Andy Feng

Shares in once-darling EV manufacturer NIO (NYSE:NIO) have taken a beating alongside the rest of the Chinese EV sector since June, falling over 40% in over three months. However, the Chinese EV sector is showing signs of strength in the face of rising geopolitical tensions, reaching record sales in September at 675k units, beating estimates and notching a second-straight 600k+ month. NIO also has managed to show record delivery figures in a Q3 which saw multiple peers such as XPeng (XPEV) struggle to find growth, and European launches and a 2023 ramp in volumes pave the way for potential multiple expansion moving into 2023 and beyond.

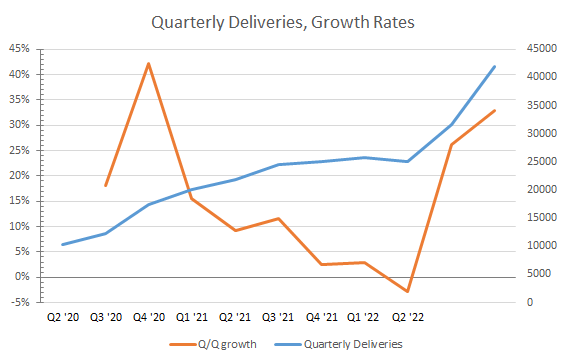

Record Q3 Deliveries For NIO

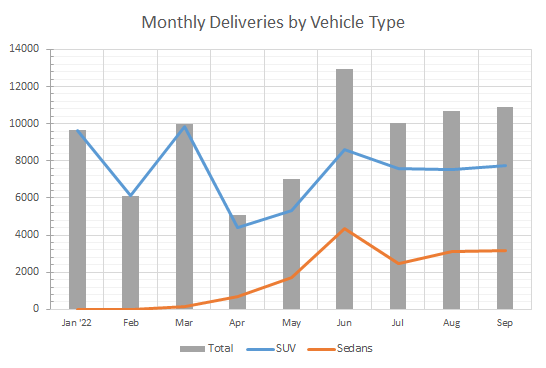

NIO’s deliveries remained solid throughout Q3, extending a streak to four months in a row above 10,000 vehicles while reaching record levels for September. For the month, NIO delivered 10,878 units, with 7,729 SUV deliveries (~71%) and 3,149 sedans (~29%). While NIO has moved away from providing deliveries about each of its six models, it still has announced figures for its newer cohort – deliveries for the ES7 rose 376% m/m to 1,895 units, while sales of the ET7 reached 2,928 units, suggesting a pretty significant drop from June’s 4,349 tally.

Nio

Overall, Q3 held surprisingly strong, with sequential growth in each month to reach ~29.3% y/y growth for the quarter. Although the final tally of 31,607 vehicles missed the midpoint of guidance (31,000 to 33,000), pushing to record levels while scaling production higher in Q4 (potentially up to 14,000 units/month for ~33% q/q growth) can see the year end with about ~37% y/y growth to hit 128,000 units. Resumption of growth at this degree should drive some multiple expansion, potentially up to 4x EV/revenues (~60% upside to $20.8), considering these rates of sequential growth were seen in late 2020, when multiples first began to expand as shares surged.

Data from Nio

Breaking down deliveries by vehicle type (SUV/sedan – given that NIO has refrained from reporting single vehicle type sales since June) provides an interesting look into monthly sales figures.

Data from Nio

Aside from Q2 deliveries surging to nearly 13,000 units with the EOQ sales push, deliveries have consistently risen since an April low. However, ES6 sales look to have peaked in June at 5,100 units (~59% of total SUV deliveries), given that SUV sales have fallen over 900 units since then with nearly 1,900 deliveries of the ES7. It is possible that ES6 sales have leveled back off to ~3,000 units (Q2/Q3 ’21 levels), on the assumption that ES8 and EC6 sales hold relatively steady at ~1,400 units. Regardless of the exact split, it’s clear that the launch of the ES7 (EL7) is either cannibalizing production and/or demand of existing models, or NIO is witnessing some sort of demand destruction from Tesla (TSLA) or BYD (OTCPK:BYDDY), which led September’s surging EV growth.

Turning Back To Growth

While NIO has had a bit of a weaker year so far, with ~14.4% y/y growth in Q2 followed by 29.3% growth in Q3, the fourth quarter is poised for a resumption to stronger growth rates that NIO can carry through to 2023.

NIO is expecting production and delivery volumes to surge in Q4, having kicked off mass production preparations for the new ET5 in Q3 – that vehicle saw over 220 deliveries in the first day. CEO William Li believes the EV startup is “going to break record[s] every month” during Q4, as NIO has “been making active preparations to meet this target.”

NIO is already showing strong initial demand for the new ES7 (EL7) and the ET5, combining for nearly 20% of deliveries in the second and first month of deliveries, respectively. NIO could quickly ramp production of the ET5 to 4,000 to 5,000 units by the end of Q4, easily allowing for volumes to crest about 15,000 should ET7 and ES6 sales hold near 3,000 or resume growth. Li mentioned that NIO believes the ET5 “will have the opportunity to surpass the 10,000 units in 1 month,” again indicative of both the strong demand picture and clearer supply picture.

Li pointed out that demand is not the constraint, but rather the supply chain/production is the main constraint. NIO’s confidence in reaching record volumes reflects on the underlying trends within broader strength in the domestic EV market and signals positively for expansion in 2023.

