Sundry Photography

Investment Thesis

ServiceNow (NYSE:NOW) is a blue-chip company that continues to report very attractive growth rates. What makes ServiceNow a compelling investment is that it’s well-positioned to embrace a weaker economic environment, given that the majority of its customers are large enterprises.

Despite a likely recession, the tailwinds at play here, namely companies’ digital transformation remains underway. Even though investors appear to be more focused on other macro considerations, such as inflation, in the case of ServiceNow, those elements will not be needling-moving to the company’s trajectory.

Furthermore, ServiceNow’s multiple has already significantly compressed in the last several months, meaning that much of the downside has now been priced in already.

I rate NOW stock a buy.

ServiceNow’s Revenue Growth Rates Remain Highly Predictable

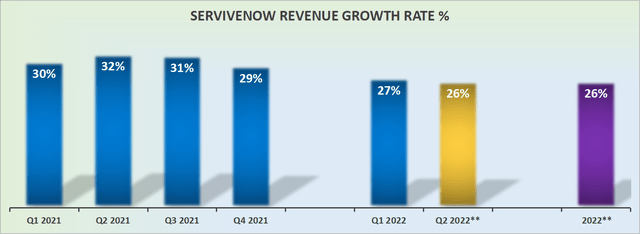

In a time when investors are running for cover and moving to a risk-off environment, I believe that ServiceNow’s consistent mid-20% growth rates are something mightily attractive.

This very steady performance and guidance amidst a truly tumultuous environment is something that I believe investors will in time come to recognize as being worthy of a higher multiple.

ServiceNow’s Near-Term Prospects

ServiceNow is a workflow productivity company. Its focus is on providing enterprises with tools to improve productivity.

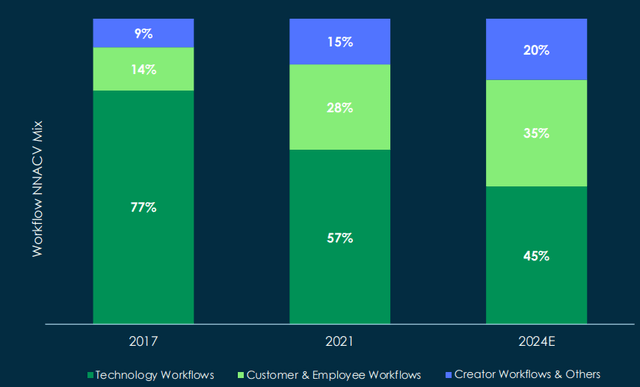

ServiceNow has three main workflows. Technology Workflows (formerly IT Workflows), Customer & Employee Workflows, and Creator Workflows & Others.

ServiceNow, through its Now Platform, makes the majority of its revenues from its Technology Workflows product.

However, looking ahead, the goal for ServiceNow will be on keeping that revenue stream ticking higher, but attempting to grow further its total exposure to Customer & Employee and Creators Workflows.

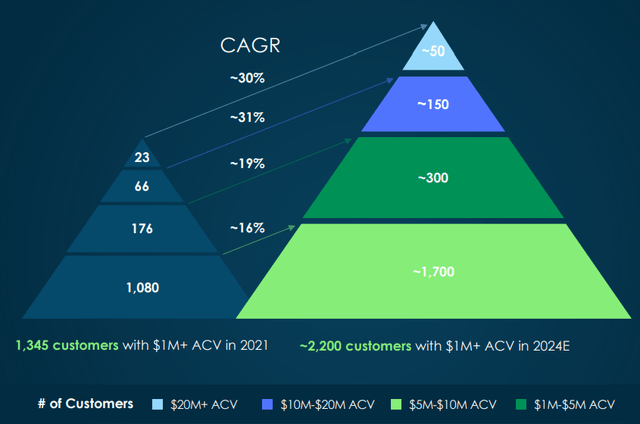

Next, as you can see above, it’s not only that ServiceNow continues to expect to see continued customer adoption.

But more importantly, it’s that ServiceNow believes large enterprises will be the customers that will see the most growth over the next few years.

From the investment perspective, as we stand on the precipice of a recession, you want to be preferably positioned in companies that can best withstand this economic backdrop.

Given that ServiceNow’s customers are some of the biggest and most well-funded enterprises, its customers will not only be able to play defensibly throughout this upcoming period, but they may actually look to double down in needed technology they need to allow them to thrive.

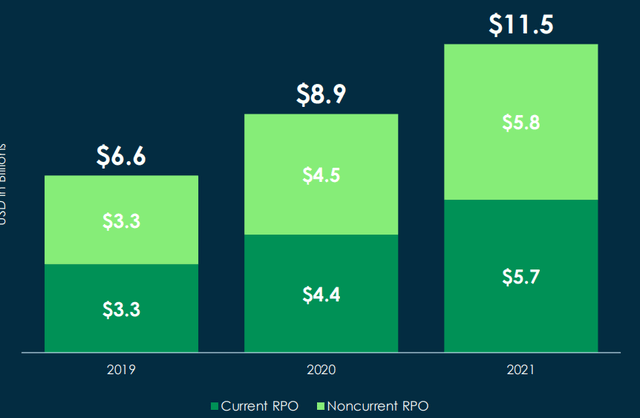

What’s more, ServiceNow’s expected revenues to be recognized, in the form of remaining performance obligations (”RPO”) offers investors peace of mind.

As you can see above, ServiceNow’s business model of taking upfront cash payments is impressive. Here’s why.

