TennesseePhotographer

Investment Thesis

Tractor Supply Company (NASDAQ:TSCO), the rural lifestyle retailer headquartered in Brentwood, TN, is scheduled to report Q3 2022 earnings before market open on October 20. In 2022, the market has pummeled a lot of stocks post earnings release, and if TSCO too falls prey, it may be an opportunity to pick up shares for a more reasonable valuation.

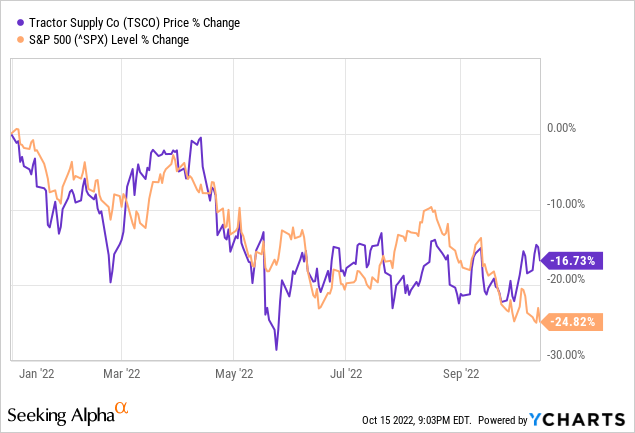

TSCO has held up quite well in 2022, with shares down 17% compared to the S&P 500’s slide of 25%. I think TSCO’s relative strength has been bolstered by its strong operating results and business fundamentals. TSCO has a long history of financial outperformance, and I’ve been waiting for an opportunity to pick up shares at a lower valuation. At TSCO’s current price of $200, shares don’t offer a large enough margin of safety to entice me to take up a position.

However, if the market overreacts to TSCO reporting slimmer gross margins or, better yet, guiding down for full year 2022, investors may consider this an opportunity to pick up shares of this quality compounder.

Long History Of Growth

TSCO originally caught my eye after showing up on one of my favorite stock screens. A quick look at the Income Statement and you can see the screen didn’t give a false positive.

TSCO has a long history of growth in revenue and earnings, pays a dividend, and repurchases shares. The company’s repurchase program isn’t a ploy to net-out Stock Based Compensation (‘SBC’) either, which is one of the practices I despise most. TSCO’s program actually reduces the total number of shares outstanding, which, coupled with the dividend, shows the company is friendly toward shareholders.

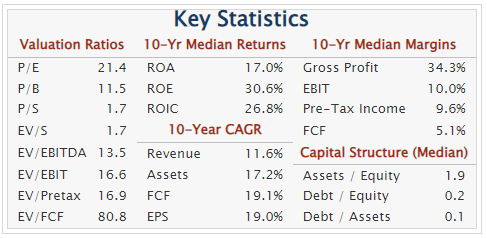

Over the past 10 years, TSCO has compounded revenue at nearly 12% and EPS and FCF at 19%. Those are enviable results by any measure. While past performance isn’t indicative of future results, it can certainly help establish expectations. After all, what’s that saying about an object in motion staying in motion?

TSCO 10YR Metrics (Quickfs.net)

Guiding For Continued Growth

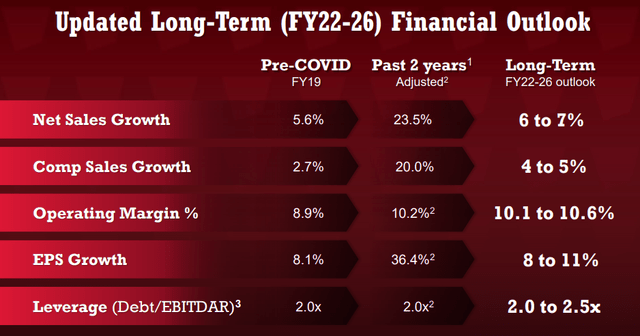

It’s TSCO’s past performance that gives me confidence management can deliver similar results in the future. That’s why I’m excited about the company’s long-term financial and capital allocation targets, which management shared with investors during the Q4 2021 Enhanced Earnings event on January 27.

TSCO Financial Outlook (TSCO IR Website)

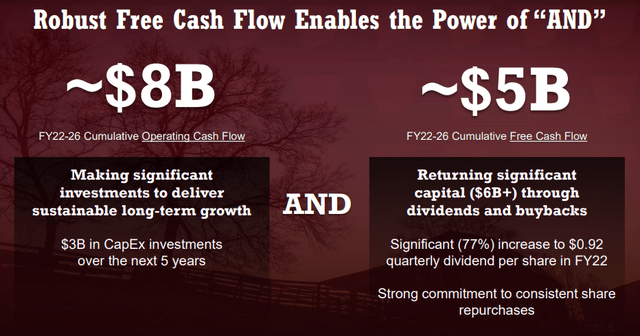

For a stock to make for a quality investment, I’m a firm believer the company needs to show friendliness toward shareholders. Two common ways they can demonstrate this is through dividends and share repurchases.

