Artur Plawgo Seagen

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. – Warren Buffett

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 28, 2022.

While you can make money trading biotech catalysts, your biggest gains come from holding carefully chosen growth bio-stocks throughout many market cycles. After all, that’s where you’ll get your multi-bagger profits. And, that’s what the investing gurus like Warren Buffett or Charlie Munger would do. As you can see, only a few biotech firms would become the large biopharmaceuticals of the future. One reason is that promising firms tend to get acquired. The other more common reason is that subpar performers never grow into a large cap operator. As such, you should follow the investing thesis (i.e., story) of your stocks to see if you should hold them for the long haul.

That being said, I’d like to revisit a company that has great long-term potential. Powered by four great medicines, Seagen Inc. (NASDAQ:SGEN) is poised to enjoy almost $1.7B in revenues for this year. Despite tremendous progress, there are many fundamental improvements to deliver long-term upsides. In this research, I’ll feature a fundamental analysis of Seagen and share with you my expectation of this intriguing Phillip Fisher growth equity.

Figure 1: Seagen chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. I noted in the prior research,

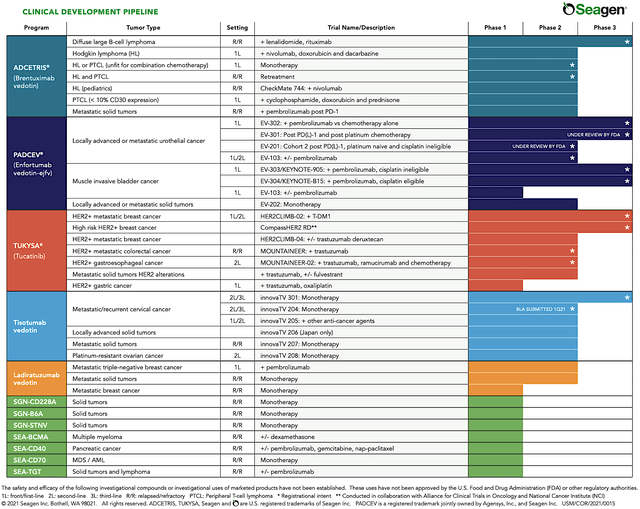

Operating out of Bothell Washington, Seagen is focused on the development and commercialization of novel antibody-drug conjugates (“ADCs”) to serve the strong unmet need in various cancer indications. Of note, ADCs work by linking a payload drug to an antibody that has binding-specificity to certain cancer cells. As such, this leads to improved drug specificity, stability, and potency. In harnessing the power of ADCs, Seattle Genetics is brewing a robust therapeutic pipeline of approved medicines and developing drugs with different partners.

Figure 2: Therapeutic pipeline

Tracking Seagen’s Investment Thesis

Before proceeding with the analysis, you should place Seagen into its appropriate investment category. That way, you can better track its progress and thereby know when to buy, sell, or hold. Here, Seagen fits into the “growth biotech” category. As such, you’d want to monitory any developments relating to its Big Four franchises (i.e., Padcev, Adcetris, Tukysa, and Tivdak). Growth for these approved drugs entails increasing sales and advancement relating to label expansions.

Beyond the approved drugs, you want to make sure the majority of new developments (either organic or via partnership/acquisition) remains in the immuno-oncology (i.e., I/O) niche and relating to its technology (i.e., ADC).

So long as you see that growth/development for the Big Four as well as additional I/O and ADC, you know that your investment thesis (i.e., story) is working out well.

LAVA Therapeutics Deal

Committed to long-term growth beyond the approved medicines, Seagen recently entered into a partnership with LAVA Therapeutics back on September 26. Given that a growth biotech is heavily invested in long-term growth, this is a good sign that your investing thesis is working out. Hence, let us take a closer look at this partnership.

