Svetlana Parnikova/iStock via Getty Images

Investment Thesis

Despite the continued correction in Freedom Holding Corp. (NASDAQ:FRHC) and Kaspi (OTC:KAKZF) stocks, I believe the next 12 months will be much more positive and profitable for the companies due to the migration of the economically active Russian population to Kazakhstan and Central Asian countries. This is definitely a tailwind that is not priced in yet. However, when choosing between the two stocks, I lean toward Kaspi – the company is freed from most of the risks of Freedom Holding while benefiting in a more obvious way from the current macroeconomic situation.

Why is Freedom Holding stock falling?

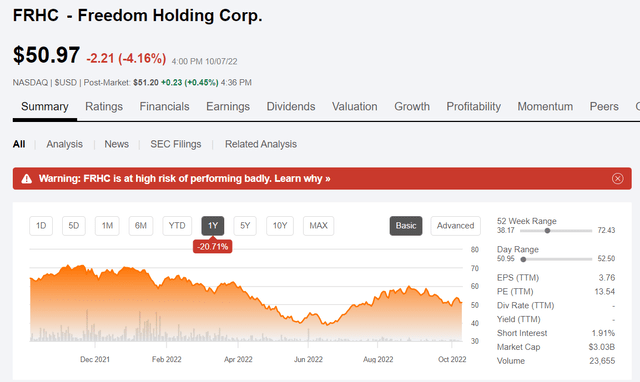

Freedom Holding Corp. is a $3-billion financial company, the biggest brokerage firm in Central Asia; the only NASDAQ-listed broker in the CIS region.

When you open the company’s main page on Seeking Alpha, you immediately see a warning sign that its stock is at high risk of performing badly:

This is because the stock has fallen 27.1% since the start of the year, while the financial sector represented by SPDR ETF – (XLF) – has fallen only 20.9%.

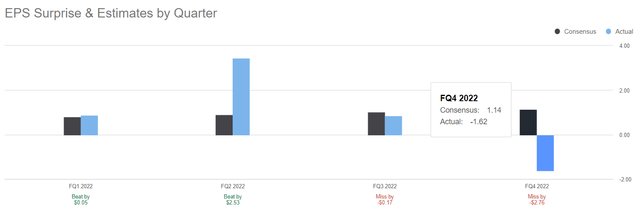

Perhaps SA’s quant rating system also took into account the results of the last reporting quarter, which showed a drop in EPS from $0.85 in Q3 2022 to -$1.62 in Q4 2022:

In addition, the selling pressure was also exerted by some foreign investors who assessed Kazakhstan’s (where FRHC is headquartered) political instability after the unrest in January – a rising country’s risk premium leads to falling quotes.

In addition, Freedom Holding had a subsidiary that provided brokerage and dealer services in Russia – the CEO himself was until recently a citizen of the Russian Federation and was accordingly associated with an aggressive country in the eyes of Western investors, which most likely also influenced their decision to sell their shares. Even S&P was forced at one point to downgrade the company’s credit rating due to the impact of the Russian-Ukrainian conflict on its operations.

Another point concerns legal practices. Despite a rather large capitalization – at least for this region – of $3 billion, Freedom Holding still orders auditing services from a no-name Salt Lake City firm – WSRP (with all due respect, that’s not even KPMG from the Big 4).

As you can see, this is anything but an obvious company to invest in – it carries a lot of risks.

But there’re a few reasons to be a bull

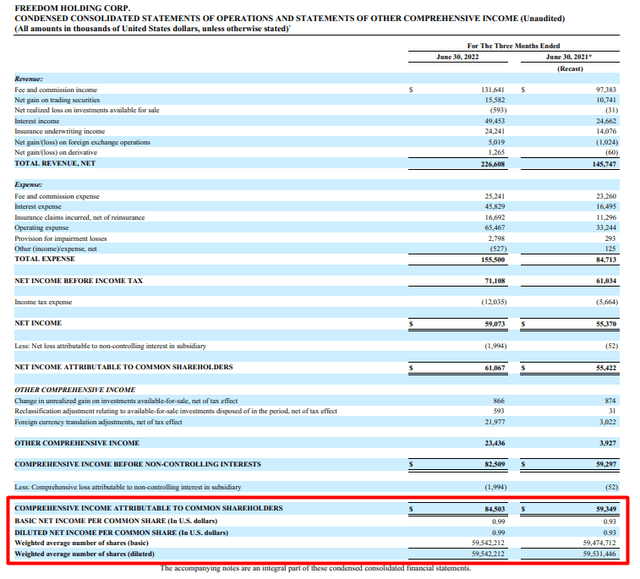

First, the company reported diluted earnings per share of $0.99 in the most recent quarter, not negative earnings of $1.66 as reported on Seeking Alpha. Revenues increased 55.5% YoY, but due to one-time expenses and an overall increase in operating costs, net income increased only 6.5% (YoY):

