Andreas Rentz/Getty Images News

Investment thesis: Shell (NYSE:SHEL) is faced with dwindling upstream reserves and production, thus it is making a big push into green energy in an effort to try to make up for the impending loss of revenues and profits from its oil & gas sector. The very obvious question that arises for long-term investors is whether Shell can continue to support its current market cap, while increasingly relying on revenues and profits stemming from its growing green energy business. Based on what we know about Shell’s largest green energy project, which is set to produce 60,000 kg of hydrogen per day by 2025, the task seems to be impossible. In other words, as Shell’s hydrocarbon production and refining business winds down, the company is likely set to shrink dramatically. In the short-term, Shell investors can still benefit from any further oil & gas price rallies. A longer-term hold strategy however may be a very risky proposition.

Shell’s current stellar earnings are a reflection of its still sizable upstream and refining sectors, as well as a perfect LNG market scenario for producers

Given the energy price spike we witnessed in the second quarter of this year, it should come as no surprise that Shell posted stellar financial results for the quarter. Despite a 14% Y-O-Y drop in oil & gas production for the first half of the year compared with the first half of 2021, the higher commodity price helped Shell to a profit of $18 billion in the second quarter of this year, compared with just $3.4 billion in Q2, 2021, and $7.1 billion for Q1, 2022. The upstream segment saw a net profit of $6.4 billion. LNG played a significantly more important role in ushering in the stellar quarterly financial performance, with the net profit from the segment coming in at $8.1 billion. Renewables were still in loss territory, with a loss of $173 million for the last quarter, and a loss of $1.7 billion for the first half of the year.

The stellar recent financial results went a long way in helping to reduce debt levels from $65.7 billion in Q2, 2021, to $48.5 billion for the latest quarter. This long-term trajectory of debt improvement is perhaps the most crucial factor that may help Shell to transition to a mostly green business profile this decade, even as the renewables sector continues to hemorrhage money.

Shell’s largest green hydrogen plant, which is also the largest such project in Europe at the moment will replace about three days’ worth of current upstream revenues that Shell gets from oil & gas

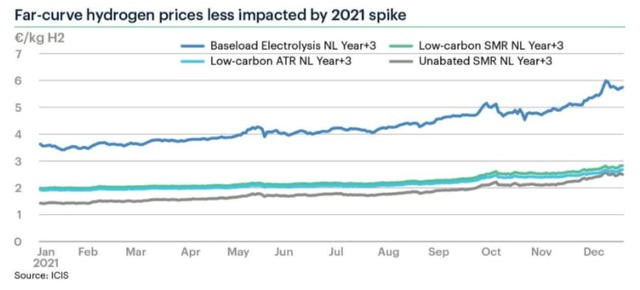

Shell made a decision earlier this year to build Europe’s largest green hydrogen plant in Holland, which will have a capacity to produce up to 60,000 kilograms of hydrogen per day when the project will be completed in 2025. Just so we can get a better understanding of what this means to Shell’s bottom line, as well as in terms of other considerations, we should start by looking at the current and expected price of hydrogen.

There is some uncertainty in regard to how much a kilogram of hydrogen will fetch on the market in 2025 in Europe, but recent forward contracts might be a decent indication. For the purpose of this article, I opted to use the average between the forward price of around 6 euros/kg, and recent prices which have been spiking to about 23 euros/kg, which yields an average of about 15 euros/kg. Given the price assumption, the 60,000 kg of daily production from Shell’s future facility will amount to about 330 million euros in revenues per year that Shell will see from its largest hydrogen production facility.

By comparison, assuming average oil & gas prices this year, and the production volume available for sale of 1.9 mb/d of oil equivalent, Shell will earn those 330 million euros in revenues in about three days from its upstream this year. I should note that this volume does not include gas sold in the form of LNG, which is counted in the integrated gas segment of the business. There is always uncertainty in regard to what price the hydrogen will actually be sold at. One limitation I see in this regard is the energy content value. One kilogram of hydrogen contains as much energy as almost three liters of gasoline. The long-term cost of hydrogen should therefore be not much more than that of gasoline. In the case of Europe, it is currently close to 2 euros/liter at retail. My choice of using an assumption of 15 euros/kg is therefore probably very optimistic, but as always, time will tell.

