jetcityimage

The Series I Bond rate is reset every May 1st and November 1st. For the next 6 month period starting November 1, 2022 the U.S. Treasury has set the new fixed rate for the Series I bond at 0.4% bringing the composite rate for new issuance during the period to 6.89%. This includes an inflation adjusted rate of 6.48% which is applicable to any previously purchased I bonds.

If you’re wondering how the composite rate is calculated, the equation according to the TreasuryDirect website states:

Composite rate formula = [Fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]

The math for this period of issuance looks like this:

[0.0040 + (2 x 0.0324) + (0.0040 x 0.0324)] = 0.0689296

The increased fixed rate and simultaneous decreased adjustable rate changes the investment thesis for I bonds. Occasionally, the savings bond makes for a good investment. All other times it is simply a form of savings. Last month my I bond strategy was about investment. Today, that thesis is changing.

Series I Bond Recap

The Series I Savings Bond offered by the U.S. Treasury are 30 year adjustable rate bonds that pay interest according to a combination of a fixed rate set at issuance and an adjustable rate determined every 6 months equal to the change in the non-seasonally adjusted Consumer Price Index for all Urban Consumers experienced over the previous 6 month period.

One significant advantage of I bonds is that the interest rate does not go below zero. If deflation occurs, meaning the CPI declines, the combination of a negative inflation-adjusted rate and positive fixed rate can decline but will not be allowed to go below zero. This means that the principle on I bonds does not decline and the worst yield that can be experienced is 0%. Interest is earned monthly and compounded semiannually. Like all Treasury securities, I bonds are backed by the U.S. Federal Government.

Although I bonds have a 30 year term, they can be redeemed after 12 months with penalty. If the I bond is redeemed in the first 5 years a penalty is assessed of the last 3 months of interest earned. In my last article on I bonds I described my strategy of using I bonds to earn a 6.4% yield over the next 12 months after the penalty is assessed. That is superior to current rates on 6 month, 1 year, and 2 year Treasuries by nearly 2%.

For more information on I bonds, please review the TreasuryDirect website.

Savings or Investment

Individuals are limited to purchasing $10,000 of I bonds each year with the following exceptions:

- An additional $5,000 of paper I bonds can be bought through tax refunds.

- I bonds can be gifted to others, but count toward the annual limit when they are received/delivered.

- Entities can purchase I bonds.

I am not discussing these options in detail because they are not part of my I bond strategy. For my portfolio, the $10,000 per year limit is sufficient, between my spouse and I. This is because, in my opinion, there is a difference between savings and investment.

Savings include liquid assets that earn a modest yield and are strongly protected against loss of principle.

Investment includes assets expected to generate cash flow or return in excess of inflation which typically involve an element of risk of principle loss.

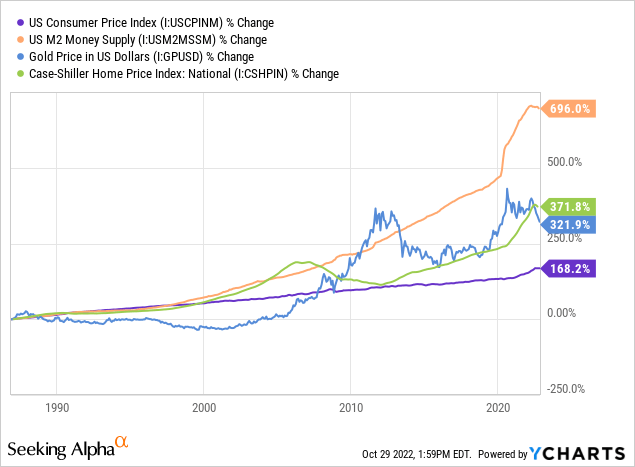

By definition, I bonds are meant only to keep pace with inflation. That inflation is calculated by the CPI which I strongly suggest is under-reporting true inflation. Without diving into the subject in detail, it seems implausible that CPI has increased by 1/2 to 1/4 of significant inflation indicators including the price of gold, the price of homes, and the M2 money supply. You can explore the subject more on your own.

The point is, I bonds are almost guaranteed a real loss in purchasing power over the long term unless the fixed rate component of the composite rate is significant or deflation is enduring. Neither has been the case for the last 20 years.

For these reasons, I typically use I bonds as a form of savings and occasionally use I bonds as a 1-2 year bond investment, as I described in September. Likewise, an unusual number of investors piled into I bonds at the end of October to take advantage of the 9.62% compound rate before it expired. While I agree with the move, I can’t help but think about their investing plan. Will they plan on holding these I bonds indefinitely? How much of their portfolio is allocated to I bonds?

Portfolio Strategy

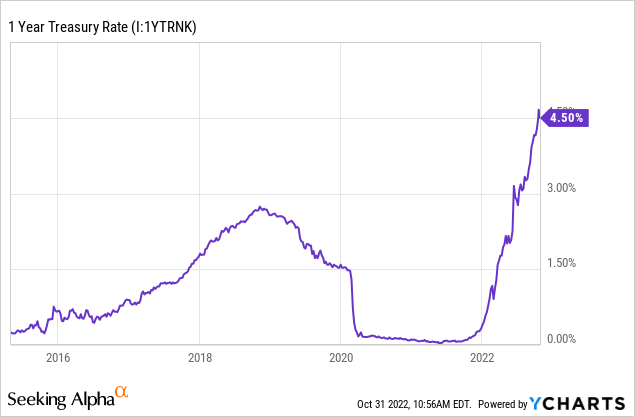

It is easy to see last month’s 9.62% sticker rate and back the truck up. But the rate is temporary and only applies to half a year of interest. It offered an attractive investing opportunity that was a product of negative real rates on U.S. Treasuries and tightening monetary policy that diminished the opportunity cost of other assets below the threshold that made I bonds attractive. Going forward, the attractiveness of I bonds as an investment is diminishing.