Strong Growth Ahead For 2023?

Given the macro and supply chain conditions, it’s still in the cards for Q4 to be a disappointment, unable to reach record volumes or over 40,000 units. However, aside from any increase in geopolitical tensions between the US and China (this may impede the development of NIO’s autonomous driving systems, which run on Nvidia (NVDA) and Qualcomm (QCOM) chips), the picture for 2023 looks quite bright with a multi-faceted geographic expansion on deck along with ample time to bring new models up to scale and to a higher scale.

It’s safe to say that at the current rate, NIO is squarely on track to miss analyst estimates and projections from earlier in the year — in June, Deutsche Bank “forecasted 2022 deliveries of 160K,” suggesting deliveries would average 18k per month in H2. NIO has fallen short of that so far, on track for 125,000 to 130,000 in a base case scenario.

Moving in to 2023, NeoPark’s operations should provide the ability to reach a 20,000 to 25,000 units/month run rate, opening the door for significant growth through the year.

NIO is pushing ahead with European expansion plans, targeting four countries to start. The ET7 “is available to order now in Germany, the Netherlands, Denmark, and Sweden with deliveries due to start on October 16.” NIO “confirmed that pre-orders for its EL7, a mid-large smart electric SUV, and the ET5, its mid-size smart electric sedan have started with deliveries set to start in January and March 2023, respectively.” NIO also is aiming to build out a European charging network to support this international expansion.

What does this mean for production/deliveries? Given that NIO’s European expansion focuses primarily on sedans, the ET7 and ET5, production and delivery levels for the two are likely to reach 6,000 or higher by Q2 2023, providing ample volumes for domestic sales (2,000 to 4,000 domestic; 500 to 1,000 per each European country). With four other models and the potential for more additional models to be added to the lineup, NIO has the ability to push deliveries north of 18,000 units/month by Q2, to a targeted run rate of 21,000/month by Q4.

The combination of NIO’s multi-faceted expansion plans, significant order backlog, and scaling of production volumes set up a very positive trajectory for FY23 deliveries. An initial projection forecasts between 210,000 to 220,000 units for FY23, guiding for low double-digit sequential growth rates; however, assuming for a higher rate of headwinds from supply chain, chips, and possible demand destruction amid lasting macro headwinds, deliveries could rise to 190,000 units.

These projections represent about 52% to 72% y/y growth from FY22’s projected 125,000 unit tally. Shares have been punished as deliveries stagnated through much of 2022, but moving forward, resumption of growth to this degree should drive substantial multiple expansion. Given the market conditions, NIO could return to valuations between 5x to 6x EV/revenues, depending on the macro environment next year globally and in China.

At the midpoint of 5.5x projected 2023 revenues of ~$15 billion (equal to March/June/Sep multiples near $22 to $24 per share), NIO would be valued at ~$77 billion, compared to its current ~$20 billion EV. This suggests about 285% upside potential possible in a multiple expansion scenario, with shares nearing $37; a more realistic scenario could see NIO hold on to multiples between 3.5x to 5x (~180% upside), given its inability to reach profits and any possible margin weakness from overextending itself into too many growth outlets at once.

Main Risks

While NIO’s projection resumption of growth is attractive, there are a few main risks to may serve as headwinds, most notably the geopolitical situation between the US and China impacting chips, as well as the weakening global and domestic economic situation. Aside from those two main risks, which likely are the most influential on keeping shares depressed in the near-term, NIO faces supply chain constraints, heightened competition, and execution risk:

- Heightened competition: Competition in China is only getting stronger, with BYD and Tesla seeing strong delivery figures in the month of September while NIO barely managed to eke out growth; competition is only likely to heighten in 2023.

- Supply chain constraints: While this is more of an industry-related factor, supply chain constraints are not expected to ease relatively quickly, with GM (GM), Intel (INTC), NXP (NXPI), and others all forecasting chip shortages to last into 2023, adding further pressure on the industry and further pressure on solid execution for NIO. Although the company expects supply chain constraints to ease, the fragility of the supply chain has been visible already this year, and any minor impacts to critical component supply could easily derail targets.

- Lack of concentration: NIO’s current strategy raises concerns that the manufacturer is doing too much, too soon. NIO is working to expand to multiple countries in Europe, while expanding their model lineup, charging and battery swapping network, while still accumulating losses. NIO is confident of reaching record volumes in Q4, but it raises questions of if NIO can successfully execute all of these facets while pushing to scale new models.

Outlook

NIO has a lot on its plate in the back half of the year, working to build out its charging and battery swap network, get NeoPark up to scale, ramp up deliveries of new models, expand internationally, navigate supply chain issues, and continue innovating in ADAS and related tech. NIO is projecting a record Q4, but its performance over the past four quarters has shown a trend of struggling to grow deliveries. September’s record deliveries reflect that NIO may be on the cusp of a turnaround and a resumption of q/q growth in deliveries, but the manufacturer will have to perform substantially better in each month to end the year to squash concerns that deliveries will fail to grow >20% q/q again. If NIO’s order book and production hold firm, and the manufacturer can deliver an average of 14,000 vehicle per month during Q4 to reach a tally of 42,000 units, the outlook reflects more positively for shares; production volumes for 2023 are projected to anywhere from 190,000 to 220,000 units dependent on the broader economic situation. Shares look poised for multiple expansion in 2023 as growth rates return to >50% y/y, but multiple risks do remain.

Be the first to comment