kokkai

Investment Thesis

This was not a great year for Sea Limited (NYSE: SE) as its recent share price declined yet again since my previous publications on the company. The recent news of Shopee’s layoff, Garena’s declining growth rates, and the uncertainty of SeaMoney’s future contribution to its total revenue has dampened investors’ confidence, leading to the sell-off in the company. And it is understandably why.

I have already laid out my investment thesis in my previous articles, so if you like, I do highly encourage you to head here for my 2Q22 update and a deep dive on SeaBank. Before the next quarter’s result, I thought I like to publish a short article to talk about some updates that I’ve gathered on the company, particularly on Garena and Shopee.

These updates reinforce my thesis that Shopee is able to attain profitability and that Garena has taken the steps needed to mitigate its concentration risk and reaccelerate its growth.

Garena

Recap on 2Q22 Result

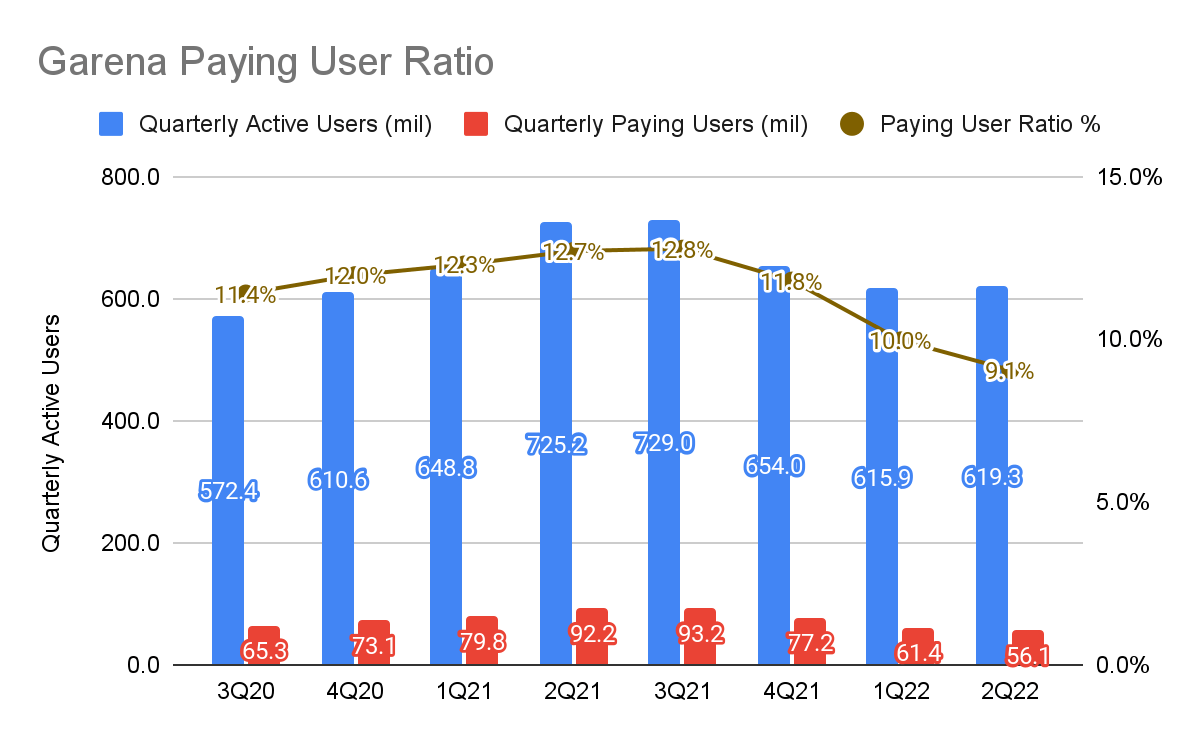

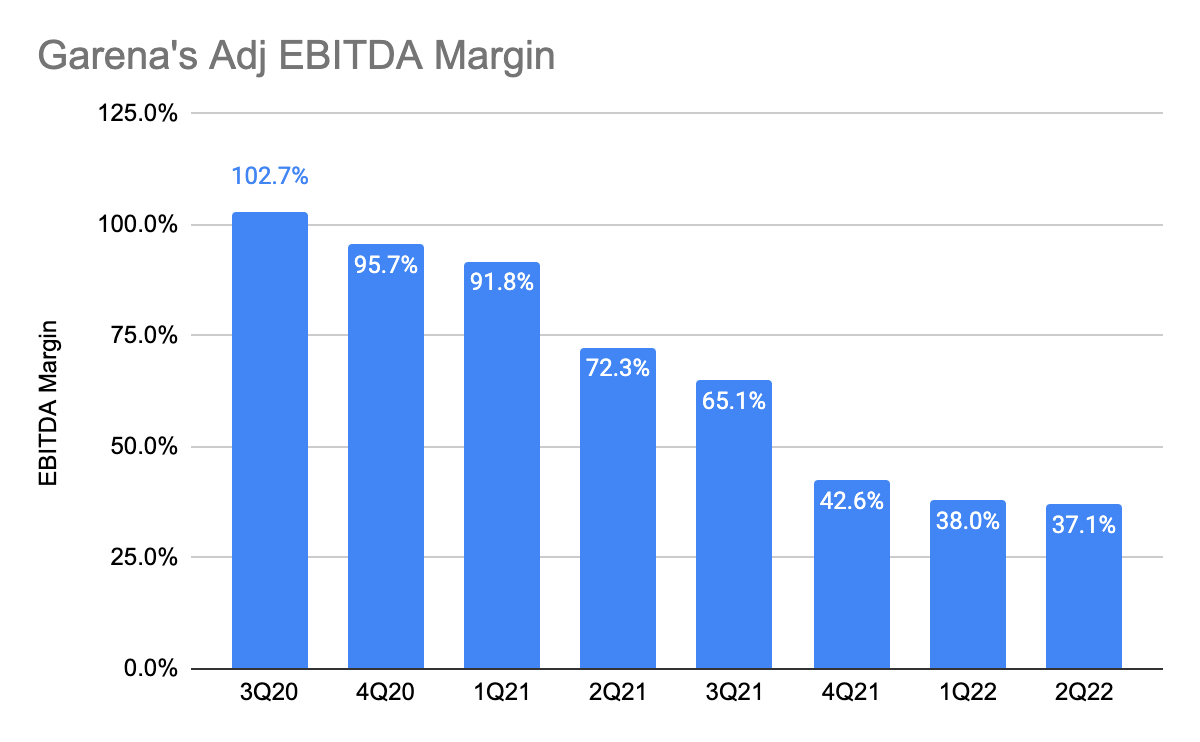

Image Created From Sea Limited 10-Q Image Created From Sea Limited 10-Q

For a quick recap on Garena’s performance, 2 of its key operating metrics were its quarterly active users (“QAU”) and quarterly paying users (“QPU”), and both have been declining consecutively for the past few quarters due to post normalization. As a result, its paying user ratio also fell. That ultimately led to a declining adjusted EBITDA margin of 37.1% in 2Q22, down to pre-COVID levels.

As Garena is the only cash cow for Sea Limited at the moment, investors were right to be concerned about whether the company has sufficient capital to invest in the growth of Shopee’s emerging markets, and also SeaMoney, which is still relatively young in its business lifecycle. And weeks later, the management announced its decision to exit all markets in Latin America (LatAm), except for Brazil, and also multiple rounds of layoffs. But first, let’s put these aside for later as we talk about Garena now.

Since Garena derives most of its revenue from Free Fire, this has proven to be a huge concentration risk. And a key question that lies ahead for most investors is, are they making concrete moves in developing their own games to mitigate such risks and reaccelerate their growth rates?