FRHC’s latest 10-Q, author’s notes

Second, the company is actively seeking buyers for its Russian subsidiary, which I mentioned above.

In light of the Russia/Ukraine Conflict, and the consequent U.S., UK and EU economic sanctions and Russian countersanctions, we are seeking to sell our interests in our two Russian subsidiaries, Freedom RU and Freedom Bank RU. Any transaction entertained by us to sell our Russian subsidiaries must comply with U.S. sanctions and related OFAC guidance, as well as Russian countersanctions, in effect at the time of the sale and any transaction related thereto. On August 5, 2022, Russia introduced a ban restricting the ability of investors from “unfriendly-states” to exit from investments in businesses in certain Russian industries, which could impair our ability to sell our Russian subsidiaries. Until such time as we are approached by a willing and able buyer, in a manner consistent with U.S. sanctions, we will provide financial support only for “maintenance” of our investment in our Russian subsidiaries consistent with our previously established practices and in support of pre-existing projects and operations in conformity with OFAC guidance concerning such activities. We will not engage in funding of new projects or expansion of pre-existing projects of our Russian subsidiaries.

Source: From FRHC’s latest 10-Q

The CEO himself has renounced his Russian citizenship and adopted citizenship of Kazakhstan, thus making it clear that his company has nothing to do with Russia. This approach will help the company to avoid being subject to U.S. sanctions, in my view. However, the subsidiary continues to operate, as of the last reporting quarter, because FRHC has not yet found a buyer.

Also, there is a risk of selling the asset for a pittance and losing money. It should be clear that the Russian branch generates about 24.12% of the holding’s total revenues and 27% of its total net income, which will hit the company’s future hard in case of an unprofitable sale.

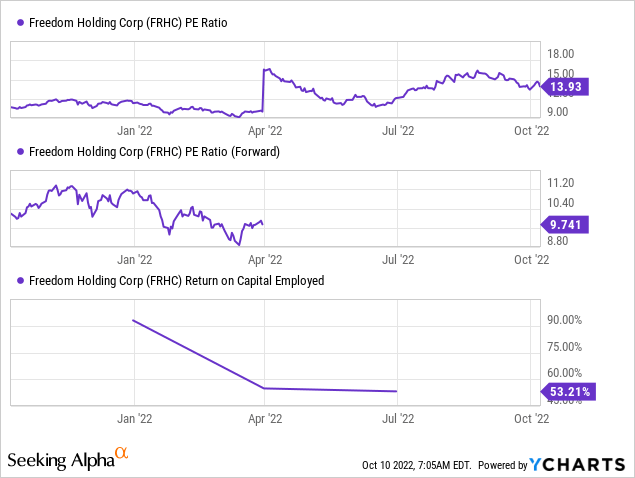

The third reason to be a contrarian is company valuation. FRHC stock is currently trading at 9.7 times the forward P/E while having a return on capital employed of over 53%:

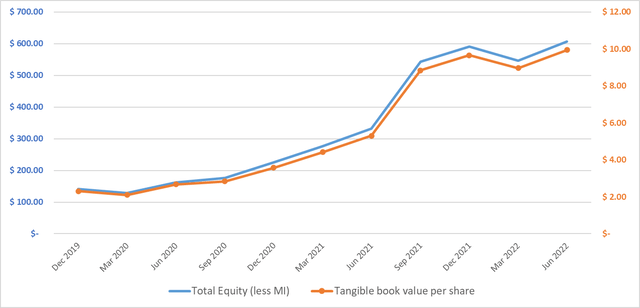

At the same time, tangible book value per share continues to grow as assets grow – intangible assets such as goodwill make up a tiny fraction, and equity makes up more than 16% of total assets, which is quite rare for the brokerage business (for example, for Interactive Brokers (IBKR), this ratio is just over 2%).

