Blue Planet Studio

Sema4 Holdings (NASDAQ:SMFR) is a big data medical platform company that offers the Centrellis information platform based on big data and machine learning to deliver solutions for the precision medicine market, which (Biospace.com):

is a new approach to disease prevention and management that is gaining popularity. It entails individually personalized approaches such as predictive diagnosis, preventative, and treatment tactics based on a person’s genetic makeup and genetic changes. Drugs are created to target specific mutations using these methodologies, resulting in better treatment and patient outcomes.

Centrellis accommodates a wide range of data inputs and knowledge bases like electronic patient records, clinical and genomic data, etc. It has a data analytics layer to mine data and constructs predictive models that are the foundation of the company’s precision medicine solution, from the 10-K:

Centrellis is designed to transform treatment decisions across multiple therapeutic areas by engaging large-scale, high-dimensional data and querying the predictive models of disease and wellness using patient-specific data to derive highly personalized, clinically actionable insights. Centrellis supports various applications, such as delivery of personalized and actionable treatment insights into clinical reports, clinical trial matching, real-world evidence trials and clinical decision support, through an advanced programmable interface, or API, layer.

The company draws on a wide variety of data (Q1CC):

Our sophisticated platform draws on information from many sources, from advanced genomic testing solutions to patient electronic medical records, including physician notes and other instructor data, to hospital records and population health, among many other large scale sets of data available in the digital universe. With this platform, Sema4 enables patients and providers to derive differentiated insights in real time that can dramatically improve the standard of care.

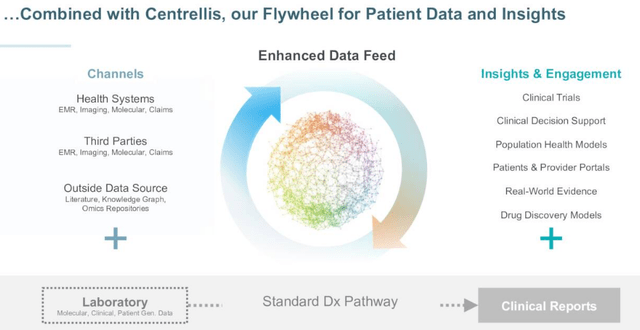

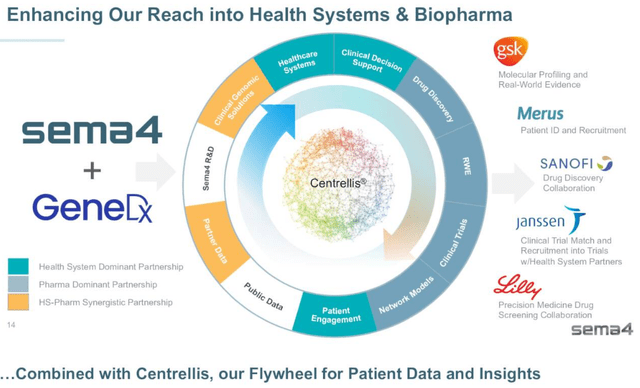

There is a bit of a virtuous cycle as data + analytics leads to insights that are used by partners and customers, and this produces more data which improves the analytics, from the Q1/22 earnings deck:

The slide also gives a nice overview of the data sources and types (here channels), and the type of output their platform produces. At the end of last year, the platform had (10-K):

approximately 12 million de-identified clinical records, including more than 500,000 with genomic profiles, integrated in a way that enables physicians to proactively diagnose and manage disease.

The company also has a genomics platform, Traversa which also fuels Centrellis (10-K):

Particularly where integrated with EMR data, Traversa provides health systems with a unique opportunity to deploy population health management programs.. Our population health offerings are designed to run through our Traversa platform and give us the ability to inform on thousands of diseases and conditions, from rare disorders, to drug safety, to risk profiles across a broad range of common human diseases of significant public health concern.

Given the above described virtuous cycle, it’s important to scale up rapidly as a means of competitive differentiation, so this is an important rationale behind the recent acquisition of GeneDx, which added a lot more data (350K+ clinical exomes, more than 2M phenotypes). We’ll look at that below, but first here is the market.

The market

The precision medicine market (Biospace.com):

The global precision medicine market size is predicted to hit around US$ 140.69 billion by 2028 from valued at US$ 66.1 billion in 2021, growing at a CAGR of 11.5% over the forecast period 2021 to 2030.

