Mohammed Haneefa Nizamudeen

Don’t fear what other people can do. Fear most what you could have done, but didn’t.” ― Craig D. Lounsbrough

Today, we take our first look at a small developmental concern. The company has had a significant change of focus, recently did a capital raise, and has several “shots on goal.” An analysis follows below.

Company Overview:

Terns Pharmaceuticals, Inc. (NASDAQ:TERN) is a Foster City, California-based early clinical-stage biopharmaceutical concern focused on the development of small-molecule therapeutics for indications with high unmet needs. The company currently has four candidates in the clinic undergoing evaluation in the treatment of two diseases, and a fifth asset that should enter the clinic in 2023.

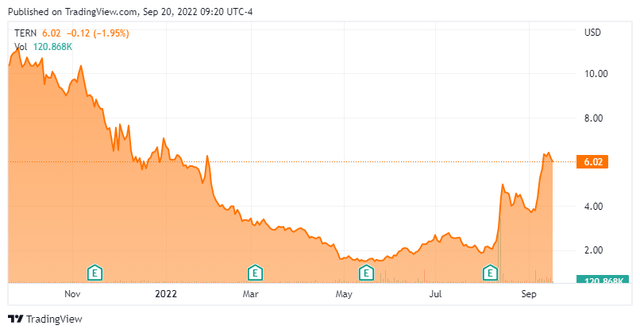

Terns was formed in 2016 and backed by Eli Lilly (LLY), which out-licensed its non-alcoholic steatohepatitis [NASH] portfolio to the then-startup, along with a Series A investment of $30 million in 2018. The company went public in February 2021, raising net proceeds of $132.9 million at $17 per share. This somewhat thinly traded stock is currently selling at just over six bucks a sharer, translating to a market cap of just under $350 million, after giving effect to 14.63 million pre-funded warrants.

Pipeline:

