ImagePixel

Investment thesis

Shimano’s (OTCPK:SHMDF) Q2 FY12/2022 results indicated signs of cost inflation where gross margins were weaker than expected, and with softening European bike sales we believe current consensus forecasts are too bullish. We estimate that the company will lower guidance for underlying demand in H2 FY12/2022 and the outlook for FY12/2023 is for a steeper negative growth profile YoY. We downgrade the shares from neutral to sell.

Quick primer

Established in 1921 in Sakai City in Japan, Shimano is the global market leader in cycling components with an estimated 70% share in the mid to high-end market. The largest geographic market is Europe making up approximately 40% of total FY12/2021 sales. Shimano is also active in manufacturing fishing equipment such as rods and reels, and rowing equipment. It has 13,000 employees and President Taizo Shimano is a member of the founding family. Manufacturing is based in Japan, China, Singapore, Malaysia, and the Philippines. Its single largest customer in FY12/2021 was Germany’s bike parts specialists Paul Lange & Co. Other customers include Taiwan’s Merida Industry (9914.TW) and Giant Manufacturing (9921.TW). Key peers are SRAM of the US, Campagnolo of Italy, Yamaha Motor (OTCPK:YAMHF), and Bridgestone (OTCPK:BRDCY).

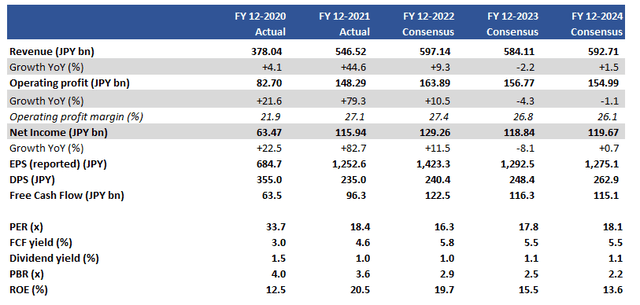

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

Our objectives

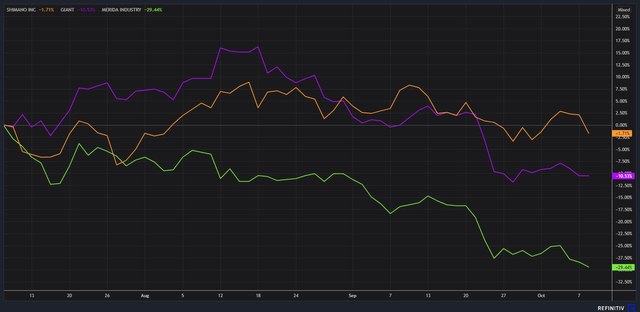

Following our neutral rating on July 2022, we take note of two developments. Firstly, consensus forecasts have been raised for FY12/2022 and FY12/2023 by around 10% after Q2 FY12/2022 results. Secondly, there have been notable drawdowns in the Taiwanese bicycle manufacturers in the last 3 months while Shimano has strongly outperformed.

Rebased 3-month share price performance – Shimano (orange), Giant (purple), and Merida Industry (green)

Rebased 3-month share price performance – Shimano, Giant, and Merida Industry (Refinitiv)

We want to assess whether Shimano’s resilient share price performance is warranted given their customers appear to be in difficulty, and the reasoning behind consensus becoming more bullish near term.

Consensus forecasts raised

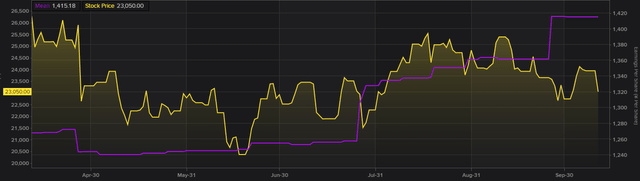

Shimano’s Q2 FY12/2022 results compelled the sell side to increase their estimates for the company. We see how the average EPS estimate has risen over the last 6 months, but the share price has been relatively stable.

Consensus FY12/2022 EPS estimate (purple) and share price performance (yellow)

Consensus FY12/2022 EPS estimate and share price performance (Refinitiv)

Q2 FY12/2022 revenue did beat consensus expectations by 8%, but one area of weakness was a decline in gross margins QoQ. Consequently, operating profits were in line and the key reason for the EPS uplift was due purely to an increase in non-operating income from paper foreign currency gains as the Japanese yen depreciated particularly versus the US dollar. This impact also led to FY12/2022 guidance being revised upward (page 4) for ordinary income (profit before tax) and net income, but not sales or operating income.

This leads us to believe that the market does not reward transient forex paper gains and that Shimano is beginning to experience cost inflation as raw material costs (mostly denominated in US dollars) appear to be placing some pressure on gross margins (actual 41.95% versus expected 42.90%). With a more pronounced weakness of the Japanese yen in H2 FY12/2022, we are concerned that there will be more gross margin compression which is not accounted for in consensus estimates.

Our conclusion here is that consensus appears too bullish for the near term, as the negative foreign currency impact from rising material costs.

Indication of difficulties for customers

Europe is Shimano’s largest market, making up around 40% of total sales. Whilst CY2021 was a bumper year for bike sales, we are beginning to see some softness in the UK with total cycle volume down a hefty 28% YoY for the first half of CY2022 due to the cost-of-living crisis. Although we expect mainland Europe to be on a firmer footing, we believe that there will also be a decline in demand placing pressure on other regions such as Asia to outperform.

Looking at the key Asian bicycle manufacturers Giant and Merida, their share price performance would indicate severely stressed trading conditions. The key issue is the strength of the US dollar which is currently at NT31.87, a level not seen since January 2017. This places significant pressure on increasing raw material costs denominated in US dollars and a need to increase pricing which may not be conducive to demand. Supply chain issues also persist, although there are some signs of normalization. However, it is also important to note that the weak Taiwanese dollar is creating major equity outflows, resulting in forced share price weakness.

Shimano is in a similar situation with cost inflation, and although it is in a position to pass on some of this to its customers, particularly for high-end products. However, if end demand is beginning to weaken into H2 FY12/2022, we expect to see consensus estimates being lowered to reflect this new reality.

Valuation

On consensus forecasts which look bullish in our view, the shares are trading on PER FY12/2023 17.8x and a free cash flow yield of 5.5%. These metrics do not look hugely overvalued. However, given that the outlook for FY12/2023 is looking less positive in the key European market and cost inflation pushing down gross margins, we believe the shares are in reality more expensive.

Risks

Upside risk comes from the foreign currency with a weakening US dollar, resulting in lower cost inflation which should help manage gross margins. Accelerating demand for e-bikes would necessitate demand for bicycle parts, although the relatively expensive pricing may limit market volumes.

Downside risk comes from cost inflation materializing as material declines in gross margins in H2 FY12/2022 results, resulting in a downward revision to guidance due to weaker underlying demand. A more pronounced negative growth profile into FY12/2023 earnings will be a poor optic.

Conclusion

Shimano is seen as a high-quality franchise with ESG credentials, and in the longer term expected to generate sustainable levels of earnings. In the shorter term, there are material risks in the form of cost inflation and pressure over consumer discretionary spending particularly in the key European market which are negative for earnings visibility. Valuations on consensus forecasts are not expensive, but given that the market has not appeared to fully price in these negatives, we downgrade the shares to a sell.

Be the first to comment