The most relevant growth drivers:

Some of the factors driving the growth of the precision medicine market are the increased approval of drugs together with their companion diagnostic assays, cost-effective DNA profiling, rising cancer incidence rates, and the advent of data-driven healthcare. Furthermore, the growing use of “multi-omics” in research, as well as the penetration of high-throughput sequencing systems, is influencing the precision medicine landscape.

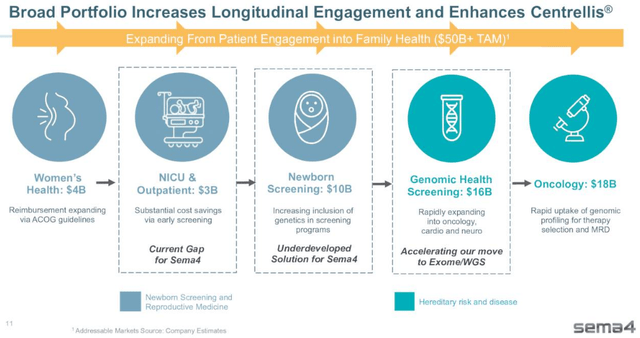

The company has health systems, pharma companies, and individual patients as customers (through their patient portal) and sells into several segments, below depicted with their respective TAMs (and enhanced by the GeneDx acquisition, see below):

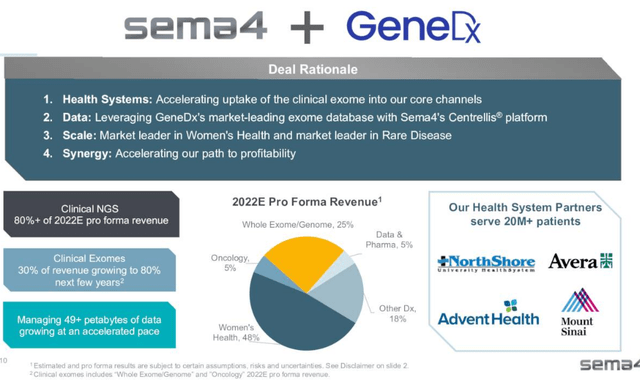

Woman’s Health was by far the biggest segment, with Oncology a distant second (before the GeneDx acquisition) as these are obvious segments where precision medicine solutions are instantly relevant. The acquisition of GeneDx has broadened sales:

Another way of amassing more data is through partnering with health systems and pharma companies, and the company has important partners here displayed in the slide above. And with individual patients (10-K):

In addition to providing a majority of our current revenue and generating hundreds of thousands of genomic profiles, our established diagnostic test solutions also allow us to engage patients directly as partners, both as part of their clinical care and also acting on their behalf, with appropriate informed consent, to acquire, organize and manage any health data generated on them through the course of their care, all of which contributes to the further development of our genomics and information platforms. Further, we have demonstrated patients’ willingness to partner with us. For example, over 80% of diagnostics solutions patients and users who engaged with our patient portal have given us their informed consent to retrieve, organize, and manage their health records and data, and to facilitate their access to and sharing of that data, as well as additional data that patients share and create through their use of our expanding suite of digital experience products.

GeneDX acquisition

The acquisition was announced in January and closed early in May, together with a $200M private placement (in which Pfizer (PFE) participated) to finance the acquisition.

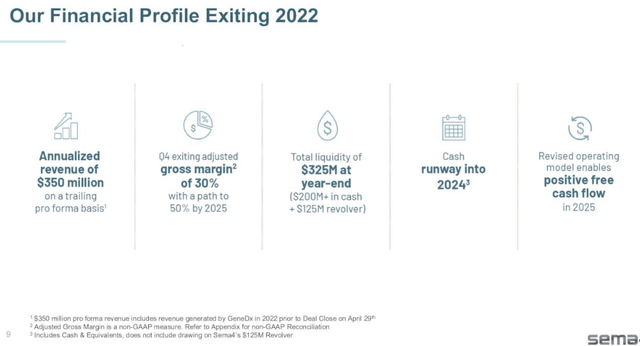

- A combined projected $350M in pro forma 2022 revenue.

- Lots of additional data: 350K+ clinical exomes, 2M+ phenotypes.

- The company is first going after cost synergies in order to preserve cash.

- GeneDx has a higher gross margin, so it will produce a lift.

- Revenue synergies will come from the combined dataset for pharma companies and health systems.

- There is likely to be an additional earnout in either cash or equity would produce an additional 8% dilution if all in shares (which seems all but inevitable).

