Nina Shatirishvili/iStock via Getty Images

Introduction

Conditions for retailers are tough and are likely to get materially worse from here. Retail P&Ls will face topline pressure as consumers react to rampant inflation by reducing spending where possible. Margins will be squeezed thanks to product cost inflation, increasing staff costs and ongoing supply chain issues. In addition to worsening operating conditions, in many cases, negative investor sentiment is being amplified by the optics of comparing earnings against recent results that were boosted by temporary COVID-related factors.

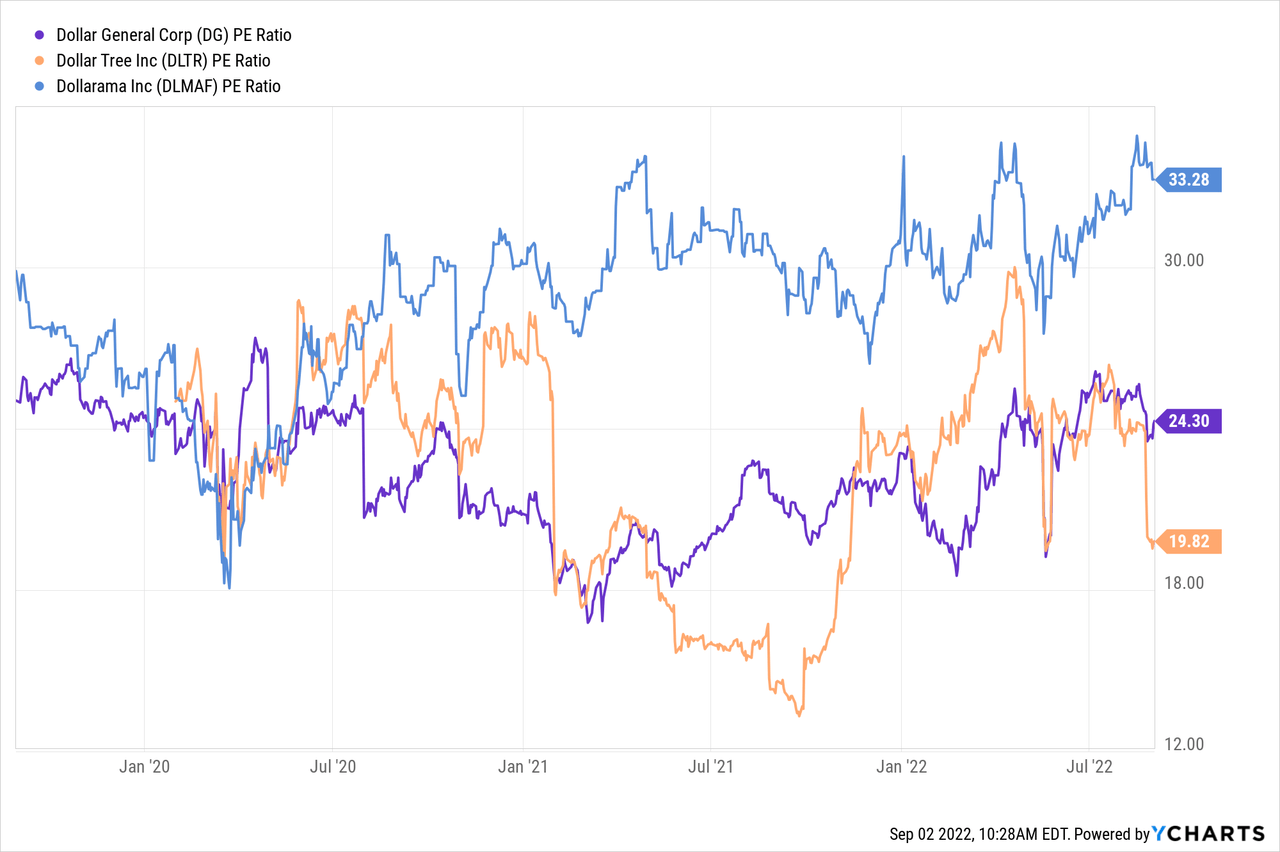

Given this backdrop, it strikes me that the relative winners in the retail sector are likely to be those companies that will benefit as consumers change shopping habits by trading down and seeking better value offerings. While I have questions about the true underlying consumer value proposition of dollar stores, companies such as Dollar General Corporation (DG), Dollar Tree, Inc. (DLTR) and Dollarama Inc. (OTCPK:DLMAF), strike me as having much less potential earnings downside risk in a recessionary environment than many other North American retailers. These stocks have attracted a lot of investor attention and have been trading at elevated P/E ratios (20x to 25x for Dollar General and Dollar Tree, with Dollarama at ~30x). Being a value investor, I regard these multiples as pretty full, and so I’m not currently inclined to do a deep-dive into either stock.

The dollar store concept is alive and well in Japan in the form of 100-yen shops. In this note, I take a look at the number-two player in the Japanese 100-yen shop market, Seria Co., Ltd. (OTC:SAOGF).