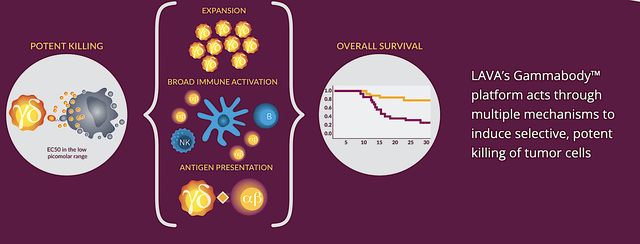

Accordingly, Seagen would in-license the pre-clinical molecule from LAVA, i.e., LAVA-1223. Capturing the power of the Gammabody technology, LAVA-123 triggers a specific subset of T-cells — the bispecific gamma/delta (i.e., GD) T cell engagers — to target a highly prevalent surface marker in solid tumors. Namely, that marker is the epidermal growth factor receptor (i.e., EGFR).

You can think of LAVA-1223 as a smart medicine telling the GD T-cells to zone in on cancers having the EGFR on its surface while sparing normal cells. That confers tremendous specificity and highly efficacious cancer decimation. With EGFR being found on many cancer cells (colorectal, lung, head/neck), the potential of this first-in-class drug is tremendous. Commenting on the deal, the interim CEO and CMO (Dr. Roger Dansey) remarked,

Seagen is committed to driving innovation to improve the lives of people with cancer, and this agreement represents the company’s entry into a novel class of therapeutics that are designed to overcome the challenges of standard T cell engagers by leveraging the activity of a distinct T cell subset. This exclusive license from LAVA provides Seagen with the opportunity to harness its expertise in developing first-in-class targeted cancer therapies, along with the company’s global development and commercialization capabilities.

Figure 3: Gammabody platform mechanism of action

Of specific deal terms, Seagen would receive the exclusive global license for LAVA-1223. In return, Seagen would pay LAVA $50M upfront plus $650M in potential development. That means, if LAVA-1223’s developments bear fruits (i.e., positive clinical results and approval), LAVA can gain up to as much as $650M. On top of that, there’s also ongoing royalties ranging from single digits to mid-teens on future sales results.

Riding Seagen’s deep expertise in therapeutic developments and tremendous experience navigating the regulatory landscapes, you can bet that this would give LAVA-1223 the best chances of success. If positive, LAVA gets to enjoy part of the profits with Seagen in the future. The $50M now would give the smaller company (i.e., LAVA) much needed cash to fund their operations.

While it seems highly in favor of LAVA, the hidden value in this deal for Seagen is the rights to LAVA’s Gammabody platform for two additional tumor targets. Those two indications can procure more blockbusters Seagen. As you know, the vast applications of LAVA’s Gammabody platform (in the hands of a highly experienced innovator, Seagen) would substantially increase the chance that some (if not most) development would deliver positive results. According to the President and CEO of LAVA (Stephen Hurly),

LAVA is pioneering the development of gamma delta bispecific antibodies to treat cancer, and we are pleased to work with Seagen in this pursuit. The combination of LAVA’s proprietary Gammabody platform and deep bispecific expertise, with Seagen’s leadership in developing targeted therapies for cancer and commercialization infrastructure, makes this an ideal partnership to advance novel therapies for patients. This agreement enables LAVA to further validate its platform in a second solid tumor product candidate, bringing us closer toward our goal of generating effective Gammabody medicines for cancer patients. We look forward to working with Seagen to develop potential next generation cancer treatments.

Zai Lab Collaboration

Asides from the said deal with LAVA, Seagen also announced the partnership with Zai Lab on September 27 for Tivdak. As the first and only ADC approved in the US for adults suffering from metastatic cervical cancer – with disease progression on or after chemo – Tivdak is an ideal drug for Zai Lab to add to their oncology (i.e., cancer) portfolio.

As you can see, the collaboration would give Seagen $30M in upfront payment. Moreover, Seagen is set to gain more money on milestones (i.e., development, regulatory, and commercial). Furthermore, Seagen and its other collaborative partner Genmab (GMAB) would share 50/50 on the tiered sales royalty. As such, Seagen is set to profit from three fonts. And, you can appreciate that a partnership like this would give Seagen more cash to invest in other deals such as LAVA.

In a therapeutic launch, your drug should either be the first, the only, or different from competitors for it to succeed. As you saw, Tivdak is both the first and only of its kind approved in the USA. As such, the chances are highly in its favor. Back in 2021, the FDA granted Tivdak accelerated approval for recurrent/metastatic cervical cancer (i.e., one of the deadliest cancers). Now, Seagen is still running a confirmatory Phase 3 open-label, randomized, global clinical trial dubbed innovaTV 301.

