Joe Raedle

Company Overview

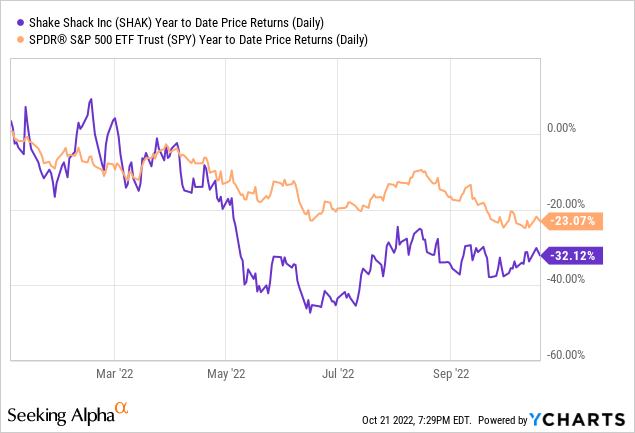

Shake Shack (NYSE:SHAK) is an American fast casual burger and hot dog chain that began in New York City. Shake Shack has had more than 350+ locations since 2021, and the company has an international presence, ranging from Korea, Turkey, Middle East, and Japan. Shake Shack completed its IPO in 2015 at $21 per share, raising $105 million from the sale. Since then, shareholders have reaped the benefits of the chain’s robust growth and popularity as the share price has more than doubled. However, this year has been a poor year for Shake Shack investors, as the company lost -32.1% year-to-date, compared to S&P 500’s decline of -23.1%.

Q2 Earnings

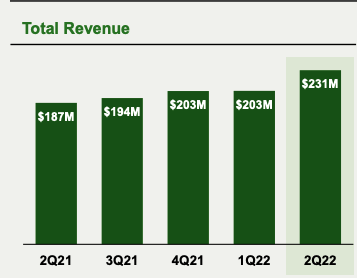

Shake Shack reported robust earnings for Q2, reporting a 23.1% year-over-year increase to $230.8 million. In that same time frame, same-Shack Sales (a measurement of same-store sales) grew by 10.1% which is a good demonstration of the continued strong franchise of the business and strong demand for its products. Shake Shack also opened up two drive-thrus in the quarter, and management signified that the drive-thru will be important for expanding the business. In addition, the company has continued to open up new stores, and management has estimated an opening of 35-40 stores this year, which is a 10% increase from last year. Furthermore, digital sales percentage of total revenue has remained consistently high, hovering at 38% for Q2 2022. We believe the strong digital penetration is a good indicator of the company’s long-term business prospects, as it is easier to upsell products and market its product once customers are using the digital platform. Overall, Q2 earnings have been great for investors in key metrics.

Q2 2022 Highlights

Margin Expansion Opportunity

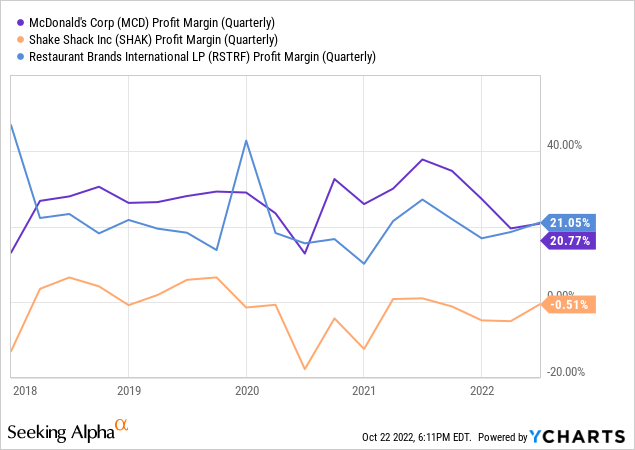

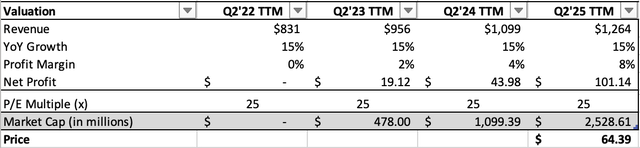

Shake Shack has a negative profit margin, as the company focuses on top line growth more so than growth in the bottom line. We believe that as Shake Shack tapers down its growth plans, shareholder value will increase from margin expansion, as the company cuts costs and pushes to derive higher margins from its business endeavors. For example, the current net profit margin of Shake Shack is hovering below 0% and having small negative earnings. Meanwhile, more mature companies like McDonald’s (MCD) and Restaurant Brands International (QSR) (owner of Burger King) have a net profit margin of ~20%, which we believe should be the target net profit margin of Shake Shack. Given that Shake Shack has an operating profit margin of 18.8%, we believe that the company can improve its net profit margin by cutting costs and improving efficiencies. Overall, we believe it makes sense for Shake Shack to focus on top line growth, and we think that the next step for the company will be to improve margins and derive a higher profit to boost shareholder value.

Valuation

We base the valuation of Shake Shack based on improving net profit margin story and higher revenue growth as the company continues to expand international presence and increase same-store sales. We base our valuation starting with the Q2 2022 TTM revenue, and project out the YoY growth rate along with an expansion in the net profit margin. Based on our assumptions of 15% YoY growth over the next three years (less than the historic revenue CAGR), along with a target net profit margin of 8% (still far below the net profit margin compared to McDonald’s and Restaurant Brands International), we derive a valuation of $2.5 billion using a 25x P/E multiple, which represents a ~27% upside from current levels. As the company continues to grow its margins, we believe shareholders will see high capital appreciation after the forecasted time period as well.

Risks

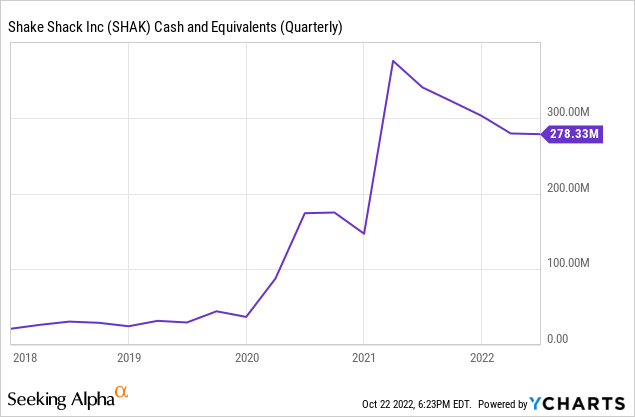

As a consumer discretionary company, Shake Shack is exposed to downside risks stemming from a downturn in consumption among the U.S. and international consumers. Similar to other industries in the sector, we believe that higher inflation and a weaker economic environment can hurt consumption overall, which would directly impact the number of consumers who choose to spend on Shake Shack’s foods and other products. Nevertheless, we believe Shake Shack’s popularity and strong brand value will provide competitive advantages that will keep consumers coming back to the product and there’s ample research to suggest that fast food chains operate in a recession-resilient environment. Furthermore, the company has $280 million in cash on hand, which is more than 10% of its market capitalization. With robust revenue growth and cash generation, we do not foresee any liquidity risks that stem from their balance sheet.

Conclusion

Overall, we believe Shake Shack remains a good growth story that can provide earnings growth as the company’s top line expands along with an improvement in the company’s margins. Recent results show that the company is doing a good job expanding international presence, and finding strong growth in the digital segment along with sales on a same-store basis. Our valuation also shows that based on reasonable margin expansion and revenue growth, our fairly conservative model shows a substantial upside of 27% for the stock.

Be the first to comment