Shell’s other green initiatives will at most replace a small fraction of the current oil and gas-based business volumes

There are other green initiatives that Shell is investing in, such as EV charging stations. We have to assume that business from those stations will at most replace declining business from its current gas stations. Many of those stations will either be transformed into EV stations or they will become dual stations.

Shell’s green transformation goals (Shell)

Shell is also entering strongly into the renewable power generation business, in addition to installing wind & solar capacity needed for electrolysis projects meant to produce hydrogen.

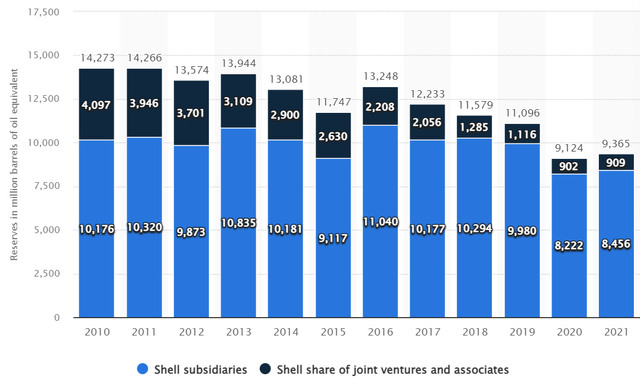

Shell’s upstream sector is set to continue shrinking at a blistering pace, given divestments as well as reserves that are already low, with only 7-8 years of reserve life currently, as the chart above shows. Its downstream activities are likely to see a decline as well, due to a variety of reasons. Some facilities may be sacrificed due to political pressures for Shell to curb its emissions. Other facilities, especially in Europe may have to be scrapped, mostly because the oil & gas needed as feedstock for those facilities may become unavailable in the face of the continuing EU-Russia economic divorce, as well as other factors.

The prospective revenues and hopefully profits from Shell’s green investments do not seem to come close to matching the magnitude of the oil & gas business that is being shed this decade. The only sector where there are real prospects of business volumes being replaced will be in the marketing sector, in other words, gas stations, that will increasingly become EV charging stations. Energy generation, including wind & solar power that Shell will feed into grids around the world, as well as its green hydrogen production, will not come close to replacing the oil & gas production that is being lost, in terms of revenues, most likely profits as well as in terms of energy volumes. Putting its largest planned hydrogen production facility within context illustrates this fact in my view. It would take about 100 such plants to replace Shell’s current upstream production. There are no green projects that seem to match the downstream displacement that will most likely take place, regardless of its magnitude, so whatever revenues & profits will be lost from that segment, there is nothing in Shell’s green pipeline to replace it.

LNG remains Shell’s only bright spot, but even there, there are possible challenges that may arise

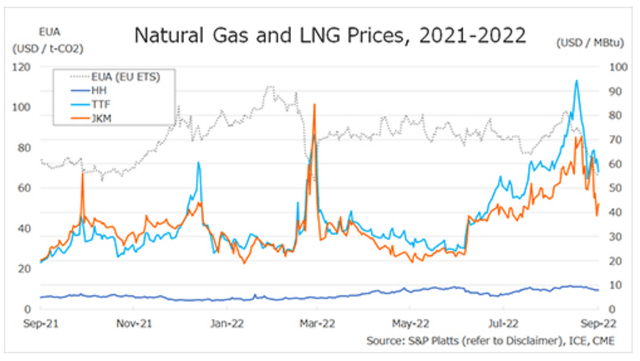

Shell sold the equivalent of .944 mb/d in LNG in the second quarter of this year. Its profitability, which I already highlighted is in large part a reflection of the massive surge in LNG prices we have seen in the past year or so.