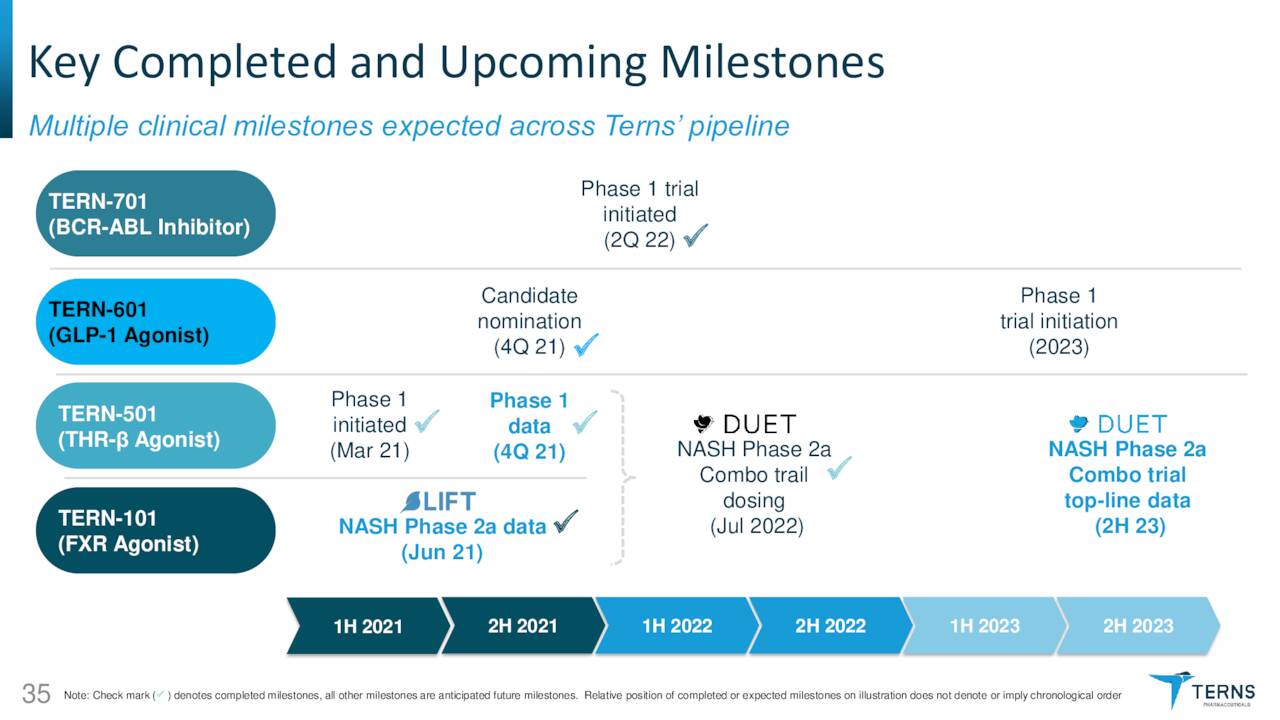

After releasing disappointing data from a Phase 1 NASH trial in March 2022, Terns is now leading with a cancer therapy in its corporate presentations and SEC filings.