Phoenix Labs: Working Behind The Scenes

On Jan 2020, Garena announced the acquisition of Phoenix Labs, the creator behind Dauntless, a free-to-play action RPG game, which is immensely popular, and they were intending to launch a mobile version of it. However, since then, there was no updates on its release, and that kept investors wondering and waiting. Moreover, in the past few earnings call, Sea’s management has been hinting that there are new games in the pipeline, and the most recent game was Blockman Go.

FaeFarm by Phoenix Labs

Thanks to a friend of mine, I was able to dig out more information on Garena up and coming new game, with one of them being FaeFarm, a Co-Op RPG game released by Phoenix Labs. This is set to launch in Spring 2023 (23 March – 23 June) on Nintendo Switch. Here is a YouTube trailer, and if you head over to the comment section, you get to see that many users were impressed and excited about the game. While that does not indicate any future success, it does speak that it is a well-anticipated game.

New Logo By Phoenix Labs

On May 7th, 2022, Phoenix Labs’ blog announced a new logo and this sentence particularly caught my eye:

“Today, we are proud to say that we have close to 10 projects ranging from early R&D to being in full production.”

New Projects by Phoenix Labs

From the same blog, this image also showcases Phoenix Labs’ upcoming new games, although, the game titles are not disclosed. This is completely in line with what Sea’s management has said in the previous earnings call, and this is assuring to know. Moving forward, I reckon that investors should place more attention on Phoenix Labs’ website for any new titles.

Garena Investment In VIC Game Studios

On July 27, Garena invested in a Korean-based video game developer company, called VIC Game Studios (“VGS”). VGS has been working on a mobile game called Black Clover Mobile. According to this article, VGS is set to launch the game in 2022, even though, there are no updates from the company itself. However, they have released multiple game teasers on YouTube, and you can see how anticipated this is from the comments section.