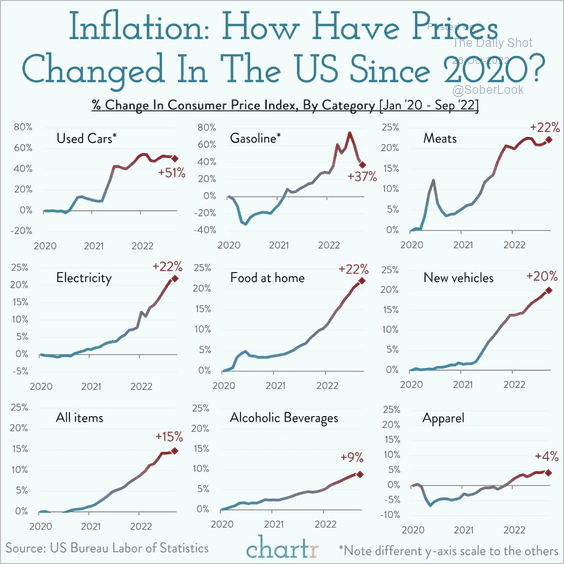

This is because the I bond adjustable rate is declining. There is a significant probability that the next 6 month period will experience no inflation or even deflation. Below is a chart of price inflation of common goods. Notice how the momentum of price inflation is changing in used cars, gasoline, meats, apparel, and all items. With monetary easing and fiscal stimulus behind us I expect this momentum to continue in decline unless the current policy stance changes.

The Daily Shot (used with permission)

The table below shows how the fixed rate and adjustable rate has changed since 2015. Included is a column that represents the total return of a 1-year investment in I bonds issued during that period including the early redemption penalty. The total return for the November 1, 2022 period is assuming a 0% composite rate for the next 6 month period, representing a worst case scenario. When the total return is higher than the 1-year Treasury I tend to favor Series I bonds as an investment.

| Date Range | Fixed rate for new bonds issued | Adjustable Inflation rate for 6 month period | Annualized Inflation Rate for 6 month period | Total Return of 1 Year Investment |

| 1-Nov-22 | 0.40% | 3.24% | 6.48% | 3.64% |

| 1-May-22 | 0.00% | 4.81% | 9.62% | 6.41% |

| 1-Nov-21 | 0.00% | 3.56% | 7.12% | 5.97% |

| 1-May-21 | 0.00% | 1.77% | 3.54% | 3.55% |

| 1-Nov-20 | 0.00% | 0.84% | 1.68% | 1.73% |

| 1-May-20 | 0.00% | 0.53% | 1.06% | 0.95% |

| 1-Nov-19 | 0.20% | 1.01% | 2.02% | 1.48% |

| 1-May-19 | 0.50% | 0.70% | 1.40% | 1.71% |

| 1-Nov-18 | 0.50% | 1.16% | 2.32% | 2.01% |

| 1-May-18 | 0.30% | 1.11% | 2.22% | 1.99% |

| 1-Nov-17 | 0.10% | 1.24% | 2.48% | 1.90% |

| 1-May-17 | 0.00% | 0.98% | 1.96% | 1.60% |

| 1-Nov-16 | 0.00% | 1.38% | 2.76% | 1.87% |

| 1-May-16 | 0.10% | 0.08% | 0.16% | 0.87% |

| 1-Nov-15 | 0.10% | 0.77% | 1.54% | 0.91% |

| 1-May-15 | 0.00% | -0.80% | -1.60% | 0.00% |

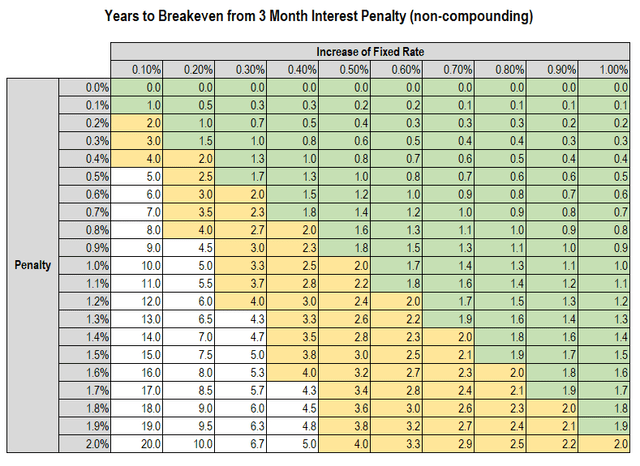

My I bond buying strategy is again focused on savings. For that purpose, I will employ a rollover technique depending on the fixed rate offered. If the fixed rate for new issuance experiences a modest improvement from the fixed rate on my existing I bonds I will redeem I bonds and replace them with higher fixed rate I bonds.

That is represented in the chart below. The yellow areas represent rollovers that I will consider depending on other factors. The green area represents rollovers that I will certainly execute. The values do not include compounding interest which would slightly reduce each breakeven period.

My objective is to maintain 50% of annual living expenses in I bonds as an alternative to traditional savings accounts which have yielded virtually nothing. Of that, I want at least 50% to be redeemable at all times. This is easily attainable with the $10,000 per individual annual limit.

Summary

The U.S. Treasury has increased the fixed rate of Series I bonds to 0.4%. This is the highest fixed rate in three years. It strengthens the characteristics of I bonds to fill the role of savings. But the adjustable rate has declined to 6.48%. This is compromising the investment use case of I bonds. Given that 1 year Treasury Rates are at 4.5% and I expect inflation to reduce significantly I’m not looking at I bonds for investment at this time. Instead, I will be working on rolling over my I bond savings to take advantage of the higher fixed rate.

Be the first to comment