Perhaps this year will be known as the best year ever for the global LNG industry. Everything is going in its favor. Europeans are bidding up the price as high as it is needed in order to price out other LNG customers such as India & Pakistan. Some LNG providers are even willing to pay the penalties for not delivering on their long-term contracts in order to sell into the EU market. At the same time, the regional price difference between certain natural gas markets is wide enough for LNG producers to be able to profit from turning gas into compressed, frozen liquid in one market, transporting it on a ship then selling it in another regional market.

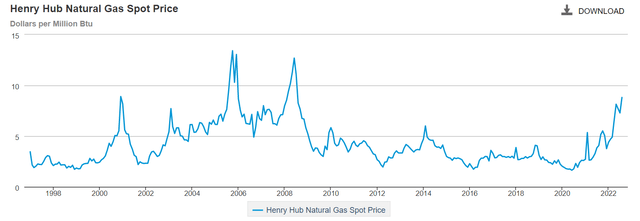

At some point, LNG will become a victim of its own success. The more LNG trade expands, the more interconnected regional markets become, leading to a narrowing of regional price differences. We are seeing this effect with US natural gas prices, where a surge in LNG demand from Europe that started a year ago, led to a significant rise in US natural gas spot prices.

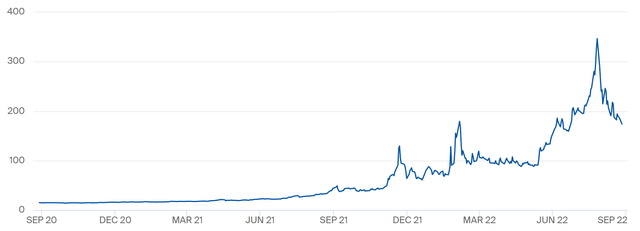

The natural gas prices we are currently seeing in the US are the highest since the beginning of the shale boom almost a decade and a half ago. It corresponds to the beginning of the natural gas price spike in the EU.

EU TTF natural gas spot price (ICE)

The magnitude of the increase is not anywhere as dramatic, but the correlation is certainly there. The more we connect the two markets with LNG shipments in the future, the closer the prices will be and the correlation and magnitude of price changes will become ever more pronounced.

Eventually, as prices across the increasingly connected regional markets will converge closer to each other, LNG profitability will most likely suffer. It will still be profitable for most companies, but we should not expect to see the profitability levels we are currently seeing. Shell’s own LNG profit bonanza of this year will not last either. With wise strategies in place, it can remain profitable and could expand, but profits will gradually decline from current levels.

Investment implications

For the shorter term, Shell will continue to profit from high energy prices, wide regional natural gas price disparities that translate into healthy LNG profits, as well as its current petrochemicals industry footprint. With upstream production declines likely to reach double digits percentage-wise in most years, just like this year, its upstream revenues and profits will evaporate fast with every year that passes. There is also a risk of it losing a sizable portion of its petrochemicals sector. The only current major oil & gas sector in Shell’s portfolio which is set to maintain business volumes and perhaps even expand in the future is LNG.

Shell is evidently betting on its green energy sector to fill the gap. As I already pointed out, its largest green hydrogen project, which is also set to be the largest such project in Europe will only amount to a drop in the bucket in terms of revenues, compared with the revenues it is currently getting from oil & gas production. While it is not the only project and I am sure there will be many other similar projects, we are unlikely to see Shell ramping up such projects to the levels needed to replace the revenues it is set to lose from its upstream oil & gas sector shrinking severely going forward. Even if revenues will eventually be matched, profits will likely not be matched. Shell’s current renewable segment continues to lose money. While there may be plenty of room for improvement in regard to green energy profitability, I doubt it will ever bring Shell the kind of profits it raked in from its oil & gas production activities.

Shell’s revenues, profits, and therefore its market cap are all set to shrink together with its embattled upstream oil & gas production. Shell’s dividend will also suffer cuts going forward, although it is not an imminent issue by any means. LNG & green energy should help to partially offset those revenue and profit losses, but Shell is nevertheless set on a path to becoming a much smaller company. The potential implication for long-term investors is a risk of seeing part of their investment shrink together with the company.

Be the first to comment