August Company Presentation

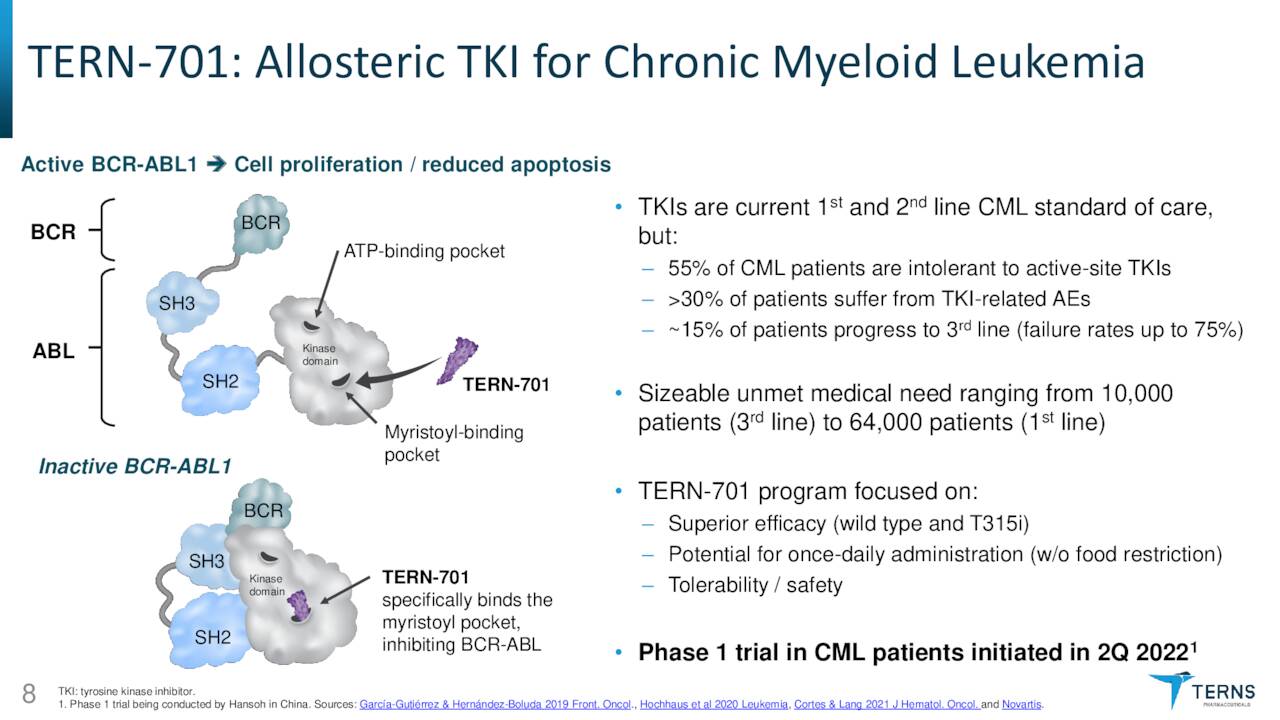

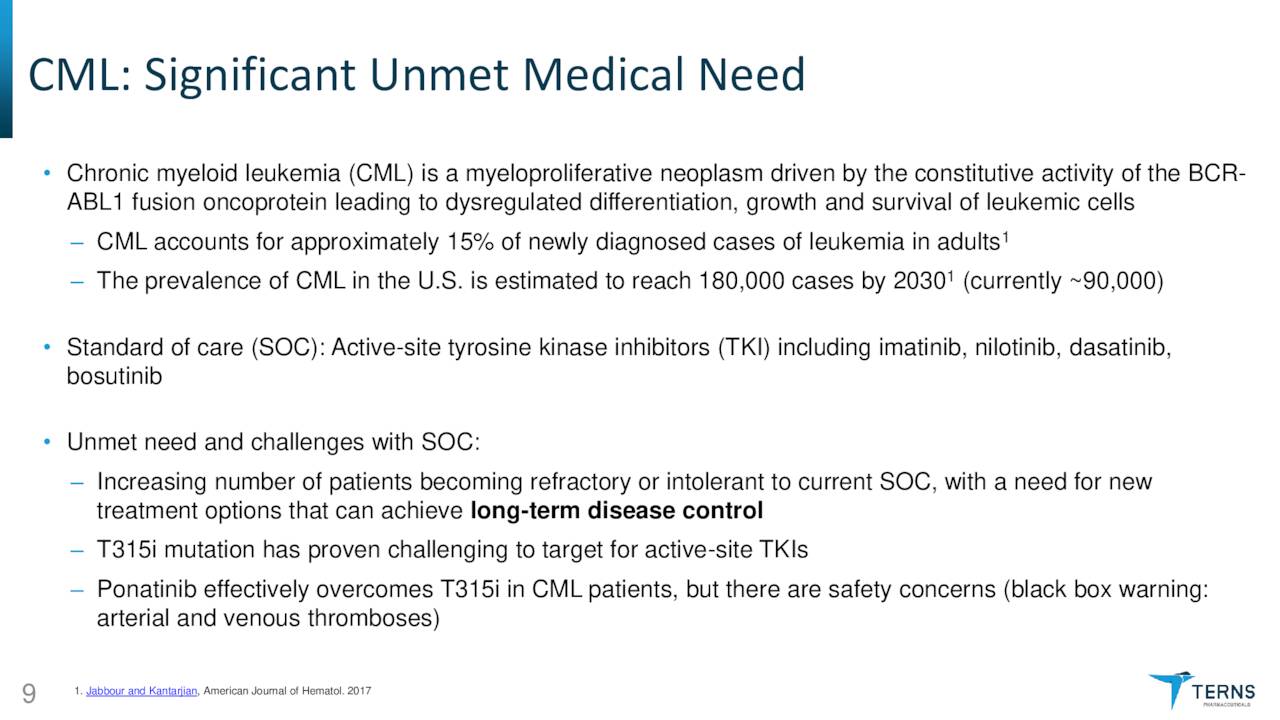

TERN-701. The newly emphasized asset is TERN-701, an oral allosteric inhibitor of tyrosine kinase oncoprotein BCR-ABL1 (a.k.a. the Philadelphia chromosome) that is being evaluated in a Phase 1 trial for the treatment of chronic myeloid leukemia [CML]. Originating in the bone marrow, CML is responsible for ~15%, or ~9,000 of the newly diagnosed cases of leukemia in American adults annually. Current therapies include tyrosine kinase inhibitors (TKIs) such as Gleevec (imatinib), Tasigna (nilotinib), and recently approved (October 2021) Scemblix (asciminib) from Novartis (NVS); Sprycel (dasatinib) from Bristol Myers Squibb (BMY); and Pfizer’s (PFE) Bosulif (bosutinib), along with chemotherapy. However, due to an increasing number of patients failing on TKIs, there is an unmet need in the CML indication.