Author’s calculations, based on Seeking Alpha and FRHC’s filings

The last reason – the main pillar of my thesis – lies in the demographic trends created by the announcement of partial mobilization in Russia.

According to Wikipedia, on 21 September 2022, Russian President Vladimir Putin announced a “partial mobilization” of military reservists in Russia after facing setbacks in the Russian invasion of Ukraine, and signed the corresponding decree No. 647 “On the Declaration of Partial Mobilisation in the Russian Federation”.

Realizing the critical situation, a large number of young, economically active men rushed to buy airline tickets for the next flight to visa-free countries, driving up the price of the flights many times over. When the tickets ran out, they flocked to the land borders of neighboring countries – Georgia and Kazakhstan in particular. With Kazakhstan, Russia has the longest land border – in fact, it is the second longest land border in the world.

According to Kazakhstan’s officials, since the announcement of mobilization, more than 200,000 people have come to Kazakhstan – people who had the financial ability to live in another country for some time. Of these 200K, only 60,000 remained (most of the people used Kazakhstan as a transit territory).

However, for 19 million Kazakhs, this is still a huge number of people – I assume that most of those who traveled further still managed to open a bank card in Kazakhstan because Visa (V) and Mastercard (MA) are blocked in Russia (and you have to pay somehow for your further movement in the country or abroad).

In theory, this should bring FRHC and its peers a large number of new customers and thus boost their share prices. However, FRHC’s risks remain high – this company has been raising a lot of questions about its existing business practices for a long time.

Much of its success in 2020-2021 was based on giving its clients access to U.S. IPOs through a hedge fund owned by a friend of FHRC’s CEO (we do not know his name). One remembers how fast and rapidly that market grew then and how painfully it fell in 2022.

But there is another company – also from Kazakhstan, which deserves your attention no less. It is Kaspi.kz – a banking ecosystem that takes the lion’s share of the market in this country.

Why KASPI is a better choice from a risk/reward perspective?

Important note: Unfortunately, the OTC quote you see here is not liquid – AIX (Kazakhstan Stock Exchange) and London Stock Exchange (ticker “80TE”) have the most liquidity.

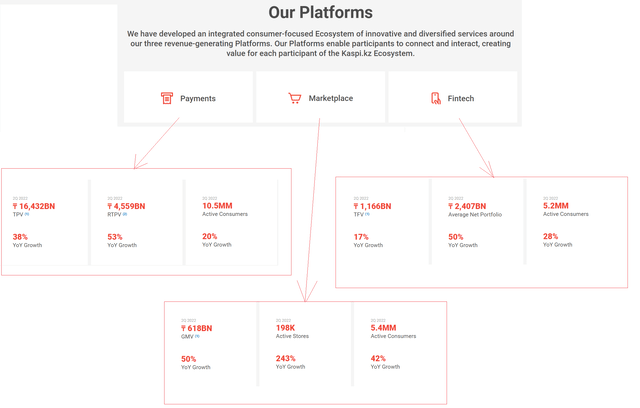

Kaspi Bank is an $11 billion commercial bank providing financial services in the Republic of Kazakhstan primarily through the online mobile app. This is not just a bank – it’s a full-fledged mobile super-app that combines many different functions, which you will learn about below. The company divides its activities into 3 segments:

| Segment | Description from the Kaspi’s IR |

| Payments | The Payments Platform enables customers to pay for regular household needs, make purchases online and in-store, and make seamless online P2P Payments within and outside Kaspi Ecosystem, both in Kazakhstan and globally to any Mastercard or Visa card. |

| Marketplace | Our Marketplace Platform is positioned as the starting point and destination for customer shopping journeys via our Mobile App, website, and in-store. Customers come to our Marketplace to buy a broad selection of products from various merchants. |

| Fintech | Through the Fintech Platform, we enable our customers to access consumer financial products primarily online through Kaspi.kz Mobile App. Our technologically-advanced infrastructure allows us to make a high-quality credit decision in real-time, usually within seconds, which ensures a seamless customer experience. |

Source: Author’s compilation, based on Kaspi’s IR

All of these segments taken together provide an incredibly large synergistic effect – we see this in the growth that each of them shows separately:

