tupungato/iStock Editorial via Getty Images

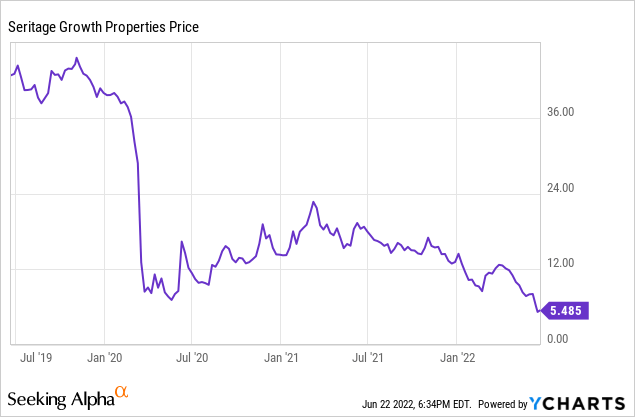

The last 12 months have been nothing short of ugly for Seritage Growth Properties (NYSE:SRG) stock. Shares of the Sears real estate spinoff have lost over 70% of their value following a sucker’s rally that lifted Seritage stock from single-digit territory in May 2020 to nearly $20 by June 2021.

Some of this share-price decline was well-deserved. A year ago, Seritage was priced for perfection, despite facing the difficult task of fixing its balance sheet while also completing redevelopments to boost its cash flow. However, Seritage stock’s recent plunge below $6 despite steadily improving fundamentals makes this company one of the biggest bargains in the market (albeit with a fair amount of risk).

What Has Changed Now?

Throughout 2021, I warned investors to avoid Seritage stock, even though it appeared to be trading at a discount to NAV (net asset value). At the time, Seritage was burning cash at a pace of more than $100 million per year and had no near-term prospects for addressing that problem.

This February, I finally began accumulating some Seritage shares after the stock dipped below $10. The falling stock price wasn’t the only reason I changed my tune. Seritage had also become more aggressive about asset sales, giving it a clearer path to slowing its cash burn by reducing its debt. That said, I continued to view Seritage stock as having significant risk relative to its upside potential at that time.

Today, the case for Seritage stock is much more clear-cut. First, the stock has fallen by another 40% since I last covered the company in February. Second, Seritage’s leasing activity has accelerated significantly since late 2021. (At the time I published my prior article, Seritage hadn’t reported its Q4 earnings or leasing results yet.) Third, the company continues to make good progress on asset sales and has many options for reducing debt further over the next 12 months.

Leasing Activity Resumes

For most of 2020 and 2021, lease terminations far outweighed new lease signings for Seritage. A deliberate pause in leasing associated with a strategic review process last year added to the existing headwind from the COVID-19 pandemic.

However, Seritage reported signing new leases for approximately $4 million of base rent (at its share) in the fourth quarter of 2021. Leasing activity accelerated to over $7 million of annual rent in Q1 2022. By early May, Seritage had already signed leases for over $1.4 million of annual rent in the second quarter. It also had a robust leasing pipeline potentially worth over $8 million of annual rent as of then.

The biggest highlight within this leasing activity was an office lease with Amazon.com (AMZN) for roughly 123,000 square feet at The Collection at UTC (one of Seritage’s premier JV properties). Gross annual rent from Amazon will be roughly $8.4 million, or $4.2 million at Seritage’s share. This deal helped boost the property’s leased occupancy from 26.8% as of 12/31/2021 to 87.5% by 3/31/2022. Having Amazon as an anchor office tenant could also help Seritage fill the remaining retail vacancies at this premier asset.

An early rendering of The Collection at UTC. (Image source: Seritage Growth Properties.)

The rebound in leasing activity positions the company for a meaningful improvement in NOI (and cash flow) over the next several quarters. As of March 31, Seritage had leases signed for future openings worth $8.6 million of annual base rent for its multitenant retail portfolio and $14.6 million for its premier mixed-use properties. Most, if not all, of this rent will come on line within a year.

Asset Sales Resume Following A Pause

During the first quarter, Seritage sold one asset for $9 million: the former Sears property at Solano Town Center in Fairfield, California. However, since it announced in late March that it would give up its REIT status and convert to a C corporation (a move designed to enable the company to sell assets at a rapid pace), asset sale activity has picked up again.

In the first six weeks of the second quarter, Seritage sold 7 properties for $74.7 million. More than half of the proceeds came from selling a redeveloped former Sears in Anchorage, Alaska and an associated warehouse for $44 million. Seritage also sold three other income-generating properties (in Riverside, California; Elkhart, Indiana; and Paducah, Kentucky) for combined proceeds that I estimate at nearly $23 million and three vacant properties (in Clay, New York; Toledo, Ohio; and Walnutport, Pennsylvania) for combined proceeds of $8 million.

