aluxum

Recently, while I was looking at information on a fund manager for some CEFs (closed end funds) that I own in my No Guts No Glory retirement account, I came across an interesting article that listed ten reasons to “re-think” retirement income. The blog post from Virtus explained that the challenge for most people in retirement is decumulation.

The challenge is decumulation—converting accumulated assets into a steady and reliable stream of income that lasts through retirement. But there is no one-size-fits-all approach. Investors over age 72, for example, must deal with required minimum distributions from IRAs and defined contribution plans such as 401(k), 403(b), and 457(b) plans. Other investors may choose to annuitize some of those assets—a hot topic in the financial services industry given the various choices, costs, risks, and complexity. In any case, the risk is either spending too quickly and outliving their resources or spending too conservatively and consuming too little, say Boston College researchers.

Some of the reasons mentioned to re-think retirement plans are ones that resonate with me, including greater longevity (most of my relatives are living well into their 80s and 90s), inflation, questions about the future of Social Security (funds are expected to be exhausted by 2034), possibility of higher taxes in the future, increasing health care expenses, and elder care.

Some of the takeaways from the article also make sense to me and include, “be diversified, be patient, and be defensive”. One recommendation included in the article was to consider alternative and shorter duration investments and companies that can survive in a slower growth global economy. Along those lines, one unique fund that I have previously covered that offers investors an alternative multi-strategy investment vehicle is the Ecofin Sustainable and Social Impact Term Fund (NYSE:TEAF).

Back in January of this year I first wrote about TEAF and suggested that younger investors in particular who are interested in ESG (Environmental, Social, Governance) allocations in their portfolio for growth and income may want to consider this fund. Since that time, the fund has performed better than the overall market and better than many similar funds with exposure to utilities, renewable energy, and other uncorrelated assets such as private credit and fixed income. In fact, when I last covered the fund over half of the portfolio included private investments.

Comparing TEAF total returns YTD versus some similar funds like Cohen & Steers Infrastructure Fund (UTF) and Franklin Universal Trust (FT) illustrates the better performance of TEAF, which is nearly break-even on a YTD total return basis.

TEAF Overview Revisited

It has been a few months since I last reviewed the fund and its holdings. This is the fund’s description:

The Ecofin Sustainable and Social Impact Term Fund seeks to provide a high level of total return with an emphasis on current distributions. TEAF provides investors access to a combination of public and direct investments in essential assets that are making an impact on clients and communities.