I forecasted 75% (extremely favorable) chances of positive data results which would grant further approval in the region where Zai Lab operates — Mainland China, Hong Kong, Macau, and Taiwan. Highly excited about the partnership, the President & CCO (William Liang) enthused,

Zai Lab has a significant presence treating women’s cancers in China, and Tivdak is an important addition to our oncology commercial portfolio. Treatments for cervical cancer remain a significant unmet need in China with approximately 110K new cases annually, and currently there are few effective therapeutic options available. We look forward to this collaboration with Seagen to make Tivdak available for patients in China as we expand our oncology portfolio.

Aside from the aforementioned Phase 3 trial, Seagen is pushing Tivdak into early clinical development for first-line cervical cancer usage and for certain other solid tumors. Therefore, the management is unlocking more value from the Tivdak franchise for the coming years. Simply put, Tivdak (like other stellar drugs of Seagen) is a fruiting tree that keeps on yielding more fruits.

Latest Operating Results

Shifting gears, you should check the latest performance. After all, the management’s previous efforts translated into the current operating results. You may think that past results do not guarantee future performance. Nevertheless, it can provide strong indications on where the company is heading.

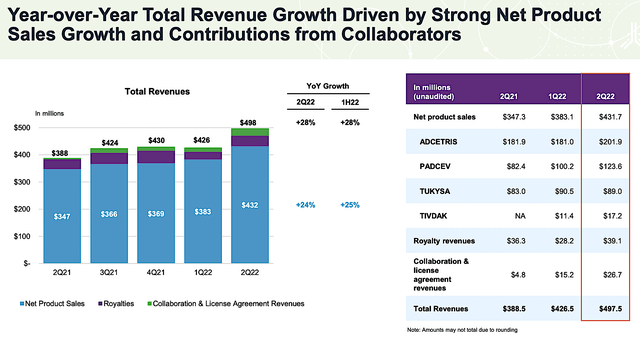

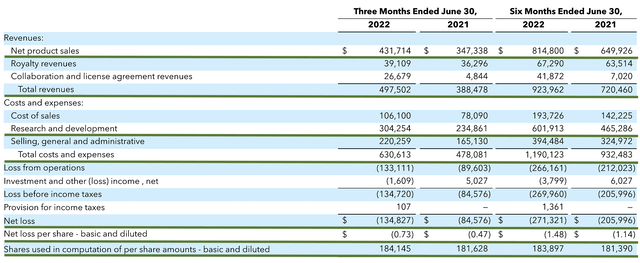

Viewing the figure below, Seagen has posted phenomenal 2Q2022 sales growths. The product sales of Big Four came in at the remarkable 24% (i.e., from $383M to $432M) year-over-year (“YOY”) rate. Adcetris and Padcev contributed to the strongest sales growth.

While Tivdak did not post impressive figures, I believe that it’ll do much better in the future because the Zai Lab collaboration would materialize over time. Moreover, becoming a first-line treatment would boost sales growth. Overall, you can anticipate that the uptrend trends for both revenues and product sales would continue.

Figure 4: Latest operational results

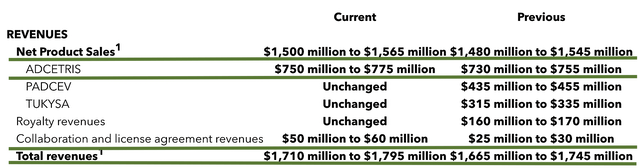

Going into year-end, you can see that Seagen is projected to deliver from $1.71B to $1.75B in revenues. It was revised from the previous estimate of $1.66B to $1.74B. Moreover, Adcetris sales are expected to come in higher (i.e., from $750M to $775M) than previous trajectory.

Essentially, Adcetris is heading closer and closer to the land of blockbusters. Meanwhile, the higher revised estimate means that these drugs are performing better than market expectation. That is a good sign indicating your investment thesis is playing out prudently.