I believe this investment by Garena shows that they are focused on self-developing their own games, and this is a sign of more to come.

Shopee – Multiple Rounds of Layoffs & Decision To Exit Latin America

On 9th Sept, Shopee announced its decision to exit all Latin America’s markets, except for Brazil, and most recently on 19th Sept, news of Shopee’s layoffs continued. Just a day later, CEO Forrest Li wrote a memo to its employees, which you can see here. The message is clear – achieving profitability is key. Recently, I also had a conversation with my friend and he was talking about how existing employees were afraid of getting laid off.

Sea Limited 10-Q

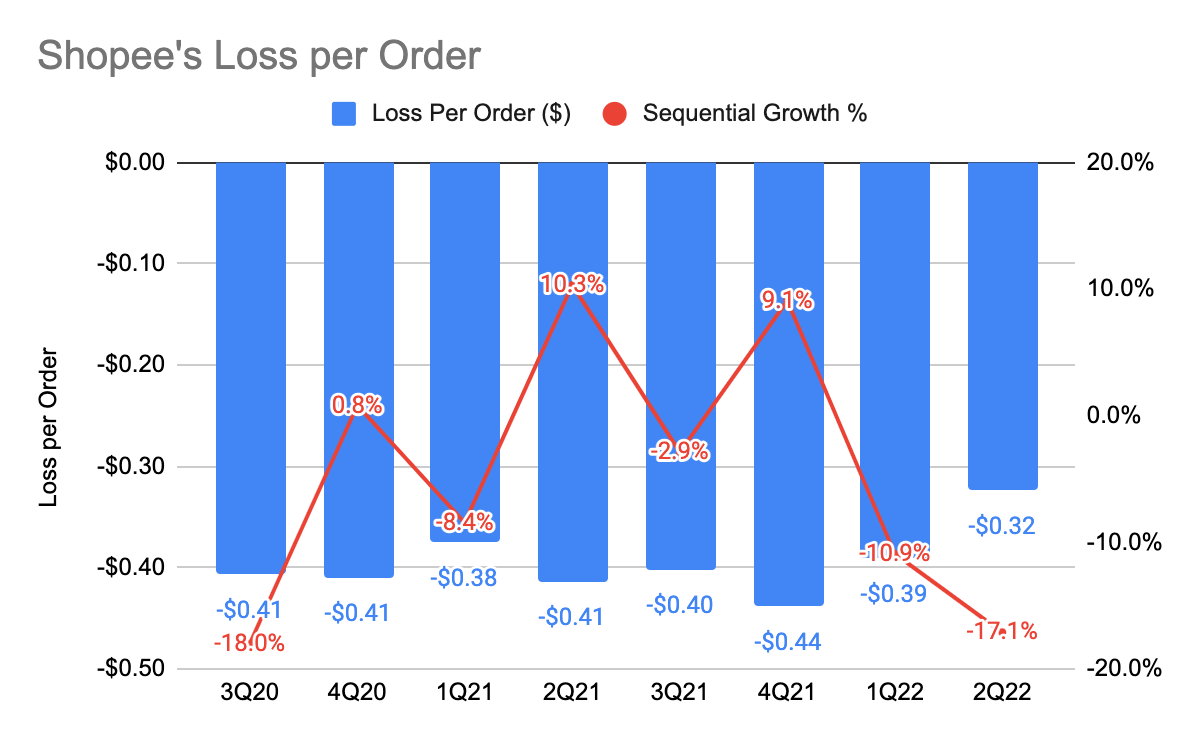

To bring back Shopee’s profitability, its unit economics have been improving quickly. More particularly, Shopee’s SEA and Taiwan (before HQ costs) improved by 75% Q/Q to $0.01 vs 73% last quarter, while Shopee Brazil’s losses (before HQ costs) improved by 7% Q/Q, although, Shopee’s Brazil did not come down as quickly as anticipated. This may explain why they have decided to pull back on other more infant markets where losses are higher.

This shows that the management has expanded too quickly and thinly in the past, and I could imagine that existing shareholders are reprimanding the management’s decision. However, my personal view is well aligned with Sea’s management. The reason is simple, the risk of not surviving seems far larger into the future as the need to raise capital could be a big thesis-breaker.

Furthermore, for a company to thrive, it has to first survive. Once it is proved that they can get over this tide, I believe it can emerge stronger in the future. These series of events undertaken by the management thus far show how quickly they are adapting, which is crucial in this environment, giving me confidence that they can break even.

Conclusion

I have touched on a few updates on Garena about its new pipelines, as well as my thoughts on Shopee’s most recent events. My investment thesis remains unchanged that Shopee is able to be self-sustaining, and that Garena is self-developing its own games to reaccelerate its growth (although this takes time). That being said, I like to ideally see these developments reflected in future results.

What are your thoughts on the article? Let me know in the comments section below.

Be the first to comment