The acquisition wasn’t exactly cheap (company PR):

Under the terms of the agreement, Sema4 has acquired GeneDx for an upfront payment of $150 million in cash, subject to adjustment, plus 80.0 million shares of Sema4’s Class A common stock, with up to an additional $150 million revenue-based milestones over the next two years (which will be payable in cash or shares of Sema4 Class A common stock at Sema4’s discretion). Based on the closing stock price of Sema4’s Class A common stock as of April 29, 2022, the trading date on the closing of the transaction, the total upfront consideration represents approximately $322 million, and the total aggregate consideration including potential milestones is approximately $472 million.

This was considerably cheaper than when the acquisition was announced in January (which mentioned a total deal value of $623M). The $200M private placement was at $4 per share, so 50M shares. There are other advantages:

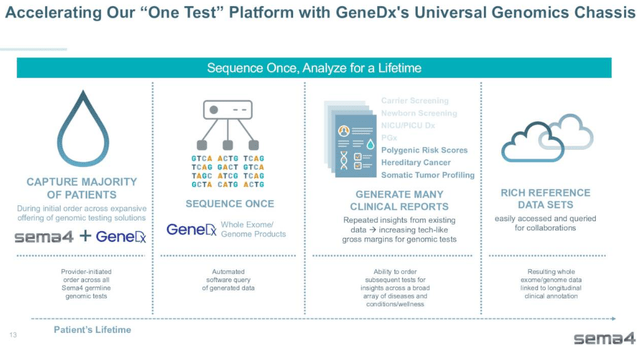

And, of course, more data reinforces the flywheel effect:

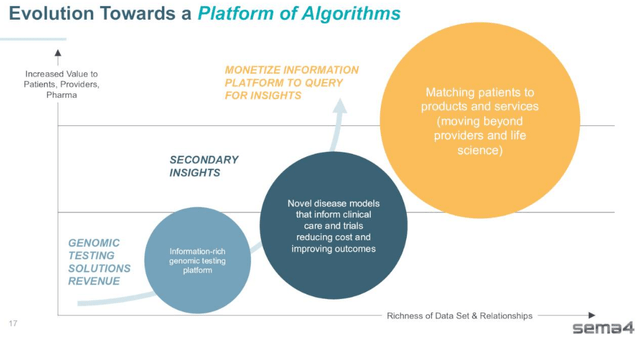

In the circle in the slide above, you also see the type of services that the combined company offers to its clients, with a few examples for biopharma companies on the right. And below is the evolution the company sees for itself after the absorption of GeneDx:

In the meantime, management sees significant revenue synergies as a result of the combined dataset (Q1CC):

like we were anxious from the signing of that agreement to 350,000 plus exome, clinical exomes, more than 2 million phenotypes on an amazing ramp to keep growing that kind of a resource and a team that has deep expertise on both the genomic side in terms of interpreting genomes for these rare disorders and their connectivity to common disorders, but then also on the clinical side, linking that molecular data with the pathophysiology of the diseases, which is how you impact clinical medicine.

This captured the attention of pharma companies, but also for health systems, there are opportunities (Q1CC):

On health systems, that became another really clear area. Obviously the model that Sema4 team has built to be able to cost efficiently improve these health system is incredibly impressive. And being able to go in and now add our exome for the pediatrics segment into the NICU is something that we’ve heard from current customers, as well as potential future ones. It is something that is of interest.

All very well, but how is the company actually doing?

Finances

At first sight, there hasn’t been a clear growth trend lately:

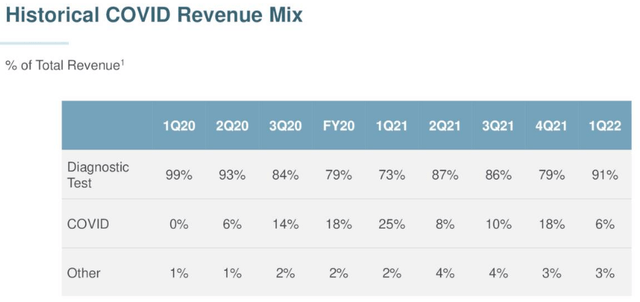

But the data are messed up by the temporary Covid testing which the company jumped on as an additional source of revenue, starting in H1/20 but terminating in Q1/22:

The main data points:

- Testing volumes +27% ex-Covid

- Women’s Health +23% and oncology +159%

- Revenue $53.9M vs $64.2M in Q1/21 (+6% from Q4/21)

- Revenue ex-Covid $50.1M vs $48.3M in Q1/21

- GM 10%

- Adj GM 13% vs 0% in Q4/21 and 22% in Q1/21

- OpEx $94.9M

- Adj OpEx $71.8M vs $43.9M in Q1/21

- Net loss $76.9M

- Adj net loss $65.9M vs $24.9M in Q1/21

- Cash $315M

- Shares out 377.25M

Costs are increasing which isn’t a surprise as they doubled the size of their sales team (now 175 reps large). Revenue growth is pretty meager, so the losses are rapidly increasing, no wonder the shares have been under pressure.