Even at this stage in its life, its total remaining performance obligations (”RPO”) grew by 29% y/y in 2021 compared with 2020. Further, Q1 2022 also saw its current RPO grow by 29% y/y.

RPO are bookings that have taken place but the service will be recognized over time through its income statement as revenues.

As long as ServiceNow’s current RPO continues to grow at, or higher, than its revenue growth rates that means that there’s a sustained pipeline of revenues running through the company. A very attractive setup for investors.

High-Profit Margins?

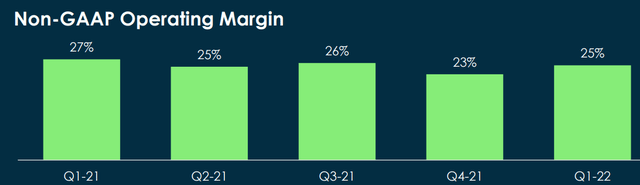

Anyone that has appraised ServiceNow will have spent some time eyeing up its juice ~25% non-GAAP operating margins.

The problem here is that of that non-GAAP operating margin, there are substantial drags on the company’s clean profitability that doesn’t show up on its non-GAAP operating margins.

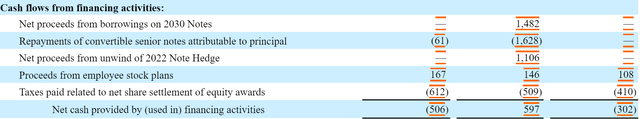

For example, in 2021, aside from stock-based compensation there was approximately $400 million of net taxes paid to stock-based compensation. Note that this figure accounts for management’s exercise of stock options.

Put another way, of the $1.8 billion of free cash flows that ServiceNow had in 2021, a net $400 million went out the door in the form of taxes against management’s options.

This implies that out of the $1.8 billion of free cash flow, only $1.4 billion was actually free cash flow. And of that figure, $1.1 billion was in the form of stock-based compensation.

That means that in 2021, the business only actually made $300 million of free cash flow.

So, I ask again, is this a high-margin business?

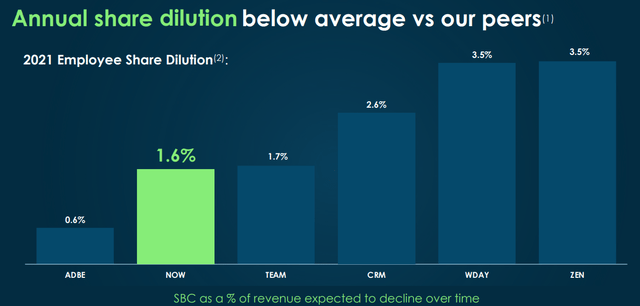

For their part, ServiceNow accurately points out that it’s not the worst offender in the group. That there are other peers that are even worse equity diluters.

All that being said, to be clear, there is a lot to like about ServiceNow.

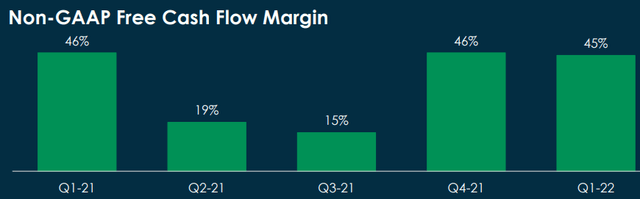

As I noted previously, ServiceNow’s business model means that it gets paid upfront for work to be recognized over time. This means that its business model sees very strong free cash flow margins. Indeed, higher free cash flows than its non-GAAP stock-based compensation.

NOW Stock Valuation – 11x 2023 Sales

We are now over halfway through 2022. Many investors will now start to price in 2023.

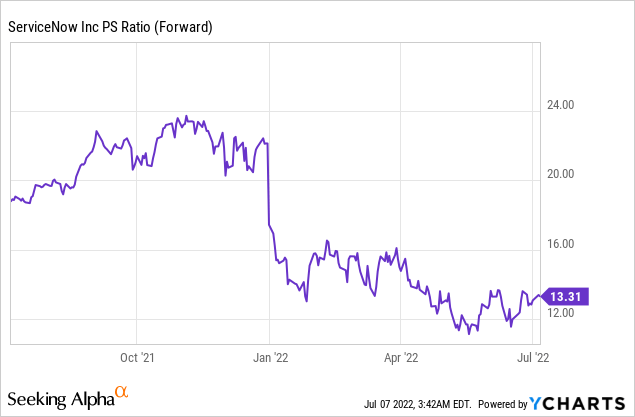

ServiceNow is now priced at 11x next year’s sales. As you can see below, ServiceNow’s multiple has come down significantly in the past year.

Obviously, it’s not that ServiceNow has been the only SaaS company to see its multiple meaningfully compress. Countless companies, if not most, have seen their multiples compress.

This does not mean that just because the multiple was previously higher, it will necessarily revert higher. I am not making that argument. What I do contend, is that ServiceNow’s multiple has already been compressed meaningfully.

Consequently, the likelihood that it meaningfully compresses further while not impossible, is improbable.

The Bottom Line

ServiceNow is one of only a handful of dinosaurs SaaS companies that still reports premium growth rates — defined as +20% CAGR. What’s more, it continues to report these attractive, strong, and sustainable growth rates, despite being fairly profitable.

While I recognize that management is very generous with its stock-based compensation, I do not believe that the market seems to pay too much heed to this consideration.

In sum, I believe that ServiceNow is well set up to not only survive but potentially thrive despite a looming recession.

Be the first to comment