Author’s work, based on Kaspi’s IR

The marketplace is growing particularly fast – it’s something similar to Amazon. As the number of users in the Marketplace segment grows (5.4 million), so does the number of users in the Fintech segment (5.2 million), because, unlike Amazon, Kaspi allows its users to order any goods on credit or in installments in just a matter of minutes, thus increasing the turnover of both Fintech and Marketplace. Given the rather high inflation in Kazakhstan – 17.7% according to TradingEconomics data – the price increase is almost immediately passed on to end consumers, who find it harder to pay the whole amount at once, so they resort to credit over 6-12 months. In the long run, I expect this segment to grow as inflation increases in the country and the number of selling units in the marketplace expands. By the way, the sellers pay a 5% commission for each item sold, as one of them told me in a personal conversation.

The overall functionality of the super app is so extensive that it is impossible to cover it all in one article without exceeding 3,000 words. Therefore, I suggest you visit Kaspi’s official website IR and check out the latest quarterly presentation. In my opinion, the company’s data can be trusted more than FRHC’s data – in any case, Kaspi’s auditor is Deloitte, not a small boutique from Utah.

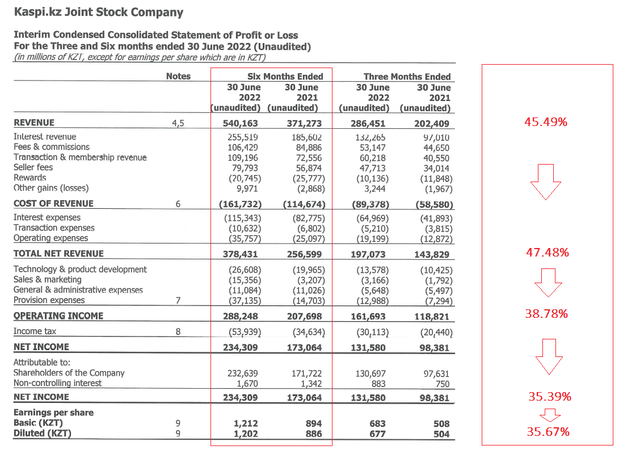

Let’s take a look at some key financial data.

Author’s calculations, based on Kaspi’s IR

Because of the complex revenue structure – the company is both a commercial bank and a marketplace – I consider “total net revenue” as gross profit (gross revenue minus direct costs). We see that gross profit is up 47.5% over the last six months (YoY) – ~200 basis points more than gross revenue. This tells us that the company is using cost optimization measures as it expands – or it is supported by a synergy effect (I wrote about this above) that allows Kaspi to spend less on the marginal unit of product/service sold.

R&D and marketing costs, however, did not allow this trend to be carried down the P&L report. EBIT increased by only 38.8% (YoY), while taxes led to a more modest 35.4% growth in net profit.

However, in my opinion, this was the result of a one-time event – during the protests in Kazakhstan in early January 2022, many bank branches and ATMs were robbed or damaged, for which the company had to spend 690 million tenges (~$1.5 million), which was booked under R&D costs. In addition, due to the general geopolitical situation, debt provisions more than doubled (from $29 million to $74 million), which also affected the financial statements.

However, it cannot be said that this has severely shaken the company. Tier 1 capital is still well above Basel 3 and has hardly changed since last year.

At the same time, the quality of loans issued remains good:

After all the events that have shaken Kazakhstan since the beginning of 2022, the willingness of retail investors to buy Kaspi shares has decreased – this is explained both statistically (from the company’s latest report for 1H 2022) and by the dynamics of the stock, which is down 43.86% on the London Stock Exchange.

However, the insiders are actively using this position – the CEO (Mikheil Lomtadze), who owns over 20% of all shares, continues to increase his stake, as does the very first shareholder, Vyacheslav Kim:

I believe Kaspi will feel the tailwind of the Russian mobilization I wrote about above. Yes, Freedom Holding is also likely to see more significant growth in new brokerage accounts, which was previously expected, but it is Kaspi that has every chance of growing revenue in absolutely all of its business lines.

Imagine a situation. A Russian young man of military age flees to the nearest country – Kazakhstan – to wait out the war or never return until the power regime in Russia changes. After going through customs and processing the necessary documents within the first 3 days, he has to think about where to look for an apartment, who to sell his car to (if he came with his own vehicle), how to pay in a store (Russian cards do not work), where to order furniture for a new place of residence, how to pay his bills, etc.

