smshoot/iStock via Getty Images

Company Overview

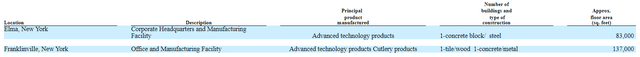

Based in Elma, NY between Buffalo and Rochester, Servotronics (NYSE:SVT) consists of two businesses. The larger and more valuable of the two is its Advanced Technology Group [ATG]. The business engineers and manufactures servo controls for the world’s largest commercial aircraft OEMs. Servo control components allow a central device to run several smaller motors in sync to produce precise actions. Think industrial automation. Currently, though, Servotronics’ primary market is in commercial aerospace. The company’s servo-control components and sub-systems are spec’d and manufactured for OEMs like Boeing and Airbus. The company also touts Gulfstream, Apache, Blackhawk helicopters, and Abrams Tanks as customers. The ATG segment historically accounts for about 78% of revenues.

The lesser Consumer Products Group [CPG] business manufactures cutlery, bayonets, combat knives, and hatchets for recreational campers, survivalists, and military customers. The segment also sells scalpels and other surgical-edged products to healthcare customers. It makes up the remaining 22% of overall revenue. Though revenue has been stable over the years, it has suffered negative yearly earnings since 2010. But the segment’s days may be numbered.

Investment Thesis

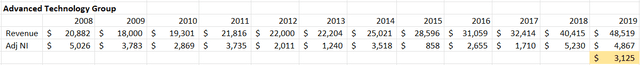

Aircraft technological advancements over the years have been great for business. Commercial aircraft OEMs rely on the company’s servo control systems to perform an increasing number of automated operations. The segment’s 2009 revenue was $18 million and grew each year to $48.5 million in 2019 before the pandemic.

Since then, however, a few things have negatively affected the business. First, Boeing airplanes crashed in 2018 and 2019, and the company had to pull back on production until it recently resolved its internal issues. The bigger issue, of course, was that COVID-19 halted an unprecedented number of flights and new aircraft shipments for several months.

2021 and 2022 have been recovery years for commercial aircraft makers. For instance, Boeing delivered 157 aircraft in 2020, 340 in 2021, and 277 through August 2022. Over the next several years, Boeing should approach its pre-crash 2018 delivery level of 806.

Airbus delivered an all-time high 863 aircraft in 2019. The 611 that it delivered in 2021 is a notable improvement from the 566 it delivered in 2020, and it has already delivered 382 this year. Plans include about 780 deliveries by 2024.

Like other aircraft suppliers, Servotronics engineers its products to each aircraft design, and the FAA approves those designs and their suppliers before production can commence. Each supplier must also be certified. Servotronics’ trusted engineering history and certification provides barriers for competing companies. In addition, aircraft OEMs are compelled to take on the risk of switching to a competitor to save a few bucks on such a small budget part like servo-controllers.

Catalysts

At arm’s length, Servotronics looks much like it did over the last 10+ years, while the stock has barely moved over that time. So, investors may ask: Why would the market realize the stock’s value now? Several items that could close the valuation gap over the next few years are currently in motion.

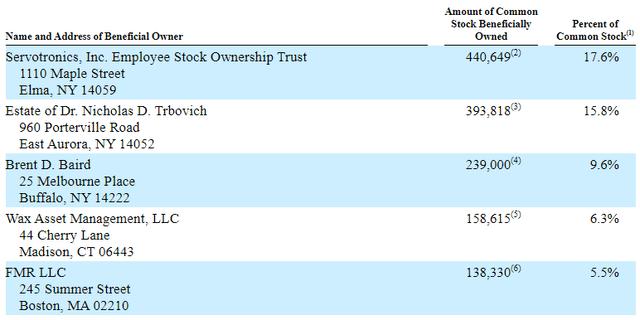

First of all, there are multiple activists involved in the stock. Each varies in its level of public disclosure and involvement. First is Wax Asset Management, which has owned the stock for years, most recently bought more shares on May 20, 2022, at $10.88. The stake represents 6.4% of the company.

Star Equity, which holds an undisclosed stake, has been more public in its attempts to make changes at the company. In a March 2022 filing, Star expressed concern over the board of directors’ support of an abusive former CEO (more on that later), an existing poison pill, and the unprofitable CPG segment.

In a September 2021 filing, Brent D. Baird disclosed a 5.1% interest in the company. Baird served as president and CEO of Buffalo, NY based Merchants Group before it went private. He also served on the board of directors of M&T bank for 37 years, where he oversaw its 24 acquisitions before he retired in 2020. Considering his history in the Western New York business community, he’s likely very familiar with Servotronics. Though Baird says he’s a passive investor, he increased his position to 9.6% according to an April 2022 filing.

But it appears the wheels were already set in motion in 2021. In June, then-CEO Ken Trbovich was placed on administrative leave after an internal investigation revealed several counts of sexual harassment and misuse of company expense accounts. Shortly thereafter, shareholder Montana Advisors issued a letter to the board demanding a sale of the entire company to the highest bidder. A complete sale hasn’t materialized, but significant changes ensued.