Seritage had additional assets under contract for $85 million as of May 10. At least two asset sales appear to have closed since then. The listing of Seritage’s properties no longer includes the former Sears in Lincoln Park, Michigan or the former Sears at Woodland Hills Mall in Tulsa, which was part of the company’s JV with Simon Property Group (SPG).

Bears would likely point to the low prices Seritage is getting for many of its vacant assets as evidence that the company’s real estate just isn’t very valuable. But this is a case where the 80-20 rule applies. The vast majority of the value of Seritage’s properties comes from a small proportion of its assets. The non-core property list still contains several gems, including prime redevelopment opportunities in San Jose and Westminster, California.

Furthermore, selling vacant assets boosts NOI and cash flow by removing carrying costs for those properties. For example, the former Sears in Clay, New York sold for just $15 per square foot. But the annual tax bill for that property is nearly $300,000. Adding in utility costs and bare-bones maintenance expenses, it wouldn’t be surprising if Seritage was losing upward of $500,000 a year from holding on to that asset.

Many Options For Further Debt Reduction

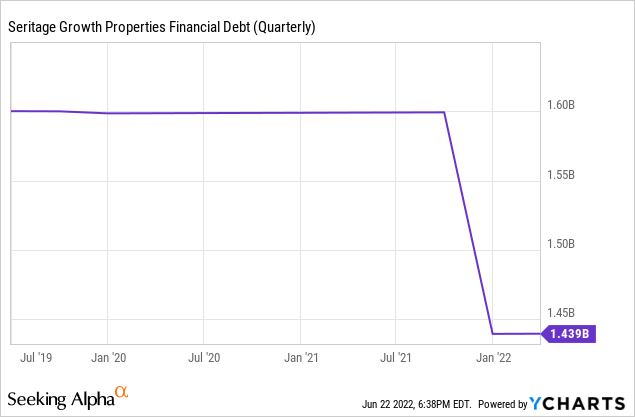

Seritage ended March with a $1.44 billion balance on its term loan. The loan matures in July 2023, but Seritage can extend it for two years if it reduces the balance to $800 million by then.

In its recent 10-Q filing, Seritage stated that it was putting assets with a total fair market value of $636.3 million up for sale. Combined with the roughly $160 million of expected proceeds from deals that closed early in Q2 or were under contract as of early May, this would enable Seritage to achieve the necessary level of debt reduction.

I’m skeptical that Seritage will be able to sell all of its non-core assets at fair value within 12 months. Volatile market conditions and the unusual nature of many of Seritage’s properties could make it hard to find buyers in some cases.

Fortunately, Seritage has numerous options for supplementing its non-core asset sales. First, its JVs with the major mall owners give Seritage the right to sell its 50% stake in each property at fair market value once designated leasing thresholds are met. The company recently decided to exercise such put rights for two properties in its joint venture with Macerich (MAC). Seritage can also negotiate with the mall owners to exit these joint ventures (as it did with the Tulsa property).

Second, Seritage has reportedly put its multitenant retail portfolio on the market. This portfolio could be worth close to $1 billion. If Seritage finds a buyer willing to pay full market value, selling these assets as a group could wipe out over half of the company’s debt in one fell swoop.

Image source: Seritage Growth Properties.

Third, Seritage could sell one or more of its premier assets in a pinch. For example, following the recent lease to Amazon, Seritage could likely sell its stake in The Collection at UTC for over $100 million if it so desired.

A Solid Margin Of Safety

At its Wednesday closing price of $5.48, Seritage has a market cap just above $300 million (including the value of operating partnership units) and an enterprise value of $1.8 billion. For comparison, I believe its real estate is worth approximately $3 billion.

The July 2023 debt maturity represents the biggest risk for shareholders. However, even with the recent market turmoil, I believe Seritage has a very high probability of raising the $640 million it needs to reduce the term loan balance to $800 million and extend the maturity for two years. If it sells the entire multitenant retail portfolio in addition to its non-core assets, Seritage could potentially eliminate all of its debt.

The other key risk is Seritage’s ongoing cash burn. However, cash burn is finally improving. Last quarter, total NOI increased by more than $1 million year over year, while the company’s $160 million debt paydown last December reduced quarterly cash interest expense by $2.8 million.

Looking ahead, Seritage is poised to reduce cash burn further through additional tenant openings and debt reduction funded by asset sales. And with the gap between Seritage’s enterprise value and its real estate value having widened dramatically over the past year, I’m no longer concerned about the discount to NAV being consumed by cash burn.

Even if the discount to NAV does not fully close, Seritage shares could triple to between $15 and $20 over the next year or two as the company fixes its balance sheet and reaches breakeven (or better). That upside potential now significantly outweighs the risks outlined above, making Seritage stock extremely attractive. Accordingly, I have quintupled the size of my Seritage stake this month.

Be the first to comment