable demand for e-commerce globally, with the market value expected to hit $8.14T by 2026 at an accelerated CAGR of 9.33%.

Despite the normalization of hyper-demand and temporary headwinds through H1’23, we continue to rate SHOP stock as a speculative Buy at the low $20s. Naturally, the market will always be full of pitfalls for anyone who tries to pitch the perfect timing, since there may still be some downsides from current levels. Investors, take note.

Be the first to comment