Trbovich resigned in December, right before a board meeting that may have scheduled for his dismissal. In March of 2022, Star submitted nominations to the board. By April, the company appointed Bill Farrell as its new CEO and board member. Less than a week later, Servotronics appointed Evan Wax of Wax Asset Management to the board as a shareholder representative and Karen Howard. Howard recently retired from Kei Advisors, specializing in investor relations and shareholder engagement. Those are traits desirable to activists trying to raise awareness of the stock, which Servotronics completely lacks. In addition, the company terminated its poison pill, freeing it to sell all parts of itself, which leads to the next catalyst.

Now that the board has been refreshed, the CEO replaced, and the poison pill eliminated, the sale of the entire company or certain assets has become a genuine possibility. One potential outcome is a sale of the CPG segment, which Star made a point of emphasis. Though the company has accumulated losses over the years, a long list of strategic buyers would likely be interested in buying just the book of business. The company also has about $147,000 in NOLs. I presume they are associated with the CPG segment, which might also garner interest from a buyer.

A sale of the entire company is also a potential catalyst. I believe the ATG segment could command a significant haul compared to the company’s current market cap. Though banking on a sale of the entire company may be a stretch, it’s interesting to note that Farrell and certain executives were given an Executive Change in Control Severance Plan in tandem with Farrell’s hiring. The plan bonuses the executives their annual salary and prorated cash bonus times an ‘Applicable Severance Multiplier.’ Servotronic hasn’t made the multiplier publicly available, so we don’t know how strong the incentive is. So, it might be wise to consider one final catalyst.

Servotronics has historically provided very little in the way of investor relations. They haven’t done quarterly calls or investor presentations, and management is tough to get ahold of (at least for me and, apparently, Star Equity, according to their filings). But they do issue quarterly press releases. Farrell mentioned entering new markets in his first two quarterly press releases.

“The Servotronics team is focused on delivering on our growth and improving processes while we explore new opportunities for current products and new offerings. Servotronics is positioned very well for expected top and bottom line growth in existing and new markets. It is a great time to be part of the team!”

The sentiment was again highlighted in a recent letter to stakeholders written by Farrell on November 1, 2022. The letter stated that the board of directors and the leadership team have established and is currently executing a new strategic plan, which includes exploring new markets:

“Building on the strong foundation of the Company, our strategy focuses on delivering quality products, on time to our existing customers while exploring new areas for applications of our technologies.”

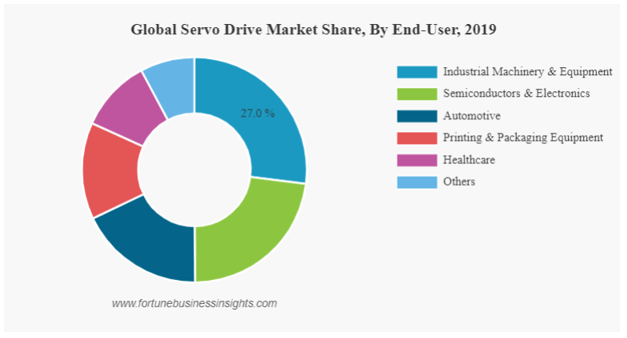

Yes, we’ve all heard fanciful growth projections and exaggerated TAM estimates. But custom-engineered servo-control systems apply to many end markets, including automotive and industrial automation. Servotronics, history in the highly regulated aerospace industry should lend some credence to the RFP process for new business in new markets. Autonomous driver assist systems, electric vehicles, and industrial robotics need torque motors in which Servotronics specializes. These applications are also significantly larger segments of the servo controller market and arguably faster growing than aerospace.

Fortune Business Insights

Risks

The CTG business continues to lose money. Though it appears the activist investors have garnered significant sway in Servotronics’ affairs and seemingly want the segment gone, that doesn’t guarantee it will happen. The company could sell it for a meaningless amount or even run it off. Closing shop would likely create restructuring charges related to severance, remaining obligations, etc.

Servotronics conducts no quarterly calls or investor presentations and lacks an IR department or partner. The situation does not pose a risk to the business, but it could turn off some potential investors. My gut tells me that they might soon become more open with investors, given the new shareholder representation on the board.

Boeing has been under incredible scrutiny from the FAA regarding its at-fault crashes. The company suspended delivery of its 787 Dreamliner twice in less than a year, but deliveries have resumed. In addition, its 777 program was expected to make its first deliveries in 2023, which has been pushed back to 2025. Instances like this could continue before Boeing completely satisfies regulatory scrutiny.

The airline industry is booming right now, but it also suffers from a shortage of pilots and labor. This situation could prevent the OEMs from reaching normal deliveries in the near term, but planes and parts still need to be replaced over time. Further alleviating the risk is that Airbus continues to ramp up production. During 2021, the company produced about 40 jets per month and finished the year at 45. They’ll be increasing the rate to 65 jets per month by early 2024.