August Company Presentation

The primary reason patients are becoming more refractory to TKIs is active-site mutations that overcome or evade treatment. Furthermore, TKIs are hampered by off-target toxicity. The only approved allosteric TKI (Scemblix) has demonstrated some ability to improve on the shortcomings of first and second generation TKIs because it binds to the myristoyl-binding pocket, inhibiting the BCR-ABL1 gene and most mutations, which are responsible for the proliferation of leukemia cells.

As a result, Scemblix has blockbuster potential in its currently approved third line setting with multi-blockbuster potential if Novartis obtains approval for it as a front-line therapy. However, due to certain factors, including twice-daily dosing, a three-hour fasting requirement, some potentially harmful drug interactions, and off-target toxicity, adherence on Scemblix is likely to be challenging. Terns believes that its allosteric candidate TERN-701 can overcome these limitations by better pharmacokinetics, allowing for once-daily dosing with minimal fasting requirements.

August Company Presentation

That said, TERN-701 has been out-licensed to Hansoh Pharmaceuticals (OTCPK:HNSPF) for development in China with domestic advancement plans still on the drawing board – most likely via a development partner. Hansoh initiated a two-part Phase 1 study in 2Q22, with the initial dose escalation phase to be followed by cytogenetic response evaluation at six months in part two. No timeline for data has been forwarded.

