Mironmax Studio/iStock via Getty Images

MP Materials (NYSE:MP) is a basic materials company focused on rare earth metals, with its primary asset being the Mountain Pass mine in California. Mountain Pass has been in operation for decades.

It was also the main holding of Molycorp, which was a hot stock for a few years in the early 2010s but later fell into bankruptcy when the price of rare earth metals declined. A financial group acquired the mine out of bankruptcy. Following a 2020 SPAC deal, the mine is a publicly-traded asset once again, now under the MP Materials banner. Over time, the company hopes to build out its own processing facilities in the United States as well.

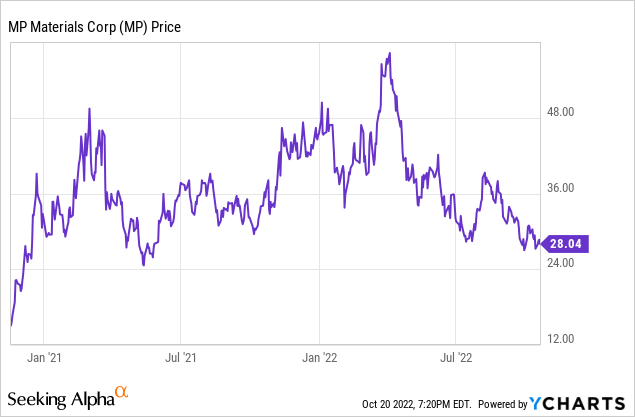

So far, MP Materials has had a successful run as a public company. Despite the recent swoon, shares are still up sharply from their SPAC debut:

Investors might think that MP Materials is the rare recent SPAC deal that can avoid the usual downward trajectory associated with companies that come public this way. However, I am skeptical that MP stock will be able to maintain its share price of nearly three times the $10 opening SPAC level.

The Appeal Of Rare Earth Metals

Rare earth is a funny term, in that it encompasses a group of materials that, in general, aren’t actually that rare. Historically, the issue with rare earths isn’t the difficulty of finding them, but rather their niche usage. Given the limited demand for rare earth materials in the past, supply chains for the group haven’t become too robust to date.

Now, however, things are changing. Rare earths are profoundly important in the making of high-performance magnets. These magnets, in turn, are needed for electric traction motors used for electric vehicles. Long story short, unless there are technological breakthroughs in motor technology, rare earths such as neodymium are likely to see a tremendous surge in demand in coming years.

Electric vehicles are arguably the biggest growth driver for rare earths. That’s not the only catalyst though.

Wind turbines are another promising area for rare earths. While wind turbines have a much smaller addressable market than electric vehicles, wind turbines use a much larger and more rare earth-intensive form of magnet, meaning that the potential upside to the industry is larger than it would first appear. And wind turbines may have extra momentum in coming years thanks to the energy shortages and extreme electricity prices we’ve seen this year in the wake of Russia’s invasion of Ukraine.

MP’s Advantage: Rare Earths From North America

Neodymium is actually one of the more common elements in the earth’s crust, however production remains fairly limited. Large reserves have been found in places such as Greenland which are not particularly conducive to commercial mining interests. As such, China has been able to largely monopolize production in recent years.

MP makes a point of marketing itself as the only rare earths producer in the Western Hemisphere:

MP slide (Corporate Presentation)

With heightened national security concerns, a United States-based rare earths mine seems like a winner in the current geopolitical environment. But, there’s a catch.

More China Risk Than You Might Realize

At first glance, it might seem like MP Materials would be a potential beneficiary of reshoring. With companies looking to relocate supply chains closer to home, MP Materials might have a strategic advantage from being a primary supplier of rare earth materials sourced from North America rather than China.

However, while MP Materials has its mine in the United States, it supply chain is still heavily tied to China. That’s because the company sells a large portion of its mined output to China to be processed. Consider the following from MP’s most recent 10-K:

We currently rely on Shenghe [a Chinese firm] to purchase the vast majority of our rare earth concentrate product on a “take-or-pay” basis and sell that product to end users in China. We cannot assure you that they will continue to honor their contractual obligations to purchase and sell our products, or that they will make optimum efforts to market and sell our products […]

To the extent we remain reliant on Shenghe, we are also subject to the risks faced by Shenghe where such risks impede their ability to stay in business, make timely payments to us, perform their obligations to us, or sell our products to their end-customers.

Just in case that wasn’t clear enough, MP Materials further explained that:

“The possibility of adverse changes in trade or political relations with China, political instability in China, increases in labor or shipping costs, the occurrence of prolonged adverse weather conditions or a natural disaster such as an earthquake or typhoon, or the continuation of COVID-19 or the outbreak of another global pandemic disease could severely interfere with the sale and/or shipment of our products and would have a material adverse effect on our operations.

Our sales may be adversely affected by the current and future political environment in China and the policies of the China Central Government.”

For people that own MP stock primarily as a “Made in America” themed investment, the language there about potentially being adversely affected by Chinese government decisions should give you pause.

Now, to be clear, MP is aware of the problem. The company is working on developing processing facilities in the United States which can reduce the company’s current dependence on China. However, there will be execution risk until American facilities are up and running and we see how they are funded and what the ultimate economics end up looking like.

