Cindy Ord

After a strong few quarters despite mounting macro headwinds in the social media advertising space, Nextdoor Holdings (NYSE:KIND) finally succumbed to sector weakness. The local social firm reported a decent Q2, but the company predicted an end to growth in what is usually a strong 2H for advertising. My investment thesis remains Bullish on the stock loaded with cash and trading at all-time lows.

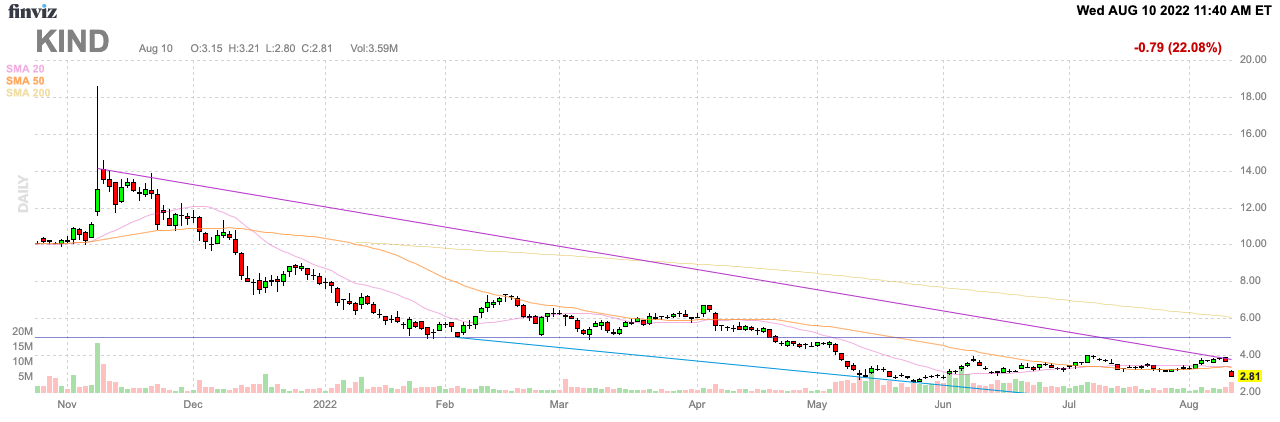

FinViz

Covid Normalization

Like other online companies, Nextdoor finally saw some covid pull forwards impact results. The company is still in such a fast growth phase that Nextdoor had easily overcome some hurdles already impacting others in the space.

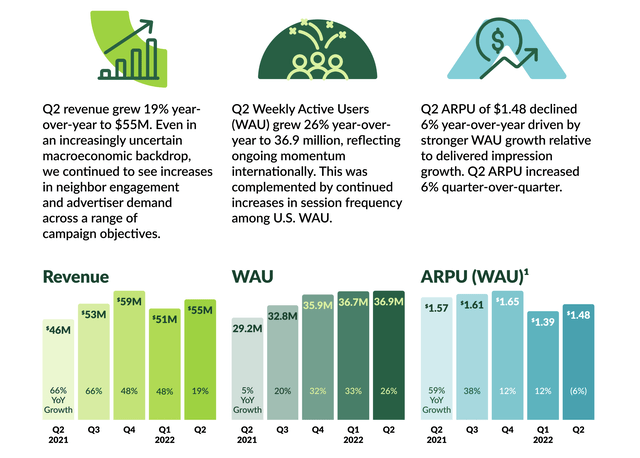

For Q2’22, the local social media player recorded revenues of $54.5 million, slightly below analyst estimates. The numbers were in the range of guidance, with revenues growing 19% YoY.

Nextdoor Q2’22 shareholder letter

Even the weekly active users (WAUs) were solid with 26% growth. Nextdoor had actually seen a solid boost in users in the 2H of last year, unlike most players in social media.

The biggest impact to the business was a dip in ARPU. Nextdoor reported a Q2’22 ARPU of $1.48, down 6% from last Q2. One of the biggest parts of the investment story is the prediction for expansion in the ARPU. The company felt pressures with impressions despite the increase in WAUs over the year.

Long term, Nextdoor has the potential to focus on hyperlocal targeting only provided by a platform focused on local neighborhoods. The problem is having the advertising platform capable of delivering the ad products. The company should be able to produce higher ARPUs than other social media providers, with this focus on ads targeted towards people willing and able to make purchases at nearby stores.

Painful Guidance

Nextdoor guided 2022 revenues down to $220 to $225 million. The updated guidance was very painful, with a prior target of $252 to $256 million. Analysts were down at $236 million in a clear sign a guidance cut was expected due to weakness in the bigger social media players, but the level of the cut is massive.

The company guided to Q3’22 revenues of $54 million, placing the Q4 target at only $63 million. The original forecast had Nextdoor 2H revenues surging above $80 million in the holiday quarter as advertising blooms during the holiday period. The guidance would now suggest revenues only rise 7% in the December quarter.

Investors need to be careful extrapolating these numbers to a problem with the platform or social media in general. The covid pull forwards combined with macroeconomic headwinds are now hitting local businesses hard and covering up the gains made over the last couple of years.

In addition, management appeared to predict some additional weakness in the ad market that might not occur with inflation rolling over and the Fed pulling back on more rate hikes. Per CFO Mike Doyle on the Q2’22 earnings call, Nextdoor is predicting more ad weakness that isn’t necessarily going to occur:

Given current macroeconomic trends, we’re anticipating a tightening in advertiser budgets. We expect mid-market advertiser demand to remain an area of particular growth. We are shifting SMBs to the new ad serving experience and expect this to result in some variability in near-term revenue.

The company ended the quarter with a massive cash balance of $666 million. Nextdoor spent $11 million on share buybacks during the quarter and has spent $27 million YTD on repurchasing shares, where the company is buying shares at $3 after selling shares at $10 with the original SPAC deal.

The good news is that Nextdoor has the majority of the share buyback remaining with the stock down 20% back close to the all-time lows. The company will still have nearly $600 million of cash in the bank after completing the $100 million approved share buyback.

The biggest negative is that Nextdoor has massive losses while still scaling the business. The company now forecasts the EBITDA margin at negative 28% for the year.

Without the large cash balance, this would be a problem. Nextdoor can easily deal with what amounts to a $62 million annual EBITDA loss. In fact, the company has the cash where the prudent move is to still push forward with growth investment opportunities for several years before strategically shifting towards a focus on profitable growth.

Takeaway

The key investor takeaway is that Nextdoor only has a minimal enterprise value of $500 million. The guidance was highly disappointing, but the stock now isn’t appropriately priced for the growth potential ahead.

Investors should use this weakness to buy shares of Nextdoor alongside the company.

Be the first to comment