Surely he will ask the locals, his acquaintances, for advice and get a tip, first on Krisha (rental housing), then on Kolesa (car marketplace) – the largest marketplaces of their kind, 100% owned by Kaspi. After selling the car – generating revenue for Kaspi – he gets in a taxi and drives to the newly rented apartment, which in turn generates revenue for Kaspi. Many business services of the company are monetized along such a chain – this is a kind of Alibaba, only not from the East, but Central Asia. Therefore, even 60,000 people, which is now likely to increase, can create quite a bit of value, which is in full swing as I write this article.

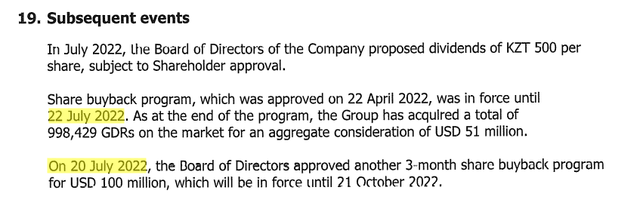

In addition, Kaspi has an idiosyncratic upside potential, namely a share buyback program that is now in full swing. It has been approved since July 20 and will expire at the end of October – to date, shares are up > 36% since the program was approved (in just 3 months). The S&P 500 Index (SPX) and the FTSE Europe (VGK) fell 7.7% and 11.43% respectively over the same period.

The program is about to expire, but Kaspi’s stock is still 60% off its November 2021 high, which means that management is very likely to approve another program – this has already happened after the previous program ended:

Kaspi’s 1H 2022 results, author’s notes

Kaspi’s valuation

Let us assume that the median revenue growth in the next few years (until 2028) is 32.5%, while last year’s growth is set to be only 15.2%.

The cost of sales will be 30% across all years, EBIT margin will gradually decrease (from 68% in 2023 to 63% in 2028). ROE will also gradually decrease (by 2% per year).

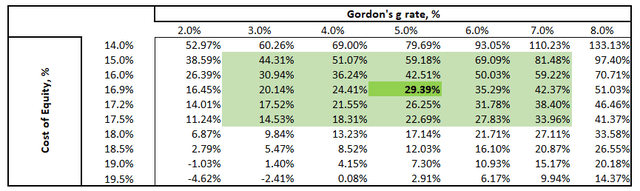

Considering the very high risk-free interest rate in Kazakhstan (15.2%) as well as Damodaran’s country premium (1.88%), Kaspi’s WACC with its capital structure amounts to an astronomical 16.95% (a beta below 1 saved the company from an even higher increase in WACC).

But even with such a high WACC, Kaspi has an upside potential of 14.5% to 81.5% according to my DCF model:

Risks and Bottom Line

I am not worried about a new possible protest in Kazakhstan – experience has shown that this does not do as much damage as many expected. I am also not afraid of an attack from Russia – as in the case of Ukraine. Kazakhstan is actively approaching China – Xi Jinping recently said that he would protect Kazakhstan no matter what.

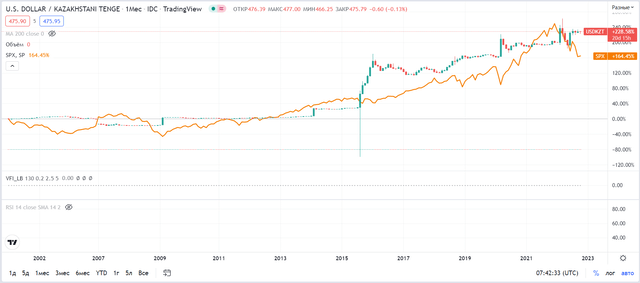

I am more concerned about currency risk – the USDKZT has outperformed the SPX in recent years in terms of “price returns” so to speak:

Kaspi generates all its revenues in Kazakh tenge. The company must therefore grow much faster than the USD/KZT exchange rate appreciates – only in this case does investing in the company make sense.

However, one must remember that Kazakhstan is a commodity country – most of the state budget is tied to the price of oil and gas. Now that we are facing a commodity super-cycle, there is a chance to see a fairly stable exchange rate in the coming months – this will allow foreign investors more potential income as Kaspi’s tenge operations grow.

Based on all of the above, Freedom Holding receives a Hold rating due to its risks. Kaspi is a Strong Buy at its current price.

Happy investing!

Be the first to comment