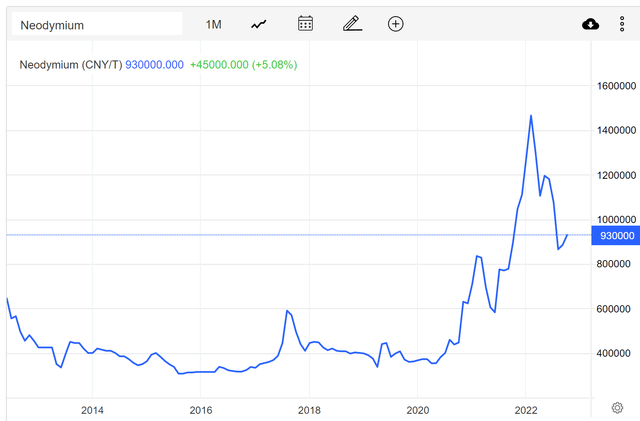

Neodymium Prices Have Slid Dramatically

Given the limited markets for rare earths, there isn’t the same level of pricing transparency that we’d see in, say, gold, silver, or copper which trade large volumes on futures exchanges.

That said, the price of neodymium gives a decent indication of how the broader industry is doing.

And, as the chart below shows, after a huge run-up over the past two years, the tide has turned and the price has dropped substantially off the recent highs:

Neodymium price (Trading Economics)

I’d note that MP Materials was unprofitable in 2019 and 2020, and only modestly profitable for most of 2021. It was when prices went sky-high at the end of 2021 and early 2022 that MP Materials has looked like a cash flow machine. Unfortunately, it appears that this burst of strong profitability may be short-lived.

The company recently said that demand remains strong, despite the apparent drop in prices. So, there is a chance that MP can maintain strong profitability despite the apparent downward turn in the industry’s outlook. However, investors should be cautious until we see more certainty on this front.

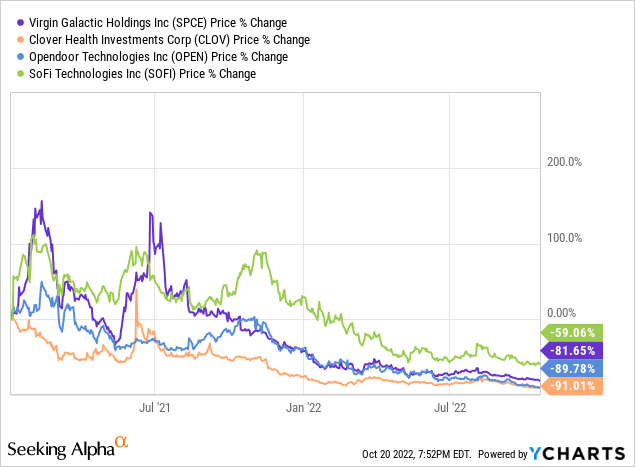

Chamath Deals Aren’t Doing So Well

Another notable point about MP Materials is that Chamath Palihapitiya was involved in a private investment in a public equity “PIPE” deal for the MP Materials SPAC. Palihapitiya’s own group of SPACs have done quite poorly:

Huge declines have been seen across the board, with some approaching minus 90% readings now.

Taking part in a PIPE is different from being the lead operator on a SPAC. However, Palihapitiya’s marketing helped lead investors to take part in recent SPACs such as Desktop Metal (DM) and Metromile. Desktop Metal shares are down 75% from their initial SPAC offering, and Metromile shares dropped roughly 90% before the company merged with Lemonade (LMND).

Given the rather unfavorable results of Palihapitiya’s investments in recent years, investors might want to approach MP Materials with a wary eye. Is MP Materials really revolutionizing the rare earths supply chain and leading the expansion of an exciting new industry? Or, like various other Palihapitiya investments, will the truth turn out to be less promising after the initial excitement passes?

For one thing, MP’s current strategy doesn’t seem unlike that of its predecessor, Molycorp.

Back in 2010, Molycorp took advantage of a run-up in rare earths prices to build an elaborate vision of the future. It was planning a “mine-to-magnets” strategy where it would build the rare earths products in the U.S.

Initially, Hitachi was supposed to be the partner for this. After Hitachi went its separate ways, Molycorp looked for other backers. At the height of Molycorp’s stock price, the company was telling its investors that a magnets factory would be operational by 2012 or 2013. That never came to pass and the rest is history; once rare earths prices tanked, Molycorp lost the financial capacity to broaden its business; bankruptcy followed not that long afterwards.

MP Stock Verdict

Is MP Materials the future of rare earths supply for the Western Hemisphere? It’s too early to say definitively. However, I’m a lot less optimistic than the bulls are.

I’d suggest that going public via a SPAC is potentially indicative of the quality and long-term prospects for the company. Thanks to a recent spike in rare earths pricing, MP Materials enjoyed a moment in the sun, just as Molycorp did back in 2010. With the company currently profitable, it’s easy to imagine huge U.S. factories and world-changing technologies.

Now, however, rare earths prices are already sliding again, just as they did in the early 2010s. There’s not much evidence that China isn’t the ultimate marginal setter of price. Problems related to Covid-19 may have created a temporary shortage in the market. But in the longer-term, rare earths aren’t all that rare and Mountain Pass historically hasn’t been the lowest-price provider.

Perhaps that changes due to regulatory or security concerns. But the Biden Administration just shot down a proposal for tariffs on rare earths magnets.

Long story short, in a market where SPACs are decidedly not appealing anymore, MP Materials looks like it has a lot farther to fall. Sure, shares are down a lot off their highs. But the stock is still at $28 in a world where very few completed SPAC offerings trade above $10. Meanwhile, profitability is seemingly set to plunge in 2023 given the current trends in the rare earths market. Don’t buy into MP stock based purely on last year’s earnings, as the future looks a lot less certain.

Be the first to comment