Thinkhubstudio

Last year’s rename from Facebook to Meta Platforms (NASDAQ:META) took many by surprise. Though it may have seemed like a prank at first, it was not. CEO Mark Zuckerberg was very serious and the capex that is now going into the company’s planned “metaverse” offerings has been robust. While the scope of this article won’t be to analyze Meta’s current advertising model or the recent Q2 results; what I will try to provide the reader is an assessment of the difficult path to profitability that I see for Reality Labs.

What Meta is now embarking on with its push to building a market-leading VR/AR ecosystem is no small task. As Facebook, the company became a household name by building a two-dimensional community that could be accessed from just about any connected device whether it was a phone, desktop computer, or tablet. Now as Meta, the company must keep up with social media insurgents like TikTok while also using cash flow to build out a three-dimensional VR community that requires a very specific type of hardware.

The question for Meta Platforms investors is not will VR/AR become a more important vehicle for spending leisure time in the future; I think it ultimately will. The question is will Reality Labs be able to sustain revenue growth that outpaces the growing cost of operations? I think that might be more of a long shot.

Reality Labs

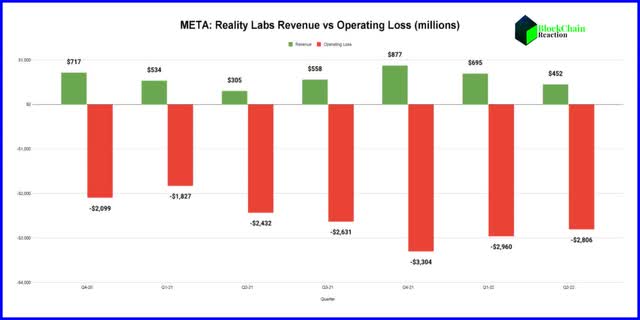

Much of the attention on Meta’s new product initiatives is centered around Reality Labs. This is the business segment where Meta’s virtual reality project Horizon Worlds lives. Horizon Worlds is essentially a 3D virtual canvas where developers can build games and experiences using Reality Labs’ infrastructure. At the user level, this ecosystem is explored with the Meta-owned Quest 2 headset. This infrastructure has already required a significant amount of cap-ex investment and reduced Meta’s profit by $10 billion in 2021 according to the company. So far this year, Reality Labs has operated at a nearly $5.8 billion loss:

While the operating loss from the Reality Labs segment has declined each of the last two quarters, that has been accompanied by declines in revenue as well. This is to be somewhat expected given the seasonality of device purchases. Holiday spending will ramp during the second half of the year. But the year-over-year pace of growth in revenue in Q4-21 and in Q1-22 was actually slower than the pace in operating loss:

| YoY Change | Revenue | Operating Loss |

|---|---|---|

| Q4-21 | 22.3% | 57.4% |

| Q1-22 | 30.1% | 62.0% |

| Q2-22 | 48.2% | 15.4% |

Source: Meta Platforms

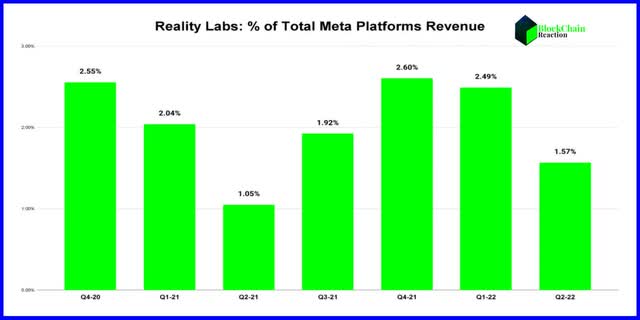

Meta finally saw the revenue growth for the Reality Labs segment outpace the operating loss in the last quarter. That’s a better sign. But it’s still a segment that is a massive cash-burner and a large gamble given the fluidity of what the “metaverse” even is. For how much cash is being plowed into metaverse building, Reality Labs is still a very tiny portion of Meta’s overall revenue at just 2% year to date:

Mark Zuckerberg seems to be taking the “if you build it, they will come” approach for his metaverse vision. But that vision is clearly still several years away from becoming reality. And ultimately, Reality Labs could wind up spending a lot of money building a metaverse that few people care to experience.

The Tolerance for Closed Ecosystems

It’s interesting to me that Zuckerberg has been calling Apple (AAPL) Meta’s biggest competitor in the metaverse, and it gives us important insight into how he views more closed ecosystems in VR. This is what he reportedly said to staffers in a meeting on how Meta’s approach differs from what Apple’s might be:

I think it’s pretty clear that Apple is going to be a competitor for us, not just as a product but philosophically. We’re approaching this in an open way and trying to build a more open ecosystem. We’re trying to make more stuff interoperable with Android. We’re trying to develop the metaverse in a way where you can bring your virtual goods from one world to another.

