Melissa Kopka/iStock Editorial via Getty Images

By Alex Rosen

Summary

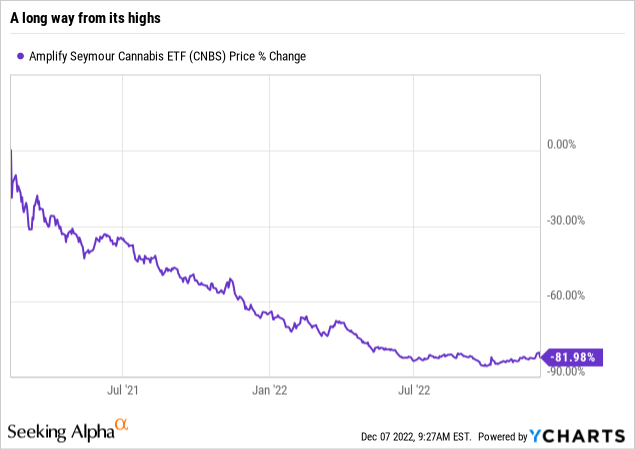

Amplify Seymour Cannabis ETF (NYSEARCA:CNBS) seeks to track global cannabis and hemp stocks. The fund, which has been around since 2019, is down over 70% cumulative since inception, and since peaking in February of 2021, is down over 82%. The fund, which is actively managed, has amassed $43 million in assets, and focuses almost exclusively on U.S. (67.1%) and Canadian (28.2%) companies. The fund’s focus on an industry that is quasi-legal in the United States makes for a complicated analysis. As a result, we rate it a Sell for now until the legal situation is cleared up.

Strategy

According to the fund prospectus “CNBS is an actively managed portfolio which allows the ETF to adjust its holdings on a daily basis. Tim Seymour, the portfolio manager, is a recognized voice in the cannabis industry”.

The fund only invests in cannabis companies that are in compliance with the federal laws of the country they are registered and operate in.

Proprietary ETF Grades

- Offense/Defense: Offensive

- Segment: Retail

- Sub-Segment: Agriculture

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): High

Holding Analysis

CNBS holds a basket of companies diversified by industry, market cap and business focus. The fund’s regional focus is almost exclusively the U.S and Canada with a bit of Ireland (4.6%) thrown in for good luck. Sector wise, the fund focuses on Management Services Organization (39%), Cultivation and Retail (26%), and Pharma (10%).

The top individual holdings are Curaleaf Holdings (OTCPK:CURLF) owner and operator of 143 dispensaries and 29 cultivation sites at 11.19%, Green Thumb Industries (OTCQX:GTBIF) a national cannabis consumer packaged goods company and retailer at 10.76%, and Tilray Brands, Inc. (TLRY) a global cannabis-lifestyle and consumer packaged goods company at 8.67%.

Strengths

Hemp is one of the strongest fibers in the world, with uses including rope, textiles, clothing, shoes, food, paper, bioplastics, insulation, and biofuel, but that’s a totally different strength altogether.

The fund’s strength is its aggressive foray into what will surely one day be a sector as big as alcohol, and probably bigger than tobacco. The fund is actively managed, and while so far, that active management seems to be struggling, that is probably a function more of the infantile status of the industry and the uncertainty regarding the legal status on a Federal level for now.

If the legal status is resolved in a manor favorable to the industry, and all indications are it will be, funds like CNBS stand to really capitalize.

Weaknesses

Despite the winds of change stirring, the exact date of Federal legalization is unknown, and may be a long way away. CNBS has been hemorrhaging money since inception, and it begs the question, how long will investors stay with a fund that routinely ranks in the bottom quartile among all ETFs? Seeking Alpha’s own quantitative analysis rates it a strong sell, and has consistently rated it as such.

Opportunities

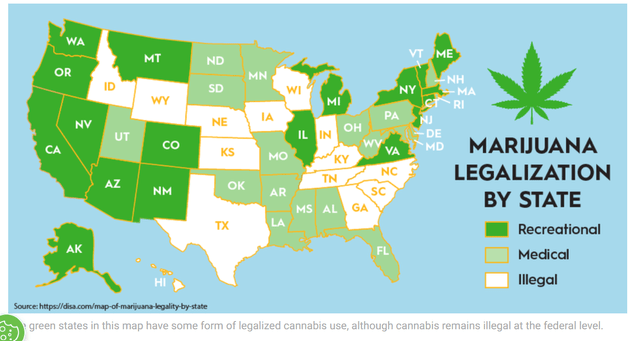

The classic buy low sell high theory of business could be applied here, but more importantly the real opportunity here is that the growth of funds like CNBS, AdvisorShares Pure Cannabis (YOLO) , Roundhill Cannabis (WEED), Cambria Cannabis ETF (TOKE), MJ, and Poseidon (PSDN), is all contingent on when the U.S. Federal government clarifies the status of marijuana. Right now, 36 states have legalized marijuana use for either recreational purposes or medicinal uses. Almost all of the remaining holdouts have some form of legislation in the works to change its status.

Globally, consumer spending on legal cannabis was $21.3bil in 2020, up 48% (from $14.4bil) in 2019. Future spending is expected to see exponential growth and it’s only a matter of time before the prohibition is lifted and we can all stop being paranoid.

The U.S. is getting higher one state at a time (Motley Fool)

Threats

One of the biggest threats to funds like CNBS which hold cannabis-only companies is that when the time comes for legalization, traditional blue-chip companies like Lowes will bogart the agricultural sector, and the major pharmacies will harsh the distribution sector. If this happens, the funds that are more amenable to holding non-cannabis exclusive companies will have a tremendous advantage.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

CNBS’s active management has allowed it to capture a good segment of the Cannabis only companies. That the return has been less than stellar is not necessarily an indictment of that management, but the slow turning of the wheels of progress.

ETF Investment Opinion

We like the sector, and really believe in its future, but we also believe that the moment the roadblocks that are slowing growth are removed, the big boys of pharma, agra, and retail will come in and swallow up the industry like a college student with the munchies. As a result, we rate CNBS a Sell.

Be the first to comment