There are a lot of companies out there who mask SBC with share repurchases. PayPal (PYPL) is an example. PYPL’s share repurchase program does little more than net-out share dilution from SBC. I’m happy to report TSCO isn’t such a company.

TSCO Financial Outlook (TSCO IR Website)

A Resilient Business

It’s no secret the economy is on the brink of a recession, or may already be in one. Inflation is sky high, the Fed continues to raise interest rates, and there’s an ongoing war in Ukraine. Consumers and businesses alike are pinching pennies and looking for ways to reduce spending. This has sent many consumer discretionary stocks to 52-week lows.

TSCO is often thought of as consumer discretionary, but, in reality, it more closely resembles a consumer staple. According to management, only 15% of the company’s revenue is considered discretionary, which means some 85% of revenue is needs-based.

Here’s what CFO Kurt Barton had to say during TSCO’s Q1 2022 earnings release:

Our business continues to be strong in a needs-based, demand-driven versus the discretionary. And as you’ve heard from us in the past, while there is some less needs-based discretionary, the discretionary piece of our business is fairly consistently been a low percentage, roughly like 15% of our business, we’d attribute to those more discretionary pieces of it.

This helps explain TSCO’s relative strength in the bear market of 2022. Because such a large portion of TSCO’s business is needs-based, I have greater confidence the company will come through the current macroeconomic environment mostly unscathed.

Valuation

I lament not picking up TSCO back in May when shares were trading near $170. I’m inclined to believe TSCO won’t get any cheaper than that in 2022. I’m also inclined to believe TSCO is one of those stocks that consistently trades at a premium, similar to Ulta Beauty (ULTA) and Costco (COST). This is because, from a valuation perspective, TSCO appears fairly valued, if not overvalued.

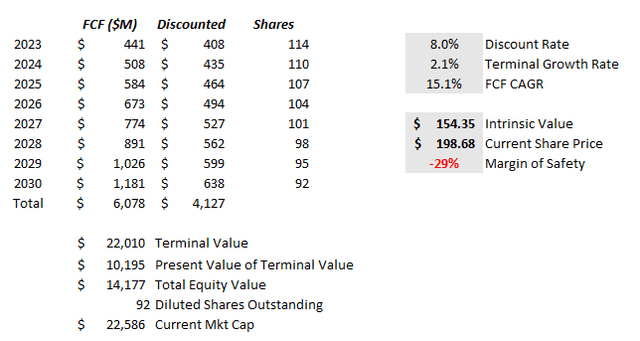

I performed a DCF analysis as well as a market multiple valuation for TSCO. Using the DCF, I arrive at an intrinsic value of $155, which indicates TSCO may be overvalued by some 29%. I used an 8% discount rate, 2.1% terminal growth rate, 15% FCF CAGR, and a -3% annual reduction in shares outstanding.

TSCO DCF Valuation (Author’s personal data)

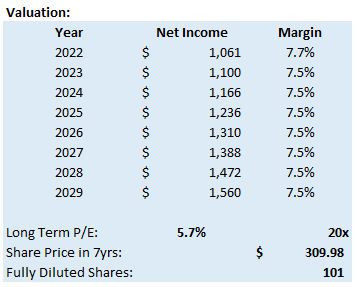

Using the market multiple approach (P/E), I arrive at a 2029 price target of $310, which equates to a 6.6% share CAGR from today’s price of $200. Not exactly a market-beating return. I assumed a long-term P/E of 20, 6% revenue CAGR, 5.7% net income CAGR, and a -3% annual reduction in shares outstanding. Note – to be conservative, my EPS CAGR is lower than TSCO’s long-term guidance.

TSCO P/E Valuation (Author’s personal data)

What I don’t understand is how I can perform two separate valuation techniques, have them both conclude basically the same thing (overvaluation and not much return potential), and yet I still want to buy the stock. TSCO’s fundamentals are just too attractive.

Bear Case

My bear case for TSCO is twofold. Firstly, is a longer-than-anticipated recession, which is likely to have a broad impact on nearly all companies. In such an environment, TSCO won’t be spared. I fully expect TSCO to survive in economic hard times, but with consumers pinching pennies, it’s possible the company halts its share repurchase program and cuts the dividend. EPS is sure to take a hit if this happens and, while not negating the thesis altogether, it certainly increases the amount of time needed for it to play out.

Secondly, is multiple compression. At 22, TSCO’s P/E isn’t sky high, but a rerating of the stock back to 16 or 18 is sure to equate to subpar investment returns. Remember, I used a P/E of 20 in the above valuation, which only equated to a share CAGR of 7%. Imagine how unimpressive returns may be with a P/E of 18 or less.

Conclusion

TSCO is a quality company with a proven track record and further growth in its future. The company is friendly toward shareholders and operates a business which should be able to weather economic hard times. At $200, shares appear fairly valued if not overvalued, but exceptional companies typically warrant a premium. I believe TSCO is such a company. If Mr. Market overreacts to the downside after TSCO reports Q3 2022 earnings next week, investors may take the opportunity to pick up shares of this quality compounder.

Be the first to comment