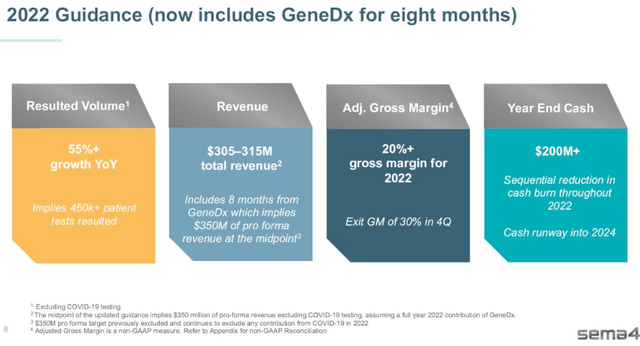

Guidance

This is what the company guides for FY22, including 8 months of GeneDx:

And some additional data:

The company is embarking on increasing operating efficiency and expects to be able to reduce the cash burn by $50M this year by improving collections and reducing headcount at Sema4 Holdings by 10% and a few additional measures in areas around lab, automation, longer-term efficiencies in the supply chain and the like.

Management also thinks they can drive ASPs higher, especially as a result of the acquisition of GeneDx and as a result of progress in reimbursement on cancer somatic profiling, which they expect by the middle of the year (Q1CC):

in general we’re obviously very excited about the potential for better reimbursement in oncology and as I mentioned earlier, that’s something that’s around the corner. And then as we look at the rest of the business, a lot of the opportunity around ASP, really relates mostly towards improved billing collections, that kind of thing. Future contracting is also important.

Cash

This isn’t a pretty picture:

Even if they achieve the planned $50M reduction in cash burn, they’re running out of cash in 2024, a year before they plan to become cash flow positive, so additional finance will be required at some point, the main reason why the shares keep sliding.

FinViz

Risks

The risks are considerable. Revenue growth might continue to disappoint as it did the last several quarters. This would further increase net loss and the already very significant cash burn and put the target of going cash flow positive by 2025 in jeopardy, increasing the need for additional financing and bringing it forward.

Since they will need additional financing anyway, we don’t know at what terms they will get it or what market conditions will be at that time (most likely somewhere in 2024).

It could be that the market for this type of growth stock is still as bad (or even worse) as it is today, which could mean the company could significantly dilute its shares.

Valuation

First, we had to check whether that private placement that came conjoined with the GeneDx acquisition is actually in the share count. It is:

Now, add to that:

SMFR 10-Q

So the fully diluted share count is 459M shares. Some additional data:

- Market cap (at $1.2 per share) $550M

- EV (at end FY22) $350

- FY22 revenue $350M (pro forma, as if GeneDx was acquired before 2022)

So the shares trade at 1x FY22 EV/S, which really isn’t a terrible stretch. On the other hand, the company is still losing lots of cash and isn’t growing very rapidly and gross margins are still rather small, although they are projected to rise considerably this year and reach 30% by year-end.

We should mention here that the founder and President bought 100K shares at $1.92 a couple of weeks ago (one also sees some of the buyers of the private placement issued for the GeneDx acquisition in that link).

Conclusion

There are multiple things to like:

- The company is amassing an enormous data vault that can be used in myriad ways in order to serve multiple customer segments in the burgeoning market of precision medicine.

- Like most platforms based on big data and machine learning, there is a bit of a virtuous cycle operative with more data improving the algorithms, increasing the use, and generating more data.

- The company has a significant roster of partners.

- Their oncology business is growing at triple-digit rates, albeit from a small base, and reimbursement is expected to improve.

- Finances are expected to improve considerably this year, with gross margin rising from 10% to 30% by year exit.

- The shares are cheap if finances improve according to plan.

Against this:

- Growth hasn’t been all that great, even leaving Covid testing aside.

- The company still bleeds lots of cash and produces large losses.

- While they’re extending their cash lasting into 2024, the company expects to be cash flow positive by the end of 2025, which still suggests a considerable need for additional financing even if things go according to plan.

Be the first to comment