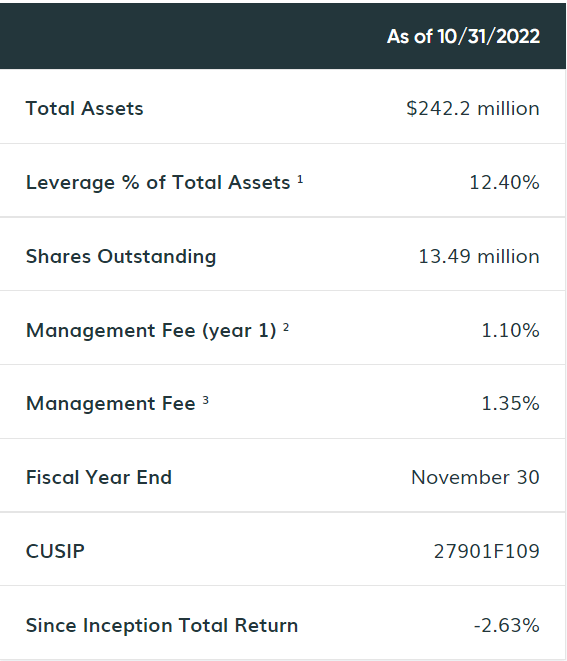

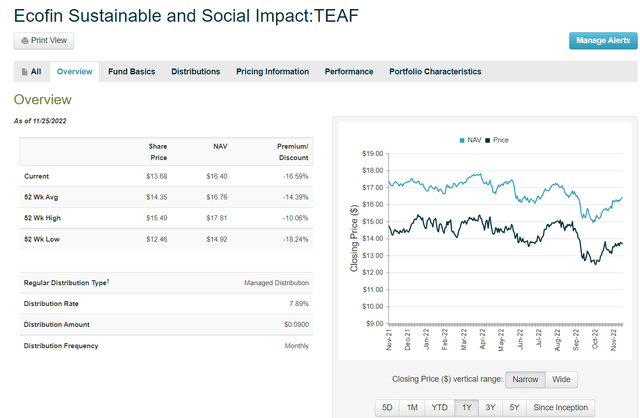

The fund’s objectives include attractive total return potential with emphasis on current income and uncorrelated assets, access to differentiated assets (e.g., private holdings), and investments in tangible, long-lived assets. The fund also strives to offer investors the ability to make a social, environmental, and economic impact. The fund went public 3/26/2019 at $20 and offers a monthly distribution. The fund NAV as of 11/25/22 was $16.40 and trades at a market price of $13.68 for a discount of -16.59%, wider than the 1-year average discount of -14.4%.

TEAF overview (fund website)

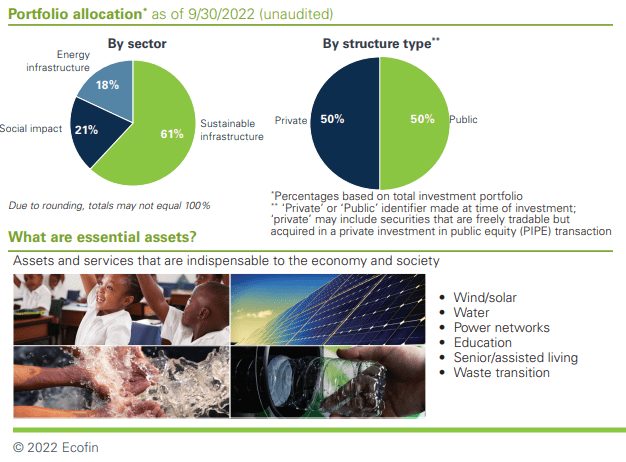

The fund assets include wind and solar power, water, power networks, education, senior and assisted living, and waste transition. The term date of the fund is 3/27/2031. From the fund fact sheet:

TEAF is a non-diversified, closed-end management investment company that will have a limited period of existence and shall dissolve as of the close of business 12 years from the effective date of its initial registration statement. If the fund has greater than or equal to $100 million in net assets at the end of the term, the Board may elect that the fund converts to a perpetual trust.

As of 9/30/22 the fund had 66 holdings with about a 50/50 split between public and private assets.

fact sheet

On November 1, the fund issued an unaudited update of its balance sheet and coverage ratios. As of October 31, 2022, the NAV was $15.70 per share (compared to $16.40 on 11/25). The asset coverage ratio was estimated at 811% with respect to senior securities representing indebtedness.

Distributions

On November 8, the company declared a monthly dividend of $0.09 per share payable December 30, 2022, January 24, 2023, and February 21, 2023. For tax purposes, the distributions are expected to consist of 40 to 60% characterized as dividend income with the rest ROC (return of capital). A final determination will be made in January 2023 and a 1099 will be issued to shareholders. The monthly distribution of $0.09 at the current market price of $13.68 results in an annual yield of 7.9%. That same monthly distribution has been paid since January of this year when it was raised from $.08 in 2021.

The fund uses a managed distribution policy, which is explained on their website:

The fund has adopted a managed distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 6% to 8% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts in May and November. The fund may designate a portion of its distributions as capital gains and may also distribute additional capital gains in the last quarter of the year to meet annual excise distribution requirements.

In addition, the fund offers a DRIP option whereby dividends can be reinvested at 95% of market price when the fund trades at a premium to NAV, or at market price when the fund trades at a discount. Therefore, by reinvesting the monthly dividends at a discounted price, the total return of the fund will be even greater than if the dividends are taken as cash. The DRIP option makes the fund more attractive to younger investors who are still in the accumulation phase, as opposed to retirees who are in more of a decumulation stage and just want the steady monthly income.