Company and Industry Background

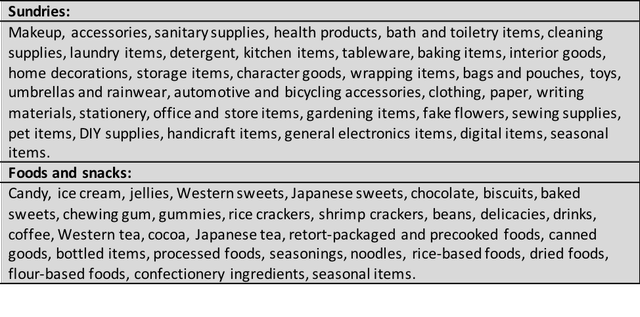

Seria operates 100-yen shops, selling everyday items at a flat price of 100 JPY. Given recent USD strength, 100 JPY currently translates to roughly US$0.72, but using longer-term average exchange rates, 100 JPY translates to something close to one US dollar. Table 1 below provides a summary of the main product lines sold by Seria (note that sundries typically make up more than 90% of group sales). The comparison with Dollar General and peers extends beyond the price and types of products sold; however, Seria also has features that differentiate it from both comparable North American stores and Japanese competitors.

Seria is the second-largest 100-yen shop player in Japan with 1,876 stores, giving it a meaningful market share of ~25%. The market leader, Daiso Industries Co., Ltd. (unlisted), is roughly double the size of Seria. Smaller competitors Can Do and Watts lack scale and are far less profitable than Seria. The founder’s nephew, Eiji Kawai (joined 2003), is the current company president and has played an important role in the turnaround and success of the business. The Kawai family owns ~36% of the company.

Table 1:

100-yen shops/dollar stores are a tough business to get right. The segment operates with a high turnover of low-value items at a fixed price, with products changing constantly depending on consumer tastes. For example, Seria estimated they have 20,000 SKUs (SKU = stock keeping unit), with ~7,000 SKUs changing each year. Companies that get it right can generate strong returns on capital. Seria was a struggling company in the early 2000s until the current President, Eiji Kawai, joined in 2003 as managing director. Kawai came from a banking background and had extensive experience in data analytics. He was responsible for the development of Seria’s proprietary POS (point of sale) and data analytics systems (which include ordering and distribution systems linked to POS data) that are crucial for 100-yen shops given the importance of managing working capital and predicting sales trends. The data-driven approach instigated by Kawai provided a competitive advantage, leading to improved margins and market share gains (Seria’s market share increased from ~14% in 2009 to ~25% in 2022). With competitors struggling to be profitable or focused on overseas expansion, Seria is well positioned to continue to gain share via continued application of its proven strategy.

Risks

The main longer-term risk is that the company’s growth runway halts. Management is confident about driving longer-term growth through store openings, with a target of 100 to 150 net new stores per annum. However, it’s difficult to gauge what the sustainable level of retail market penetration is for 100-yen shops. Within the segment, while Seria has made significant market share gains over the last decade or so, competitors may lift their game and make future gains harder to achieve.

The main short-term risk is the potential for Seria’s operating profit margin to be squeezed by the combined effects of persistent global inflation, supply chain issues and a weak JPY. These influences already have depressed the operating profit margin from ~10% to ~8%. If this was to continue for an extended period, margins could stay depressed. Weakness in the JPY is problematic in two ways – a) it inflates the cost of products that Seria imports, contributing to margin squeeze, and b) for non-Japanese investors, a weaker JPY creates a drag on the currency-converted share price.

Can Do (the No. 3 player in the industry) was recently acquired by Aeon. This could lead to more intense competition in the 100-yen shop segment. AEON is a serial acquirer with no experience in this store format, so although this risk should not be ignored, I’m not overly concerned about the potential for the acquisition to materially improve Can Do’s competitive standing relative to Seria.

The current President, Eiji Kawai, has been crucial to the strategy and success of Seria. The company has maintained a clear strategic focus under Kawai’s leadership and has avoided the temptation to expand beyond 100-yen shops within Japan or to venture offshore. Key-person risk relating to Kawai is therefore a factor for investors in the stock.

