LumerB/iStock via Getty Images

Generally, we are very bullish on real estate investment trusts (“REITs”) (VNQ) at High Yield Landlord.

These are not empty words, as I personally have about 50% of my net worth invested in them.

Many would probably describe me as a “cheerleader” of the REIT sector because I regularly post articles on my favorite REIT investment opportunities.

However, this does not mean that I am bullish on every REIT.

In fact, over the past year, I have sold many REITs that had either reached my fair value target or lost appeal due to growing risks.

In today’s article, I highlight two examples that I sold in order to reinvest in other better opportunities:

Broadmark Realty Capital Inc. (BRMK)

We invested in the company back in 2021 because we saw an opportunity to profit from the housing boom.

BRMK is a mortgage REIT that specializes in hard money lending and most of its loans were backed by residential properties.

Typically, hard money loans are quite risky and this is why lenders like BRMK are able to charge double-digit interest rates and additional fees on top of that. We always knew that BRMK was one of our riskiest holdings, but we liked the risk-to-reward because residential prices had risen a lot, and we thought this would provide enough margin of safety for BRMK to recoup its principal in case of loan defaults. BRMK also had a good track record with just 0.2% of cumulative losses over the past decade and the company had no debt, reducing risks even further.

Broadmark Realty Capital

But then things started to head south.

As inflation took off, increasingly many borrowers began to miss payments. Then interest rates began to rise, which caused the housing market to cool down a bit. At the same time, the hard money lending business became more competitive, making it harder for BRMK to find new loan opportunities, and forcing it to reduce its interest rates and fees.

By then, the hopes of the dividend getting covered in the near term were slowly evaporating. We still held some hope that as they take on some debt and reinvest it at a large positive spread, the accretion would show in their funds from operations (“FFO”) per share, eventually covering the dividend.

But as interest rates surged to historic highs, we began to lose even those hopes and decided to sell our position at a loss.

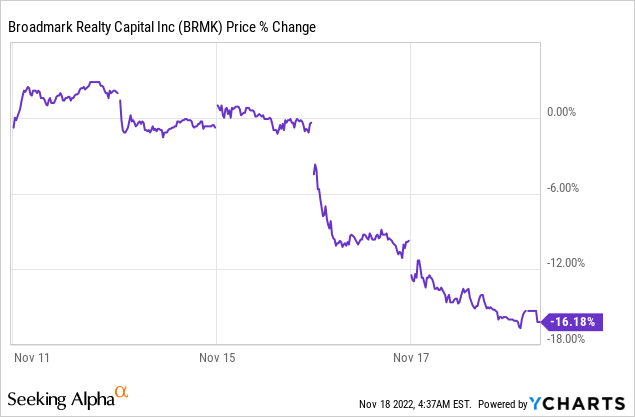

And I am glad we did, because the news has only gotten worse since then!

Its provisions for credit losses were increased further in the third quarter, but even more worrying is that the company’s leadership is a mess. They are searching for a new CEO after the previous one resigned, and they are also in the process of switching their CFO.

As if that wasn’t enough to worry about, the board decided to slash the dividend by 50%, putting an end to the hopes of growing the cash flow to eventually cover the dividend.

The share price is down significantly as a result, and understandably so.

I think that BRMK is cheap and could present an attractive opportunity for long-term investors now that they have right-sized the dividend, but as long as their leadership situation isn’t fixed, I wouldn’t be interested to buy the stock.

I am not bearish, but not particularly bullish either. The company went from bad to worse and there are better opportunities elsewhere.

Iron Mountain Incorporated (IRM)

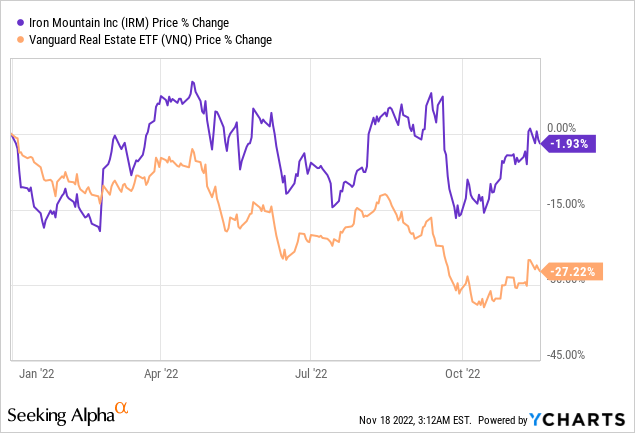

In hindsight, we sold IRM too soon. It has risen quite a bit since then, and the company’s share price has remained stable even as the rest of the REIT sector sold off heavily:

This is precisely why I wouldn’t be a buyer today, and if I owned it, I would consider selling it.

The company was opportunistic when it traded in the $20s, as it offered a high yield and the market was overly pessimistic about the future of its paper storage business and overlooked the company’s ability to grow a data center business.

But now, at $50+ per share, the market is doing the opposite.

It went from being too pessimistic to now being overly optimistic. It is now pricing IRM at a premium relative to other REITs as if it was a safe REIT with steady long-term growth prospects, but that really isn’t the case.

The vast majority of its business remains paper storage, which has an uncertain future. I agree that this business will likely stay around for much longer than many might think, but even then, the long-term outlook is bleak. Eventually, growth will turn negative because so much paper simply isn’t needed anymore.

Iron Mountain

And I fear that just a 1% negative growth rate in paper storage could lead to drastic repricing of the stock. Right now, the market does not seem to care about the risks of this business because the growth is still positive, but when this changes, the deterioration in market sentiment could be rapid and very punishing to the stock. The market is quick to extrapolate recent trends far into the future, and even a small negative growth rate could lead to painful losses since the stock is priced quite expensively, especially relative to other REITs.

Something else that the market appears to have overlooked is that IRM has quite a bit of leverage. Investors used to worry about IRM’s balance sheet back in 2020/2021 when the sentiment was low, but the balance sheet is still more or less the same.

Right now, the focus is on the data center business, which is growing nicely, but I suspect that the paper storage business will eventually regain the center of attention, and the stock price will underperform as a result.

Priced at 18x FFO, we think that there are better opportunities elsewhere, and ultimately, this is why we would not own IRM. Just to give you an example: Alexandria Real Estate Equities, Inc. (ARE), the leading life science REIT, trades at a similar valuation, but has safer assets, a stronger balance sheet, and faster growth prospects. Why would you favor IRM?

Bottom Line

REITs make up a huge portion of my portfolio, and I am very bullish on a number of them.

However, it is important to remember that there are over 200 REITs out there, and just because I own ~20 of them does not mean that I am bullish on the remaining 180.

It is very important to be selective in today’s environment, and that explains why we only invest in 1 out of 10 REITs on average at High Yield Landlord.

Be the first to comment