I think this is important. One of the core elements of the “Metaverse” or “Web 3” as I personally see it is the fundamental belief by many that there should be some presence of interoperability. For instance, users may be more likely to spend money on digital items and goods if they can use them in as many applications as possible. We see an obvious overlay here in the crypto community where software extensions like MetaMask allow users to log into a variety of different unrelated applications that are all built on the Ethereum (ETH-USD) network.

While Zuckerberg seems to understand interoperability is important, it’s not exactly clear yet what that will actually look like. For example, Solana (SOL-USD) ecosystem users can buy NFT sneakers for the “move to earn” lifestyle app STEPN (GMT-USD) on a platform like OpenSea, use the sneaker in the STEPN game, and then sell them on a completely different platform like Magic Eden. If Horizon Worlds can build something similar, users will likely be more inclined to make in-app purchases. That said, I think it’s still too early to tell. The answer may come down to whether or not Meta Platforms truly has pricing power over a future user base that is difficult to even quantify.

Pricing Power?

I think the biggest potential problem for Meta Platforms though might be navigating the pricing conundrum. The company is currently selling the VR headsets essentially at cost. The reported plan is to charge quite a bit in platform fees; likely to make up for not taking a profit on devices. But when it comes to digital asset marketplaces, it is my view that Meta has an inflated expectation of what it will be able to take from NFT creators. It wants a 17.5% commission on Horizon Worlds sales and a 30% hardware platform fee from Meta Quest Store. I think this is unlikely to happen in reality.

Digital goods creators are already using numerous other marketplaces, and they’re paying generally somewhere between 2-5% in commissions to the marketplace operators. OpenSea is by far the largest NFT marketplace by sales volume, and it only takes 2.5%.

| Marketplace | Traders (000s) | Sales Volume (millions) | Commission |

|---|---|---|---|

| OpenSea | 2,058 | $31,760 | 2.5% |

| Axie Infinity | 2,136 | $4,240 | 4.25% |

| Magic Eden | 881 | $1,590 | 2.0% |

| LooksRare | 98 | $1,580 | 2.0% |

| NBA Top Shot | 565 | $962 | 5.0% |

Source: DappRadar, all-time sales as of 8/10/22

The counterpoint is there’s certainly a case to be made that marketplaces like OpenSea aren’t building VR ecosystems. They’re simply building gateways to a less centralized 2D network infrastructure that already exists. There is likely some validity to that argument, and it may justify a higher fee in a more 3D environment. However, if users don’t see it that way, Meta’s profit is going to have to come from somewhere and the obvious answer there might be the headsets. But that’s a potential issue as well because the headsets can’t be too expensive or VR user growth will struggle.

Interestingly, Meta Platforms already has some experience with a walled garden marketplace for real goods through its Facebook platform. Facebook’s Marketplace users have already been using that solution without paying a platform fee for years because the transactions are generally settled in real life with either cash or Venmo (PYPL). Whether the Facebook marketplace users are already crypto native or not, it is highly unlikely in my view that Meta’s existing customers will be willing to pay Meta close to 50% in commissions on digital products or services that they start offering in the metaverse.

The point is, the early adopters of NFTs are likely to push back on the cut that Meta Platforms wants for digital asset sales, and Facebook’s current user base likely will as well. If those commission rates prove to be too high, then the cost of the hardware has to increase so that Reality Labs can start working towards profitability. Ultimately, the user experience may be the most important driver of the metaverse success. And so far, those reviews seem less than stellar.

Risks

There are a considerable number of risks for Meta Platforms going forward. The company has drastically decreased its total profit in an attempt to build a new product that may ultimately get rejected by the market. Investors could grow tired of that strategy and bail on the company, which would likely put more pressure on the share price. Though, after a 60% selloff, it’s probably fair to wonder if that metaverse risks have been priced in already.

Equally concerning is the possibility that Meta’s core business could be under pressure as well if the economic slowdown lasts for a long time. Advertisers may continue tightening their marketing budgets and look for different ways to reach consumers. There is also the concern that Facebook’s user growth story is over. If the core business suffers, it may get harder to justify plowing cash into Reality Labs to sell devices at cost while building a virtual product that is still essentially just a concept.

Summary

Reality Labs is a massive gamble. If the metaverse doesn’t progress the way company leadership seems to think it will, Meta Platforms could be in serious trouble. The early adopter ethos of an open and interoperable Web 3 would suggest creator fees in the Reality Labs metaverse are too high. That said, Horizon Worlds may not need to appeal to Web 3 creators as much if VR enthusiasts and gaming developers prove to be enough to sustain growth to segment profitability. So far, the user experience reviews that have been shared in the 2D internet would suggest things are far from ideal in 3D land. What remains to be seen is how long social media investors are willing to subsidize Mark Zuckerberg’s vision for the future.

Be the first to comment