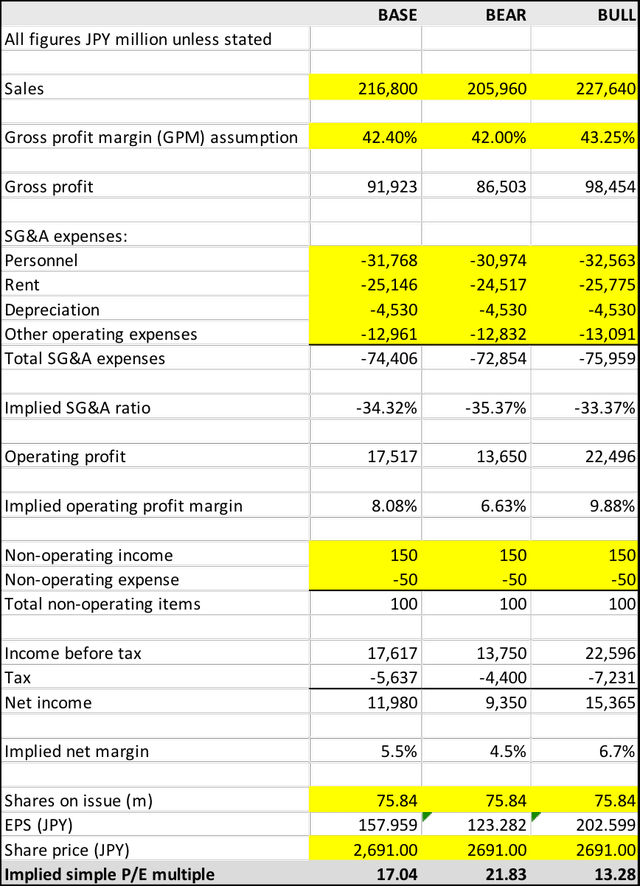

Valuation Analysis – Normalized Earnings Approach

In making an assessment of normalized earnings, I’m essentially arriving at a point-in-time estimate of how I expect a company to perform on a through-the-cycle or sustainable-earnings basis. Table 2 sets out my Base Case for Seria’s normalized earnings, along will Bear Case and Bull Case scenarios. At 2,691 JPY per share (Tokyo Stock Exchange close 01 September 2022), the valuation analysis indicates that Seria is trading at a P/E of between 13.3x and 21.8x, with a Base Case of 17.0x.

Table 2:

Created by author using data from Shared Research

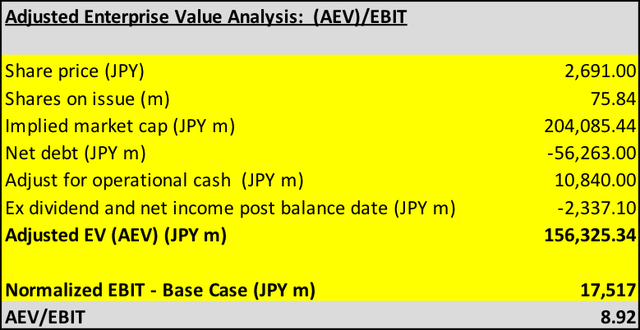

For retail stocks, my preferred valuation metric is EV/EBIT. Table 3 sets out my calculation of AEV/EBIT, where AEV is the adjusted enterprise value, and EBIT is my normalized EBIT.

To arrive at AEV, I make the following adjustments:

- Seria has a very high cash balance. I have assumed that a proportion of the reported cash (roughly equal to 5% of annual sales revenue) is operational in nature.

- Allow for dividends and profits post balance date.

Table 3:

Created by author using data from Shared Research

For a retail company such as Seria, I would typically regard an EV/EBIT multiple in the range of 10.5x to 12.5x as representing around fair value. Based on a current share price of 2,691 JPY, my analysis points to Seria trading on an EV/EBIT multiple of ~8.9x.

Investment Thesis Summary

100-yen shops/dollar stores are a niche retail segment within which market leaders have demonstrated an ability to deliver a rare combination of:

- strong sales growth

- high returns on capital

- a macro-defensive topline

Seria is solely focused on its core area of expertise – 100-yen shops – and operates in one of few retail categories in Japan with organic growth prospects. Within the segment, Seria has built a competitive advantage through its proprietary data analytics/POS systems, which have enabled the company to outperform peers. Seria’s data-driven approach delivers distinct benefits in the areas of: a) better anticipation of sales trends, b) highly efficient inventory management, c) store design and expansion. As a strong player in a healthy market segment, Seria has been able to produce strong returns on capital over the last decade – with an average RoE of ~20% and an average ROIC above 40% (although it should be noted that returns have been slightly lower over recent years). Due to the uniqueness of 100-yen shops in the broader retail space, and the low profitability of peers, Seria can be expected to continue to gain market share. With ample cash on the balance sheet (~25% of market cap), Seria is well positioned to reinvest surplus cash back into the core business in a value accretive manner, with the optionality of improved shareholder returns (via higher dividends and/or buybacks) over time.

The combination of high global inflation rates and a weak JPY has created material headwinds for Seria. With an inability to increase prices, cost pressures cannot easily be passed on to consumers. As a result, Seria’s profitability is forecast to decline by around -20% in FY23, which will be the first time since FY09 that profits have declined more than -5%. The stock has fallen out of favor with investors.

In summary, at a share price of around 2,700 JPY, Seria provides an opportunity to invest at a reasonable long-term valuation in an uncomplicated, high-returning, topline macro-defensive company. Assuming that current cost pressures fade over the longer term, I expect that operating margins will return to recent historic levels of ~10%, and coupled with consistent sales growth, an upward re-rating of the share price seems likely. Share prices for North American peers such as Dollar General, Dollar Tree and Dollarama point to the potential for Seria’s P/E multiple to re-rate materially to at least 20x.

Be the first to comment