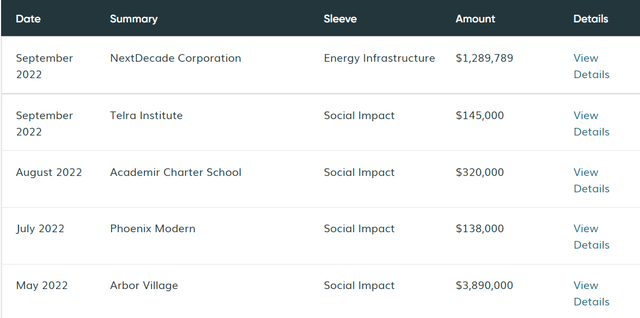

Recent Deals

Some of the recent deal summaries are included on the fund’s website as well. Most of the deals in 2022 have been in the Social Impact category including education and senior/assisted living. The NextDecade deal is a play on natural gas with the development of an LNG facility in Texas, as well as carbon capture and storage.

NextDecade is developing Rio Grande LNG in the Port of Brownsville, Texas. By combining our carbon capture and storage project, responsibly sourced gas, and our pledge to use net-zero electricity, we expect Rio Grande LNG to produce a lower carbon intensive LNG for the world.

summary of recent deals (TEAF website)

The market opportunity for TEAF is based on the concept of “essential assets”. As described in the fund Prospectus, this is a significant opportunity that is sustainable, long-term, and offers investors an opportunity to participate in these trends.

In a world increasingly prone to rapid change, our adviser believes that essential assets and services such as social infrastructure, sustainable infrastructure and energy infrastructure will continue to experience growth throughout cycles. Our adviser believes there is currently a significant need for capital investment in social infrastructure projects to expand and enhance education and healthcare, housing and human services systems, sustainable infrastructure projects to enhance and/or replace the U.S. electrical grid, particularly through wind and solar power, and to improve global water systems and energy infrastructure projects to build out the critical pipeline network.

Our adviser believes that the need for such investment in essential assets also creates an opportunity for investors to participate in the ongoing growth of these sectors while achieving attractive income potential. These assets are generally long-lived with low obsolescence risk, high barriers to entry and relatively inelastic demand across the business cycle. The Fund is intended to provide investors with exposure to essential assets in a range of sectors and across the capital structure, including access to direct investments that may not otherwise be widely available to many investors. The Fund will emphasize income-generating investments in social infrastructure, sustainable infrastructure and energy infrastructure.

While the fund is relatively young and picked a somewhat inopportune time to go public, I believe that the long-term potential for growth and income is strong and relatively low risk for the reasons outlined above.

In his August article on TEAF, my fellow author Nick Ackerman goes into much greater detail regarding the specific holdings and delves into the private sector holdings in more detail than I have as well. He rated the fund a Hold at that time, when the price was a bit higher than it is today. The Renewable Holdco private investments are some of the largest holdings of the fund. As Nick explains, one of the Holdco investments pays a regular monthly installment that amounts to a 9% annual yield. Another smaller investment is in a charter school that pays 11% on a senior taxable bond. These are just a couple of examples of how the fund generates income.

Summary and Recommendation

While the TEAF closed end fund is not a good fit for everyone, it probably deserves a closer look for those seeking growth and income and have some time to accumulate shares and reinvest the monthly distributions. I believe in the long-term sustainability of the essential assets that the fund is targeting, and it offers an alternative investment choice that is uncorrelated to other assets like traditional stock or fixed income funds.

While the fund struggled bit in 2020 due to the collapse of the energy markets, it has managed to hold its own in 2022 even as other ESG or utility-related funds have underperformed. The price/NAV chart on CEFConnect shows how the trend appears to be moving in a positive direction for the fund’s NAV, while the market price discount widens.

I feel that this is the sort of investment that fits the advice that I discussed in the introduction to this article – be defensive, be patient, and be diversified. This fund is a Buy for investors who are willing to wait for this defensive, diversified alternative investment to deliver a strong total return in the years to come.

Let me know in the comment section if you agree or disagree, or if you have other information that would help potential investors to make an informed decision regarding whether to invest in TEAF.

Be the first to comment