15.8% of the voting shares are held in under the Estate of Nicholas D. Trbovich. Nicholas Trbovich founded Servotronics in 1959. Executors of the estate are Michael Trbovich and possibly disgruntled former CEO Kenneth Trbovich. Though Institutional investors, including the company’s Employee Stock Ownership Trust (votes allocated to employee shareholders), hold more voting shares than the Estate, it may choose to vote against management actions requiring shareholder approval.

Servotronics’ stock is a microcap stock with limited liquidity. At the time of this writing, the three-month daily volume was about 3,600 shares or $39,600 per day. Please trade carefully!

Valuation

The catalysts mentioned above vary in their effect on the company. For instance, the activists certainly have already left their mark on the company. Star’s desire to part with the CPG segment would indicate there is a strong likelihood that will happen. On the other hand, entering new servo controller markets will be difficult and may not happen right away, if ever.

I think valuing the company based on its current assets and being honest and conservative regarding future catalysts is important. So, let’s start with the company’s hard assets. Servotronics’ second quarter balance sheet ($35m stockholder equity) contained $5.1 million in cash and $636,000 in debt (all fixed-rate amortized). Let’s call it $4.5 million in net cash. In addition, the company owns the two buildings which house the two businesses, which total 220,000 square feet.

The average annual rent per square foot on similar industrial properties in the area between Buffalo and Rochester, NY, where the properties sit, is ~$6.60. At that rate, Servotronics buildings could generate $1.452 million ($6.60 x 220k SF) in rent. For valuation purposes, a cap rate of 6% would imply the buildings are worth roughly $24.2 million. Add the net cash, and we get $28.7 million. The cash component will change over time, but as its stands, the company’s hard assets are worth more than its $26 million market cap!

I’m not suggesting the company will monetize the properties. But, because the business is normally profit-generating, it doesn’t deteriorate the value of the assets and sets a baseline for the company’s value. It’s also important to note that the company’s share count has been consistently around 2.5 million shares, implying the hard asset value is $11.48 per share. Modestly above the ~$11 per share, the market is offering at the time of this writing.

Base Case

A base case for the company looks more favorable. From 2008 through 2019 (including the Financial Crisis and excluding the once-in-a-lifetime COVID beleaguered 2020 and 2021), the ATG segment produced an average segment net income (adjusted for arbitration expense in 2014 and an associated insurance claim in 2015) of $3.125 million.

Author constructed chart. Source: Company Filings

If we apply a pedestrian 16 times earnings multiple to our normalized earnings estimate, we come to a valuation of ~$47 million for the ATG segment.

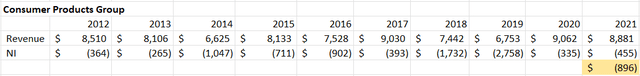

Since the sale of its Queen Cutlery subsidiary in 2011, the CPG segment produced average annual losses of ~$900,000. I’ve read many write-ups that ‘assign zero value’ to lesser segments in situations like this. I don’t think that’s fair because losses can siphon value from a profitable segment. So, if we assume that CPG continues to lose money at our estimate of normalized returns for five years before it is sold or liquidated, it could drain $4.5 million ($900,000 x 5) of the value of the ATG segment.

Author constructed chart. Source: Company Filings

Taken together, the value of the two businesses (including corporate overhead) is roughly $42.5 million. The base case implies the stock is worth ~$17 per share or 55% above today’s price.

Bull Case

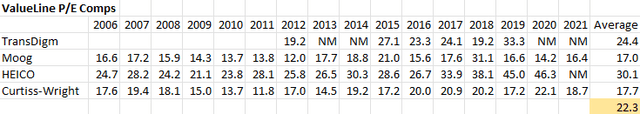

In a bull case, some catalysts play out in the shareholder’s favor. If the ATG segment recovers from the pandemic slowdown and picks up some business in new markets, it’s certainly not out of the question that normalized earnings buoy to the $5 million it produced in 2018 and 2019. If a successful IR campaign can raise awareness of the growth, it could conceivably command a 20 times earnings multiple, which is still lower than long-run comparable Average Annual P/E Ratios from ValueLine.

Author constructed chart. Source: Value Line

That would imply the business would be worth $100 million ($5m earnings x 20). Interestingly, Mr. Farrell worked at Moog for 30 years.

I don’t think it’s a stretch that the company can find a strategic buyer for the CPG segment that buys the book of business and brings production in-house using excess capacity. The segment’s book generated about $8 million in revenue from 2012 to 2021. If Servotronics can get even one times its normal revenue, the segment is worth ~$8 million.

Taken together, the value of the two segments (including corporate overhead) is worth $108 million ($100m + $8m) or $43 ($108m / 2.5m shares) per share. Our bull case implies a 295% premium over today’s price.

Actionable Conclusion

The case for Servotronics is one with minimal downside and a range of potential positive outcomes. With the downside protected by hard assets and normalized earnings, the upside will depend on how the several catalysts play out. With activists already entrenched in the company and an experienced new CEO, I think there is a good chance they will address catalysts in the coming quarters and years.

Be the first to comment