August Company Presentation

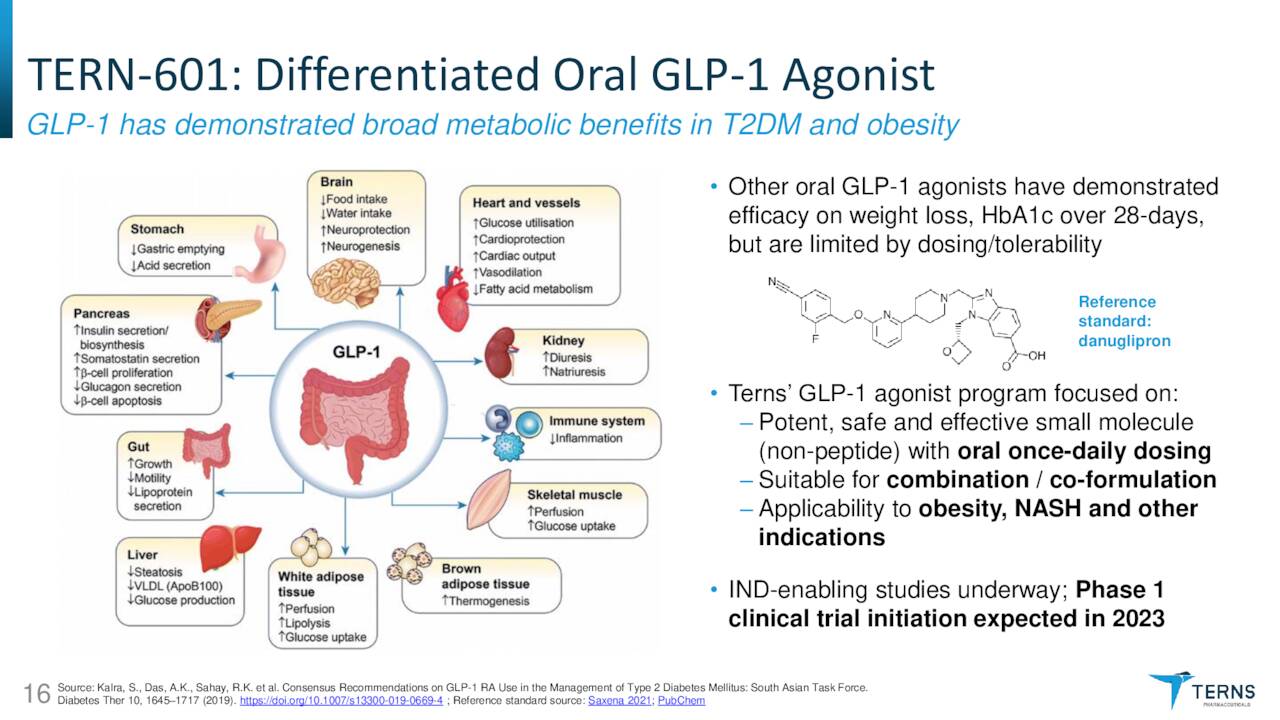

TERN-601. Terns now lists TERN-601 second in its investor-targeted material. It is an oral glucagon-like peptide-1 receptor (GLP-1R) agonist for the treatment of obesity, a malady that afflicts one-half of Americans, although only 2% seek treatment. The company believes GLP-1R agonism can increase insulin secretion by the pancreas, reduce glucagon secretion in the liver, slow gastric emptying, increase satiation, and reduce inflammation – all of which should lead to weight loss.

Synthetic GLP-1 peptide semaglutide, marketed as Wegovy, Ozempic, and Rybelsus by Novo Nordisk (NVO), is approved for weight management and type-2 diabetes. However, Wegovy and Ozempic are once-weekly injectables and oral Rybelsus is only approved for lowering A1C (blood sugar) levels in type-2 diabetes patients, like Ozempic. Furthermore, semaglutide is a biologic, which is less stable and harder to administer than small-molecule therapeutics. An oral version for weight loss may require significantly higher doses for weight loss versus A1C reduction. Terns aims to improve on Wegovy with its oral, small-molecule alternative. TERN-601 is expected to enter the clinic in 2023.

TERN-101. When Terns went public, its lead program was TERN-101, a liver-distributed, non-bile acid Farnesoid X receptor [FXR] agonist that was being studied in the treatment of NASH. However, data released in June 2021 from a Phase 2a study (LIFT) showed that it was well-tolerated, but it decreased high-density lipoproteins (good cholesterol), increased low-density lipoproteins (bad cholesterol), and only demonstrated statistically significant improvements in two of eight NASH biomarkers.