Figure 5: Fiscal 2022 outlook

Competitor Landscape

Regarding competition, Seagen’s ADCs are competing against conventional chemoradiation therapies and immunotherapies. They’re the bread and butter treatments for cancer that will not go away. Notwithstanding, ADC represents an efficacious/safe approach that confers competitive advantages. Additionally, there are new treatment modalities that exert stronger competitive pressure than conventional drugs. I noted in the prior research,

There are novel treatments like CAR-T, CAR-NK, and CAR-macrophage. Notably, CAR-T is already approved for blood cancers. Though these novel CARs have not been proven effective for solid tumors, that’s where future developments are heading. You can bet there will be some CARs that would be highly effective against solid tumors. That aside, there are the tumor-infiltrating lymphocytes (i.e., TILs) of Iovance Biotherapeutics (IOVA) that have demonstrated robust efficacy for cancers. Regardless of the competition, there is always a strong demand for novel therapeutics. The oncology space is vast and thereby affords many blockbusters.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 2Q2022 earnings report for the period that ended on June 30.

As you know, Seagen procured $431.7M in revenue compared to $347.3M for the same period a year prior. Of that figure, the net product sales are comprised of $431.7M while the royalty revenues are made of $39.1M and the collaborative agreements brought in $26.6M. As such, the total revenue grew by the remarkable 24.3% YOY.

That aside, the research and development (R&D) for the respective periods registered $304.2M and $234.8M. I viewed the 29.5% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $134.8M ($0.73 per share) net losses compared to $84.5M ($0.47 per share) net declines for the same comparison. As you can see, the higher expenses related to R&D cuts into the bottom line. Right now, the most important growth metric for Seagen is its topline (i.e., revenue). Nevertheless, you can expect the company to bank a net profit in the future as the company grows larger to leverage the “economy of scale.”

Figure 6: Key financial metrics

About the balance sheet, there were $1.9B in cash and investments. On top of the $431.7M quarterly revenue and (against the $463.6M quarterly OpEx), there should be adequate capital to fund operations for many years. In a nutshell, the cash position and revenue are quite robust relative to the burn rate.

Valuation Analysis

It’s important that you appraise Seagen to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discounted Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 183.6M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Padcev for advanced urothelial cancer |

$4B (Estimated from the $8.4B global urothelial cancer market). |

$1B | $54.46 | $49.01 (10% discount because it is successfully launched and is growing aggressively at the 44% clip). |

| Adcetris for lymphomas |

$3B (Estimated from the global $13.1B lymphomas market) |

$750M | $40.84 | $36.75 (10% discount because it is successfully launched and is growing aggressively). |

| Tukysa for breast cancer | $5B (Estimated from the $55B breast cancer market) | $1.25B | $68.08 | $61.27 (10% discount because it is successfully launched and is growing aggressively). |

| Tivdak for cervical cancer | $4B (Estimated from the $12.6B cervical cancer market. Raised my estimate from the prior $3B because the company is pushing it overseas & getting it approved as 1st-line) | $1B | $54.46 | $49.01 (10% discount because it is successfully launched and growing). |

| Young pipeline assets | Will wait for further development | N/A | N/A | N/A |

|

The Sum of The Parts |

$196.22 |

Figure 7: Valuation Analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Seagen is whether the company can continue to ramp up sales growth for the Big Four medicines.

The other risk is if the company can gain more label expansion for the approved therapeutics. There is also a concern that not all developing molecules (i.e., the other pipeline expansion) would deliver the good clinical data needed for approval.

Conclusion

In all, I maintain my buy recommendation on Seagen with a 5/5 stars rating. Seagen is a story of investment success that rewards long-term investors. Over the years, the company successfully launched its Big Four drugs (Padcev, Adcetris, Tukysa, and Tivdak). Interestingly, those molecules are now either the first-line treatment or the standard of care for various cancers. Meanwhile, the company continues to aggressively expand their labels and penetrate into new markets.

The recent Zai Lab collaboration is an example of prudent expansion into the vast SouthEast Asia market where there is a high demand for Tivdak. The deal with LAVA is also solid proof in the pudding that Seagen is highly ambitious to grow beyond its Big Four. That aside, recent data reported were robust. Going forward, I expect more positive clinical results and regulatory decisions from Seagen.

Be the first to comment