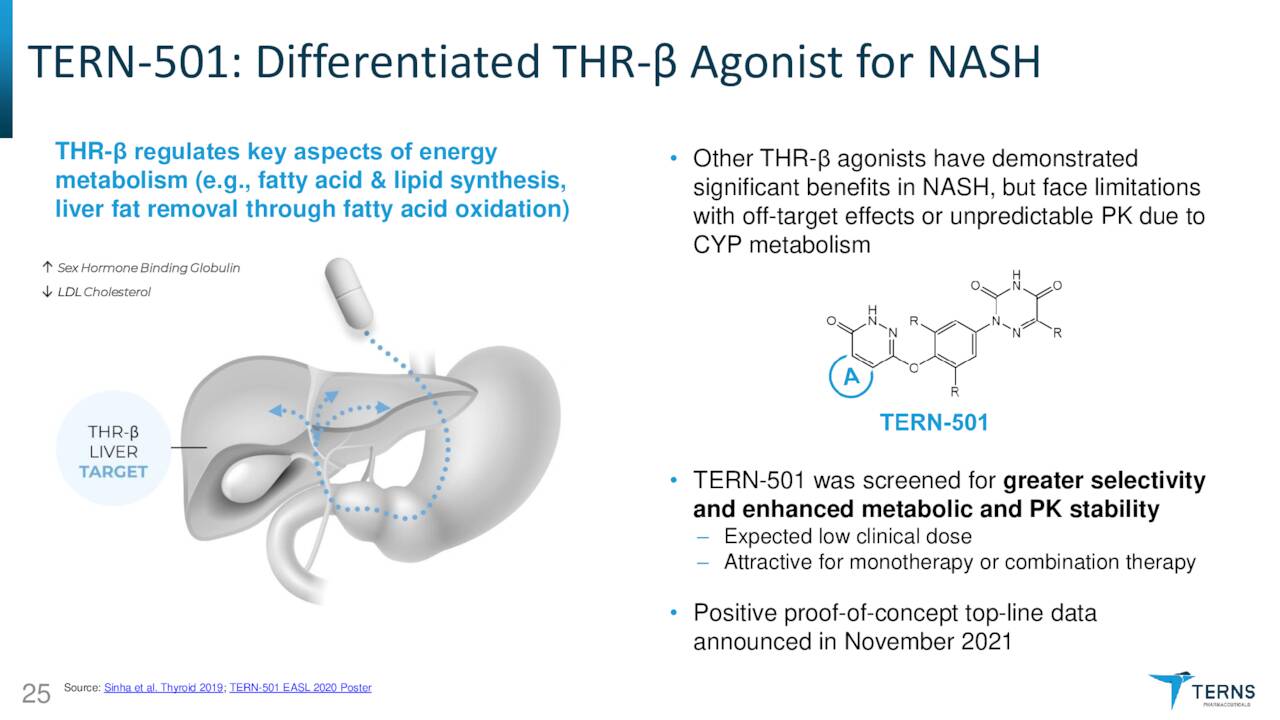

TERN-501. As such, TERN-101 has advanced sideways into a NASH Phase 2a study [DUET] with TERN-501, an orally administered THR-β agonist. THR-β is a thyroid hormone receptor found in the liver and is responsible for fatty acid synthesis and liver fat removal through fatty acid oxidation. THR-β agonism has been clinically shown to reduce liver fat and atherogenic (fatty plaque promoting) lipids; however, this approach is plagued by unintended activation of THR-α, which can result in cardiotoxicity, muscle wasting, and reduced bone mineral density. TERN-501 is 23 times more selective for THR-β than THR-α; thus minimizing those risks. DUET will enroll 140 patients across seven arms: three TERN-501 monotherapy doses; one TERN-101 monotherapy dose; two combination doses; and one placebo. Primary endpoint is relative change from baseline in liver fat content as measured by MRI-PDFF (magnetic resonance imaging – proton density fat fraction) at week 12 for TERN-501 monotherapy versus placebo. The first patient was dosed in July 2022 with top-line data anticipated in 2H23.

August Company Presentation

TERN-201. Another Terns NASH treatment, TERN-201, demonstrated no meaningful changes in serum or imaging NASH biomarkers versus placebo in part 1 of a Phase 1 study announced March 2022. Although the company plans on releasing data in from the second part of the study in 2H22, the asset has essentially been shelved, removed from the company’s most recent investment literature.

Balance Sheet & Analyst Commentary:

To bolster its largess to fund its trials, Terns executed a secondary offering on August 12, 2022 (that closed August 16th), raising net proceeds of $61.1 million through the sale of stock and pre-funded warrants at $2.42 a share. This upped the company’s cash position to ~$200 million, providing it an operating runway into 2025.

Over the past six weeks, JP Morgan has reissued a Hold rating on TERN with a $6 price target, while H.C. Wainwright initiated the shares last week with a Neutral Rating and $5 price target.

Some of Terns’ initial investors, who are now beneficial owners with board seats, are still bullish on the company. Vivo Opportunity Fund has used the offering and the sub-$3 range prior to the secondary as buying opportunities, adding 2.62 million shares since August 12th. Also adding was Orbimed Advisors, who purchased nearly 3.7 million shares on the offering. Since then, beneficial owners have added another 1.2 million shares so far in September.

Verdict:

Despite the beneficial owner participation and its stock surging nearly 150% since the pricing of the secondary, Terns is devoid of any near-term catalysts. The recent run was due to the fact that, at $2.42 a share, the company was trading at a ~$75 million discount to cash. Now trading back at a premium to cash ($350 million market cap versus ~$200 million cash), the easy money has been made.

August Company Presentation

The only items on the calendar are Phase 2a data from DUET in 2H23 and the initiation of a Phase 1 trial (assuming IND clearance) for TERN-601 in 2023. And, to date, the data have been sparse and underwhelming. Barring an unexpected and positive update out of its CML trial in China or a domestic partnership for TERN-701 clinical development, there is nothing to suggest that Terns won’t be dead money for another year, pulled along by the performance of the biotech sector instead of any company-specific events. As such, investment is not recommended.

Acceptance is good but change is better.”― Abhishzk

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment